Good morning!

At the moment a lot of investors are asking me why particular shares have gone down, when logically they should not have done so (e.g. a company like Somero Enterprises Inc (LON:SOM) which is mainly US-based, hence its profits will translate into a higher sterling amount).

I think the answer is that we're not in an entirely rational market at the moment. We're still in price discovery mode - where the market often over-reacts on the downside after a shock to the system, then prices gradually find a level where demand & supply for each share balances out. This is a particularly chaotic process in small caps, which can move on the tiniest of volumes.

None of us know for sure what the economic outlook is going to be. It's safe to say that the UK economy is slowing, but how much, and for how long, nobody knows.

The FT today mentions that the latest consumer confidence reading has sharply deteriorated. Of course it has, that shouldn't come as a surprise to anyone. The latest reading is that 60% of people expect the UK economy to worsen, up from 46% a month ago.

If you're bullish (like me), then you probably see this as a blip, and expect to see a gentle recovery in confidence. Still a slowdown, but not turning into a recession (2 consecutive quarters of economic contraction).

If you're bearish, then you might see this as the thin end of the wedge, with the economy gradually sinking into a recession. Bears are also more nervous about the banking sector, with yet another Eurozone crisis brewing at the moment with Italy's banks, and Deutsche Bank's derivatives exposure is a big worry.

You need to have a view on the macro picture, because otherwise you can't logically make decisions about which shares to buy, hold, or sell. So it's not pointless guesswork, it's vital to our investment strategy. If in doubt, then arguably play it safe, and sit on the sidelines in cash. Whatever you decide is best for you.

Empresaria

In such interesting times, I'm trying to do more CEO interviews when time permits. I've lined up the CEO/FD of staffing group Empresaria (LON:EMR) to do an interview next week. So if you wish to submit a question for me to ask, please fill in the form here.

I've also hopefully got the CEO of Norcros (LON:NXR) lined up for an interview too, I'm awaiting a date on that one.

Retail margins

I've recently taken on a couple of NED roles for small private companies. Yesterday afternoon I had a meeting with our CEO for a small wholesale/ecommerce fashion business. They wanted some guidance on product pricing, margins, etc, given the big movement in exchange rates.

As a small company, it doesn't have any forex hedging in place. So, we went through all the costings, for mainly Far East production, and I calculated that they would need to raise UK wholesale prices by 16% (because they are currently pricing things based on £1 = $1.50). Yikes. We decided that the market just wouldn't take that, so compromised on an initial 10% price rise, with further price increases planned for 2017, if the customers will take that. If customers stop placing orders, then we'll have to backtrack to maybe just a 5% price rise.

Therefore, there's no doubt in my mind that prices in the shops are going to rise significantly next year. We could see overall inflation rise to say 3-4%, I reckon. Higher prices mean that consumers will buy lower volumes of goods, which will affect freight companies, plastic bag manufacturers, and all sorts of other companies in the support chain for retailers.

It probably also means job losses in retailers, as rotas are trimmed to take into account lower profits, and lower sales volumes. I think retailers will have to absorb some of the pain themselves, with lower gross margins too. Therefore it's going to be a particularly tough sector next year, in my view.

Mind you, the above is assuming that sterling remains low. We don't know what will happen. Most commentators just extrapolate from whatever the current trend is. So most people are saying that sterling will continue to weaken. Nobody knows in reality. In an ideal world, sterling might recover somewhat, thus mitigating the problems mentioned above.

So when looking at retailers' shares, I'm taking the broker forecasts with a pinch of salt at the moment. In fact generally, I think broker forecasts need to be treated with great caution at the moment. A lot of forecasts have been cut back, but we need to keep a close eye on whether they're being cut enough. History suggests that profits often fall a lot more than broker forecasts expect, when an economic downturn starts.

EDIT - also see Jane's comments in the comments below. She makes the excellent point that retailers will not be passive. They will be putting a lot of pressure on Far Eastern suppliers to reduce their cost prices, to offset some or all of the impact of weaker sterling. There will also be product modifications, to lower cost I think. Great point, well made, thank you Jane!

Avanti Communications (LON:AVN)

Share price: 20.6p (down 26.5% today)

No. shares: 147.4m

Market cap: £30.4m

Trading update & financing requirement - an update yesterday effectively says that the game is almost up here. This won't come as a surprise to readers here, as I've explained in several articles before how the junk bond financing and falling prices for its satellite bandwidth meant that the equity is worth nothing.

I certainly didn't hold back in my report here of 16 May 2016 (shares then at 88.9p), concluding;

"Overall, this looks a total dud. Insolvency looks inevitable, it's only a matter of time before it runs out of cash, and the bondholders wipe out equity holders. You would have to be completely out of your mind to buy this share, in my view. The company is the living dead - due to its insurmountable debt pile."

Why on earth didn't I short it? Schoolboy error, as this was easy money.

The company said yesterday that;

...it has now become probable that as a pre-condition to the full availability of the facility and to satisfy working capital requirements the Company will need to raise at least $50 million of equity.

I cannot see how that could possibly happen, whilst the company has $645m of 10% junk bonds outstanding. Why would anyone stump up fresh equity, when the company has crushing debt liabilities, and interest payments?

The only way this company can survive, in my view, is a debt for equity swap. That is likely to dilute existing shareholders down to virtually nothing.

Management are hoping that a new satellite launch will save the day. The trouble is that there is price deflation for satellite capacity of about 20% p.a.. So they're trying to run up an escalator the wrong way I reckon.

The Board is focussed on ensuring that the Company has the best opportunity to benefit from its early market advantages and forthcoming launch of HYLAS 4, which will more than double available capacity without materially adding to the Group's operating cost base.

The Board has also identified possible cost saving initiatives in operating and capital expenditure to save up to $58m over a three year period.

If Avanti is not able either to secure the above funding or deliver on contingency cost reduction or deferral measures, the Company may not have access to sufficient liquidity to meet its funding requirements through Q2 FY 2017. The Company will keep the market updated as appropriate.

The way I read that, it looks like the company is finished. Or rather, the equity is finished - i.e. worth nothing.

It's the junk bonds that have killed off the equity here. If you take on a massive pile of debt, at very high interest rates, without any means of paying the interest, let alone the capital, then it's game over.

A debt for equity swap will have to happen here in my view, as the figures just don't stack up otherwise.

If people are daft enough to hang on to their shares, they're facing in all likelihood a 100% loss. The only glimmer of hope is that someone with crazily highly rated paper might come along and bid for it. Apparently that has happened before with apparently doomed satellite companies.

As regards shorting, in my view it's usually best to close short positions before the shares are suspended. This means you can bank your shorting profits and move on. Whereas if shorters hold out for the last scrap, their profits are often tied up for a very long time - months, or even a year or more, before the profits are actually paid out.

Also, bizarre things can happen, so in my view if you've made 80%+ profit already, then it usually pays to bank the profit and move on, rather than get greedy for the last little bit, and then have a big profit suspended for a long time. The SB companies often move it to 100% margin as well, once the shares are suspended - this can be very inconvenient, as it could force you to close other positions to free up margin for the suspended shares. A lot of money is tied up for no reason, for a long time - which has an opportunity cost.

Well done to the shorts here. Longs - well what can I say? Take a course in how to read accounts maybe, as this one was so obviously doomed. Or protect your remaining capital by just giving up investing/punting altogether maybe?

Churchill China (LON:CHH)

Share price: 725p (up 2.1% today)

No. shares: 11.0m

Market cap: £79.8m

Half year trading update - a solid update from this pottery maker, very much better than the recent one from Portmeirion (LON:PMP) . Churchill China (which is focused on practical, hard-wearing pottery for the hospitality sector), today says;

Following our positive AGM update in May, the Group has continued to perform well in the period to date. We have achieved strong growth across the business as a whole, with particularly good progress in our target Hospitality export markets.

Whilst the result of the recent EU referendum has introduced some uncertainties into our markets, our business is increasingly international and focused on attractive markets with good potential.

We remain confident that we will continue to deliver against our performance targets.

A good geographic spread of business is absolutely key at the moment, as it mitigates or even benefits from forex movements. Although as we saw with PMP, if one large market goes wobbly (or two, in their case), then things can get difficult.

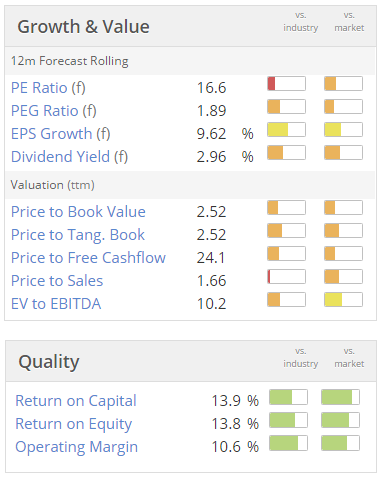

Valuation - this looks about right to me, but there's no scope for anything to go wrong on this sort of PER;

My opinion - I like the company, and it has a good balance sheet.

I expected this one to go wobbly (as it serves the hospitality sector), and PMP to remain solid (as they do decorative items mainly), but I got that wrong, as the opposite has happened to date.

Am not sure I'd want to rush in and buy at this point in time, given the economic situation.

EDIT - it's now Sunday afternoon, and Andy Murray has just started playing the Wimbledon final, it's 2 games all, in the first set. Sport doesn't interest me, although tennis & rugby are about the only ones I don't actively dislike. I blame the education system - I went to a very sports-focused state grammar school, where we were forced to participate in team sports. That just created a lifelong aversion to sports in me.

So instead of cheering on Andy, I'll catch up with some gaps in this report. We had another health crisis at my adopted family in London - our house Mum tripped over, walking the dogs. So I got a frantic call, mid-afternoon on Friday, and rushed over to the accident spot, to find her sitting on a dining room chair in the middle of the pavement. Some locals, and kindly passing Londoners, had stopped & made her comfortable, and called an ambulance.

I went with her in the ambulance to UCLH (a credit to the NHS, I should add), and we spent 6 hours in A&E, and it was bad news - a fractured hip & knee. They operated on her yesterday, and I'm pleased to say that the operation was a success, and she's sitting up in bed, remarkably perky considering.

Anyway, enough chit-chat, here are a few more comments on Friday's results/trading updates:

Indigovision (LON:IND)

Share price: 123.5p

No. shares: 7.6m

Market cap: £9.4m

(At the time of writing, I hold a long position in this share)

Trading update - as with everything, what's happened in the past doesn't matter, because we can't change the past. All I'm interested in is the future - i.e. all things considered, is this company worth more, or less than its current market cap of £9.4m? That's the only thing that matters when it comes to deciding whether to sell, hold, or buy more.

Here is the latest update for the 6m ended 30 Jun 2016;

Sales in the six month period to 30 June 2016 amounted to approximately $21.8 million, 3% below the corresponding period last year. Within this, camera volumes increased markedly but this gain was offset by lower camera product margins arising from continued competitive market conditions. Notwithstanding the market challenges, gross margin remained broadly in line with 2015 as a whole and within the Group's normal trading range.

The impact of overhead reductions made in 2015 continued to flow through in the six month period. As a result, the Group expects to report that last year's first half operating loss of $1.26million has been largely eradicated. Working capital management remains strong, with net cash of $4.6million at the period end.

Note that IND reports in US dollars, which makes sense since most of its product purchases, and sales, are in US dollars. All manufacturing is out-sourced, with IND choosing the spec for its cameras & encoders, and then getting world class manufacturers to make them. Therefore IND is mainly these days a software company - the hardware is really a means to get customers using its highly-regarded software.

A Motley Fool reader warned me, years ago, that IND would ultimately face price deflation as its early technological lead would be eroded by competitors. He was absolutely right, that's exactly what has happened since. Wish I'd listened! This is actually a very important theme for many investments. Companies which generate soaring profits for ground-breaking new products are often hauled in by competitors, chasing & then gradually eroding the fat margins. That's how capitalism works - super-normal profits attract competition. So I definitely need to think more deeply about how sustainable profit margins are for all growth companies.

H1 last year was particularly poor ($1.3m loss before tax), but H2 2015 was better, with a profit of $0.5m.

It sounds as if H1 2016 will be a small loss, driven by overheads reductions, so that's a good improvement against H1 2015, but a sequential deterioration against H2 2015. One of the positive things about IND, is that it has a largely flexible overheads base. So the company can adjust overheads to suit prevailing market conditions.

Net cash of $4.6m is great news - that's £3.5m, more than a third of the market cap. Note the benefit from forex movements too - each dollar is worth more, in sterling terms, than it was 6 months ago.

When net cash was last reported, it was $2.8m, at 31 Dec 2015. Therefore a big improvement in cash, in a near-breakeven half year, suggests that inventories & debtors have been usefully turned into cash.

So we seem strongly asset-backed at the current valuation. With flexible overheads, and a very strong balance sheet, IND remains copper-bottomed - there's no danger of it going bust for the foreseeable future anyway. This improves risk:reward considerably - especially as a strong balance sheet also means there's no risk of a discounted placing, which is so damaging for shareholder value at many other small caps. IND has had about 7.5m shares in issue since the dawn of time - unlike a lot of tiny companies which issue new shares like confetti.

Outlook comments - none given. Probably wise, given that the company has enormous difficulty forecasting performance. This is because just one big contract can mean the difference between a lousy year, and a blockbuster year. Shareholders simply have to accept that there is little to no visibility over performance, given that IND often has long-gestation major contracts.

My opinion - I'd like to exit, as I think the really big opportunity, to become a major player in the sector, globally, now seems unlikely to be achieved. However, IND is still very much in the game, and has a good suite of products, and numerous excellent reference sites, globally.

It spends a lot on product development, and has a good current range, with e.g. body-worn cameras with excellent features - such as a button to start recording in the past - 10 seconds ago - after a security incident has occurred. I think this is done by constantly recording on a short term loop in the background.

Overall, I would accept an exit at about 400p per share, but selling at 123p per share now doesn't make any sense at all to me, so I'll sit tight. Management have reasonable stakes, so interests are aligned. There's a good geographic spread of business, so Brexit impact should be mitigated. The recent exchange rate movements should be beneficial, as the sterling overhead base in Scotland just got cheaper, relative to gross margin in US dollars.

I think the company is fighting well, but is possibly too small to go it alone. Perhaps a takeover bid, or a JV with a larger player might make sense?

Johnston Press (LON:JPR)

Share price: 14.25p

No. shares: 105.9m

Market cap: £15.1m

The i newspaper sees record increase in readers - this is pure fluff. The equity is worth nothing, as I've said for years.

Debt ranks ahead of equity.

This is a nice share to punt in, so could be very volatile, but has no underlying value. Management are delusional, in my view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.