Good morning.

Some absolutely superb posts in the comments section yesterday, terrific stuff! It's particularly good when readers with relevant sector experience post about companies from first hand experience as a customer or supplier.

All too often we just get our information about a listed company from that company itself. Yet this will obviously be a rose-tinted view! So these days I'm trying increasingly to search for info & views on companies from third party sources.

I've seen cases, e.g. Sprue Aegis (LON:SPRP) , where investors have picked up on poor product reviews online (hence publicly available, not insider information), and deduced that there was a serious problem. Some time later the company told the market that there was a serious problem and the shares more than halved.

Portmeirion (LON:PMP)

Share price: 1215p (down 4.1% today)

No. shares: 10.8m

Market cap: £131.2m

AGM Statement (trading update) - this is an uncharacteristically downbeat statement from this UK maker of pottery & associated products:

"Our two largest markets, the US and the UK have performed better than during the same period last year but sales to South Korea have not recovered as we had expected.

As a result total sales for the four months to the end of April were 2% below the corresponding period last year.

We have also experienced an unexpected decrease in demand from some of our other Asian markets. However, we do not believe that this is a permanent trend.

That's not good, sales overall being down - albeit not disastrously so, at 2% below last year.

I'm confused by the last section above. How do they know that weaker demand from other Asian countries is not a trend? Overall, this is a company which is reliable & trustworthy in its announcements, so I've found over the years that we can generally accept what they say at face value. This is not always the case for all small caps - I keep a mental note of which companies put out misleading announcements. Portmeirion isn't one of them thankfully.

Overall though, the company says it's on track to meet full year forecasts, so panic over:

We are taking action in response to the decrease in demand and we are confident that this, combined with our recent acquisition of Wax Lyrical, will provide overall growth for the Group this year. Consequently, we expect profit before tax to be in line with market expectations for the full year."

By "taking action" (somewhat vague) I presume the company means cutting costs, and having a sales push? If so, why not just say so?

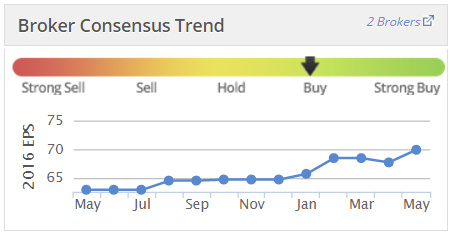

Looking at the broker forecast graph on Stockopedia, below, it seems to me that forecasts were not increased enough to reflect the Wax Lyrical acquisition. So possibly a degree of finessing might have gone on here? So I suspect the company might have guided brokers lower on the core business, but indirectly - by getting them to under-forecast a bit for Wax Lyrical. Thereby avoiding a profit warning.

Valuation - broker consensus is only 69.9p for this year, not a big increase on last year's 65.5p. It should be noted though that last year was a particularly good year, with the company comfortably beating forecasts. So it's up against quite tough comparatives.

That drops out at a PER of 17.4 times 2016 forecast EPS.

My opinion - given the more hesitant update today, I'm less keen on this share, and think it's probably fully priced for now. So am taking it off my potential buys list for the time being, on valuation grounds. With a degree of uncertainty around its Asian markets, I feel a PER of 17.4 is looking perhaps a tad too warm now. Maybe time to take some profit? What do readers think? Comments in the comments below.

Bear in mind also that the cash pile has been used to buy Wax Lyrical, and that there is now modest net debt. So there is less balance sheet protection than there used to be. That said, the acquisition looks a sensible one - a good business, bought at a reasonable price.

Indigovision (LON:IND)

Share price: 140.5p (unchanged today)

No. shares: 7.6m

Market cap: £10.7m

(at the time of writing, I hold a long position in this share)

AGM trading update - we all know the history of this company, so I won't go over old ground again. All that matters now is interpreting today's update, and comparing it with the current valuation, to judge whether the share is worth selling, holding, or buying. So I'll work through the statement in sections:

"We indicated at the time of our annual results in March that the start to 2016 had been better than last year, although as the corresponding period was particularly subdued, this should be seen in context. This trading pattern has been broadly continued in the year to date.

To put that into context, in H1 2015, IND reported turnover of $22.6m (note that it now reports in US dollars), and a $1.3m loss before tax.

It then cut costs, and moved into profit in H2 2015, as set out in the table below (I have deduced the H2 figures by deducting H1 from FY):

| IND, $m's | H1 2015 | H2 2015 | FY 2015 |

| Revenue | 22.6 | 24.5 | 47.1 |

| Profit before tax | -1.26 | 0.51 | -0.75 |

The interesting thing is that the company's overheads are variable to a considerable extent. So the company can, and has, cut back overheads when turnover falls, thus stemming the losses. Note that in H2 last year, it actually moved back into profit, of $0.51m for the 6 months.

The company continues:

Revenues are a little behind last year, but operating performance is ahead as a result of action taken to adjust to market conditions. Efficiencies continue to be realised, cash balances are strong, and currency movements have benefited the Group in the year to date. Pricing pressure continues to be evident in the marketplace, but this has been ameliorated by higher sales volumes year on year and by product cost reductions aimed at maintaining gross margins.

"Revenues are a little behind" - so that means below the $22.6m reported in H1 last year. That represents a decline on the sequential half year ($24.5m in H2)

"Operating performance is ahead" - I would hope so! Last year's H1 was a disaster, at a loss of $1.26m. By my simple calculations, I reckon the performance for H1 2016 is heading for a small loss, of c.$0.5m. Not good, but not a disaster.

I'll summarise the other points in today's update, as follows:

Bull points

- Gross margins (51.4% last year) being maintained through product cost reductions

- Cost cutting (overheads) in 2015 has lowered the breakeven point

- Overheads are variable, so scope to cut further if required

- Cash balances strong, and balance sheet overall is good, underpinning current valuation (NAV = $23.3m at 31 Dec 2015)

- Positive impact from currency movements

- Higher sales volumes, but at lower prices

Bear points

- Revenue has fallen back again from H2 last year, and is slightly below H1 last year - a very poor half

- Competitive landscape - selling price deflation is ongoing

- Looks as if the company has moved back into (modest) losses, after a profit in H2 last year

- Little visibility on profits, as large lumpy orders skew results

My opinion - not a good update, but not a disaster either.

Given how far the share price has fallen, I'd say things are probably priced about right for now. If the company can demonstrate improved sales going forwards, then obviously there's scope for the valuation to potentially rise considerably. Although investors are tired of waiting, and have so many false dawns over the years.

I think the massive upside potential is long gone now. However, at just £10.7m market cap, with a very strong balance sheet, and relevant products, there's still plenty to play for. My view is that IND is still firmly in the game, winning decent contracts around the world - just not enough of them.

The company's sales & marketing has always been poor, and that's where its fundamental problems have come from. Things have improved on that front, and it's still a viable business, with a good set of products - note that it spent $4.4m on R&D last year, so IND is keeping pace with the sector.

It's a competitive sector though, so sales have to be hard fought for. I haven't given up hope here by any means, but I would like to see an exit through a trade sale, if a sufficient premium to the current share price was offered.

BREAKING NEWS!

Restaurant (LON:RTN)

(at the time of writing, I hold a long position in this share)

Rumoured bid approaches - Sky News & Betaville are both reporting that RTN is on the receiving end of (early stage) potential bid interest. In my view this is very credible, and hence I think this is an excellent opportunity. Although of course, these are only rumours at this stage.

I've mentioned before that, in my view RTN is a sitting duck for a takeover bid, since the valuation on a PER basis had fallen from a high level (about 20) to only about 10 when I flagged it at the UK Investor Show here as a bargain at 275p.

At the time, the PER (on lowered, most recent forecasts) was only 10, and the divi yield (twice covered) was 5%. Since then, the shares have risen 22% to 335p at the time of writing, but still look great value to me.

Sure, the company has had problems recently, but it remains highly profitable. Also it has an excellent balance sheet, with negligible debt. Freehold property is over £100m. This is the ideal situation to attract a private equity bid - since the acquisition cost can be partly funded through loading up the balance sheet with debt, selling off freeholds, etc.

I believe that the company needs new management, and a refresh of the brands & menus, at which point profit is likely to begin rising again.

Therefore I think this is a cracking opportunity at 335p. The valuation stacks up nicely even without a bid approach. With bid interest on top, risk:reward looks superb to me. So I've been buying more today. Obviously, as usual, please do your own research & make your own decisions.

The company will be forced to issue a statement imminently, to confirm or deny bid approaches. So if they say nothing is happening, then there could be 10-20% downside risk, I suppose. There again, this is such an obviously attractive situation for bidders, that I'd say it's unlikely such an announcement would be issued.

My guess is that the company is likely to confirm today or tomorrow, that it has received potential bid approaches, but that these are very early stage, and there's no certainty that any bid would be forthcoming. They might also say something about the company being undervalued, and bid approaches being optimistic. That's the type of thing companies say when management want to keep their well-paid jobs!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.