Good afternoon!

It's a fairly brief report today, as I don't have much time unfortunately.

There was a Radio 4 programme about fraud on AIM last night at 8pm. I've not had a chance to listen to it yet, but the link is here.

Of course, we all know there's plenty of fraud on AIM (especially with foreign companies listing on AIM, and in the natural resources sector), and it's a total disgrace. Sadly, it seems that white collar crime DOES pay. So whilst it continues to go unpunished, we need to be ever more vigilant for conmen and fraudsters who are attracted to AIM like moths around an electric lightbulb.

It's such a pity, because there are several hundred excellent companies on AIM, and they are sullied by association with all the junk. Mind you, having said that, it's pretty easy to spot the frauds, so people who get caught out largely have themselves to blame, some might argue.

MySale (LON:MYSL)

Share price: 94.75p (up 3.0% today)

No. shares: 151.3m

Market cap: £143.4m

(at the time of writing, I hold a long position in this share)

Results y/e 30 Jun 2016 - the market is going crazy for online retailers that are demonstrating strong growth. MySale is slightly different, in that it floated in Jun 2014, on high hopes, but growth subsequently slowed, and the share price crashed.

My view has always been that the experienced management and backers (including Philip Green and Mike Ashley) would in all likelihood get it back on track. Meanwhile the strong balance sheet protected the downside. It's played out very well so far, with the shares having more than doubled now, since my original purchases in the 40p's.

Some of the upside has come from the general re-rating of growth stocks, but today's results clearly show that the company is indeed making progress - although not at the stellar level which Boohoo.Com (LON:BOO) demonstrated earlier this week.

MYSL is slightly different, in that it operates "flash sale" websites, where special offers are made for stock which is usually owned by another company. MYSL helps other fashion companies shift slow-moving stock, at a discount, and it accepts a lower gross profit margin because generally it doesn't own the stock being sold.

Personally I'm not madly keen on that business model, as you only have limited control over performance. It's much butter to buy cannily, and sell your own brand stock, which is what BOO does, with great success.

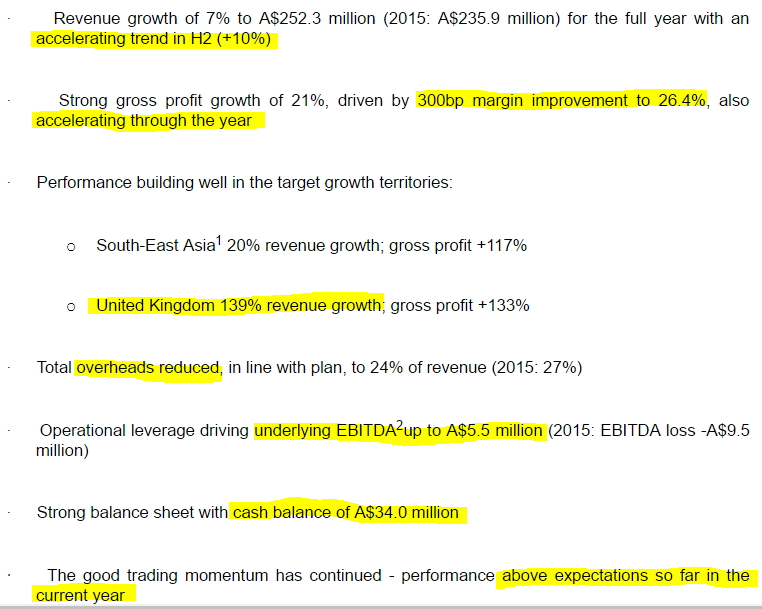

Key points from today's results. There's a lot to like here - some strong & improving positive trends;

Although the above is positive, the market cap of £143.4m is already factoring in a lot of growth. So this is definitely not a share for value investors - it's more for people who recognise the future potential.

Note that sterling has depreciated heavily against the Australian dollar (in which MYSL reports), and the rate is current £1 = A$1.70.

Other points;

- Profit before tax is only A$167k, so the EBITDA figure flatters performance quite a bit.

- Although this is a dramatic improvement from last year's loss of A$21.5m - so if positive sales & margin trends continue, then the figures could be transformed in a year or two - which is exactly what the market cap is telling us.

- UK growth looks exciting, but it's from a very low base. Note the ambition to become the UK's leading flash sale website, and the lack of competition in any scale.

- Sales of own-buy product are up to 15%, but in my view this is still far too low. I'd like to see own-buy rise to 50%+, as that would drive up margins dramatically.

- A customer returns rate of 5% is exceptionally low. I'm not sure how they achieve that.

My opinion - it's not often you find online retailer shares at a reasonable valuation. Even the rubbish ones (like AO. and Ocado (LON:OCDO) - neither of which are likely to make much profit, ever, in my opinion) are enormously expensive. Meanwhile cash-burning junk Koovs (LON:KOOV) is also on a ludicrous valuation, at about £90m. So I wouldn't touch any of those.

What I look for are up & coming online retailers, maybe where something has gone wrong during the growth phase. Or where they're just off the radar. This worked excellently for BOO, although we've probably had most of the immediate upside there.

I see MySale (LON:MYSL) as a promising, up & coming company. So based on the positive trends announced today, am happy to continue holding.

One other up & coming online retailer which I've mentioned before here, and which I also hold, is £G4M. That one is a bit more niche, but is growing at a remarkable pace, and still looks cheap to me. As always, don't just take my word for it, please always do your own research, and form your own opinions.

I think we do have to be careful about highly rated growth stocks. The market loves them at the moment, but if the German banks go into crisis, which is looking increasingly likely, then we could get a nasty shock to the system.

What could really propel MYSL shares is if they get the growth rate well into double digit percentages. It was 10% in H2, on improving margins, but I think there could be potential here for growth to accelerate. Note the deal done to stock Sports Direct products.

So MYSL is quite an interesting one, but tricky to value, and arguably rather expensive at the moment.

Moss Bros (LON:MOSB) - interim results out today look good. LFL sales were up 4.9% in H1. Although as I've pointed out before, this is not an accurate figure, because it's boosted by store refurbishments - which clearly are not a valid LFL comparison! Note the £4.8m capex cost of refurbs in H1, so the growth is being bought by refurbs, and that type of growth tends to wane after a while. Still, it's better to have positive sales growth, than not.

Gross margin is also up, to an impressive 61.9%. Remember that MOSB also does hire, as well as retail, so is very unusual in that respect.

Profit before tax is up 30% to £3.7m, a decent result.

Note that the £21.1m cash is flattered by a big jump of £5.9m in payables. So I would expect that cash figure to reduce in future, when payables normalise.

Sales since the half year end have remained positive, up 3.7%, and the company sounds confident about achieving forecasts for this year.

This share looks too expensive to me, priced at about 18 times current year forecast earnings. I struggle to see why a business with limited growth potential should command such a high rating.

Note the generous dividend yield, although the divis are not quite covered by earnings, so will deplete cash.

I have to leave it there for today. See you tomorrow!

Regards, Paul.

(usual disclaimers apply - NOT advice or recommendations, just my personal opinions - which will sometimes be right, and sometimes wrong. So please always DYOR).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.