Good afternoon!

Pennant International (LON:PEN)

Share price: 41p (down 15.5% today)

No. shares: 26.5m

Market cap: £10.9m

Trading update - this company describes itself as the;

AIM quoted supplier of integrated logistic support solutions, products and services, principally to the defence, rail, aerospace and naval sectors and to Government Departments

That's as clear as mud then! I think they basically make simulators, and other training equipment. This link is for the products section of their website.

In my report of 28 Sep 2015 I concluded that another profit warning was likely this year, due to the dreaded H2-weighted year expectations commentary which accompanied poor interim results. And so it has come to pass, with the company today saying;

In the Group's interim statement published on 28th September 2015, the Board stated that the outcome for the full year would be dependent on the timing of securing certain contracts with an aggregate tender value in excess of £15m. One of these contracts has now been secured, pre contract work has been agreed and has commenced on another and the Directors' confidence of signing the remaining major contract with a Middle Eastern client has been further enhanced following recent further developments.

Despite this progress, the delays in these contracts have adversely impacted the results for H2. As a result the loss for H2 is now expected to be significantly greater than that reported in H1. H2 has however, as expected, seen a significant improvement in the cash position from interims, with year-end balance likely to be in line with the opening net cash position at circa £1m.

An H2 weighted year commentary is nearly always a deferred profit warning, so it's a sell, or at the very least, not one to buy, whenever companies come out with that type of language. Companies are always optimistic, but reality usually disappoints.

Looking back at the interims, the company made a £756k loss, so the H2 loss being "significantly greater", says to me that we're probably looking at >£1m loss in H2, which is terrible. That means the full year loss of probably going to be close to £2m, an appalling result which might have been enough to bring down a company with a weak balance sheet.

Thankfully, Pennant has quite a strong balance sheet, although as I commented on 28 Sep 2015, the debtors figure looked dangerously high, at £5.7m, and no cash - indeed an overdraft of £643k was reported. So it's good to see the company today reporting that cash has improved, to c.£1m. The company lives to fight another day then, although it's used its Get Out of Jail Free card, I would say.

Outlook - is sounding more sensible;

The current order book for delivery in 2016 and 2017 produces underlying revenue of £10.2m in each of the next two years which is more than the anticipated Group revenue for 2015. Given this forward order book, the steps taken earlier in the year to realign the cost base and the encouraging order prospect pipeline, the Directors are confident as to the Group's financial prospects well into 2017.

My opinion - clearly the company has had a lousy 2015, but is looking forward to somewhat better 2016 & 2017, based on a firm order book, not just hope. Maybe this could be a good time to buy, in anticipation of the share price recovering?

Although it's an illiquid share, with a wide spread, and with such unpredictable performance, it's difficult to see a compelling reason to buy the shares, as the price will probably have a permanent discount to reflect the risk of more profit warnings in future.

Current year forecasts shown on Stockopedia are clearly pie in the sky, so ignore the forward PER of 5, because that's clearly wrong. I wouldn't rely on the divis being continued at the current level either - it looks to me as if a divi cut is on the cards.

Mycelx Technologies (LON:MYX)

Share price: 15p (down 54% today)

No. shares: 24.8m

Market cap: £3.7m

Trading update - I wouldn't normally comment on something this small, but seeing as I've taken a hit on this one, think it's a good idea to write a section on it, on a "memo to self" basis - with the lesson being, don't touch illiquid micro caps again!

To give you an example of how illiquid this share is (even when it had a mkt cap of £15m, which was when I bought some unfortunately), my broker either groans or laughs whenever I ring him up to deal in this share.

Foolishly, I bought some at about 60p, thinking that it might be a turnaround situation, but I got cold feet at about 40p, and realising I had made a mistake, tried to sell my holding of c.15,000 shares.

Guess how many he managed to sell for me? Just 1,000 shares, and the price was marked down 5p after me selling just £400 worth! What a joke. I then tried to sell some more, and was quoted 30p for 5,000 shares, i.e. 10p below the then bid price of 40p. Thankfully, I took it.

However, that still leaves me with 9,000 shares, and on today's profit warning the Bid price has been marked down to, wait for it, 5p! Yes, 5p! The Offer price is 30p. So the one market maker (Numis) is basically saying that he's not interested in buying any shares in it, at any price. I doubt you would even get 5p if you tried to sell more than the 750 shares that his quote is sized at (so he's quoting to buy £37.50 worth of shares, more than the commission I would pay on the trade, so it would actually cost me money to sell 750 shares!). I ask you, why bother with all the hassle & costs of a Listing, if this is what the market in the shares looks like?

This reinforces the reality that buying micro caps really is a dead end, with no reverse gear. Once you're in, that's it, you can't get out, especially if things are going badly wrong. For this reason, risk:reward is all wrong with micro caps, unless there is a strong possibility of it becoming a multibagger. If not, then it's not worth taking the risk of being left high & dry in something that can become completely illiquid.

Today's update says;

MYCELX has continued with its cost reduction measures and consequently, in line with the Company's previous guidance, the Company confirms that it will be at least cash neutral from operations in H2 2015. Net cash at year is expected to be not less than $3.7 million.

The Company now expects to report full year revenue for FY2015 that will be in line with that for FY2014, and will be in the region of $13.5 - 13.8 million (FY2014: $13.581 million). In response to continued weakening of the oil price during H2 2015, MYCELX's customers have increased focus on their own cost management and reduced their purchases of MYCELX media impacting the Company's ability to sustain its forecasted run rate.

The reduction in revenue is expected to result in a post-tax loss in the region of $3.4 - 3.8 million. The substantial reduction in the net loss of approximately 40% compared to FY2014 ($5.920m) is due to the cost reductions implemented by the Company in response to the current market conditions and which have been continuously monitored during H2 2015.

The Company will provide guidance on its revenue expectation for FY2016 in due course.

So things look bad, but there's still $3.7m net cash in the kitty, so the company looks to be able to continue trading for perhaps another year?

What the future holds, who can tell? It doesn't sound very promising, does it?

I'll resist the temptation to average down here, even thought the market cap is peanuts, as it seems likely that the end game will probably be running out of cash, and de-listing.

Memo to self - don't buy into illiquid micro caps, unless there is a realistic chance of the shares multibagging.

Snoozebox Holdings (LON:ZZZ)

Share price: 7.75p

No. shares: 211.8m before placing, 295.1m after placing (39.3% enlargement of share capital)

Market cap: £16.4m before placing, £22.9m after placing

6p Placing - yet another fundraising from Snoozebox, raising £5.0m before expenses. It's been cornerstoned by Kestrel (£2.1m) and Hargreave Hale (£1.1m) - I have to say that, in my opinion, they're throwing good money after bad.

It's a lovely concept, and the revised business model with new style bespoke, self-contained trailers, does have apparent appeal, but I think it's unlikely that this company will ever reach significant profitability, or even breakeven. The overheads are too high, and its business model is too capital-intensive, in my opinion.

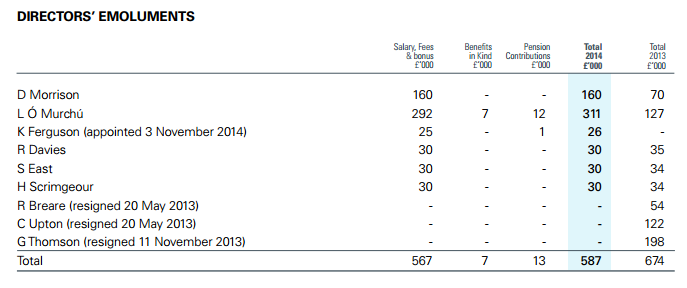

Just look at the Director emoluments from the 2014 Annual Report - ridiculous!

£160k for the Chairman - of a tiny, heavily loss-making company! £311k for the CEO. These are insane levels of pay. The Chairman should be on about £10k p.a., and the CEO on £50k, if this was a private company, but they would have big personal shareholdings. That's the way to run a tiny company.

Putting in place a corporate structure & costs, is akin to putting the cart before the horse, in my view. So I hope Kestrel & HH insisted on deep cuts in Director pay, as a condition for injecting more funds for the company to dissipate.

No doubt the share price will now descend to the 6p placing price, a nasty 25% discount. Note that private investors have been shafted, since there was no Open Offer to enable them also to participate, although they will no doubt be able to buy in the market at 6p in due course (next week?!), so it probably doesn't matter.

My opinion - as you have probably gathered, I'm not keen on this company - it's had long enough to prove the concept, and it hasn't worked on a commercial basis, with the company structured as it is. I think the concept might work, if the company is slimmed right down to the bones, and operated on a shoestring as a Mom & Pop type business.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.