Good morning!

There's an interesting article in the Telegraph this morning, saying that Persimmon shares (which I currently hold, currently 1302p) are worth a look, after the recent plunge which has affected the whole housebuilding sector. I agree. After all, people won't stop buying houses in the long run just because of Brexit. There might be some short term impact from people who panic, and cancel a reservation, but in my view that is likely to only be transitory.

Mortgages are extremely cheap right now, and banks are happy to lend on great deals, with e.g. a 5-year fix or cap. Both housebuilders and banks have very much stronger balance sheets now, than in 2008, so I really don't see why things should move into a recession - unless there's some big external shock, e.g. another Eurozone banking crisis - which is a concern. Italy's banks seem to be under strain - the EU has banned short selling on Banca Monte dei Paschi di Siena SpA, usually a bad sign.

A French Govt Minister arguably hasn't helped matters by declaring that the French state is "totally bankrupt" in a recent interview. So who knows, we might be regarding Brexit as a very smart move, if the Eurozone implodes at some point in the future?

Persimmon's update yesterday was positive, although they included the too early to say comment on the impact of Brexit, which seems to be becoming the norm at the moment. This to me implies that there probably has been some short term impact from Brexit, but that it's not a discernible downward trend. Personally, I think the housing market (outside London) is probably going to bounce back. There is so much demand for housing, and affordability based on low mortgage rates, is decent outside of the South East. It's difficult to overstate the yearning of generation rent to own their own home. So once they've got the deposit together, they'll go for it, in my view, regardless of Brexit.

Although there's always the risk of anchoring in this type of market. Most of us tend to make the assumption that stocks were correctly priced before Brexit. However, what if they were actually over-priced to begin with? Then prices might now simply be adjusting down to where they should be, given much more uncertain times. Or they could still be over-priced, who knows?

The trouble is, everything is so difficult to value right now. We cannot rely on broker notes, since if the economy does go into recession, then many forecasts out there at the moment are likely to be wildly over-optimistic. So forward PER is a valuation measure that needs to be treated with great caution at the moment - as it's probably based on forecasts that may now be unrealistically optimistic.

There again, where there's a lot of fairly indiscriminate selling, as we're seeing at the moment, then there can be some cracking bargains. So very much a stock-picker's market.

Also, I think it's worth considering that recessions are not necessarily disastrously bad, and drawn out. Perhaps our mindset is still burned by experiences in 2008? In my lifetime, recessions in the UK have been caused by the economy overheating, and inflation rising to c.10%+, with rising interest rates snuffing out growth. That's what happened twice in the 1970s, also at the end of the 1980s. 2008 was a bit different, in that the financial system blew up, triggering a dramatic withdrawal of credit.

Right now, we don't have inflation, although it is likely to begin creeping in later this year, and next year, as the impact of sterling's devaluation kicks in - making imports more expensive. Remember that a lot of imported (from Far East) consumer goods are invoiced in US dollars - hence why that is such a key rate, and just look how much sterling has depreciated since 2014. In particular the huge move from the mid 1.40s to now just under 1.30:

(chart courtesy of IG)

I think it's inevitable that retailers will need to absorb some of the impact of such a big drop in sterling, so expect to see their margins coming under pressure. This is at the same time as cumulative rises in Living Wage, so a double squeeze on their net profits. Hence why most retailer shares are down so heavily. I suspect that the Govt may well have to moderate, or defer, future rises in Living Wage, as the cost to jobs could otherwise be too great.

Labour now doesn't have the same ability to screw employers for pay rises, which was what fuelled inflation after the initial oil price shocks in the 1970s. Also, I think the Bank of England might just leave interest rates at rock bottom now, even if inflation creeps in. We've had negative real interest rates before, so why not again?

Anyway, it's interesting to bounce ideas around, about what scenario is most likely to play out now. Personally, I don't see a prolonged, or deep recession as being particularly likely because of Brexit. However, I'm watching the Eurozone closely, as that's probably the biggest worry right now. There are other worries too, e.g. China, the balance of payments deficit, etc. But there are always worries, and we always muddle through somehow.

Another bit of news has rattled property investors - that Standard Life, M&G, and Aviva have suspended redemptions in their UK property funds. In my view, the open-ended structure of these funds is the real problem. It's ridiculous to buy illiquid assets such as commercial property, within an open-ended fund structure. The FCA probably needs to ban, or heavily restrict open-ended funds of this kind, in my view. Property investments should always be in closed funds, I feel (e.g. an investment trust). That way, investors can withdraw any time they like, without forcing the fund into asset fire sales.

I'm not an economics expert, but I did study it up to & including degree level, so know the basics, and find it interesting to bounce ideas around. If you don't like my ramblings on this, then just skip the preamble, and go straight on to the individual company sections. That's why these reports are arranged in sections, so that people can easily skip the bits that don't interest you.

Enough thinking out loud, on to today's company news.

Topps Tiles (LON:TPT)

Share price: 102.1p (up 0.6% today)

No. shares: 192.9m

Market cap: £197.0m

(at the time of writing, I hold a long position in this share)

Q3 trading update - in normal markets, this positive announcement would have propelled the shares upwards nicely. We're not in normal markets now though. So good news now perhaps only persuades people not to sell.

TPT has a year end around end Sept. So today's update covers the quarter to end June, and YTD. It looks encouraging:

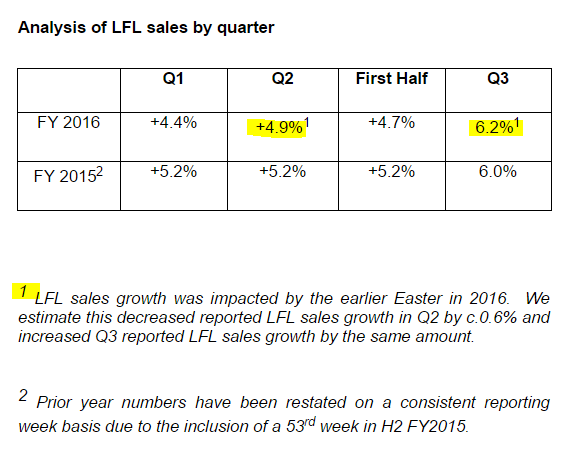

So like-for-like ("LFL") sales growth actually accelerated in Q3, to +6.2%. That's very impressive. It's always important to read the footnotes though. In this case footnote 1 points out that the timing of Easter boosted Q3 sales by c.0.6%, and a corresponding negative impact on Q2. So if we adjust those figures, Q2 goes from +4.9% to +5.5%, and Q3 goes from +6.2% to +5.5%. Therefore the adjusted LFL sales increase in Q3 was exactly the same as in Q2, at +5.5%.

There are not many retailers reporting LFL sales growth of +5.5% - this is a very strong performance. As you can see from the second row, this builds on a similarly strong LFL sales performance last year.

I like the strategic initiatives the company is taking, which is clearly helping to drive their strong sales growth;

- Personalised eBrochures for individual customers

- New product lines - which account for 8.8% of current sales

- New store format - of smaller, boutique stores (15 out of 348 stores)

On Brexit impact, the company has also gone for a too early to say comment;

...While it is currently too early to ascertain the implications of the result of the UK referendum, we remain confident in the longer term outlook for our business and in our ability to outperform the market."

I think that last bit is important - out-performing the market is what retail is all about. So in my view, buying good retailers in a bombed out market, is absolutely the way to go. The best companies tend to do OK, even in poor markets. The weaker competition goes bust in a downturn, leaving them with more market share, and ready to power ahead once the economy improves.

EDIT: Broker update - I see that one broker revised their forecasts yesterday, as part of a sector-wide reduction. Liberum is now forecasting 8.7p EPS this year (down from 9.1p), and 8.9p EPS next year (down from 10.0p). This is to reflect a reduction in demand, and changes to margins brought about by recent big forex moves.

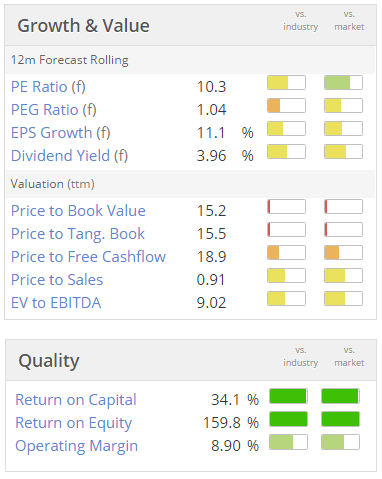

At 102p, the shares look reasonable value on the more prudent forecasts. The downgrades also move the bar a little lower for the company, which reduces the risk of a profit warning. So once the reduced forecasts filter through to Thomson Reuters, then the forward PER will rise from 10.3 to about 11.5 - still good value I would say, for a company that has been out-performing the sector.

My opinion - I like this company a lot, especially now it's almost a third cheaper than it was just a couple of weeks ago.

The danger is of course that there could be a Q4 profit warning, if demand slows down sharply, and the shares could lurch down another 20-30p. So there is a good argument for keeping at least some powder dry, until economic conditions become more clear.

On current broker forecasts the PER is looking reasonably good value, but bear in mind my comments above that we may not be able to rely on forecasts, due to economic uncertainty.

There again, most of us are not much good at timing the market, so in my view if a share represents excellent long term value, then personally I just like to buy some, and ride out any future share price volatility. Indeed, I would happily buy more if it dropped again in price significantly from here.

It's helped in this case by the fact that its well-covered dividend is now yielding almost 4%.

This company very much looks like a long-term out-performer in my view, reinforced by today's strong update.

Cambria Automobiles (LON:CAMB)

Share price: 65p (up 1.6% today)

No. shares: 100.0m

Market cap: £65.0m

Acquisition & trading update - Cambrian has bought a Jaguar/Land Rover dealership in N.London, for £2.1m. Its estimated profit is £0.7m p.a., so that looks a good deal. Although there is an additional £1m future cost from taking on an onerous (over-rented) lease.

Of more interest is the trading update. No sign of Brexit-related problems here;

The Group continues to trade well and the strong trading performance reported to March has continued through to the end of June which leaves the Group significantly ahead of the prior year and trading in line with current market expectations for the year to 31 August 2016.

There's no mention of Brexit, or any downturn in trade, which is encouraging. Although of course the post-Brexit period would only have been the last week in the period being reported on. However, I feel if there had been any material downturn in orders, then the company would have been obliged to say so today, but they didn't.

My opinion - personally, I'm very bullish on car dealer shares right now. Most have been brutally smashed in price, some have halved - e.g. my favourite pick from the sector on value grounds is Vertu Motors (LON:VTU) (in which I hold a long position).

The sector dynamics have radically changed in recent years. Most customers now buy on personal contract hire, which is highly affordable. The car manufacturers have to shift their production, so they subsidise prices to whatever extent is needed to move the cars. Cheap personal lease deals make it far more affordable to have a new car then it's ever been before. Hence why volumes are so high.

Dealers make very little margin on new cars. Where they do better, is on after-sales. People who are leasing new cars are often obliged by the contract to have the car serviced at the main dealer. So even if new car sales do slow, there will be a long tail of profitable after-sales work. Therefore, even in a downturn, I believe dealers should fare a lot better than in the past.

The market doesn't seem to have recognised the above factors, and is selling off dealer shares in a way which is revealing some smashing bargains, in my view. Also bear in mind that many of the smaller car dealerships own a lot of freeholds, and have little debt. So they should be well-placed to withstand any (hopefully temporary) downturn in business. Not that any downturn in business has actually been reported by any of them yet, that I've seen (correct me if I'm wrong on that, as I do sometimes miss RNSs).

I think Cambrian is well managed, and has a sensible growth strategy, and sound balance sheet. Therefore it looks good value to me, at the current level.

More new car sales in recent years also of course means more secondhand cars to shift, and dealers make money there too.

Overall then, I see this sector as being a good place to hunt for bargains which have been over-sold in the recent market sell-off.

Vislink (LON:VLK)

Share price: 16.75p (down 48.9% today)

No. shares: 122.6m

Market cap: £20.5m

Trading update (profit warning) - commiserations to any readers who still hold this one. Many private investors sold out in disgust at management's greed when they created a so-called Value Creation Plan ("VCP"). Such schemes are regarded as completely toxic by many private investors. It's an elaborate form of theft basically, in my view - targets are set which management think they can beat, then they basically are given c.15% of the company through the dubious practice of creating an intermediate holding company.

VCPs are morally wrong, and to any company or adviser thinking of implementing such a scheme I would simply say - don't! It will destroy reputations, private shareholders will mostly hate you forever more, and in the current national mood of revulsion at fat cat greed, and excessive remuneration for executives, it would be much more wise to be grateful for already being richly rewarded, and not try to create yet another method of screwing the companies you manage for even more (usually unjustified) personal gain.

This is even more the case, as we seem to be entering more uncertain economic times, where employees may lose their jobs. It's utterly disgusting to see executives drawing out big bonuses, and salaries, plus often lucrative LTIPs, etc, when they're slashing jobs in order to boost company profits. Something has to give - the whole system stinks right now, and Directors would do well to think carefully about the public mood, before lining their own pockets.

Anyway, back to Vislink. Today's statement is pretty awful;

...As the lower than expected trading performance of VCS in H1 is expected to continue into H2, the Board believes that the financial performance of the Group for the full year will be materially below previous estimates.

As if that isn't bad enough, there's potential trouble with the bank covenants too;

As trading has been lower than expected, the Company's bank has agreed to defer covenant tests until the end of July from the end of June and remains supportive of the Company.

That's only a one month deferral. Therefore, I read this as making the risk of a discounted placing now very likely. For that reason, personally, I would ditch my shares, if I still held them (which thankfully I don't).

Clearly this means that dividends are probably now a thing of the past, as the company alludes to today;

The Board intends to review the Company's dividend policy in light of the intended restructuring, with further information to be provided in relation to dividends in the Company's half year results.

There's more restructuring to come, which costs money of course. Plus a write-off of intangibles. People always say that's non-cash, which is true now. However, it was historically a cash outflow, so that needs to be borne in mind - it's shareholder value that has gone up in smoke;

This restructuring includes a non-cash write-off which could be between £6 - £9 million of increasingly inappropriate legacy technology. In addition, it will result in a more focused range of products that are appropriate for today's market, a further reduction in costs of £1 - 2 million annualised, and a clear focus on improving asset management and cash generation of the division.

I'm concerned by the phrase "increasingly inappropriate legacy technology".

My opinion - I don't rate management here. In my view the Exec Chairman is not an entrepreneur, but is a financial engineer - obsessed with doing acquisitions. The inevitable effect of that is that the balance sheet fills up with intangibles at the top, and debt at the bottom. Something then goes wrong, and the group is in trouble.

I recall a presentation by Vislink some time ago, when the Exec Chairman outlined his glittering business career. The gentleman sitting next to me leaned towards me and whispered, "He actually made a dog's breakfast of things at Anite!"

There have been various issues of outrageous remuneration for the Exec Chairman, which I've mentioned here before. The company even paid his tax bill, as was revealed in a small note to the Annual Report. Plus excessive remuneration, for only working part-time. It was quite clear to me that this individual was not someone to back, hence why I bailed out of this share some time ago.

Based on today's news, the group sounds as if it's in trouble, so I would have no hesitation in selling.

That's all I have time for today, as another investor lunch is looming. Hopefully I'll get the time & venue correct today, unlike yesterday, when I ended up dining alone because the event had been cancelled & I'd forgotten to update my calendar!

Regards, Paul.

(usual disclaimers apply - the above are my personal opinions only, not advice or recommendations)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.