Good morning!

ShareSoc Brighton

Firstly a date for your diaries - 13 Sep 2016 - ShareSoc are re-starting investor evenings in Brighton, just down the road from me. The idea is to make this a monthly event, on the 2nd Tue of each month.

Palace Capital (LON:PCA) are coming along to give a presentation. Also, I'll be giving a 30 minute talk about the most interesting small cap share ideas that I've come across in the last month. Then there's an optional meal afterwards. Plus of course I shall be propping up the bar & chatting shares with everyone, so am really looking forward to this.

We're keen to get the numbers this time, so please book as early as you can, here is the booking link. Note that it's a new venue - very near Brighton station, called the Caxton Arms.

Enterprise Inns (LON:ETI)

Share price: 93.75p (up 0.5% today)

No. shares: 497.4m

Market cap: £466.3m

Trading update - pubs seem to be doing quite well at the moment, with a number of quite positive statements recently from pub/brewery groups, e.g.;

Young & Co's Brewery (LON:YNGA) - reported on 5 Jul 2016 that LFL sales were up 4.1% FY to date.

J D Wetherspoon (LON:JDW) - reported on 13 Jul 2016 that LFL sales in the last 11 weeks were up 4.0%, although its operating margin for the full year had fallen to 6.8% (prior year 7.4%). This is the statement where its Chairman blasted the "unprecedented & irresponsible doom-mongering" of many august bodies and individuals over Brexit.

Fuller Smith & Turner (LON:FSTA) - reported on 21 Jul 2016 that LFL sales were up 2.1% in managed sites, but down 2% in tenanted ones, and referred to "a more challenging environment".

Marston's (LON:MARS) - reported on 27 Jul 2016 that LFL sales were up 1.8% in the most recent 16 weeks, down a bit from the higher growth of 2.5% for a longer 42 week period."Not seen any discernible impact" from Brexit.

Mitchells & Butlers (LON:MAB) - reported on 27 Jul 2016 - that LFL sales were down 0.7% in the most recent 15 weeks, but this is an improving trend from the previous 28 weeks (down 1.66%). It notes that margins will be impacted by Living Wage. "Underlying trading has improved in recent months...". Brexit comment doesn't really say anything - "We are monitoring developments closely..."

Of the above companies, it sounds mostly positive, and no concerns over Brexit by the sounds of it. Although Living Wage is clearly squeezing profit margins, and is likely to continue to do so, as further increases are quite punchy over the next few years. I suspect that Govt may need to moderate, or defer the increases.

Enterprise Inns (LON:ETI) - says today that LFL sales are up 1.9% in the 44 weeks to 30 Jul 2016. It also says that;

...all aspects of the strategic plan (are) on track.

Directorspeak/Brexit comments;

"We are pleased to have maintained our trading momentum through the second half of the year to date.

The consequences of Brexit may be far-reaching but to date we have seen no discernible impact on consumer spending and no consequential impact on our trading performance.

Whilst mindful of the potential for some economic uncertainty in the months ahead, we are confident in our strategy and the actions we are taking to grow value for shareholders, and we remain on track to deliver our financial and strategic expectations for the year."

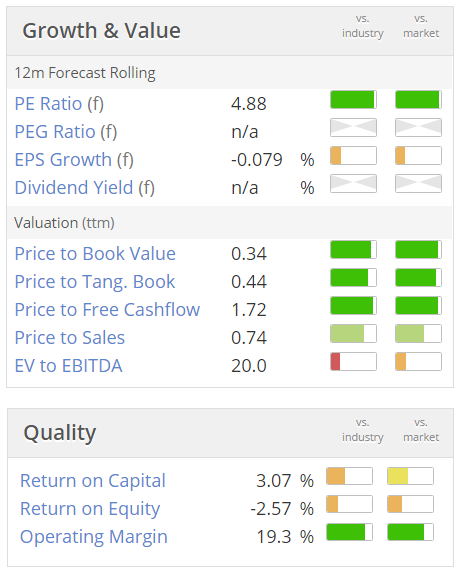

Valuation - the PER is amazingly low, but there's a good reason for that - debt - mountains of it, and it's expensive too, with bonds paying out between 5.7% to 7.4%.

The interest costs on the debt are a very heavy burden, which is a pity because the actual business is tremendously profitable. None of that goes to shareholders though - it hasn't paid a dividend since Jan 2009. Meanwhile the bond holders collect in juicy interest receipts, so really it's the bonds that are probably more attractive than the equity.

A lot of the debt seems to have quite long maturities though, so unless the company buys back its own debt in the market (but it's not generating enough cashflow to do that in sufficient scale to make much difference), then it's difficult to see what's going to change any time soon.

I can't really fathom why ETI is buying back its own shares. Surely it would make more sense to buy back expensive bonds? Maybe they want to push up the share price, to eventually do a refinancing with fresh equity?

This share is trading at a significant discount to its net tangible asset value. Note that P/NTAV of 0.44 is very low. I think there's possibly scope for that discount to narrow, but it depends what freeholds are worth. A friend of mine in the sector tells me that the big pubs groups have freeholds in the books at way above market value, in some cases, because they overpaid during the boom years.

The financiers who loaded up this sector with debt, thinking it was a cash cow, have done enormous damage in my view - killing off many pubs that would have been viable on more sensible rents. To service the debt, pubcos have suffocated their tenants with excessive rents, in many cases, often destroying the business in the process. So the trend now is for some pubs being changed to direct control by the pubcos, rather than having a tenant operating the pub. Others are being converted to residential use.

My opinion - at some point I think there could be a refinancing here, which might be lucrative for shareholders. If the expensive debt could be repaid, using cheaper new borrowings, then it's possible there could be a decent re-rating of the shares.

So for people who like special situations, this, and Punch Taverns (LON:PUB) look worthy of deeper research.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.