Good morning!

News is quiet today so I'll be taking care of things myself here while Paul takes a day off.

Regards

Graham

Devro (LON:DVO)

Share price: 181.4p (-2%)

No. shares: 167m

Market cap: £303m

There are some big differences between the underlying and statutory results today from sausage skin maker Devro.

Statutory (or as I like to call it, actual) operating profit comes in at £15.4 million, down from £19.2 million.

Note that constant currency revenues fell this year (by almost 7%), but were more than offset by FX gains.

Dividend: Maintained. Covered by the underlying EPS but not by actual EPS.

Alternative Performance Measures: See explanation below.

Devro is undergoing a major transformation including the construction and start-up of two new plants in China and the US which completed in 2016, a restructuring of operations in Scotland and Australia initiated in 2014 and the Devro 100 programme which will continue until 2018. The incremental costs associated with implementing this transformation are significant, and as a result have been classified as exceptional items.

What to make of this?

Potentially reasonable, except that it's a multi-year programme and so it becomes a bit of a stretch to have a big difference between underlying and reported results over several years.

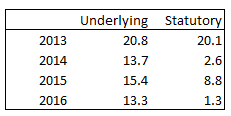

This is the gap between underlying (or "before exceptional items") EPS and actual EPS since 2013:

Net debt has also been rising sharply, up from just £36 million in 2013 to £154 million today.

Using the underlying profit measures, the company thinks it has been earning a return on capital employed over the last two years of c. 11.5%, which is ok if not spectacular.

My opinion

Checking the footnotes, I see that £20 million was spent during the year to establish new manufacturing plants, versus £11 million last year.

While I'm not sure about the other exceptional items, I can see the rationale for excluding these set-up costs from the underlying numbers.

I also see that cash flow was pretty strong (£39 million from operations), although more than a third of this was spent on taxes and interest and the rest was used up in capex, so that the company effectively had to borrow to pay the dividends.

Overall, it's hard for me to get too excited about potentially investing here.

The underlying quality does not seem to be fantastic, the investment programmes are expensive, and the trading environment sounds really tough.

Volumes in Europe were down 7.5% due to "increased competition", down 13% in Russia due to "the extremely competitive nature of the market", down 33% in Latin America, and down 31% in China due to "an oversupply of product at the lower end of the market".

I've previously been a fan of this company but it doesn't sound to me like they have much of a competitive advantage as things stand. Perhaps the new manufacturing plants will change this, but I'd be steering clear for now.

£UPGS (new ticker)

Share price: 155p (+21% against IPO price)

No. shares: 82.2m

Market cap: £127m

Thanks to billytk for requesting this in the comments.

On its website (www.upgs.com), it describes itself as "the leading general merchandising, sourcing and product development house in the Far East".

It looks like an important (if somewhat hidden) piece of the retail supply chain.

From the "global markets" page on the website:

It is our goal to be world-class suppliers to world-class customers. We work with some of the most successful brands, both nationally and internationally.

With over 16 years in business, we have acquired a large and impressive customer base of over 450 retailers and that number continues to grow every year.

We work closely with some of the most popular big name supermarkets and department stores, together with TV shopping channels and selling online via e-commerce.

Retailers shown on this page include Aldi, Amazon, ASDA, House of Fraser, Matalan, Tesco, etc.

UPGS has a portfolio of product brands, according to the Prospectus, being focused on "mass market, value-led consumer goods for the home".

It appears that most of the brands are on license from 3rd parties. For example, UPGS has a licence for the cookware products from Russell Hobbs which runs until 2020.

UK customers were 70% of sales in the most recent financial year.

Sales and "underlying EBITDA" growth are both strong in the short and medium term, achieving £33 million and £4.4 million in each, respectively, in Q1. PBT last year was £6.3 million.

The underlying EBITDA margin was 10% - it's rising, but is unsurprisingly not huge given the sector it's operating in.

Management

The founder remains the CEO, holding 45% of shares at the Prospectus date - projected to reduce to 22.55% on admission. The MD has been at the business since 2005. His stake was set to reduce from 19.6% to 9.8%.

My opinion

I'm inclined to monitor and learn more about this.

For what it's worth, this flotation is not bringing any new money into the company. It is purely to allow the sale of £52.6 million of stock (pre-expenses) by existing shareholders, and provide the other benefits of listing (employee Share Incentive Scheme, etc.)

Those who got in at the IPO price of 128p are already up 21%! But I can see how the valuation could easily make sense, if PBT keeps rising on the current trajectory.

Games Workshop (LON:GAW)

Share price: 905.25p (+2%)

No. shares: 32.1m

Market cap: £291m

This was unusually released just before mid-day:

Games Workshop is pleased to announce that the sales and profit growth, that was discussed in the January 2017 trading update, continues. Income from royalties receivable is also ahead of expectations. In light of the above, profits for 2016/17 are likely to be materially above market expectations.

Sales and profits have further benefitted from the continuing favourable impact of the weaker pound. However, the Board remains aware that there is some uncertainty in the trading periods ahead for the rest of the 2016/17 financial year.

Paul reported on the previous update (also released during the trading day), when Games Workshop reported a "significant increase in sales and profits" for the period from end-November to mid-January.

I see that the broker forecast EPS had nudged up again to 67.7p as of last week.

So that will have to be further revised upwards now.

I never really got into Warhammer - but I appreciated the devotion of those who did.

A little bit of research suggests that GW have created quite a lot of excitement among fans with their latest characters and storyline (pictured below). Some of the latest commentary can be found at this link.

These items can be pre-ordered online for £55. It looks to me as if GW is set up very well for the rest of the year with this kit and the buzz it has generated.

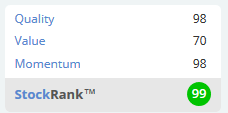

The product cycle will always ebb and flow, but well done to GW for getting things so right recently! And the shares do look good value, with an almost perfect StockRank.

That's it for today, thank you for reading.

Regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.