Volvere (LON:VLE)

- Share price: 705p (+5%)

- No. of shares: 4.1 million

- Market Cap: £29 million

(Please note that I currently hold a long position in Volvere)

I don't get to use the above disclaimer very much, because my personal portfolio is recklessly undiversified. I only own nine stocks, and the top 5 currently account for 75% of everything (or 79% if you exclude cash). Volvere is a top 5 holding for me.

I bought into it when I discovered it a year ago, and you can find my article on it at this link (external website).

It's an investment company, which typically seeks out unlisted companies which are in need of change - often a change in their financial structure (removal of bank debt) or occasionally a change in strategy/management. It's a supportive shareholder, not a raider or an asset stripper.

It only holds a few investments at a time, and currently has 3 in its portfolio.

Two brothers are the key executives. They own 25% and 13% of shares, respectively.

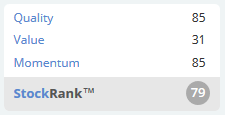

Today's Results

These results are for the year ending December 2016 - admittedly, slow reporting.

But they're rather good:

As a consequence of the above, NAV increases to 617p from 569p. That's an increase of 8%, below Volvere's prior long-term average of 15%.

NAV moves in mysterious ways, however. Because Volvere's holdings are unlisted, they are held on the balance sheet at the price originally paid for them, and they only increase NAV by their net profit contribution to the group every year. But if they are sold after profitability has improved, then you can get a sudden jump in NAV (as the underlying gain in value is realised).

Last year, NAV increased by 32%, as an investment was disposed of after its profitability had improved.

This year, there has been no disposal, but PBT has significantly improved, as you can see in the table above.

Shire Foods, previously the largest contributor to profits, lost a large customer and saw margins increase as a consequence of the Sterling devaluation, and PBT reduced from £1.6 million to £1.15 million (before the charges Volvere makes for managing it and lending to it).

The big winner, however, was the new holding Impetus Automotive, a consultant to car manufacturers. It saw PBT (again, before Volvere's charges) increase from £0.6 million over the prior 9-month period, to £1.5 million this full year.

Volvere originally only paid £1.25 million for it, when it needed to remove a bank creditor and find more working capital.

I would expect that Volvere's share of Impetus will reduce to 79%, as was planned if internal management options were to vest. The share has already been reduced to 83%.

The final holding, a CCTV software business, remains profitable but still very small for now.

Summary

If you exclude the central costs incurred by Volvere in managing these businesses, pre-tax profitability has improved to £2.8 million.

Or on a statutory basis, PBT is £2 million and after paying taxes, there is £1.3 million in net income for equity holders, plus £0.3 million for minority interests (the internal managers at their subsidiaries).

Outlook

Conditions at Shire remain tough:

Whilst we remain positive overall about Shire's contribution to the Group, there are some headwinds facing the business, not least increasing labour rates and a reluctance by customers to pass on price rises to consumers. However, raw material prices now seem to have largely stabilised and we have agreed with customers new pricing and product specifications, which are expected to relieve downward margin pressure from the second quarter of 2017.

But things at Impetus are looking better:

The automotive industry is evolving, driven by increasing innovation and technology in both vehicles and their supply and support channels. This provides a dynamic and challenging back-drop for Impetus and we believe the business is well-positioned in such an environment.

As part of a plan to widen Impetus's service offering the company has, with effect from April 2017, assumed responsibility for the management and delivery of a large automotive manufacturer's learning and development activities in the UK. As a result, Impetus now employs almost 400 people (an increase of approximately 150 compared to March 2017) and we expect Impetus' financial contribution to increase further this year as a result.

My opinion

The kicker to all of this is that Volvere is sitting on a cash position of £20 million (up from £16 million a year ago).

Another way of analysing the balance sheet strength is as follows:

- Freehold property +£2.4 million

- Loans and receivables +£7 million

- Cash +£20 million

- Payables -£2.6 million

- Borrowings -£3.7 million

Total Value: £23 million (or £20.7 million excluding freehold property)

It has never paid a dividend, preferring to buy back its own shares from time to time.

I'm happy to continue holding it at a £29 million market cap, looking for progress at Impetus to offset tough conditions at Shire, and for the long-term rate of NAV growth to hopefully continue. I did consider buying a few more this morning, but it's already 12% of my portfolio and that's probably enough.

Plastics Capital (LON:PLA)

- Share price: 121.5 (-1%)

- No. of shares: 35.8 million (before Placing)

- Market Cap: 43 million

Placing to raise £3.74 million

At the risk of trying too hard to make us at the SCVR look smarter than we really are, this niche manufacturer is a share about which Paul and I have each written sceptically.

The balance sheet looked bloated to me when I covered it back in December, and I suggested that the targeted EBITDA growth plan would lead to yet more balance sheet expansion, and poor returns on assets.

Paul has also argued that the accounting adjustments are too large, the net debt is too high, free cash flow negative, and that dividends made further acquisitions unaffordable, without dilution.

Today, it announces that the share count is being increased by 9% by a Placing at 117p. Last night's close was 122.5p.

The net proceeds of the Placing, which are expected to amount to approximately £3.54 million, are to be applied, in part, towards the proposed increase of the Company's stake in the CCM Group, its US based minority investment focused on the production of creasing matrix. In addition, part of the net Placing proceeds will be invested in other parts of the Group in order to increase capacity to satisfy increasing demand for the Group's products and thereby accelerate organic growth.

That sounds like the company needs some extra cash only for growth purposes, but two paragraphs later we also find that dividends are being suspended:

The net proceeds of the Placing will be augmented by the decision of the Board to suspend dividend payments for at least the next two scheduled payments. The Directors estimate that this will result in a cash saving of approximately £1.7 million. It is intended that the cash saving will be re-invested in the business, alongside certain of the net proceeds of the Placing.

The share price has barely moved since I first covered it, so it's hardly been a disaster for shareholders. But raising more cash from shareholders and suspending dividends is 100% consistent with the thesis that this is a poor-quality investment.

Scientific Digital Imaging (LON:SDI)

- Share price: 25.5p (-11%)

- No. of shares: 88.8 million

- Market Cap: £23 million

By request, I'm taking a look at this multi-pronged designer and manufacturers of high-tech products across a range of industries.

This short post-close trading update for the period ending April 2017 has been badly received:

Reported profits before tax are expected to be in line with management's expectations, with the latest acquisition, Astles Control Systems, as expected making a contribution to the profits of the Group.This share has made huge progress over the past year, more than doubling.

The company has five subsidiaries and appears to be hungry for more:

"We have once again strengthened the Group with the recent acquisition and are pleased with the positive contribution from Astles Control Systems. This is a business model we plan to continue to replicate in order to grow a diversified company with increasing revenue streams."That shouldn't be news, but perhaps investors are a little nervous of another placing.

When SDI acquired Astles in December, it did so with a fairly large placing (nearly 24 million shares issued, versus 64 million outstanding prior to the deal).

The issue price was at a discount of 23.5% versus the prior close.

That hit the share price on the announcement day, but it quickly recovered.

So perhaps investors are thinking that more news of that sort may be coming down the tracks shortly.

Headline interim results for this year were good, revenues up 33% and PBT improving to £0.4 million. The subsidiaries are apparently quite active with lots of new product launches.

It could be worthy of further research, but I note that the share count has already multiplied several times over the past few years (up from 18 million in 2012) and it's more my style to go far shares where the share count is going to move in the opposite direction.

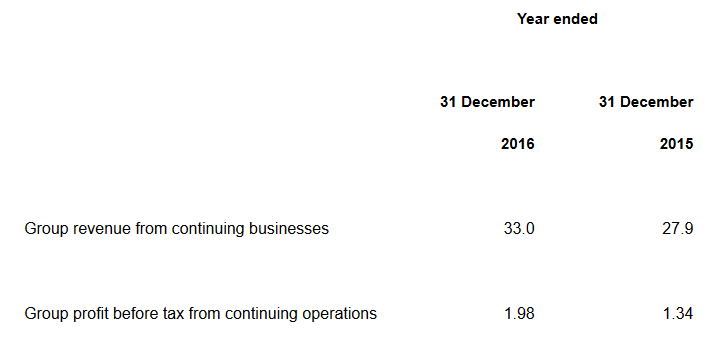

StockRank is not bad, and could improve with the full-year results:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.