Good morning!

Another avalanche of trading updates today, so I'll do my best in the relatively short time available today - I'll be interviewing the CEO of Proactis (PHD) at 11:30 today, the audio of that I'll publish tonight. Any last questions for him, here is the link again (closes at 11am today).

Firstly, my topical retailers update (not small caps, so skip this bit if you're only interested in small caps)

Home Retail (LON:HOME)

Share price: 157.8p (up 5% today)

No. shares: 813.4m

Market cap: £1,283.5m

(At the time of writing, I hold a long position in this share)

Trading update - mildly disappointing, but that's hardly a surprise, given the widespread reports of lower footfall on the High St. The exceptionally mild weather undoubtedly had some impact, but also increased online competition. Although note that Argos is at the forefront of the push for online - with about half its sales originating online, and its click & collect option being increasingly popular.

Argos (about three quarters of group sales) achieved a lacklustre sales performance, LFL of -2.2% in the 18 weeks to date of H2. That's not good enough, because of course costs are rising, and will continue to rise (e.g. the Living Wage).

Homebase (about a quarter of group sales) sales were better, with LFL of +5%.

Overall, profits are down, but not catastrophically so;

"As a result of the most recent trading period, we expect that Group benchmark profit before tax for the financial year ending February will be around the bottom of the current range of market expectations of £92m to £118m."

My opinion - it could have been a lot worse, so I think this is satisfactory, given low expectations.

Offer for Homebase - probably of more interest, was the news last night that negotiations are at an advanced stage for the disposal of Homebase to large Australian group, Wesfarmers, for £340m. This looks a very good price, so let's hope it proceeds. It also smooths the way for the sale of Argos to Sainsbury - a deal which looks likely to go ahead, in my opinion.

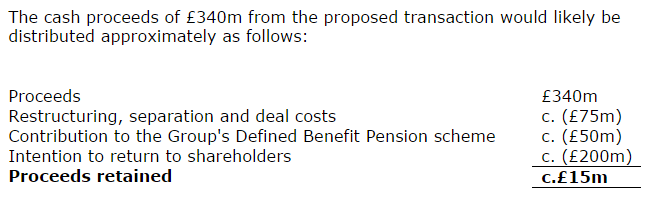

Few divorces are cheap, but this one looks particularly expensive - of the £340m proceeds, shareholders are only likely to receive £200m (or 24.6p per share), see this table in the RNS last night;

My opinion - Reports in the press suggest that SBRY might offer up to 200p for HOME, in a mixture of shares and cash. Since a good chunk of that would simply be handing back HOME shareholders their own money (the cash, and the storecard debtor book), then even at that level it's not as generous as SBRY shareholders might like to imagine.

That said, I'd much rather bank 200p, even if some is in SBRY shares, then have the price slip back to probably 100-120p if the SBRY offer talks fall through. As mentioned before, personally I have sold more than 90% of the HOME shares in the market, as it's all about risk:reward, and to my mind I'd rather not risk losing money if the bidding activity falls through, rather than hold out for the last tranche of upside. It's been a more than satisfactory outcome to date.

With poor trading, and only a limited return of cash to shareholders as the alternative, then I think HOME's days as an independent group are probably now very much coming to an end.

JD Sports Fashion (LON:JD.)

Share price: 1105p (up 4.4%)

No. shares: 194.6m

Market cap: £2,150.3m

Trading update - an absolute barn-storming update, this one! LFL sales rose a remarkable +10.6% in the 5 weeks to 2 Jan 2016, absolutely trouncing larger rival Sports Direct.

This is obviously positive for profitability;

Given the continued strength in the core Sports Fashion fascias, the Board now expects that the headline profit before tax and exceptional items for the current financial year is likely to exceed current consensus market expectations of £136m by up to 10%.

I hadn't realised just how far JD has progressed. The Directorspeak sounds confident too;

"I am delighted to report that the exceptional performance in the year to date has continued during the key Christmas period. This is particularly pleasing given the very strong comparatives in the core Sports Fashion fascias in the prior two years. This performance particularly reflects the increasing strength of the JD Fascia and our continuing commitment to delivering a unique and often exclusive sports and fashion premium brand offer which enthuses and excites both customers and suppliers.

So it's clear that JD is eating Sports Direct's lunch, hence the diverging share prices. This also explains why SPD is building up a stake in sports brand owners, as reported in my SCVR yesterday. Intriguing stuff!

My opinion - JD is priced on a much higher PER than Sports Direct, and based on its performance reported today, that looks justified. The design of the stores couldn't be more different either. JD is a much smarter environment, which is clearly a more attractive option for the brand owners, who seem to prefer their stock being sold in JD, than in Sports Direct - which has the look of a pile it high & sell it cheap operation.

There's probably room for both formats, but it will be fascinating to see how things play out over the next few years. No doubt SPD will be fighting back. Although JD has the support of key brands Adidas & Nike, giving it a competitive advantage. There is also overseas expansion, and a strong balance sheet with net cash.

Lavendon (LON:LVD)

Share price: 132.5p (up 4% today)

No. shares: 169.7m

Market cap: £224.9m

(at the time of writing, I hold a long position in this share)

Trading update - I was bracing myself for a profit warning here, as the share price has been relentlessly declining. So it was surprising to read a positive update this morning, with sales trends improving decently in Q4 (up to +5% in Q4, as opposed to +1%, +2%, +1% in Q1-3 2015).

Overall trading looks good;

"The Group has delivered an improved year on year performance, with growth in revenues and further operational efficiencies driving increases in profitability, margins and ROCE. The Board expects the Group's results for 2015 to be at the top end of market expectations.

Outlook - there's a note of caution, but still upbeat;

As we move into 2016, whilst recognising the recent increase in uncertainty of the economic outlook, we are looking forward to building on the momentum we have developed during the past few years and to making further progress in the year ahead."

Valuation - Lavendon appears strikingly cheap compared with other equipment hire companies, both on a PER, and a P/NTAV basis.

It has a sound balance sheet too, and a good dividend yield.

My opinion - I think this looks strikingly good value, and am treating the recent price fall, combined with today's positive trading update, as a buying opportunity. As always, that's just my personal opinion, which may turn out to be right or wrong. It's not a recommendation, the onus is on readers to research things yourself, and form your own conclusion.

The downside risk is mainly of deteriorating trading in future, in particular in the M.East, where about 30% of the group's profits come from. Although the comments in today's statement about that region were surprisingly upbeat. I feel the share price more than factors in the downside risks.

Blinkx (LON:BLNX)

Share price: 18.25p (up 17.7% today)

No. shares: 404.1m

Market cap: £73.7m

Trading update - as usual, this company makes positive-sounding noises, but the reality remains dismal - there isn't a viable business here yet. The key phrase below is adjusted EBITDA breakeven - which means that it's still loss-making, because there are a load of additional costs to deduct from EBITDA to arrive at a proper profit figure - mainly in this case, capitalised development spending.

Based on preliminary, unaudited results, Q3 2016 revenue performance was in line with management expectations, during the seasonally strongest quarter of the financial year. Core products continued to ramp and offset declines in Non-Core products, while management continued to rationalize the Company's cost structure during the Period. As a result of the progress made on revenues and cost reduction actions, profitability in Q3 2016 was ahead of management expectations, achieving break-even on an adjusted* EBITDA basis during the Period.

Outlook - to me, this just reinforces the reality that Blinkx is still loss-making;

"We are pleased to provide an update on our third quarter trading, with adjusted* EBITDA performance ahead of management expectations," said S. Brian Mukherjee, CEO of blinkx. "Our focus on Core mobile, video and programmatic products, and exit of Non-Core product lines, is fully aligned with broader structural market trends. In addition, we continue to take cost reduction measures, which have begun to positively impact our path to profitability."

Note path to profitability - i.e. still some way off.

Net cash - in my opinion, the only value in Blinkx at the moment, is its cash pile. Unfortunately, I don't see any mention in today's announcement of what the cash position is.

It had $83.2m when last reported, as at 30 Sep 2015, which is likely to still be reducing, due to ongoing cash burn.

My opinion - this company has been a dismal failure. It's quite obvious to everyone but the completely deluded, that Professor Edelman's expose of the company's issues was bang on the money.

Since its legacy product profits collapsed (once customers clearly realised they were being scammed), then the company has struggled to reinvent itself with new products.

The shares have one main attraction - the cash pile. Although how much of that will ever find its way to shareholders? It seems to be depleting, providing jobs for people in America.

Other than that, the shares remain a punt on the company being able to successfully come up with profitable new lines of business. They've done it before, so who knows, maybe they might succeed again? So I wouldn't completely rule out this share if you just wanted to have a speculative punt, but personally I wouldn't want to pay any more than net cash, since the business as it stands is not worth anything to me, due to it being loss-making.

The lesson people should have learned from Blinkx, is that you should never invest in anything where you can't understand where the profits come from. Blinkx always spun all sorts of yarns about their business model, but it never rang true to me. It should be crystal clear how a company makes its profits. If you can't get to the bottom of that, and management deliberately obscure how profits are made, then something is wrong, and the profits probably aren't sustainable. That's exactly what happened here.

As I'm running out of time, a few very brief comments on other announcements;

Rosslyn Data Technologies (LON:RDT) - I've not looked at this company before, but don't think much of its interims today - "poor results (loss-making) & cash running out" were my initial thoughts.

Tesco (LON:TSCO) - quite a good update. LFL sales +2.1%, and results for 2015 are in line. Might be worth revisiting?

Cambria Automobiles (LON:CAMB) - substantially ahead of last year, but in line with recently upgraded forecasts. Is the boom in car sales sustainable? I'm wary of this sector, as electric vehicles are likely to decimate their business model in the coming 10-20 years, since they require very little maintenance.

Goals Soccer Centres (LON:GOAL) - trading in line with revised expectations. UK LFL sales poor at -7%. This puts me off taking the investment idea any further, as it suggests something is going structurally wrong - falling demand. Strong growth in the USA, but only 1 site there I think? Possible bid interest from Sports Direct, I wonder?

ASOS (LON:ASC) - on track for the year as a whole. Impressive growth, but sky high rating still. I prefer Boohoo.Com (LON:BOO) - faster % growth, better margins, and a lower rating.

Bioquell (LON:BQE) - trading "broadly consistent with the Board's expectations" - so a little below then. £47.5m in net cash, compared with £59.1m market cap! Activist shareholder will probably get the cash distributed, so worth a look.

Zotefoams (LON:ZTF) - trading in line. 4 month delay on commissioning new plant. Efficiency gains at existing production site(s).

Moss Bros (LON:MOSB) - trading in line. Good LFL, up 4.2%. Positive outlook. Net cash. Possibly worth a look, but has been too expensive last few times I've looked at it. Note that high divi yield has not been covered by earnings, so is depleting cash pile.

Right, I have to prepare for my next CEO interview, so will sign off for now.

Regards, Paul.

(of the companies mentioned today, I have long positions as disclosed above, and no short positions.

NB. These reports are my personal opinions only, which are subject to change without notice. They are never share recommendations - the onus is on readers to do your own research, and take responsibility for your own investment decisions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.