Good afternoon!

What a fascinating evening at Mello Beckenham last night, and great to see so many friends there! The draught Peroni is just magnificent at Sea Salt restaurant, it's worth going just for the beer. The barman told me it's that good because he is so fastidious about cleaning the pipes.

Lakehouse (LON:LAKE)

(at the time of writing, I hold a long position in this share)

Management of Lakehouse (LON:LAKE) (CEO Stuart Black, and CFO Jeremy Simpson) came along and gave a presentation, and fielded questions in a lively Q&A session. I think they deserve great credit for coming along to speak to investors in such difficult circumstances - the founder has teamed up with Slater Investments to call an EGM to oust the NEDs, so this was a hot topic of discussion last night.

As I pointed out to the CEO, Slater Investments are a highly respected firm, so if they want to oust NEDs, then something really must be up. I thought the response was excellent actually - as they pointed out, there's no way that the company (or other shareholders) can possibly accept an attempt to oust independent NEDs, and replace them with appointees of two shareholders. The whole point of NEDs is that they're independent, and can't be appointees of particular shareholders. That's a totally valid point, which I accepted.

There's definitely a concern that the company is racking up heavy costs with advisers, dealing with the board room issues. So I hope this is dealt with quickly, and sensibly. It's certainly a major distraction for everyone, and has got to be sorted out.

Overall I thought the Directors didn't come over particularly well - mainly because the session was being filmed, and I think this made them clam up - there were clearly things they wanted to say, but couldn't. So I think most of us felt a bit mystified & frustrated by what's going on at the company, and that we've only been told part of the story.

That said, there were some useful snippets in the discussion, and I sat next to the CEO over dinner, and had a good chat with him. We discussed how the city firms tend to float companies with large, lumpy shareholdings placed with Institutions, in order to earn their huge fees for as little work as possible. The trouble is, this then leaves a poor shareholding structure, with inadequate market liquidity.

So newly floated companies have to court a private investor following, in order to generate some liquidity in the share. It would be far better if a private shareholder base could be included within the original float for all companies.

The CEO indicated that the share price had crashed so heavily on the recent profit warning because one Institution dumped their entire holding on the day.

The Directors sounded pretty confident about the updated forecasts out in the market, as indeed they have confirmed in a recent RNS. Whilst the forecasts are from their broker, the CFO confirmed that of course the broker has extensive discussions with the company, and is given a steer on key facts & figures by the company, as you would expect - that's the same everywhere.

As John McArthur of Tracsis said a while back at a presentation, the house broker forecasts for all companies are really the company's own forecasts.

Overall, I felt that the presentation improved from being a car crash early on, to being OK by the middle-end. I think it was probably a mistake to have it filmed, as that just caused the Directors to clam up. It's usually great to have events filmed, where there is nothing contentious going on.

I feel that the Directors have perhaps been overwhelmed by events recently, but they struck me as fundamentally decent people, and it's really good that they're getting out & about, and talking to private investors, and of course facing sometimes hostile & sceptical questioning. So that is admirable.

As I've mentioned before, if LAKE does hit this year's forecasts, then the shares will be dirt cheap. Although you can't rule out more problems emerging, as we still don't really know what's at the bottom of the EGM requisition. So I'm just hoping that there won't be more problems that surface.

T Clarke (LON:CTO)

Share price: 87.5p

No. shares: 41.8m

Market cap: £36.6m

(at the time of writing, I hold a long position in this share)

Results y/e 31 Dec 2015 - these figures look terrific, compared with last year. Underlying operating profit has risen from £1.3m in 2014, to £4.6m in 2015. Although it should be noted that the profit margin is slim, since turnover was £ 242.4m (up 16.6% on 2014). That's a profit margin of only 1.9%.

Underlying diluted EPS has come in at 6.86p, which looks to be usefully ahead of expectations (of 6.0p). That's a PER of 12.8.

The order book looks healthy at £300m, up from £250m last year. It's important to understand that the quality of contracts is improving - as the sector is buoyant, margins are improving, and customers are increasingly having to lock in specialist contractors in advance, which of course means that T.Clarke has more pricing power than it did in the downturn, when it was a question of accepting low margin work just to keep its workforce utilised.

Dividends - a final divi of 2.6p is the same as last year, giving 3.1p in total divis for the year - yielding 3.5%

Outlook - this is a buoyant sector, and has several years of good times ahead of it, according to several CEOs I've spoken to. Today T.Clarke says;

As we exit the recession, and market conditions continue to improve, our Executive team is focused on taking advantage of market opportunities as they present themselves to grow the business and deliver increased value to shareholders.

A bit vague, but there's no doubt the general tone of the announcement today is positive. So we should be able to expect increased profits again this year.

Broker consensus of 7.2p for 2016 looks too low. Personally I'm hoping for nearer to 10p EPS this year.

EDIT: I see that N+1 Singer has today increased its 2016 adj. EPS forecast from 7.2p to 8.0p, so that's good news.

Balance sheet - the main issue is the pension deficit, which is shown as £13.4m. This requires annual payments of £1.3m, and by the sounds of it that could increase perhaps?

The next triennial actuarial valuation, as at 31st December 2015, is underway and is expected to show a further deterioration in the funding level due to market related factors. The results of this valuation and its impact on future funding will be known towards the end of 2016.

The pension deficit is the main reason for NTAV being negative, at -£ 3.4m.

So it's not a great balance sheet, but bank debt isn't a problem with a net cash position at year end of £ 6.7m - although as with all companies the year end position is usually window-dressed - so it's a favourable snapshot, rather than a typical figure I tend to find.

I'm glad the company is retaining some cash within the business, rather than increasing the dividend. That's the right thing to do - strengthen the balance sheet in the good times.

My opinion - this is a cyclical, low margin contracting business. So it's not one to bet the farm on. However, I think the company is well-managed, and has a skilled, specialist workforce which is maintained throughout downturns, thus allowing the company to take on higher margin work in the good times. Today's results were very good, and beat expectations.

We're in the right part of the cycle now, with good market conditions likely to pertain for several more years. Of course we all have to sell right at the top, at some point in the future! That's a long way off for now though, in my view.

Synety (LON:SNTY)

Share price: 80p (up 19.4% today)

No. shares: 13.5m

Market cap: £10.8m

(at the time of writing, I hold a long position in this share)

Results y/e 31 Dec 2015 - I would have written a section earlier on this company, if I'd realised it was going to rise nearly 20% today! This is the company which offers a software product - cloud telephony, integrated into customers' CRM systems. It's a terrific product, which I use myself, but the company has had a rather painful growth journey from start-up, through a period of heavy cash burn (which hasn't finished yet), but at last the results are starting to show through, hence today's surge in share price.

Key points;

Excellent growth - revenues up 103% to £3.3m. Growth in USA is particularly noteworthy, up over 600% (from a low base)

87% of revenues are recurring (monthly direct debit mainly), and sticky

High gross margin of 77%, hence considerable operational gearing from further revenue increases

Still heavily loss-making though, with a £4.5m loss before tax

A R&D tax credit of £369k helps somewhat, as part of an overall tax credit to the P&L of £833k

Turnover needs to almost triple to reach profitability, so still some way to go - however at the current growth rate, that looks do-able.

Cash position getting tight again, with £1.5m cash at 31 Dec 2015, plus £400k R&D tax credit receivable, plus £900k bank facility, giving about £2.8m available cash.

The Chairman (Peter Simmonds, formerly of DotDigital) says it's now funded to breakeven;

An equity fund raising in April 2015 raised approximately £3m to finance the continued development of the business and in February 2016 a £900k loan facility was agreed with Barclays. The Board is of the opinion that, with continued tight cost control and sales and client retention levels prudently assumed to continue at a similar rate to H2 2015, the business will exit its cash burn phase without the need for further funding.

That's very important, because the last fundraising was botched, and killed the share price, as we've discussed before. Although I note that the broker has been changed to Cenkos, who I'm sure could execute a small additional fundraising quickly & easily, should one be needed or desired (e.g. to accelerate growth once the company is close to breakeven).

Directorspeak - the Chairman sounds confident;

In the relatively short time that I have been involved with the Group I have seen it make great strides towards its strategic goals, driven by the hard work and enthusiasm of the whole team. On behalf of the Board I would like to extend my thanks and congratulations for all that has been achieved so far.

Of course, we all know that the journey is far from complete, and there remain many strategic and operational challenges and opportunities to be navigated by this young Group for it to reveal its true long term value. In my role as Non-Executive Director, and since January 4th this year, as Non-Executive Chairman, I am confident that the necessary steps to strengthen the Board, optimise the performance of all the Group's resources, and build on the progress made to date, are in place or well advanced. All of which means that the Group can look forward with increased confidence to achieving its strategic objectives in 2016.

Cash burn has been further reduced by refocussing growth on existing CRM partners, so this should help the drive to breakeven;

As a consequence of this review, further reductions to non-customer facing operations were identified, and have already been actioned, with the net result of reducing costs by just under £40k per month with immediate effect.

The strongest evidence yet has been given that Synety can indeed reach cashflow breakeven;

Following these latest cost reductions, the Group's underlying annualised cash outflow from operations (see definition in the Glossary at the end of this announcement) will be reduced to under £200k per month. With continued tight cost control and a conservative assumption that sales and service delivery continues at similar levels to H2 2015 on average, we would expect this figure to drop by approximately £12k - £15k per month which, when considering year-end cash balances, newly signed loan finance from Barclays, and other expected cash flows, clearly shows us having enough cash to deliver this company to break-even without the need to raise further funds.

That stacks up. As noted above, the company has £2.8m cash available to it, so this time next year the company should be getting close to cashflow breakeven.

My opinion - this is really encouraging stuff. This is the strongest evidence to date that this company should indeed succeed - i.e. become profitable, probably in 2017.

Management has demonstrated that it won't need to do another fundraising, so the risk of further dilution has now receded, which is great news for the rather battered & bruised shareholder base!

I believe that, during 2016 we are likely to see this share re-rate, as the market begins to price it as a growth company. So I see potentially 50-100% upside on the current price over the next 12-18 months, if the current growth trajectory continues.

It seems to me that shareholders have taken the pain here, and we could well be in for a much better time in future. Although there are likely to be some stale bulls who want to exit on increases in price, so that could weigh on the share price for some time. Note that the biggest shareholder, Helium Rising Stars, has been steadily adding to its already large position, so that's helpful in hoovering up sellers.

It's looking good I think - but as a long-suffering bull, maybe I'm seeing things through rose-tinted spectacles? Although I think the stuff above specifically about cash burn has gone a long way to extinguishing the bear case on the shares.

The 2-year chart below is a reminder that we've got an awful long way to go, to regain the previous highs. Although personally most of my shares were bought in the Placing at 90p, so I reckon those will soon be in profit.

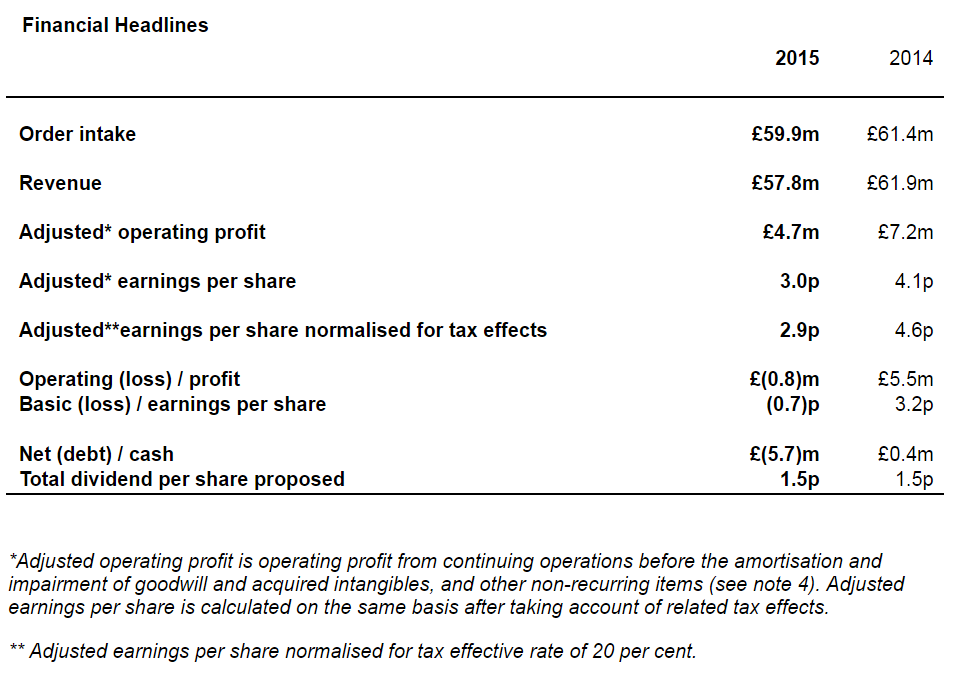

Vislink (LON:VLK)

Share price: 26.9p (down 0.9% today)

No. shares: 122.6m

Market cap: £33.0m

Results y/e 31 Dec 2015 - here are the highlights from today's results;

The house broker put out a note this morning, saying that results are in line with revised expectations, after the profit warning in Dec 2015, which I reported on here.

The company also warned in Dec 2015 that there would be some working capital issues at year end, which would unwind in 2016. That explains the poor cash generation in the 2015 figures, and that Receivables on the balance sheet actually went up by £ 2.8m in the year, when you would have expected it to go down in a year when turnover declined.

The shares have more than halved from the peak of around 60p last summer, so the lacklustre performance in 2015 is now arguably already in the price.

Valuation - it does look quite good value now on a PER basis - using adj. EPS (normalised tax) of 2.9p above, gives a PER of only 9.3. Paul Hill at Equity Development, who is a superb analyst (and an accomplished small caps investor) is forecasting a rise to 3.6p adj. EPS in 2016 - for a forward PER of 7.5.

An acquisition spree means that the group now has net debt of £ 5.7m, although that should reduce somewhat as the working capital normalises in 2016 as noted above. I don't see this as a problem level of debt, providing trading does not deteriorate further.

Restructuring - a poor performance in 2015 by the core business means more restructuring, with a hefty £ 3.1m exceptional charge this year. Although of course this year's restructuring is next year's higher profit.

The Pebble Beach acquisition has again reported strong figures, so without that acquisition, the figures would look pretty bad. If the figures can be believed - there always seem to be a lot of adjustments, and exceptionals with this company, which makes me uncomfortable.

Outlook - to me, this reads as a bit wobbly;

Our markets continue to be variable. The Group enters 2016 having repositioned its capabilities and invested in new products, both in software and hardware. The Group can with confidence exploit the technology shift in the market in 2016.

We are transforming the Group. As our software group grows we aim to enhance earnings, margins and cash generation and remain completely aligned to our shareholders' objectives of delivering long term profitable growth.

On a positive note, the year end order book was up, at £ 11.0m compared with £ 8.8m at end 2014.

The Chairman's comments point towards a possibly improved performance in 2016;

In its core broadcast markets Vislink Communication Systems found market conditions in 2015 challenging and they are expected to remain variable in 2016. However, the significant restructuring of Vislink Communication Systems, coupled with the investment and launch of new products and an increasing order pipeline, provides an encouraging platform for improved results from Vislink Communication Systems.

Both the Harmonic and GoPro strategic relationships continue to progress and we are pleased with the progress made.

The Group is confident of its strategy, with the development of its IP based solutions and the growth of software and services, which will benefit the Group as a whole in 2016 and beyond."

My opinion - I'm beginning to thaw towards this share somewhat. Not enough to want to buy any, but not far off. It has fallen a lot, and whilst performance in 2015 wasn't great, it wasn't dire either. Possibly 2016 might be better, who knows?

The personal greed of the Exec Chairman is an ongoing issue. Whilst the ill-conceived, morally repugnant "Value Creation Plan" now looks so far underwater that it probably won't pay out, the fact remains that Directors had such poor judgement as to think this was a good idea, and didn't even ask for shareholder approval of it.

Moreover, note that the (part-time) Exec. Chairman trousered £ 438k remuneration in 2014, and £ 459k in 2013. However, that's not all. Note that in 2014 he also plundered the company for an additional £304k to settle a tax bill;

Having achieved the performance related criteria a bonus was earned by both Executive Directors for the year ended 31 December 2014. The remuneration table above indicates the value payable to Ian Davies but John Hawkins has elected to have the bonus he earned of £303,840 used to offset against an outstanding HMRC liability, which is referred to later in this report.

(source: pages 51-52, Vislink 2014 Annual Report)

So that makes his total remuneration for 2014 an astonishing £ 742k! What a complete joke. Remember there's an LTIP and a VCP on top of that too.

Part of me therefore thinks that it's best not to go near this company's shares. However, it's not about moral outrage, it's about making money. So if the shares are likely to go up, then maybe it's best to just hold my nose and buy some?

I'm on the fence at the moment. What do readers think? I'm wondering if there is a short term trade here, maybe to scalp a 20% gain? I wouldn't want to hold longer term, that's for sure.

Time is running short now, so I'll finish with a few brief comments;

Hardide (LON:HDD) - a profit warning, as expected. This was a disastrous trade for me recently, which I ate humble pie over here on 22 Feb 2016. It seemed obvious from the AGM statement on that day that things were not going well, so the profit warning today is entirely to be expected.

It's an interesting technology, but the shares are too illiquid, and the company is too dependent on one key customer, and one sector.

Billington Holdings (LON:BILN) - fantastic results from this structural steel company, which is enjoying an impressive turnaround. At 21.1p EPS has come in ahead of expectations (of 20p), and the dividend has been doubled to 6p.

On outlook, it says that 2016 has had a slow start but,"the remainder of the year looks set to be busy for all divisions".

The balance sheet looks alright. I tried to buy some of these shares 2 years ago when they were around 100p, but couldn't get any - too illiquid. Pity I didn't pay up to get some, as they've since tripled in price.

It's probably too late to get involved now - the main part of the upward move has probably now happened.

IQE (LON:IQE) - this share has looked cheap for a while, so it's definitely worth a closer look. Have any readers looked into this one? Results today look terrific, although boosted by a £5.2m property disposal profit.

Cashflows look impressive, although it's spending about half of cashflow on capex (including capitalised development spend). Debt is coming down usefully. Well worth a closer look I think.

Johnston Press (LON:JPR) - it's managing the terminal decline of its newspapers very well - and they're generating tremendous profits & cashflow. However, about half cashflow is required just to pay the interest on its bonds. Then the pension funds have to be serviced. Will it leave enough to repay the capital on the bonds? Probably not. However, there's an intriguing possibility that the group might be able to buyback its own bonds at a deep discount.

It's going to survive for a few more years, but what happens then? The ad revenues & circulation figures make depressing reading - an unrelenting downward trend.

Xeros Technology (LON:XSG) - it's a jam tomorrow company, so it's all about the future potential, rather than the current results. Today's results are for 5 months to 31 Dec 2015. It's a £5.6m loss, so over £1m per month. However, there's pots of cash on hand - nearly £ 50m on the balance sheet.

A market cap of c.£ 180m certainly anticipates considerable success. I try not to invest in things like this any more, as they nearly always end up very poor investments.

Victoria (LON:VCP) - this carpet company has gone absolutely bonkers in recent times. Astounding! Today it puts out another positive update - "materially ahead of current consensus market expectations". Who would have thought that a carpet manufacturer could have 20-bagged in 3 years? Miraculous stuff, and it doesn't even look expensive now, as earnings expectations have risen so much.

Judges Scientific (LON:JDG) - today's 2015 figures look decent to me. The outlook comments seem OK overall;

After experiencing an acceleration of order inflow during the last few weeks of 2015, bookings for the first ten weeks of 2016 were low, as has been the experience in the previous two years. The slow start to the year may become a permanent feature of our business, perhaps attributable to the eagerness of many public bodies to order before the end of the calendar year and to the Chinese New Year shutdown each February.

The US Dollar has continued to progress since the year-end and Sterling has also weakened against the Euro, producing the most favourable forex environment since 2009. The Group starts the year with a solid order book, a small but exciting new acquisition and a strong financial position, all of which serves to underpin the Board's confidence that Judges is well positioned to face the inevitable challenges of 2016.

Interesting comments re forex.

The shares look priced reasonably, given the group's strong track record, in my view.

Mission Marketing (LON:TMMG) - results today look reasonably sound. Balance sheet issues remain - with negative NTAV. Outlook comments sound encouraging. This share seems to want to hang around in the low 40p's. It's a cyclical business with a rather flimsy balance sheet, so it's difficult to see that much upside on the current price. Although the very low PER may attract buyers perhaps?

All done for today, see you tomorrow lunchtime!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.