Good morning!

Bonmarche Holdings (LON:BON)

Share price: 126p (down 1.2% today)

No. shares: 50.0m

Market cap: £63.0m

(At the time of writing, I hold a long position in this share)

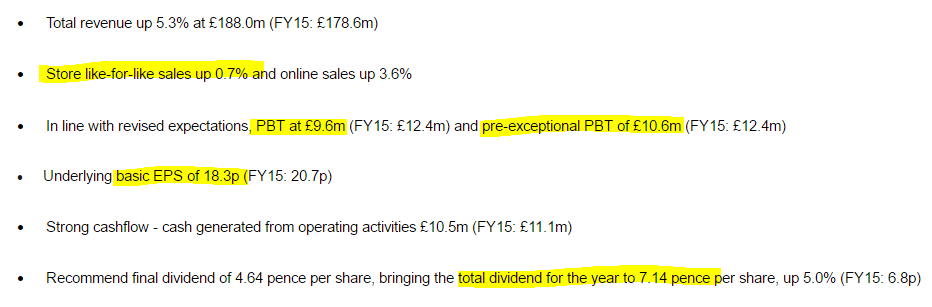

Results, 52 wks ended 26 Mar 2016 - here are the highlights:

Given how bombed out the share price has been of late, these figures don't look too bad at all. Note that LFL sales growth of only 0.7% isn't enough to maintain profits - because I suppose their costs are increasing faster than that.

The PER is only 6.9 times, based on the underlying EPS of 18.3p. This seems to have come in above forecast EPS of 16.9p.

Dividend yield is 5.7%

Outlook - the company today says:

The market niche in which we compete continues to represent an opportunity to gain market share from less focused competitors. I believe in our strategy to deliver successfully our five pillars of growth (described further in the CEO report), and in the ability of our colleagues to execute it. The beginning of FY17 has continued to be tough due to poor weather, however our full year expectation is unchanged provided trading conditions normalise.

The way I read that, it's almost a profit warning, but not quite. So there has to be a heightened risk that there could be another profit warning, given that the new year has started badly. For this reason, I would take say 10% off current year forecasts, to be on the safe side.

Broker consensus is currently for 20.0p EPS this new year. So if we reduce that to 18p to be prudent, then the current year PER is 7.

I've just found some more outlook comments, which say:

Looking ahead, there will continue to be external factors that affect consumer confidence and the cost of doing business - the EU referendum, rising costs driven by the Living Wage, forex rates, and business rates are all unhelpful macro headwinds. Consumers are also spending a greater proportion of their disposable income on technology and leisure - however we are focused on continuing to provide customers with a compelling reason to shop at Bonmarché. We firmly believe that as a niche retailer, focused on catering for the mature female demographic, Bonmarché is well positioned to continue to grow.

The brand development work we are conducting through the early summer will serve to focus and drive our five key business initiatives and support our modernisation programme, which is core to our growth strategy. I am a firm believer that the key to successfully executing our strategy will be the strong talent of our newly recruited specialists and existing colleagues. Timely delivery of our vision through a continued team focus is our priority in the year ahead.

Trading during the early part of FY17 has continued to be tough due to poor weather, however our full year expectation is unchanged provided trading conditions normalise.

Balance sheet - very solid, with net cash of £13.0m.

My opinion - I already hold this share, but didn't want to commit fully until I'd seen these figures. In my view this share now looks strikingly cheap. A very low PER, good yield, and a solid balance sheet with net cash on it, is extremely unusual.

I don't see anything particularly alarming in the outlook comments. A poor outlook is already priced-in. So whilst there is a possibility of another profit warning, I'd be amazed if this share dropped by more than say 10-20%, and would probably recover reasonably quickly as people focused on the value.

So risk:reward looks good to me. I see 10-20% downside risk, and upside of possibly 50% to bring it up to a more sensible valuation. That's an appealing situation in my eyes. So I'll probably be increasing my position in this one going forwards, if it stays down at this level.

Getech (LON:GTC)

Share price: 25p (down 6.5% today)

No. shares: 32.7m

Market cap: £8.2m

Trading update (profit warning) - unfortunately, it appears that strong trading reported a little while back was a false dawn, with trading deteriorating again:

As previously reported, the Company delivered a loss before tax of £704,000 in the first half of the year, but had an extremely successful third quarter from February to April 2016. However, the market has continued to remain very depressed and a number of potential sales for the fourth quarter have now either been deferred or cancelled. As a result, the Directors confirm that the Company is trading below current market expectations. Nevertheless, the Company expects to generate a profit before tax for the year ended July 2016.

Disappointing but not disastrous then, with the key point being that the company will be profitable for the year as a whole.

Outlook comments provide some hope of improved trading at some point in the future, possibly?

Stuart Paton, Non-Executive Chairman of Getech Group plc, said "We were pleased to have made such an exceptional start to the second half of the financial year, but the market has remained very depressed and clients in general continue to delay expenditure. However, interest in our products remains strong, and this is reflected in the heavy schedule of planned client meetings over the next few months.

The oil price has shown signs of strengthening but this is unlikely to have an immediate impact on purchasing behaviour. However, if it shows signs that the price rises are sustainable, we anticipate that the demand for our products will convert from a wish to buy to actual purchases when budgets are available."

My opinion - If you think the oil & gas market is likely to improve, then this share could be an interesting play on that. Historically it has been reasonably profitable.

The balance sheet looks strong, so there doesn't seem to be any risk of insolvency. Although it has an unusual structure, holding both debt and cash simultaneously, which I don't understand.

I'm tempted to have a little dabble here.

Catching up from yesterday:

Flybe (LON:FLYB)

Share price: 56.5p

No. shares: 216.7m

Market cap: £122.4m

(At the time of writing, I hold a long position in this share)

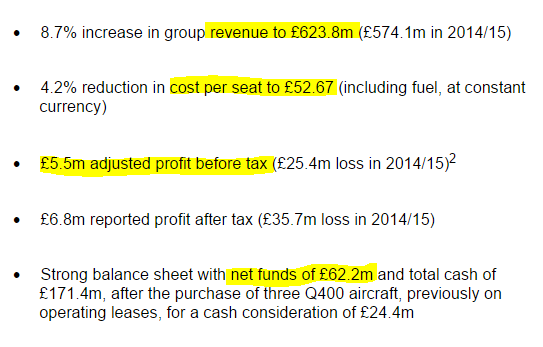

Results, y/e 31 Mar 2016 - the turnaround here has been painfully slow, but does seem to be getting somewhere at long last. The company has moved into (modest) profits, after 5 year of losses. This is said to have been year 2 of a 3 year turnaround, so the hope is that profits might now increase considerably.

Highlights - showing a dramatic improvement in profitability compared with last year, and this looks to be slightly ahead of broker consensus:

Note that the adjusted profit figure is a tiny sliver - under 1% of turnover. So there's still a long way to go before this starts to look a good company. At the moment, a lot of capital is being deployed to generate a very modest return.

Note that the excess aircraft was a £20m drag on profit this year, and the 2 terrorist attacks quite close to home:

This performance was delivered despite the adverse bookings impact experienced from the tragic events in Paris in November and in Brussels in March, the absorption of c£20m of cost relating to the E195 jets, and pressure on yields from industry-wide capacity growth acceleration and lower fuel costs.

The company mentioned 58% customer satisfaction, as if that were good! I'd say that's atrocious. Customer satisfaction should be well over 90% before any business starts celebrating.

The load factor was down 2.6 points to 72.6%. That doesn't look great to me - that's a lot of empty seats. Although it does give an idea of the profit growth potential, if the company can get more bums on its seats.

Legacy issues are said to now have all been resolved.

Fuel costs - Flybe has been held back by a hedging policy which locked it into high fuel prices. The average cost per ton of aviation fuel was:

2014/15: $949

2015/16: $826

2016/17: $569 (average hedged price)

It spent £101.6m on fuel in 2015/16, so there should now be a large reduction in the cost of fuel this year. I make that a saving of about £31.6m in fuel costs for this new year. That's offset partly by a reduction in seat prices. It's a smashing tailwind though, which should help boost profit this year.

Balance sheet - is strong, with owned aircraft, and net cash. Note that airlines benefit from customers paying cash up-front, ahead of flying. That is accounted for as deferred income, which needs to be considered in conjunction with cash.

Net assets of £154.2m is healthy, and only £13.3m of that is intangibles. Note there is a smallish pension deficit of £15.3m, requiring £0.5m p.a. recovery payments - not a big deal.

Outlook - this mainly just waffle:

As a result of all the action we have taken, Flybe is now a much more resilient business and well positioned for profitable growth.

We are pleased with this performance and confident that we are well placed to navigate the current industry challenges with the strongest balance sheet in our history and a disciplined organisation which is already taking cost and capacity actions to support profit growth in the coming year.

Flybe's successful transformation is the product of our talented, dedicated and hard-working people and I am hugely appreciative of every single Flybe member of staff.

As we enter the final year of our turnaround, we have set down strong foundations for the future and made good progress in transforming Flybe into a sustainable, world-class regional European airline."

My opinion - I don't usually buy shares in airlines, and wish I'd stuck to that policy, as this share has been a dog so far. That said, there are good reasons to expect a further improvement in profit this year. Broker consensus is for 9.5p EPS this year, which if achieved would make the share look very cheap, on a PER of about 5.8.

Mind you, Flybe usually falls well short of the original broker forecasts each year.

There is no dividend proposed, whereas brokers seem to have been forecasting the start of small dividend payments.

I'm happy to remain in this share, at the current low valuation, because it has good profit-improving factors in the pipeline. If things go as planned, then I could see this share doubling in the next year - quite a good prospect, if it happens.

Also, I can see the need for a short haul airline. People I know are much more likely to consider flying now, as opposed to expensive rail fares, and congested roads. So I think Flybe has a favourable long-term trend, in terms of increasing demand. A lot of its routes have no direct competition too.

Investor mood is very gloomy towards this share, which I like. The mood can rapidly change once a share starts rising strongly. We've had that happen before here, but it was a false dawn unfortunately. I'll give it another year, and hopefully we'll get an opportunity to exit at a much more favourable price. It's not a share I particularly want to hold, but there's no way I'm selling at the current price, especially when profit is likely to rise this year.

Avesco (LON:AVS)

Share price: 207p

No. shares: 19.1m

Market cap: £39.5m

Interim results, 6m to 31 Mar 2016 - these numbers are dominated by a £10.7m exceptional profit on the sale of its freehold site, Fountain Studios. The cash received has almost cleared net debt, which is now only £3.2m. So the equipment which the group hires out, is now almost owned outright.

There's a useful summary from the Chairman:

The Avesco Group has again delivered a strong first half performance, with interim operating profits for the six month period to 31 March 2016 (which include the profit on the sale of the land and buildings at Fountain Studios) once more at record levels and net debt reduced to just £3.2m.

Whilst the Board's view of the outlook for the full year remains positive, when the Fountain Studios sale is excluded, the underlying trading results for the first six months of the year are, as expected, down slightly on the corresponding period last year, due in part to the timing of certain events. The Creative Technology ("CT") division was once again the star performer, whilst trading at mclcreate has been disappointing.

The underlying trading performance in H1 is slightly disappointing, a number of factors explain this:

Revenue in the six months ended 31 March 2016 increased to £73.0m (six months ended 31 March 2015: £66.0m). However, a combination of reduced gross margins (caused by strong pricing pressures, particularly around LED products) and increased overheads (mainly in CTUS, which had until now been able to delay the increase in staff numbers required by its revenue growth) has seen trading profit for the six months ended 31 March 2016 reduce to £4.6m (six months ended 31 March 2015: £5.5m).

My view is that shareholder value with this share would best be maximised by breaking the group up. So I suggest ditching all the sundry parts of the group (most of which are loss-making), and renaming the group after its jewel in the crown, CT USA.

CT is a fabulous, and highly profitable business, that I think is probably worth 2-3 times the current market cap of the whole group. The other, smaller businesses, don't add any value at all. They just dilute the value of CT. So this is a group which makes no sense, where the whole is worth considerably less than the sum of its parts.

Still, I love investments like that - where you're getting value thrown in for free, due to an illogical group structure.

The group is also inefficient from a tax perspective - its profits are in high tax USA, and its losses are elsewhere in lower tax areas, and cannot be offset against its US taxes.

Dividends - a key attraction of this share. When I bought (around 100-120p per share), the yield was over 6%. As the share has now almost doubled from that level, then yield has come down. However the divis are still rising strongly, and the progression in divi payments over the last 6 years has been outstanding - it's gone from 1p in 2010 to 7p last year, and 8p forecast this year.

Note the positive comments made yesterday:

As a sign of the Board's confidence in the outcome for the current year, we are again increasing the interim dividend, this time to 2.5p per share (2015: 2.0p per share). This payment will be made on 3 October 2016 to shareholders on the register on 2 September 2016 and the shares will be quoted ex dividend from 1 September 2016.

Further outlook comments sound upbeat:

Trading in the six months to 31 March 2016 has not been without its challenges, but our core CT business continues to perform strongly thanks in part to the quality and reputation of our exceptional staff. With net debt now at historically low levels and the Rio 2016 Olympic Games to come over the summer, the outlook for the Group remains very positive.

My opinion - this share just looks the wrong price to me. I think the company is worth perhaps double the current market cap?

If you look at CT, it did £107.1m turnover, and made a profit of £9.1m last year. So that business alone is probably worth maybe £50-75m? So I really cannot fathom why the market values the whole of Avesco at £39.5m? It just doesn't make sense to me. Especially now the group is almost debt-free.

The balance sheet is strong, with net assets of £44m, with only £229k of that being intngibles. So the market cap is at a discount of about 10% to NTAV. Why?! It doesn't make sense.

Overall then, I'm very happy to continue holding, for the long term. I see considerable potential upside on this share. Although the trading performance for H1 was slightly disappointing, i'm encouraged by the upbeat H2 outlook comments.

Don't forget too that when the Chairman sold £945k of stock this time last year, at 175p, the whole lot was bought by other Directors. That's a tremendously strong indicator, in my view. It's not often that you find a share which simply looks the wrong price (i.e. much too cheap), but this one looks that way to me.

Am I missing anything? Do any readers take a more bearish view? If so, please add a comment below.

Bond International Software (LON:BDI)

Response to bid approach - an interesting announcement today from this software company. It says the indicative 105p cash takeover approach from its largest shareholder, Constellation, is too low:

The Board, having consulted its Rule 3 financial advisers, Houlihan Lokey Capital, Inc., has unanimously concluded that the Proposal fails fully to reflect the fair value of Bond and if a firm offer were to be made on the terms of the Proposal the Board would not currently recommend the offer to its shareholders.

Given its historic performance, I'd say that 105p is not unreasonable. However, Directors presumably feel that it undervalues the company's future potential.

It will be interesting to see if Constellation increases its offer now?

BDI seems to be selling off its constituent parts:

The Board has indicated that it is pursuing a divestment strategy to maximise shareholder value and recently announced the completion of the sale of Strictly Education Limited for a total consideration of £11.3m. The Board can also confirm that it has received multiple offers for the other operating divisions of the Group and having entered into exclusivity agreements, the Board is in advanced negotiations for the sales of the Recruitment Software Division and the HR & Payroll Software and Services Division.

All done for today. Apologies for my absence yesterday.

Have a good weekend, and see you back here on Monday!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.