Good morning. My apologies for no reports on Mon or Tue - I'm not doing very well at the moment. Anyway, let's get this show back on the road, as there are lots of results to comment on today. I'll catch up with the backlog over the next few days.

accesso Technology (LON:ACSO)

Share price: 992p (up 3.7% today)

No. shares: 22.0m

Market cap: £ 218.2m

(at the time of writing, I hold a long position in this share)

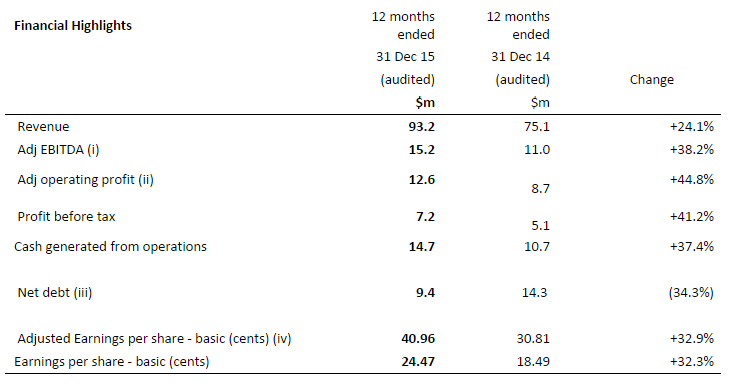

Results y/e 31 Dec 2015 - the highlights look great - decent increases in all the main metrics. NB. remember that Accesso reports in US dollars - so it's frighteningly easy to forget that if you skim the numbers too fast, and mis-read the figures as being in sterling. I did that earlier this morning, and thought to myself, ooh it's only on a PER of just over 20. But of course once you translate 40.96c into sterling (currently £1 = $1.41) then adj.EPS is 29p, so the PER is actually very high, at 34.2.

So the main question is whether the company's growth potential justifies it being on what is undoubtedly a pretty aggressive rating. Personally I think it does, hence why I hold a long position in the company. The Merlin deal changed everything for me (that was when I bought in). There have been impressive subsequent deals announced too, e.g. with Six Flags, so there's really no doubt now that Accesso has become the most serious global player in its market. Although it's also worth bearing in mind that Disney is probably never going to become a client, as they do their own thing.

Here are the highlights from today's results announcement:

Impressive stuff. There should be plenty more growth to come, as the big Merlin deal rolls out to all their sites.

Directorspeak/Outlook - flags up impressive numbers of contract wins, and the long-term nature of the client relationships;

...92 new accounts comprising between them over 200 new venues being added to our customer base during the year.

The clearest signal of our progress lies not in the numbers, and not even in the many achievements of the year in review. Rather, I would urge people to look at the significant, long-term trust that both Merlin and Six Flags have placed in us over the last six months. To select a partner for one year, even two is a big step to take. To select a partner for seven or even ten years, however, is quite a vote of confidence in our technology and our team - and it is this which underpins my confidence in 2016 and the years ahead of us."

I think this is absolutely correct. If you look at the accounts from Merlin, there is considerable validation of ACSO in their own commentary, saying very positive things about it. So there's no doubt in my mind that ACSO is on an exciting growth path.

One broker flash note this morning comments that upgrades are now likely for 2016 & 2017 forecasts, and that the upward momentum in the share price should continue.

Dividends - there aren't any. That's fine for the time being - this is a growth stock, so people are buying the shares for capital appreciation, not income. Also the balance sheet is not strong enough yet to pay out divis.

Balance sheet - not great - I'd like to see this strengthened, to protect the downside. Although with revenue being largely recurring, over long contract lengths, then you could argue that there is little risk to the revenue/profit forecasts, so balance sheet strength isn't so important.

Net assets are $63.6m, but that's dominated by intangibles. So once the $71.9m intangibles are stripped out, NTAV is negative, at -$8.3m. Not ideal, but not a disaster either.

Bank debt is $14.7m, partially offset by cash of $5.3m, giving net debt of $9.4m. That looks manageable, given the profitability of the group.

New bank facilities - note the separate RNS yesterday, giving details of extended bank facilities, and warm words from the bank manager included in the announcement. So the bank are clearly very comfortable with things here, and in providing very cheap borrowing facilities, it looks as if the bank are very keen to be associated with this company - a nice position to be in.

For these reasons, I can live with the relatively weak balance sheet.

Development costs - note that the group seems to be capitalising a lot more in development costs - the cashflow statement shows that it capitalised $6.2m which is described as "purchase of intangible fixed assets" - I assume this is mainly development spending, i.e. internal costs.

The amortisation charge shown for development costs is much smaller, at $1.2m so the net benefit to adjusted profit is hefty, at $5.0m from this accounting treatment.

My opinion - on any conventional basis, this stock looks really expensive! So normally I'd run a mile from these sort of valuation metrics. However, in this case, I feel that ACSO is that very rare thing - a superstock - i.e. a company that is developing a unique niche, with a huge moat around it. So just looking at the PER this year & next is missing the point.

The point is that this is likely to be a very much larger business in say 5 years' time. Also, if you look at the >3% shareholder list, there are only 3 Instis in it, holding 18.8% in total. That's much too low - so I believe there is likely to be great demand for this share from Instis. This is backed up by what happened in the market sell-off we had in Jan 2016. Whilst many other small caps were tumbling, this one was remarkably solid. Why? Because Instis were hoovering up all the sellers. I watched the trades, and you could see it happening. The price should have been falling as small sells went through, but it didn't fall - as someone was in the background pleased to be buying up all the sells that came their way. This is very encouraging.

I read a book about superstocks last year, and it really opened my eyes to the potential, when you very occasionally find a genuine superstock. The trick is not to worry about valuation during the big move up. The Instis will have to bid the price up, to get hold of stock. After results like today's, I reckon this stock could have a lot further to rise, so personally it's the only stock in a virtual compartment in my portfolio marked "Ignore valuation for now. Hold".

CEO Interview - good news! Tom Burnet, the CEO of Accesso has agreed to do an interview with me on 22 Mar 2016. So please submit your questions using this link only please for me to ask Tom. I can't guarantee to ask all questions, but will do my best.

This share won't be

for everyone, and in particular, value investors will probably be taking me off

their Xmas card lists after reading the above! However, look what the share

price has done since the big contract announced with Merlin, which I flagged up

to readers as highly significant here on 30 Jul 2015;

WANdisco (LON:WAND)

Share price: 110p (down 21.4% today)

No. shares: 29.6m

Market cap: £32.6m

Let's go from the sublime to the ridiculous.

Results y/e 31 Dec 2015 - this set of results has got to be one of the worst I have ever seen.

A $30.5m operating loss, on revenues of just $11.0m. This growth stock didn't even manage any top line growth, revenue is down 1.8% against the prior year.

Worse still, it's completely out of cash - there was only net cash of $2.6m at 31 Dec 2015, so I doubt whether they will be able to make the end of March payroll. There's an undrawn borrowing facility, but I'm not sure what the terms are for the use of it.

The company says that cash overheads have been reduced to $25m p.a. at a Mar 2016 run rate, but that's nowhere near breakeven, with gross profit only running at $10m p.a..

My opinion - this is a total dog, and needs to be put down, in my opinion.

The narrative reads as completely delusional to me.

Let's see what price the next, imminent fundraising is done at. 50p? 20p? I suspect the company might get a few more months' money from investors, in return for an agreement to absolutely slash costs to the bone.

For me it's a total bargepole stock. The worst kind of story stock - which raised a ton of money, and then burned through it at a frantic pace, with nothing to show for it now, in the figures. What a terrible waste of investors's money. I'd be livid if my pension fund manager had backed this.

Fairpoint (LON:FRP)

Share price: 154p (down 5% today)

No. shares: 45.6m

Market cap: £70.2m

Results y/e 31 Dec 2015 - the figures look quite good - Stockopedia shows broker consensus of 18.4p, and the actual results today show basic adjusted EPS of 19.29p, so looks a beat against forecast. So I'm not entirely sure why the share price is down 5% today.

The outlook comments look OK - it's not news that the IVA part of the business is declining, that's been known for some time.

During 2015 we have delivered on our strategy to expand the Group`s consumer legal services (which now represents 67% of the Group`s revenue on a pro forma basis) and we continue to see this market as an area with significant growth potential in the future. 2016 will benefit from a full year contribution from the acquisition of Colemans and our integration, marketing and new product initiatives. In addition, we are targeting further value enhancing acquisitions to further consolidate our market.

We anticipate the market conditions in the IVA and DMP segments will remain challenging given the benign interest rate and employment outlook. We will therefore continue to focus on margin management and cash generation and expect these businesses to continue to make useful contributions to Group earnings.

As a result of the above factors, the Board expects to make good progress in 2016 and beyond.

On a PER basis then, the shares continue to look good value - I make the PER 8.0 times. That's perhaps the right sort of price, for businesses that don't really achieve high valuations - a declining IVA business, and legal services (which is now about two thirds of revenues, following several acquisitions).

Something always seems to go wrong with legal services businesses. Look at how Quindell imploded, but was bought out at a madly high price by Slater & Gordon, who have now themselves imploded - S&G share price has dropped in the last year from about AUS$8.00 to just AUD$0.29. The main reason seems to be that they totally screwed up the acquisition of Quindell, and overpaid by a gigantic factor, and have now been hit by Government action to clamp down on false whiplash claims - which was basically how Quindell made its profits, as I said all along.

Fairpoint reiterates today that it has only 8% of revenue exposure to whiplash claims, and that it mainly does fixed fee legal work, driving down the cost for end customers, using call centres to streamline the processes. So that kind of work doesn't sound toxic to me, indeed by doing things like divorces very much more cheaply, it might be a good thing.

Dividends - not bad, with a 6% increase to 6.8p for the full year.

Balance sheet - OK, but not brilliant.

My opinion - I'm not sure about this share. It's probably priced about right, on a PER of 8. Legal services businesses are cheap because they're not great businesses in truth. If they were, the owners wouldn't sell them cheaply, would they?

So you can't really expect an aggregator of legal services businesses to itself be on anything other than a low rating.

I've just realised the 2016 Budget is being announced now on Radio 4, so am listening to that now.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.