FCA Action

FCA proposes stricter rules for CFD products

This news may affect you if use leveraged trading products. The proposals include new disclosures, risk warnings and leverage reductions for retail clients, depending on their trading experience.

Shares in related companies are all currently down by more than 25%: IG Group (LON:IGG), CMC Markets (LON:CMCX), Plus500 (LON:PLUS).

One thing I'd note is that IG has some international diversification, earning 45% of operating profit from offices outside the UK last year. But I suppose there are no guarantees that other regulators won't decide to take similar actions in the future!

The FCA remarks that 82% of client accounts, in a representative sample, lost money on these products. While I'm certain that the vast majority of those clients did not intend to lose money, it would be really interesting to know how many of them are using CFDs for legitimate risk management purposes: to hedge the risk of their physical stock portfolio, or a large foreign exchange transaction they are about to make.

My simple point is that there are ways to judge client satisfaction, other than by how many of us are profitable!

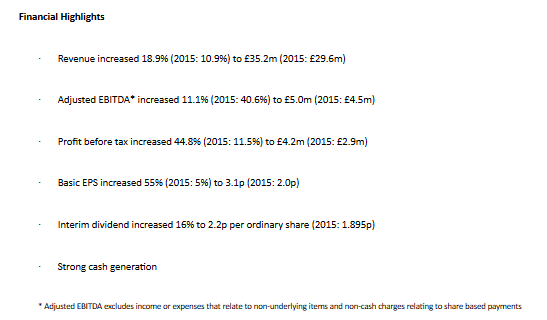

Gateley Holdings (LON:GTLY)

Share price: 118p (+5.8%)

No. shares: 106.8m

Market cap: £126m

Half Year Results for the six months ended 31 October 2016

This is a commercial law firm, making it one of those few businesses on the stock market which would normally use the partnership model (instead of having external shareholders).

While all businesses are reliant to a greater or lesser extent on their employees, businesses like this are completely reliant on their staff. That makes them somewhat risky territory for external shareholders!

To lessen the risks, I look for the following two key elements:

- A respected company name which has been around for a long time (Gateley has this).

- A track record of treating external shareholders well.

Gateley has only been listed for about 18 months, but it has at least paid two dividends during that time. Today, with strong results, it announces a substantial dividend increase:

Balance sheet: worth noting that the company has a large book of receivables (£33.0 million) which is almost as big as revenues during the six-month period. The position is partly funded by debt of £7.4 million.

My opinion: I would personally see this as an income play, with decent chances that the dividend can be increased over time, through acquisitions and additional hiring.

It's a professional services group and so it will certainly need to make more acquisitions to continue on the growth path, but it looks to a me as if it has the resources and the ability to execute. According to my source, the consensus forecast is for pre-tax profit of £13.1 million this year. That would give it plenty of firepower.

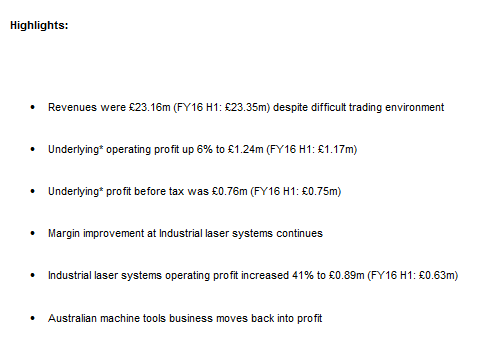

600 (LON:SIXH)

Share price: 9.25p (-3.9%)

No. shares: 104.4m

Market cap: £10m

Interim Results for the six months ended 1 October 2016

The Executive Chairman describes today's results as "acceptable".

For a company which has had a disappointing share price performance in recent years, there are some signs it may be on the mend. The order book is 30% higher year-on-year. But the company acknowledges that it has visibility for only two months ahead!

Donald Trump's $1 trillion infrastructure plan is relevant:

The anticipated infrastructure spending programmes

outlined in both the UK and the USA should improve the market for

capital goods, and the products we supply in particular, and the medium

term market outlook therefore appears to be brighter.

Profit: "Underlying" profit before tax is given as £0.8 million, but the interest on its pension surplus helps to bring statutory profit before tax up to £1.4 million.

Balance sheet: The company has an extraordinary balance sheet: its net asset position of £38 million is mostly accounted for by £34 million of pension surplus, which you get by subtracting £217 million of pension liabilities from £251 million of scheme assets.

With pension scheme assets which are 25 times the market cap, this is effectively a pension fund with an industrial business attached to it.

My opinion: It looks quite possible to me that these shares are undervalued, given the discount to net assets. But the surplus can change dramatically with a few changes to the assumptions, so you really need to have a view on the correctness of the assumptions.

If we just assumed that the pension fund would take care of itself, it does look as if the volatility in the order book may have been priced in at this market cap.

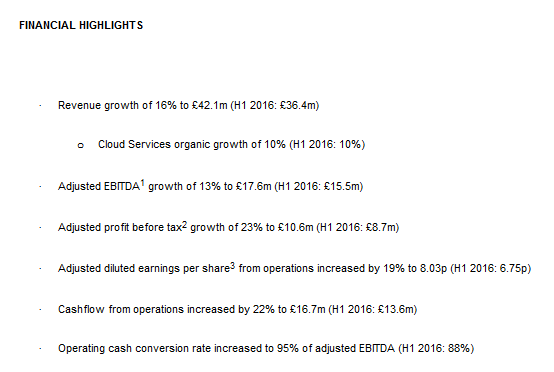

iomart (LON:IOM)

Share price: 287p (+2.1%)No. shares: 107.4m

Market cap: £308m

Half Yearly Results (30 September 2016)

Fantastic results from this provider of cloud services, which is at the centre of business migration to outsourced data services.

The organic growth rate, not mentioned in the above table, is a still very respectable 10%.

Outlook statement:

Trading in the first half of the year has been very

good and we remain focussed on building our recurring revenues in line

with our business model. We are uncovering an increasing breadth of

opportunities to constantly grow that recurring revenue and remain

confident in our future prospects.

Operating margin for the half-year is an impressive 19%, a little higher than the result achieved for the full-year to March 2016. Return on capital employed has in recent years been c. 12-13%.

So even though cloud technology has been around for years now, many businesses are clearly still moving to it and need plenty of help in managing that process.

My only concern here is the company's potential longevity. When the transition to the cloud is complete, what happens next? While the growth has been excellent and it looks as if the company has barely put a foot wrong, I just don't know what time horizon I would need to have in the back of my mind if I made an investment here.

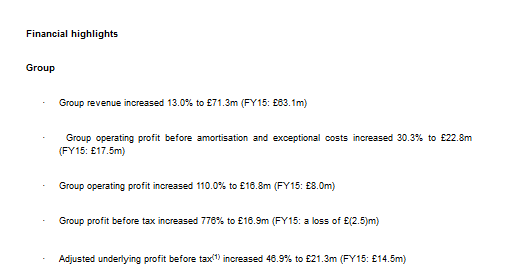

On The Beach (LON:OTB)

Preliminary Results for the Year ended 30 September 2016

Maiden final dividend: 2.2p per share.

Impressive stuff from a business with c. 20% market share in its niche (short haul beach holidays).

Adjusted underlying PBT at £21.3 million was ahead of the £21.1 million forecast by Numis.

Management strategy was to accept slower revenue this year, "to avoid the business chasing unprofitable growth". But UK revenue grew nevertheless by 12.3%, to £70 million, suggesting that there is plenty of underlying momentum at work here. Online market spending was reduced to 44.5% of revenue.

Overall, the company thinks that its addressable market was flat this year, with the effects of terrorism on consumer confidence offset by the structural shift of the travel industry online. This means that all gains must have come at the expense of the competition!

The international business remains very small, but Norway will be launched soon to add to the Sweden offering.

I like the reporting style: it's very clear.

Cash flow: reasonable match-up between PBT and free cash flow, as £17.0 million of the former translates to £15.3 million of the latter.

Outlook:

the Board is pleased to report that current performance

is in line with expectations and believes the business is well

positioned for the key trading period that commences in late December

and continues into Q1 2017.

The Board remains "confident" of meeting market expectations for FY 2017; the forecast is for underlying profit before tax of £27.0 million next year - that's growth of 28%!

My opinion: Not cheap, but could be worth this rating, given the anticipated growth rate.

I quite like the economics of the business: it has generated a very high return on equity this year, and the capital required to maintain the brand, the websites and its technology do not look particularly intensive (you can see these intangible assets broken down in Note 9).

There are macro risks and the international expansion may take a long time to bear fruit but overall, I'd be more positive on this compared to the average stock!

That's all for today - thanks very much for reading.

It would be a big help if readers would let me know in the comments each day which companies they want me to cover. Within reason, I can have a try at covering whatever there is the most demand for!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.