Good afternoon!

I'm starting a little later than usual today, due to recording a CEO interview this morning with Gavin Lavelle of Brady (LON:BRY) . This is an interesting one, in that the company got in touch via advisers, saying that they would like to respond to my highly critical articles here on 7 Sep 2015, and again on the profit warning here on 1 Dec 2015. So that interview is now published on my website here.

As usual, Stockopedia readers submitted most of the questions, and I thought the CEO coped well with some fairly tough questions. (disclosure: I picked up a few shares in Brady once they stopped falling, after the recent profit warning). There wasn't time to cover all the reader questions, but we covered the main topics.

Kudos to the CEO for seeking to engage with a critic, and I'm very happy to be even-handed, and welcome a company putting their side of the story. Although I remain of the view that Brady really should have been more prudent, and guided down expectations earlier, instead of relying on Q4 contract wins to meet the full year numbers. Hopefully they will take this on board, and guide the market more conservatively in future.

Gable Holdings Inc (LON:GAH)

Share price: 14.65p (down 25% today)

No. shares: 135.3m

Market cap: £19.8m

Funding, trading update & related party transactions - I don't normally cover the insurance sector, as it's too specialised, accounts are strange, and I've never made money on this type of share, hence now it's just a sector I completely ignore.

However, as there's very little other news today, thought I would pass comment on the strange announcement today which has sliced a quarter off this company's shares.

It seems a rather convoluted fundraising, via a convertible loan, with Directors participating. Conversion terms seem to be variable, between 10-15p, so the shares have fallen to within that range.

I don't like the look of these arrangements at all, which result in the company apparently signing away £2m of 2015 profits, in order to get a relatively small (just under £4m) fundraising away, in order to meet regulatory capital requirements.

A friend in the City warned me away from this share earlier in 2015, saying that related party transactions made it high risk, and I'm jolly glad I listened to him, as that issue has surfaced again today as a catalyst for destroying shareholder value.

It was an oversight on my part, not adding this share to my Bargepole List, but I have corrected this mistake today, belatedly, by adding it. I'm not predicting what the share price will do, but am simply flagging a share that I would feel very uncomfortable getting involved with. Looking at this chart, one imagines that existing shareholders are also kicking themselves for holding this share. The accounts looked odd too, when I last looked at them.

Rightster (LON:RSTR)

Share price: 5.25p (down 30% today)

No. shares: 369.1m + 200m Placing shares = 569.1m

Market cap: £19.4m (before Placing), 29.9m (after Placing)

Placing at 5p - this fundraising was announced 3 minutes before the market closed on Friday (at 4:27pm) - how crazy is that?

I've been warning readers about this share for over a year now, and it has indeed been a complete disaster for shareholders. As recently as 27 Nov 2015 I warned readers that a discounted Placing was on the cards, when the shares were 10.6p.

Sure enough, a deal has been done, to raise £10m before expenses, with the issue of 200m new shares at just 5p each. Of course that has dragged down the share price to almost the same level, as the temptation to flip the shares and bank an instant profit is nearly always too much for some participants in Placings.

I've read the Placing announcement, which details the management and strategic changes made, so this is in effect a second attempt to create a viable business under new management, where the first attempt failed. Directors have stumped up £0.8m in the Placing, which is encouraging, being a meaningful amount of their own money.

Connected parties to the Directors seem to be stumping up most of the balance of the monies, if I'm reading the announcement correctly, which if correct, is very interesting.

My opinion - in all honesty, I didn't understand the old business model, and reading today's announcement, I don't understand the new one either.

Talk is cheap, so let's wait and see how the numbers progress in future.

With a decent amount of cash in the bank, and new management with plenty of skin in the game, perhaps something sensible might emerge at Rightster after all? It's still too risky for my liking, but in the past I've made a lot of money from buying into companies which initially failed, but then raise fresh money and have a more realistic business plan, so it's not something to reject out of hand in my view, now it has refinanced.

The key point to stress is this - it's sheer folly to invest in any loss-making, cash-burning company which is likely to need to raise more cash relatively soon. You will almost certainly be diluted, sometimes heavily, in a discounted Placing. Therefore if you value your savings, it's usually vital to sit on the sidelines unless & until the company you're interested in has actually raised the money it needs. The shares will often then be substantially cheaper, and you can buy in at a lower price, and with less risk.

Overall though, I try to avoid all loss-making AIM shares, as practically every one goes wrong in some way - either the blue sky idea will flop completely, or at the very least takes far longer, and costs far more money than originally planned - all of which are scenarios which are likely to cause heavy losses for shareholders. So why get involved at all?

Audioboom (LON:BOOM) is another one that is going to run out of cash soon, so watch out for a discounted Placing there. It's easy to work out whether a Placing is coming - just look at the last balance sheet, see how much net cash is remaining, then calculate the cash burn, and you can easily estimate when fresh funds will be needed. It amazes me that some people just ignore this issue - they might as well just toss £20 notes onto the fire, it's such a huge error.

Tribal (LON:TRB)

Share price: 25.1p (up 4.7% today)

No. shares: 94.8m (+ Rights Issue pre-announced, but price uncertain)

Market cap: £23.8m

(at the time of writing, I hold a long position in this share)

Update on banking - this one's quite an interesting special situation, potentially interesting in my opinion. The company's performance has been a disaster, as I mentioned in my report here on the second profit warning this autumn, on Dec 14, 2015. Tribal shares have lost about 85% of their value since the summer.

The key issues concern bank debt (likely breach of covenants at 31 Dec 2015), and a planned Rights Issue in 2016, scheduled for the time of the results, due out in Mar 2016. I don't think there was ever any serious danger here, because the Rights Issue has already been underwritten, but it's encouraging to see that the bank has indeed been co-operative, with today's announcement saying;

Tribal Group plc ("Tribal" or the "Company") announces that it has today reached agreement with its Banks to waive the testing of its financial covenants for the period ending 31st December 2015. As set out in the update issued on 14 December 2015, this will ensure that the Company remains in compliance with the terms of its debt facilities and enable the Company to progress with the proposed rights issue in the first quarter of 2016.

My opinion - I've been repeatedly warning about not investing in companies which need to raise funding, and generally I hate weak balance sheets. However, this one looks potentially interesting to me because the company has specifically stated its intention to repair its balance sheet with a Rights Issue.

The key point with a Rights Issue, is that the new shares are issued to existing shareholders. So providing you're prepared to stump up some more cash for new shares, then you are not diluted. This is vastly superior to a discounted Placing, where existing shareholders are shafted basically.

Tribal appears to be a reasonably sound business, with recurring revenues, so once its balance sheet has been repaired with the Rights Issue, then I think there's a good chance of the share price recovering.

With bank covenants now waived, a key risk (of the bank forcing it into Administration) seems to have disappeared. The £30-35m Rights Issue should fix the group's finances, and I reckon the market may well look more positively on the shares in Q2 of 2016 and beyond. Time will tell. My main concern is that the outlook statement for 2016 was not as upbeat as I would have expected, with it saying (from the RNS of 14 Dec 2015):

The Board expects the wider market backdrop for education management systems and services to be stable in 2016. Whilst the timing of order completions is difficult to predict, the Company is well positioned to benefit from continuing international demand for student management system upgrades which deliver strong back-office efficiencies and underpin student engagement programmes. The Company will focus on reducing its cost base and improving operating efficiency to reflect the present trading environment.

Whilst the deferral of revenues from 2015 into 2016 should benefit trading in the first half of 2016, our overall results are expected to remain weighted towards the second half of FY16.

British Polythene Industries (LON:BPI)

Share price: 690p (down 1.3% today)

No. shares: 27.2m

Market cap: £187.7m

Trading update - a reassuring update today from this polythene films manufacturer;

Trading remains consistent with what was disclosed in our trading update on 11 November 2015. Raw material costs increased in November and again in December with a forecast of further increases early next year.

Overall the Board remains confident that our business is on course to meet our expectations for 2015.

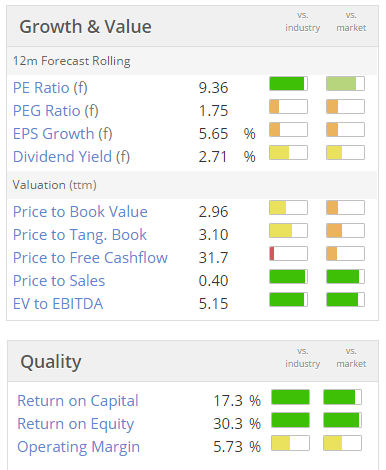

Valuation - the shares look attractive at first glance, on a modest PER and with a good divi yield. The quality scores are quite good too, and it has a StockRank of 90. Debt seems far from excessive too.

My opinion - I don't really know anything about this company, but the figures look rather attractive at first sight, so it's going on the list of things to research in more detail.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.