Good morning,

Boohoo.Com (LON:BOO)

Let's start with a few comments on the latest Dispatches TV programme. I think it's a good thing that Dispatches is keeping the pressure on the rag trade - because it's notorious for having a supply chain where conditions for workers can often be very poor.

Warehouse management procedures have come under criticism for Sports Direct, JD Sports, and now BooHoo. The trouble seems to be that the workforce is transitory - with agency temps being extensively used, to boost the workforce during peak times.

Overall though, despite the TV peoples' attempt to dramatise things, BooHoo didn't seem to be doing much wrong. Specifically, these struck me as the main negatives;

- Docking pay by 15 mins for being 1 min late - clearly unfair, and should not happen.

- Long queues for bag-checking, and workers unpaid whilst waiting - again, clearly wrong, needs to be rectified.

Other than that, the following points were presented as terribly negative, but which strike me as being par for the course;

- Long shifts (12 hours), involving extensive walking - that's what warehouse work is like. So it's only suitable for people who are fit & active.

- Workers being pressurised to meet targets - it was filmed at peak trading, and everyone would understandably be under pressure to reach peak productivity.

- 3-strikes and you're out, with strikes being for quite trivial things. The company has denied this is their policy. However, when there is plenty of supply of willing agency workers, employers will naturally keep the most productive, and want the least productive replaced.

It's a fine line between urging staff to work hard, and crossing a line into bullying & maltreatment. The BooHoo supervisor filmed by Dispatches actually seemed quite polite in the way he spoke to agency staff, I thought. Certainly I've seen, and been personally on the receiving end of far worse treatment when working in warehouses! Bullying supervisors are a widespread problem.

This type of Dispatches programme can cause a lot of brand damage, so I think it's important that BooHoo properly reviews how it's treating agency staff. Overall though, on my visit to BooHoo HQ last year, I was highly impressed with how professional everyone was. So the culture of the company is good, in my experience.

The issue of goods being manufactured in factories where workers are underpaid, is an ongoing problem for the whole industry. The big problem is that factories often take orders, then sub-contract the manufacturing. So buyers often have no idea where the garments have actually been made. Suppliers tend to fill in paperwork with what they know the buyer wants to see, irrespective of what reality is. This was my experience from working in the sector throughout the 1990s, and I doubt much has changed.

It's important that programmes like Dispatches keep the pressure on the retailers, as otherwise they'll slip back into complacency. Overall though, I reckon BooHoo came out of things reasonably OK - a few tweaks needed, but nothing too bad. The share price said the same thing, and hardly budged.

BooHoo has put out a detailed press statement here.

Right, on to today's trading updates & results. There's nothing that particularly interests me, but I'll go through the motions.

Epwin (LON:EPWN)

Share price: 102.75p

No. shares: 141.5m

Market cap: £145.4m

Trading update - for the year ended 31 Dec 2016.

The summary sounds alright, but note the challenging market conditions comment;

The Group's profits for the year ended 31 December 2016 will be in line with expectations, with continued strong cash generation in challenging market conditions. The performance of recent acquisitions continues to be encouraging.

Various other comments are given, but this one caught my eye on rising import costs;

The long term impact of the outcome of the EU Referendum on consumer confidence and demand remains unclear, but input costs have increased as a result of the weakening of sterling since June 2016 and the Group is continuing its efforts to mitigate this.

That shouldn't come as a particular surprise to anyone. Investors should already be well aware that the UK is entering a period where we'll have a burst of higher inflation. The same thing happened in 2008 when sterling devalued sharply.

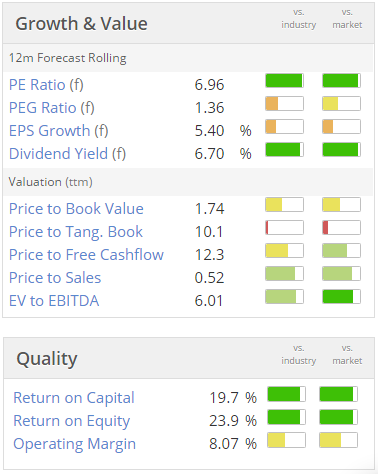

Valuation - this appears a decent value share - with a low PER, and high divi yield:

The trouble is, that Epwin's sister company, floated at the same time, Entu (UK) (LON:ENTU) also looked similarly good value. The trouble is, Entu has since performed extremely badly. So it's difficult to avoid the conclusion that Entu might have been hung out to dry, with the profits instead going to Epwin (which supplies Entu).

All in all, very much a reminder that incestuous relationships between listed companies are not a good thing. I remember a fund manager telling me at the time that the structure of the Epwin/Entu float looked horrible, and he was keeping well away. I should have listened to him. Instead I got sucked into the value trap Entu, and took a nasty loss.

Once bitten, twice shy, so Epwin is not something I would buy on principle now. Although as the graphic above shows, it does look cheap, providing nothing goes wrong in future.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.