Good morning!

My attention is mainly on retailers at this time of year, given that it's my specialist sector - having been the FD of a ladieswear chain between 1993-2002, which we grew to about 150 shops by the time I left.

So I look at the trading updates at this time of year from large cap retailers, to provide the context with which to judge small cap retailers' trading updates.

Next (LON:NXT)

Trading update - compared with the often imprecise reporting from small caps, it's a real treat for me to look at this update from the UK's stalwart mid-market clothing retailer. The company gives clear guidance on profit throughout the year, adjusting, and narrowing the range as the year progresses. It's just superb, and is typical of the way the company is run overall.

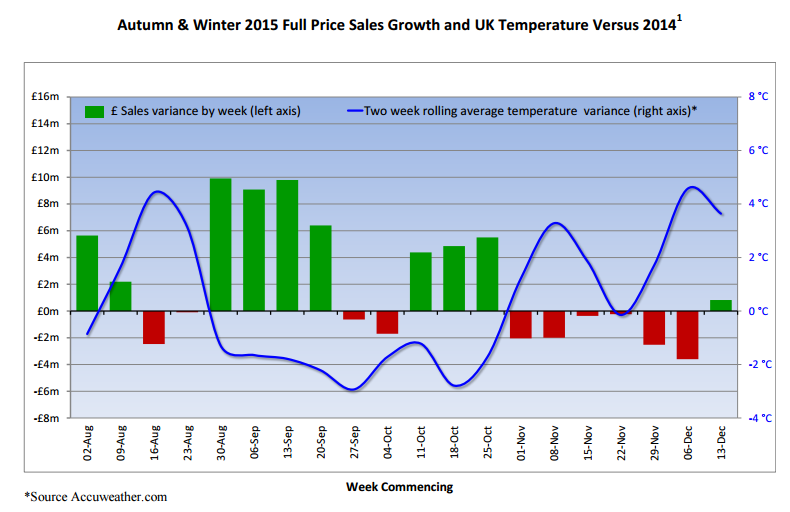

We already know that the UK saw probably the mildest winter weather for several decades, in Nov & Dec. This does genuinely impact clothing retailers, since winter coats, and other products designed for cold weather, just don't sell very well. They then have to be cleared at deep discounts, impacting on margins, as well as reduced sales.

On the other hand, consumers do have more disposable income this year, so it's not all doom & gloom.

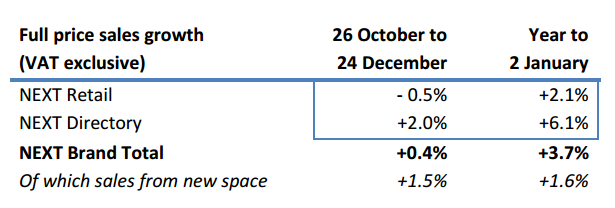

Personally I think the slowdown in sales shown in the last two months in the table below looks perfectly reasonable, given how extreme the weather was;

Clearly the market was expecting Next to have somehow worked miracles, as it has marked down the shares by nearly 5% today to 6835p. The shares don't appeal to me, as the business is looking increasingly ex-growth now, so perhaps needs to come down to a slightly lower PER? I'd be tempted to pick up a few at the 6000 level, but not higher than that.

There's a super graph in the Next announcement today, which clearly shows the correlation between mild weather, and reduced winter clothing sales, as you would expect;

Impressively, Next owns up to some mistakes too, unlike many others, who are likely to use the weather as an all-encompassing excuse for weaker performance;

Whilst warm weather may have been the main reason for a difficult fourth quarter, we would not want to allow difficult trading conditions to mask any mistakes and challenges faced by the business. Specifically, we believe that NEXT Directory’s disappointing sales were compounded by poor stock availability from October onwards. In addition, the online competitive environment is getting tougher as industry-wide service propositions catch up with the NEXT Directory.

Note also the very interesting last sentence, which I've highlighted, re competitive pressures, as online catches up, as they modestly put it!!

Full year guidance - if only all companies reported so thoroughly, promptly, and accurately to shareholders throughout the year;

Full price sales for the year to date are currently +3.7% ahead of last year, just below the bottom end of our previous guidance of +4.0% to +6.0%. However, good control of margins, costs and stock, along with healthy clearance rates means that we expect profits for the full year to remain within our profit guidance of £810m to £845m, issued in October.

Our revised central forecast for full year Group Profit is now £817m, though this might increase or decrease by £7m depending on trade in January. £817m would represent an increase of +4.4% on last year...

Outlook - the company indicates an expected range of +1.0% to +6.0% for sales and profit growth in y/e Jan 2017. A wide range is fine, as that will narrow as the new year progresses.

My opinion - I think Next has performed well, in a very tough Autumn/Winter season. This is now the benchmark for other clothing retailers, and I imagine others will generally have done worse than this, with perhaps a handful of stand-out good performers, probably including SuperGroup (LON:SGP) which seems on a roll at the moment.

John Lewis Partnership

Xmas trading update - Another high quality retailing outfit, but of course not stock market listed, because it's owned by its staff (and doesn't it show, in customer service, and quality generally?).

Updates from John Lewis are however useful for read-across to other retailers.

Performance looks absolutely excellent - LFL sales are up 4.8%, which comes on top of strong figures last year.

Online has been very good, up 19% vs LY, and now 36% of total sales.

Click & collect is proving extremely popular, and is now more popular than home delivery, with 56% of online orders being collected in this way. This is extremely important in my view, as it has obviously good read-across for Argos (Home Retail (LON:HOME) - of which I am long), if UK consumers are now gravitating towards click & collect as their preferred method of receiving goods. Although this might be skewed due to the demographic of John Lewis' customers, being affluent & mobile.

Black Friday is described as a "stand out success", so it looks as if this is here to stay, and has perhaps permanently changed the UK's shopping habits, from the previous gradual surge up to Xmas, to now being a sharper peak at end November (for Black Friday on 28 Nov), then softer sales in December.

Electricals are mentioned as a strong category, up 6.8% YoY. This might also be behind today's spike in the price of HOME.

** BREAKING NEWS! An announcement has just come out that SBRY is interested in buying HOME, I will come back to you on this once I've read it in more detail.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.