Good morning!

I'm walking wounded today, after a bit of a session last night. I was celebrating some good news, of putting to bed my last big legacy issue from the 2008 financial crisis. I can't go into details now, but it will all be in my book - work has started on that.

A friend gave me a copy of "What I learned from losing a millions dollars", and suggested that I write a similar book about my experiences in the financial crisis. I retorted that, for a start, put a zero on the end of that number. There are lots of books out there supposedly telling us how easy it is to make a fortune from the markets, and explaining how clever the author is. There aren't enough books explaining how easy it is to get things disastrously wrong in the markets (which often happens after a long period of outstanding performance, as it did with me). So I intend writing just such a book - but with a happy ending - focusing on what I learned from getting things so badly wrong in 2008. If it stops just one other person from blowing up through combining gearing & illiquidity as I did, then it will be worth it.

As I've mentioned before, I made disastrous mistakes in 2008, and learned some very painful lessons, the hard way. Hubris has hopefully now turned into humility - an essential first step to learning lessons from the mistakes we make in life. I love this quote, attributed to an author called Will Rogers;

Good judgement comes from experience, and a lot of that comes from bad judgement.

(I never know whether to put an "e" in the middle of judgement or not. Have just googled it, and apparently the version with an "e" is the conventional English version, which is my preference)

Anyone who claims to get all, or almost all, their investing decisions right, is a liar. As mentioned yesterday, a 60:40 win:lose ratio is perfectly adequate to give terrific overall results - especially if you ensure that the winners are generally larger positions, and the losers smaller ones. So we shouldn't beat ourselves up when we get a stock idea wrong. The important thing is to learn from each experience, and mistake.

As ever, my mission here at Stockopedia is to flag up potentially interesting shares, and warn you away from dodgy shares. 5-10k readers per day seem to find that useful, so I must be doing something right! The onus is then on readers to DYOR, and take responsibility for your own investment decisions. That's not a disclaimer - it's the entire ethos of this website.

Vertu Motors (LON:VTU)

Share price: 46.25p (unchanged today)

No. shares: 397.3m

Market cap: £183.8m

(at the time of writing, I hold a long position in this share)

AGM statement (trading update) - this covers the 4 months to 30 Jun 2016 (this group, car dealerships, has a 28 Feb year end). It reads well, with the key bit saying;

Profitability in the four month period to 30 June 2016 ahead of prior year and in line with the Board's expectations.

That's all very well, but Brexit was 23 June, so it's really more important to understand what has happened since then, and what the outlook is like.

Brexit/outlook -

On 23 June 2016, the UK voted to exit the European Union (EU). This has led to some uncertainty for the economy and the motor retail industry in a number of areas.

Yes, we know that, but thank you anyway.

Regulations surrounding Manufacturer Franchise contracts are currently determined on an EU basis by Manufacturers and reflect EU competition policy. The Board, at this stage, does not anticipate any major changes to the franchise contract position under which the Group transacts with our Manufacturer partners resulting from the UK leaving the EU.

That makes sense. I imagine very little is likely to change, in most areas. Existing EU rules are likely to continue in most areas of commerce, in my view.

My apologies for reproducing the following in full, but it's all interesting;

The UK represents the second biggest market for new vehicles in the current EU and thousands of continental European jobs are reliant on a continuation of this trade with the UK.

Consequently, the Board believes that Manufacturer partners are likely to be keen to support UK retailers through any period of uncertainty.

The majority of the Group's new vehicle sales are imported to the UK from the EU. Our Manufacturer partners clearly have a vital interest in ensuring continued free trade access to the key UK market and the Board will be monitoring the negotiations of the trade relations between the EU and UK.

The £:€ exchange rate is important to Manufacturer profitability on the UK sales and is a factor in determining the level of supply push of vehicles into the UK market. Whilst sterling has declined against the Euro following the referendum result, it remains at levels above the lows seen in 2008/9, and more recently throughout much of 2013, and at levels which the Board believes remain attractive for European Manufacturers to export vehicles to the UK. This should help to underpin the UK new car market which is currently at record levels.

So pretty reassuring. It's important also to consider that dealers make very little profit on new car sales. Their profits mainly come from aftersales (e.g. servicing & warranty work), and used car sales.

New car sales have fallen since the referendum - but the key profit earners of aftersales & used car sales are fine;

It is possible business and consumer confidence in the UK may also come under some pressure as a consequence of the uncertainty in the next few months.

In line with trends in recent months, since the referendum new retail vehicle sales volumes have been behind last year.

However, the important revenue streams of used cars and aftersales have not seen any negative impact to date. The Board will update shareholders further in the pre-close statement in early September 2016.

That sounds encouraging to me, and underpins the bull case that the recent steep plunge in share prices in this sector may have been an over-reaction. I believe that profits at car dealers may be more resilient than investors currently believe.

So as things stand, Vertu management sound fairly happy with things, and have also been expanding recently too;

Given the performance of the Group to date and the ongoing integration and improvement of businesses acquired in recent periods, the Board expects the performance for the full year to be in line with current market expectations.

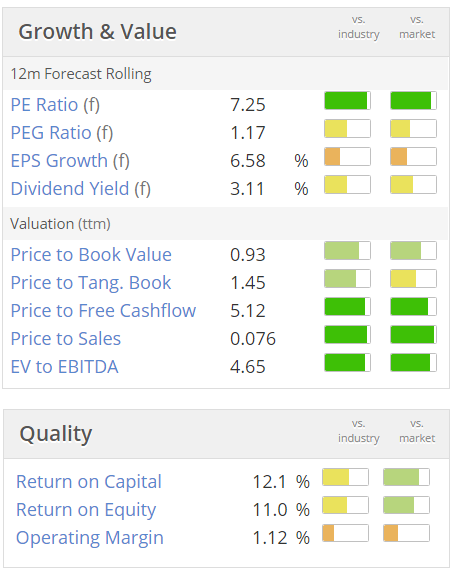

Valuation - a strikingly low PER reflects market pessimism about the future;

Note that the quality scores aren't great - this is obviously a low margin sector. Mind you, if you look at aftersales in particular, the margins are good there. So I see new & used car sales as a means to an end - churning through to cover the overheads, but more importantly stimulating demand for higher margin aftersales.

My opinion - this is a straightforward choice. If you're gloomy about the economic outlook, and think a recession is coming, then you should probably deploy your bargepole for this sector, which suffers badly in recessions.

If on the other hand, you think (as I do) that we're likely to see a temporary economic slowdown, followed by recovery in 2017, then the recent steep fall in valuations in this sector could present a very nice buying opportunity.

In previous recessions car dealers have tended to be highly geared, and some went bust. This time around, balance sheets are generally very solid, and Vertu is one of several which owns loads of freeholds. Note that the price to tangible book value is modest, at 1.45. Those freeholds often have higher alternative use value too, so book value could be understated.

I like it, and will probably buy some more after today's reassuring update.

Looking at the chart - will it get back to 80p? Probably not any time soon, but with patience, I could see it recovering to c.60p level, maybe next year, providing the economy doesn't really nosedive?

Judges Scientific (LON:JDG)

Share price: 1320p (down 11.3% today)

No. shares: 6.1m

Market cap: £80.5m

Trading update (profit warning) - I'm confused by this update. The whole RNS reads like a mild profit warning, nothing much to worry about, but then the last sentence is a bombshell;

The recent revival in order intake and the positive impact of a weaker pound post Brexit give the Board confidence that the second half will produce better results, however it will be difficult to claw back the underperformance of the first half, as indicated in the AGM statement.

The Board now believes that earnings per share for the full year will be substantially below market expectations.

The reasons given are really just sluggish order intake from Jan-May 2016. Although business has picked up since;

For the third year in a row, order intake in the first quarter was weak; this lasted until the end of May and was followed by a healthy rebound with five consecutive weeks of strong bookings narrowing the decline in Organic order intake for the first half to only 1.6% below 2015.

The company had previously warned that business was slow, in its AGM update on 25 May 2016, hence the muted share price fall today.

Valuation - it's very difficult when companies don't quantify the change in profit expectations. Substantially below market expectations sounds bad, but it could be anything from maybe 15% below, to 75% below. The only solution is to refer to updated broker notes, as they will have probably been briefed in more detail. That's not satisfactory, as many private investors can't get access to broker notes.

Thankfully, I do have access to broker notes, hence can help readers by giving you more information in these reports. I am intending on writing to Mrs May about this ridiculous anomaly in the regulations, which harms private investors.

One broker reckons the EPS shortfall this year could be about 20%, saying that 2016 could end up around 100p EPS. That doesn't tie in with the broker consensus figure I've got, of 109.1p.

My opinion - use of the word "substantially" makes me fear that things could be worse than the broker suggests. I'm perplexed as to why though, as the narrative today suggests only a very modest downturn in sales.

However, there's also under-performance at an acquired company, Armfield, which is said to be trading "well below" H1 of 2015. So perhaps that has skewed things to the downside more heavily?

So I'd probably feel safe to value the company on a range of say 80-100p EPS for this year. Mind you, in the past, the company has been quite conservative with its guidance, and things haven't turned out as badly as feared. Sterling's fall should also stimulate demand & improve margins in the future, so overall I think it's probably not too bad a situation.

Overall, I think the market has probably marked down this share by about the right amount. It already had a big drop in May, so today's news isn't particularly unexpected, and arguably was already mostly priced-in.

I'm not tempted to jump in at the current price. It doesn't scream bargain to me at 1320p, especially since we know that lousy interim figures will be the next bit of news. However, if you like the company & its excellent management, then this might be an opportunity to top up 11% cheaper.

Work-in-progress - I will be updating this article in sections, this afternoon

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.