GYM (LON:GYM)

Share price: 183.9p (+2%)

No. shares: 128m

Market cap: £236m

(Edit: Please note that after initially publishing this note, I bought some shares in GYM. I now have a long position in this company).

Nice progress at The Gym, with the growth strategy being executed as planned.

To quickly summarise what it's doing: The Gym is pioneering the low-cost gym model with 24 hour opening times, a skeleton staff structure, no long-term customer contracts, and much cheaper prices than the conventional gym chains.

Today's statement mentions that one third of joiners are new to gym membership, which bodes well for discount chains growing the market and not just taking share from the competition (although they also mention that the largest number of new joiners come from traditional higher cost gyms).

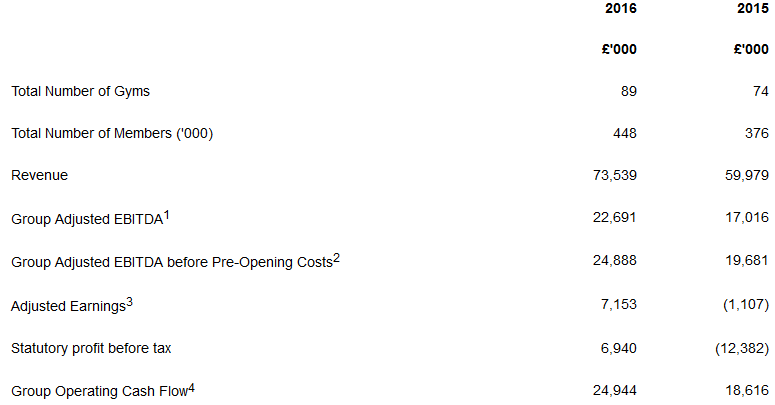

The adjusted profit before tax for the year was £8.7 million and customer numbers grew by 19% to 448,000, as had already been revealed in the trading statement I covered here in January.

According to the CEO, "the way our new sites mature over time remains predictable", and this can be seen seen in the EBITDA per mature site, which is almost flat year-on-year despite the growth of the estate.

They also claim to have a "known and predictable cost base", in contrast to other leisure businesses and indeed the EBITDA margin on mature sites is fairly stable year-on-year (up to 47.5% from 46.3%).

Outlook

The new financial year has started well and in line with the Board's expectations. January and February are the two most significant trading months of the year for any gym business. Membership numbers at the end of February had increased to 495,000, a record level, with a 10.5% increase since December 2016. This level of member growth will help to underpin our performance for the rest of the year.

In 2017 we anticipate opening towards the top end of the guidance range of 15 to 20 sites. As in 2016, these site openings will be weighted to the second half of the year, with six sites expected to be open in the first half of the year.

Financial Results

I'm sure some folks will be looking at this on a PE ratio basis, but for something which is rolling out across the country, it really needs to be looked at from a growth runway point of view - how big might it be in 5 years? For how many years could it open 15-20 new gyms annually? The mature valuation is what counts.

Dividend: Not very important at this stage but .75p is declared so that 1p will have been paid for the full year. A progressive dividend policy is intended.

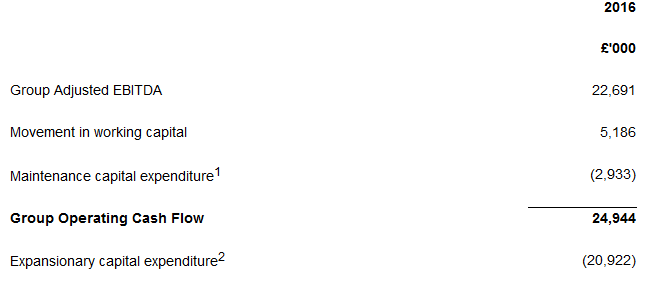

Cash flow: A really interesting cash flow breakdown is included. The company has broken down its maintenance and expansionary capex, to illustrate the cost of its growth strategy and the cash generation of existing sites:

The consolidated cash flow statement shows £26 million in net cash flow from operating activities, not far off the £25 million Group operating cash flow shown above. So it looks like there are serious arguments to be made that the company is already in a very healthy cash generative state.

My opinion: To put it simply, I think that this is one of the more interesting growth stocks in the UK at the moment.

Blancco Technology (LON:BLTG)

Share price: 241p (-22%)

No. shares: 58.2m

Market cap: £140m

This is not a company I've studied recently, as I thought the remuneration policies and corporate governance situation at Regernesis (as it was formerly known) were questionable, and that management were at least as interested in promoting the share price as they were in developing it into a sustainable business.

Through various corporate maneuvers, most of its value is now driven by the data erasure activities of Blancco - which it purchased in 2014 for £60 million.

Regenersis was primarily a mobile phone repair outfit. At the time, Regenersis said that Blancco would provide "a new way to leverage the Regenersis global sales team and its relationships with major global mobile operators and OEMs", and "a one stop solution to Regenersis' existing repair clients."

By early 2016, that strategy had gone up in smoke as the repair business was completely sold. The company had decided to become a pure play software business, and that was that.

But the shareholder base and management team are evolving, and readers have requested that I take a look at this today, so I'm happy to make a few comments on the latest news.

Adjusted Profit

I see that the company is still making a great number of adjustments to its statutory numbers. Unfortunately, this is what happens when investment bankers run businesses. There are seven adjustments, plus their tax effect, which turn a statutory loss of £2.1 million into an adjusted profit of £2.2 million. Previously, Regernesis called this the "Headline Operating Profit".

Adjustments for this year include £1 million in share based payments, which are said to have rewarded participants "for growth in the value of the company", i.e. the share price went up.

My opinion

I'm afraid I still can't take this company seriously.

Of course, it's possible that I'm missing something, and there is a real investment opportunity here. Revenues have grown to £14 million for the six month period, and I see revenues forecast by brokers of £32 million for this full financial year.

Putting it in the best possible light, you could argue that there was nearly £7 million in adjusted operating cash flow (before working capital and before exceptionals), and that this cash flow is set to grow with increased sales in the years ahead.

Maybe if the market cap was closer to what was paid for Blancco in 2014, and especially if management could stop playing with the numbers, it's something I could start to look at with an open mind.

Addendum: There is a useful discussion around the sudden departure of Blancco's CFO on another Stockopedia thread at this link.

Burford Capital (LON:BUR)

Share price: 752.5p (+3%)

No. shares: 208m

Market cap: £1,567m

This is a bit bigger than our mandate at SCVR, but I'll take a look at it by popular demand.

Burford claims to be "the world's largest publicly traded provider of litigation finance".

The financial highlights are excellent:

- 75% increase in net profit after tax to $115.1 million (2015: $65.7 million) and 61% increase in operating profit to $124.4 million (2015: $77.2 million), contributing to a 21.1% ROE

- Income increased by 59% to a record $163.4 million (2015: $103.0 million), driven by 60% increase in income from litigation-related investments to $140.2 million (2015: $87.9 million)

- Strong organic cash generation, with record investment recoveries of $216 million (2015: $146 million)

There are five sources of income, with litigation accounting for the lion's share.

Litigation income rose by 60% (as mentioned in the highlights above), and the $52 million income increase was accompanied by just a $10 million increase in related expenses. Hence, the very large increase in profitability.

The RNS link does not include as much information as you might expect - go directly to the Burford website for the full report and investor presentation slides.

It was an incredibly successful year, which has been recognised in an increased market capitalisation:

It has been a momentous year for Burford. Since the beginning of 2016, our share price has more than tripled and we have created well over a billion dollars in shareholder value. We acquired the other leading player in our space and solidified our position as the industry leader in a growing and evolving industry. We successfully floated a second bond issue, raising $144 million of fresh capital, and benefitted to the tune of tens of millions of dollars from the devaluation of Sterling – a benefit that accrues to our shareholders given our US Dollar denominated assets and dividend payments. And the business itself had by far its best year ever, setting records for income and profits, for cash receipts

The company claims to have assembled "what is clearly the leading and most experienced team in the litigation finance industry".

Somewhat surprisingly, it appears that insiders own very few shares, with no insider owning more than 200,000 shares (or 0.1%). Instead, it is being backed primarily by certain well-known institutional investors.

Edit: John Eustace has noted in the comments that management do own shares - 24 managers own 14.4% of shares, per the annual report. It is the named directors who do not own very many shares,that is all. Thanks for helping me on this point.

My opinion

I can't do this company justice based on the limited amount of time I've been able to dedicate to it today, but I'm intrigued that it appears to have come up with a highly profitable combination of financial and legal insights.

Were there regulatory and legal changes which created Burford's opportunity (it was only founded in 2009), or did it innovate to take on old challenges? I'd like to understand the business model better.

Momentum is incredibly strong:

French Connection (LON:FCCN)

Share price: 34.75p (-0.4%)

No. shares: 96.3m

Market cap: £33m

This is an old story and has been crying out for some kind of a conclusion, at least according to most observers except for the Chairman & CEO (one person).

Anyway, the underlying operating loss has reduced to £3.7 million from £4.7 million, and the cash position was almost stable at £13.5 million (compared to £14 million a year ago). So once again, the company seems to be struggling along without profitability but also without facing an imminent collapse.

The outlook statement does not suggest that the Chairman is going to abandon his efforts to turn the company around any time soon:

Overall whilst the performance for the year as a whole has been disappointing, the noticeable improvement we have seen during the second half and into the new financial year leads me to believe that we are moving in the right direction. The reaction to this year's collections has been very strong so far with sales both in our own stores and wholesale customers' up on last year. It is early in the year and we have a considerable amount of work to do to take the Group back to profitability, however I believe that the actions we have taken and continue to take, will go a long way to achieving that goal this year.

The "noticeable improvement" referred to above is a 4.4% increase in like-for-like retail sales. Overall retail sales were down 5% due to store closures.

Store closures are arguably the most important factor here: it needs to return to a size where retailing isn't ruining the financial performance every year.

So I'd zero in on this paragraph:

In the last four years we have closed 37 full price French Connection stores representing over 40% of the store base. This programme will continue during the current year with two stores already closed and another six expected later in the year. Whilst there are still some stores within the portfolio that we wish to exit given their performance, the rate of closure will reduce going forward and we expect to have around 30 full price French Connection stores remaining by January 2019. The average lease length of the remaining UK/Europe stores is 3.2 years (2016: 4.0 years).

I'm afraid I will have to agree with many other investors who have analysed this company: the rate of store closures is not sufficiently urgent.

The retail division lost nearly £10 million this year, a big improvement on 2016 (loss of £15.6 million) but still enough to ruin the overall results once again.

And the company opened a new store along with two concessions this year, while closing nine other stores. If I owned shares in FCCN (and I did previously, although do not own them currently), I would not want to see any store openings at all, while the retail division is in its current state.

Cash: the minimum cash position during the year was £2 million, helped by a working capital inflow. But assuming continued losses and considering the risk of a working capital outflow in 2017-2018, it's easy to imagine that the company will need to start using a bank facility very soon.

Segment Results

I wonder how many of the common/group overheads could in reality be attributed to the retail division:

After including store disposal and closure costs, the final loss for the year was £5.3 million, worse than the £3.5 million seen in the year ending January 2016.

My opinion

I don't know if the company will end up going to the wall, but I could see it eventually being bought out when it is financially distressed and there are no other options.

Whatever happens, I wouldn't trust that external shareholders will be treated well (based on what I understand from the Chairman's past dealings with them). So I won't be buying shares in this company again.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.