Good morning!

Somero Enterprises Inc (LON:SOM)

Share price: 156.5p (down 1.9% today)

No. shares: 56.2m

Market cap: £88.0m

(At the time of writing, I hold a long position in this share)

Trading update - this update is ahead of the AGM tomorrow. I like the concept of putting out a trading update the day before the AGM, as it gives everyone time to digest the news before the meeting. Other companies might like to consider adopting this approach too?

The key message is positive:

This positive trading environment, together with margin improvement due to price increases and cost controls, and solid operating cash flow generation means the Company's overall results are tracking comfortably in-line with market expectations for the full year ending 31 December 2016.

"Comfortably in line" must presumably mean slightly ahead? It seems odd that the share price should have slightly fallen today, when a rise would have been more logical.

Perhaps some investors were spooked by these comments about regional markets?:

Somero is pleased to report that overall business is progressing well in 2016 with positive trading in the Company's core US, European and Chinese markets. In the Latin America, Southeast Asia, Korea and Middle East territories, while year-to-date trading is somewhat below previous year levels, the Company remains encouraged by solid activity in these markets and expects improvement over the rest of the year.

Some people might have read this as introducing risk that these markets may not improve in H2? That doesn't concern me, because SOM is essentially a play on the health of the US economy - by far its most important market.

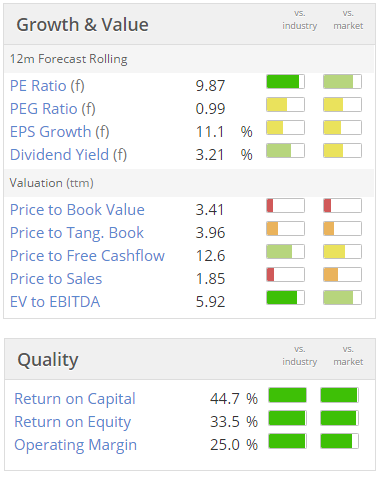

Valuation - the figures look extremely attractive - a low PER, together with a strong balance sheet (with net cash), and very high quality scores too. No wonder the StockRank of 97 is so high. This looks remarkably good value to me.

My opinion - of course, there is a reason that this share is so modestly valued. That's because earnings collapsed in 2008 when the financial crisis hit. So at some point in the future, we know that earnings will again fall sharply.

However, my view is that a crisis of the same severity as 2008 is probably not likely to happen for a while. Famous last words! Importantly now, policymakers know what to do when banks get into trouble - refinance them asap basically, to protect the stability of the whole system.

Furthermore, SOM itself is now very much more financially strong than it was back in 2008. It also has new products generating additional sales, and is expanding more into potentially large new markets (e.g. China, India). Therefore the peak earnings in this cycle are likely to be a lot higher than in the last cycle.

Overall then, I like this one, and continue to hold.

Some brokers insist on investors completing a complicated US tax form, which will certainly put off some potential buyers of the stock. That might possibly explain partly why this share looks such good value - i.e. restricted demand from investors, possibly?

Software Radio Technology (LON:SRT)

Share price: 39.3p (up 2.7% today)

No. shares: 127.5m

Market cap: £50.1m

(At the time of writing, I hold a long position in this share)

Results, y/e 31 Mar 2016 - the company put out a trading update on 2 Apr 2016, which I reported on here. It guided investors to expect turnover of £10.6m, and profit of £0.2m for the year ended 31 Mar 2016. Let's see how the actual numbers compare.

- Turnover £10.7m

- Profit before tax £275k

- Profit after tax £434k (note the negative tax charge this year and last year)

So the P&L looks fine, slightly ahead of previous guidance.

Balance sheet - inventories and debtors both look rather high, but this is probably due to sales being made near the end of the period. I'll query that with management.

The current ratio is very strong, at 3.80, however there is a long-term loan of £1m shown in creditors. Gross cash of £1.9m more than offsets this, giving net cash of £0.9m. It's a rather inefficient funding structure, as the loan costs about £45k p.a. in interest charges. However, with so much tied up in debtors & inventories, clearly the company needs the flexibility of having this loan.

Outlook - some very positive-sounding contract wins, and sales pipeline, has propelled this share a lot higher in the last 3 months. So the market cap of £50.1m looks very expensive based on the historic numbers. Therefore, I would say the valuation hinges very much on expectations of future growth. So outlook comments are absolutely key.

The order book & pipeline figures are huge compared with the reported figures:

· £70 million contracted future order book

· Growing validated sales opportunity pipeline of over £200 million

A reminder that the big order received earlier this year is very heavily weighted towards year 3, so there's some risk there.

My opinion - if things pan out as the company suggests, then the future could be very exciting. When you work out the profit (at c.50% gross margin) on the order book, let alone the sales pipeline, then the numbers get very exciting.

However, I think this needs to be tempered by remembering that sales have been lumpy & unpredictable in the past. SRT relies on Governmental bodies making purchasing decisions, and there have often been very long delays in the past.

For this reason, the figures are very difficult to predict, and there's considerable scope for disappointments if something goes wrong. Therefore, in my own portfolio, I am leaning towards top-slicing, to lock in some of the recent gains, and reduce risk of future disappointments. A £50m market cap doesn't leave any room for setbacks.

Mind you, looking at the chart below, it's clear that one or more big buyers has been in the market, hoovering up stock in the last 3 months. Every time it falls back, buyers take the price back up again.

EDIT: I had a 15-minute catch up telephone call with Simon Tucker, the CEO of SRT today. Here is the link to the audio of our call.

Amino Technologies (LON:AMO)

Share price: 106p

No. shares: 70.6m

Market cap: £74.8m

(At the time of writing, I hold a long position in this share)

Trading update - for the 6 months to 31 May 2016. I'm the first to admit that I don't really understand this company, or its market. It makes set-top boxes for TVs.

Having said that, today's update sounds good. This is combined with a low valuation, hence why I think it looks potentially interesting. I've bought a small, opening-size position in the company today, just to dip my toe in the water.

Today's update says:

Trading for the period was in line with market expectations for revenue, and profit before tax and exceptional items. Net cash of £3.1m as at 31 May 2016 (FY 2015: £2.1m), after record outflows of £3.0m for dividend payments and £1.2m for acquisition-related cash outflows, is ahead of expectations.

The Company has delivered a strong first half performance with record order intake and a very encouraging backlog to take into the second half of the year following sales growth in key regions.

I particularly like the combination of in line trading in H1, and a strong order book for H2. That greatly reduces the chances of a profit warning any time soon.

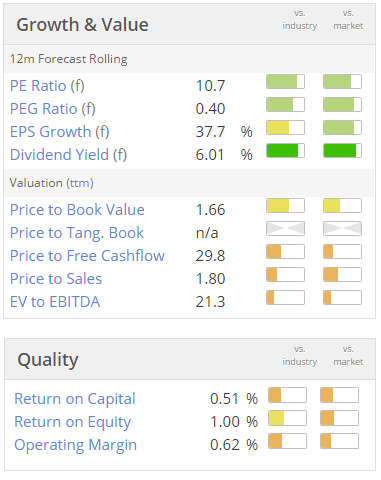

Valuation - the PER and divi yield in particular look attractive:

I'm surprised the quality scores are so low. However, the company incurred exceptional costs in 2015, which suppressed its performance. So these scores could improve in future perhaps? The adjusted profit margin looks OK to me.

More details is given in the announcement, which I won't cover here, but it all sounds pretty encouraging.

Directorspeak - upbeat again:

"Amino is now in good shape - with the integration of Booxmedia and Entone complete and clearly defined propositions for target markets, supported and driven by a strengthened and focused sales team providing improved visibility of sales performance and prospects. We look forward with confidence to the second half of the year."

My opinion - reader comments are particularly welcomed on this stock, as I don't know much about this sector. My worry is that technology is changing so rapidly, with companies like Netflix, Amazon, and others offering internet-based TV services. So I wonder how sustainable profits at AMO will be, in the long term?

It's worth a look anyway. I'm just flagging that the valuation appears good value, and with a strong update today too, that's a nice combination.

The chart makes this look a potentially good time to buy - with the price back down to where it was 2 years ago, but the newsflow now being positive. Could the tide be turning perhaps?

Swallowfield (LON:SWL)

Share price: 195p (up 19.6% today)

No. shares: 11.3m pre-Placing + 5.5m Placing = 16.8m post-Placing

Market cap: £22.0m pre-Placing, £32.8m post-Placing

Acquisition, Placing, Trading Update - well done to the company, and N+1 Singers - this is very much what I consider a good Placing, because:

- Positive purpose - to make what seems to be a good acquisition

- Little to no price discount for new shares (depending on where you measure it from)

- Over-subscribed, so must have been well-presented to Institutions

- Management are committing a decent slug of their own money to buying new shares

As there was no price discount, then an Open Offer isn't really necessary, so that's not a concern.

The acquisition, is called The Brand Architekts Ltd. Its last published accounts at Companies House are for y/e 31 Jan 2015. It files abbreviated accounts, so there is no P&L. However, net assets rose by about £600k in the year, and there was no issue of new shares. Therefore profit after tax is £600k, meaning that profit before tax would probably have been about £800k.

Swallowfield's announcement today suggests that profit rose considerably for y/e 31 Jan 2016:

FY16 Revenues of £10.7m, EBITDA of £2.0m, PBT £2.0m in the year to January 2016

It looks strange that EBITDA and PBT are both £2.0m. This is due to Brand Architekts having minimal fixed assets (only £31k at 31 Jan 2015). Therefore the depreciation charge would be minimal.

The price being paid for the acquisition is as follows:

Total consideration of £11m including 12 month performance based earn out of £1.85m

This is a major deal for a small company - bear in mind that Swallowfield only had a market cap of £18.4m last night.

My opinion - clearly the market likes this deal, as its shares are up almost 20% today. From what I can tell, this seems a sensible deal. Although you have to be careful sometimes with acquisitions of private companies - because profits can be over-stated due to owners paying themselves minimal salaries, and instead drawing dividends.

Whether a 20% jump in share price today is justified, only time will tell.

All done for today. See you tomorrow!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.