Good morning!

A shortish report today, as we have British Gas coming round to fit a "Hive" wireless controller for the boiler, and a washing machine repairman also visiting. Plus an investor lunch to get ready for.

In case you missed it, I had a 15-minute chat with Simon Tucker, the CEO of Software Radio Technology (LON:SRT) (in which I hold a long position) last night, asking him a few questions on their results, published yesterday. The link to the audio is here.

I know from the email list that quite a lot of PR companies & brokers read these reports. So just to flag up that if I write something positive about a company here, then (time permitting) I'd probably be interested in recording a 10-15 minute chat with the CEO or FD. Therefore do feel welcome to get in touch with me, to arrange, if that situation arises.

These interviews are a great way to communicate with c.1,000-3,000 private investors, via me. The feedback is really positive from investors, who seem to find these interviews helpful, and I enjoy doing them, so all good. I don't usually charge a fee to the company or the listeners, and there are no ads.

A reminder, it's the Q1 trading update for Boohoo.Com (LON:BOO) tomorrow morning. I know a lot of readers hold (as do I).

VP (LON:VP.)

Share price: 710p (unchanged today)

No. shares: 40.2m

Market cap: £285.4m

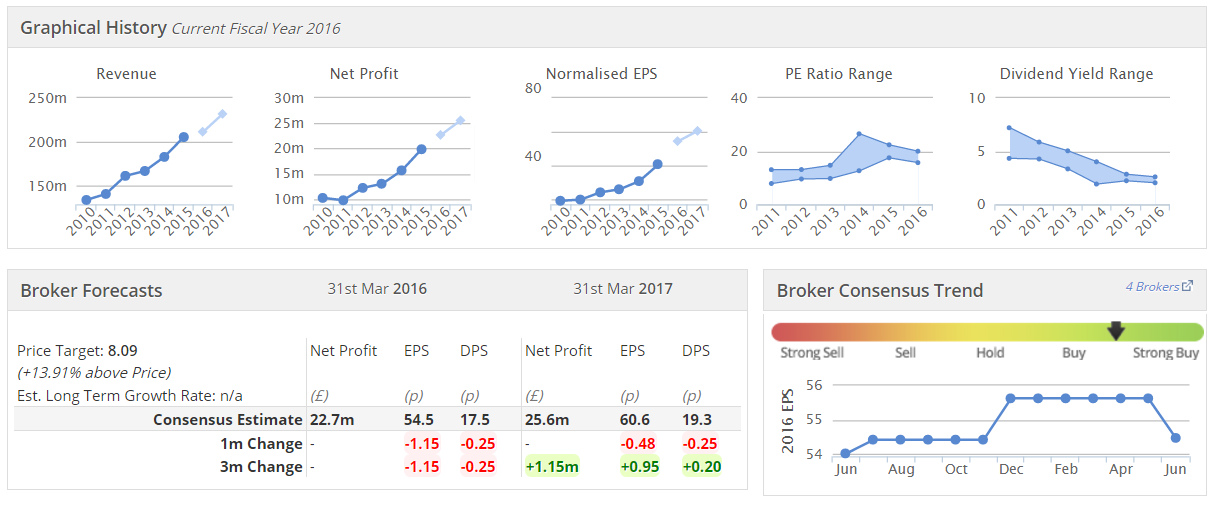

Results y/e 31 Mar 2016 - another good set of figures from this group of niche hire businesses. A few key points:

Revenue only up 2%, to £208.7m

14% increase in basic earnings per share, pre-amortisation, to 62.21 pence (PER of 11.4)

Net debt up by almost £20m, to £86.1m - due to expansion of hire fleet, and 2 small acquisitions.

Operating profit margin looks strong, at 15.3%, and finance costs are modest.

ROCE is reported as 16.3%, which is a good return.

Divis up 14% to 18.85p (interim + final) - yield of 2.7%

Outlook comments sound positive:

Vp has, in the year under review, reported good progress, with further improvement in profit margins and returns, delivered from a relatively modest growth in revenues. This trend is expected to continue as the varying demands of supportive infrastructure, housebuilding and construction markets play against a challenged oil and gas sector.

The new financial year has started well and we look forward to another year of progression for Vp and our shareholders.

Balance sheet - overall this looks OK to me. It's an equipment hire group, so fixed assets are large, and part-funded by debt.

Net assets was £121.4m, less intangibles of £46.4m, gives NTAV of £75.0m.

I like to look at loan to value with hire companies. So in this case, fixed assets are £167.2m, and net debt is £86.1m. So that gives a loan to value of 0.51. In other words, the hire fleet is funded half by bank debt, and half by equity. That's about the right level, in my view.

My opinion - I like it. This seems a good quality, well-managed business, whose shares seem priced reasonably. It's showing a very nice progression in key metrics:

Belvoir Lettings (LON:BLV)

Share price: 124p (up 6% today)

No. shares: 31.4m

Market cap: £38.9m

Proposed placing & acquisition - it's getting busy for deals at the moment, in small caps. Cantors has executed what I consider a good Placing here, judging it on these key factors:

- Most importantly, the price discount was modest, at only 4.3% (Placing done at 112p, compared with 117p last night)

- There is little dilution to existing holders, at only 2.2m new shares

- The purpose of the funds is positive - to part-fund a sensible-looking acquisition.

My only reservations are that:

- Bank debt is funding £6m of the initial £8m consideration - this perhaps is a bit too much debt?

- At 8 times EBITDA, the acquisition doesn't exactly look a particular bargain.

- The earn-out heavily incentivises management to make a frantic dash for profits growth in the next 2 years, which may lead to some corners being cut, perhaps?

- Increased bank debt might put the very generous dividend yield at risk, possibly?

My opinion - I like this company, as explained in my report here on 4 Apr 2016.

This looks an interesting deal, to scale up the business a fair bit.

Vianet (LON:VNET) - just a brief comment on its results for y/e 31 Mar 2016.

Overall, the figures look robust. The problem is that the core (beer flow monitoring) business is still declining, in terms of number of installations. The growth part of the business (vending) is probably too small to move the dial much, although number of installations has risen an impressive amount.

The balance sheet looks much improved, following the sale of the fuel business.

Dividend maintained at 5.7p, so a decent yield, shored up by a stronger cash position.

Overall, I feel the limited growth potential makes this share of limited attraction. Although long term holders have enjoyed a flow of nice divis.

That's me done for today!

The washing machine has just been repaired, and Hive is installed, so a very productive morning for me, writing this report and supervising various workmen! We even had the Jehovah's Witnesses call round too!!!

See you tomorrow.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.