Good morning!

There's only one share that interests me this morning, Lavendon (LON:LVD) , so let's crack on with that.

Lavendon (LON:LVD)

Share price: 134p (up 7.2% today)

No. shares: 169.9m

Market cap: £227.7m

(at the time of writing, I hold a long position in this share)

Interim results, 6m to 30 Jun 2016 - this is an equipment hire group, operating in UK, Europe & M.East. Its niche is powered aerial access equipment - the website is quite interesting, showing all the different types of product which Lavendon hires out. It claims to be the market leader.

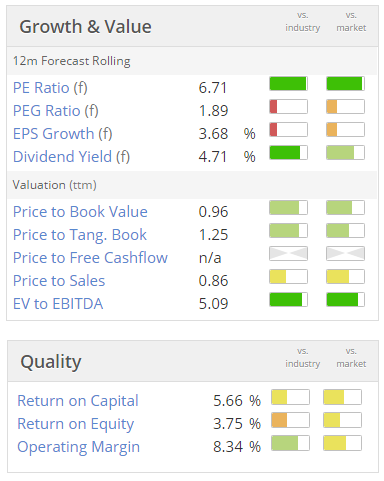

What interests me is that the valuation seems compelling, compared with other hire companies;

- Forward PER is only about 6.5

- Dividend yield is almost 5%, 3-times covered.

- It has a strong balance sheet.

- Equipment hire companies are often on a rating of about 2x NTAV. In this case, the latest NAV figure announced today is £237.9m. Deduct goodwill & other intangibles of £51.7m, arrives at £186.2m NTAV. So 2x NTAV (a fair rating, in my opinion), would give a valuation of £372.4m, or 219p per share - which is my reckoning of where the shares probably should be now. That's a very attractive 63% potential upside, if I'm right about this.

- Consistently meeting market expectations, yet share price has fallen considerably - this doesn't make sense to me. The market is clearly expecting a big downturn in earnings, but there doesn't appear to be any evidence at all to suggest that is happening, or likely to happen.

Looking at today's interim results, the only surprise is a big increase in the dividend - up 18% - so clearly management are confident.

Forecasts - Peel Hunt is forecasting 18.7p for 2016, and 19.4p for 2017. However, there is possible upside on these figures, because they have not factored in favourable forex movements. Over half of revenue, profit & cashflows are generated outside the UK.

Outlook - there is more detail given, but the key part says;

Trading since the half year has continued to be in line with our expectations and, whilst mindful of the recent increased economic uncertainty, the Board remains confident of making further progress in the second half and delivering on its expectations for 2016.

That sounds reassuring. I wouldn't be surprised if they deliver full year results ahead of forecast, given the forex tailwind. So why the market is only rating this on a PER of about 6.5, is a mystery to me.

Balance sheet - net debt has risen to £148.9m, due to fleet expansion, and forex movements which increase overseas debt when translated into sterling. This really isn't a problem though, and in my opinion the debt is perfectly reasonable when compared with EBITDA and the book value of the hire fleet.

When interest rates are this low, it makes sense for equipment hire companies to borrow cheaply, and generate a much higher return from the equipment. The ROCE here is 12.2%, which has gone down a bit, but looks pretty good to me compared with dirt cheap bank debt.

I suppose the danger is that such low interest rates may cause hire companies to over-invest, resulting in over-supply of hire equipment, and eventually a plunge in profits when the next recession coincides with over-supply.

On a more general level, interest rates being too low, for too long, is likely to lead to all sorts of capital misallocations, with pretty bad consequences eventually. In the meantime however, we can make hay whilst the sun shines.

My opinion - to my mind, this stock is just the wrong price.

The market seems to be anticipating downturns in Lavendon's main markets, which are just not happening. Bear in mind that Saudi Arabia is a particularly profitable market for Lavendon, but other M.Eastern countries seem to be doing well too, and compensating for some margin reduction there.

I'm not madly keen on general hire companies. It's the niche ones which are interesting, such as this. With such attractive valuation metrics, and more positive results/outlook today, I'm feeling very bullish on this stock, and will probably be adding to my position further over the coming weeks.

There again, I'm fairly bullish on the economic outlook. If you're bearish on the economic outlook, then hire companies are the last sector you want to be in - as they're very cyclical. Just look at how profits collapsed at HSS Hire (LON:HSS) and Speedy Hire (LON:SDY) recently, although their problems seem to be more about poor management. The trouble is that when revenues do fall, there's an operationally geared impact due to huge, fixed depreciation charges.

So I'm not in any way glossing over the risks in this sector. However, in my view the lowly valuation at LVD seems excessively pessimistic, hence why I'm bullish on this share. I see good upside, and lovely big divis to collect in whilst I wait. Ideal really.

There's nothing else of interest announced today, and as we're 2 hours ahead, it's lunchtime here in Greece. So I shall sign off for the day, and the week.

I think it's worked quite well, writing reports on holiday. I enjoy keeping in touch with the market in the mornings, but on a scaled-down basis, and then relaxing in the afternoons.

We're hiring 2 little motor boats tomorrow, and will spend the whole day bay-hopping, snorkelling, etc. around Paxos. Then on Sunday we're taking the tourist boat to Antipaxos, apparently a beautiful smaller island (population 20!) a couple of miles away. So should be very enjoyable & relaxing.

I'm already showing the beginnings of a good suntan, and the family are enjoying the holiday too, so all good! I hear that the weather in the UK is nice too, so I hope you're enjoying the summer too.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.