Good morning!

Ed asked me to do a cameo appearance in his talk at UK Investor Show, in a side room. So I dragged myself out of the Westminster Arms, and popped over at 2pm to do a short talk on my favourite shares. Nobody told me that it was being filmed, but it was. Here is the link, of me rattling on about shares. I've not watched it back yet - everyone hates seeing/hearing them self!

Michelmersh Brick Holdings (LON:MBH)

Share price: 79.4p (down 1.4% today)

No. shares: 81.2m

Market cap: £64.5m

AGM statement (trading update) - a simple, but well-constructed trading update:

"After a very strong trading performance in 2015, I am pleased to report that the Group has performed well for the first four months of 2016. The Board expects the Group's trading performance for the twelve months to 31 December 2016 to be in line with market expectations.

This is the correct way to do things. All investors really want to know, is how the company is going to perform in the current year. It annoys me when companies duck this issue, and use a form of wording which gives them wiggle room (as for example was done yesterday with Fairpoint's trading update). The market sees right through it, when companies & advisers try to be too clever, and use weasel words to avoid making a clear statement about the company's performance.

So happily in this case, there is no such confusion. The company is trading well, and in line with expectations.

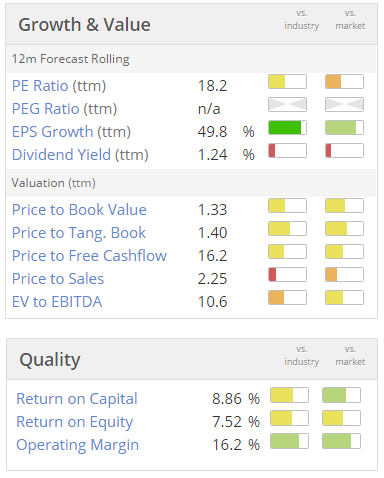

Valuation - it looks rather pricey to me - a PER of 18, for a brick-maker? That seems a pretty punchy rating to me:

Ah! I've just noticed something. In the graphic above it says "(ttm)" - this indicates the absence of forecasts, so in this situation Stockopedia defaults to trailing twelve month figures - i.e. historic earnings figures. So that could mean that the PER is possibly over-stated?

I've had a look through my email inbox, but unfortunately there's no sign of any broker notes for MBH, so I'm in the dark with regard to earnings estimates for the current year.

It would be helpful if companies actually state what they believe market expectations are, by putting an asterisk next to the "in line" comment, then giving the figure below. Especially where there is little broker coverage, as in this case.

My opinion - since I don't have broker forecasts, I can't really comment any further on whether the shares are good value or not. Bear in mind there are also property assets here, so a hybrid valuation is probably best - i.e. using a PER to value the business, but then adding on an additional (discounted) amount for any surplus property value.

The divi yield here seems unexciting. One also has to bear in mind the cyclical nature of this type of business, and not end up over-paying in the good times, only to see earnings collapse when the next downturn occurs.

Cambria Automobiles (LON:CAMB)

Share price: 77.3p (up 10.4% today)

No. shares: 100.0m

Market cap: £77.3m

Interim results, 6m to 29 Feb 2016 - the market clearly likes this statement, with the shares up 10.4% today.

The figures look excellent to me. The key figure is:

Underlying Earnings per share increased 42.5% to 3.69p (H1 2015: 2.59p)

Can't argue with that! Cambria also makes some interesting comments today about the significant change in car buying habits - people are leasing cars now, instead of buying them:

The UK market has now had a sustained period of year-on-year growth in new car registrations. The March registration data showed 518,707 registrations in the month, the largest single month since the change to a bi-annual plate change in 1999. The consumer offers from the manufacturers make new car purchasing much more affordable with strong accessibility programmes and a dominance of Personal Contract Purchase ("PCP") product penetration in the new car market. PCP renewal activity in the new car market is now becoming the norm and Guest's changing their vehicles in a more structured manner, led by the finance product on a 3-4 year cycle, is now commonplace and has structurally changed the new car market over the past four years. We believe that the new car market is mid-cycle and registrations will continue above the 2.6m unit level for the foreseeable future.

As long as interest rates remain low, I expect this new pattern to continue.

I recently took delivery of a brand new car, because financially it was a complete no-brainer. Rather than paying out increasing repair bills to keep my 14 year old Jaguar on the road, instead I now have a brand new car, for just over £200 per month on a personal lease. Repair bills are nil, and it uses about a third less fuel than the old car did.

Outlook - this sounds excellent - trading ahead of market expectations. So forecasts will be raised no doubt:

Cambria's performance in the key March plate change month was strong and was ahead of both our business plan and substantially ahead of the previous year. The Board is confident that Cambria will maintain this momentum trading ahead of current market expectations for the full year and continue to deliver an improved performance across all its activities.

Balance sheet - very often when companies claim to have a strong balance sheet. they're lying. However in this case, the company does have a pretty sound balance sheet, with plenty of freeholds.

My opinion - I like it. This is a well-managed, entrepreneurial business, on a reasonable valuation.

I'm off for a siesta now.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.