Good morning!

There are lots of interesting things going on today, so I'll try to get through as many as possible.

I've been further pondering yesterday's thoughts on whether we've hit a market top. Obviously I don't know whether we have or not, I can only comment on things I observe. It seems to me that the momentum trade - of everything (growth stocks anyway) rising simultaneously, might have ended. Or at least is having a correction.

I think the danger is that we can all think we're ace stock pickers, but afterwards it becomes apparent that we just happened to buy a random growth stock, which went up along with all the others! Then when they fall, they all tend to fall together.

For me, the key thing is positive newsflow. To take growth stocks to new highs, it really does now require excellent newsflow. Not spurious contract wins (which often turn out to be immaterial), but beating expectations, and upgrading forecasts. That's what I particularly look for all the time, but especially now that valuations are very high, and the market feels more nervous. If a company is only meeting, not beating expectations, and the valuation is very high, then maybe it's time to bank some profits?

Purplebricks (LON:PURP)

(at the time of writing, I hold a long position in this share)

Talking of which, I'm very impressed with the announcement this morning from Purplebricks (LON:PURP) and have this morning bought them back for both BMUS and my real portfolio. Yes, the valuation of c.£1.1bn (at 414p per share) looks crazy. However, its results today show that the UK operation is operating at breakeven after spending £14.4m on marketing. It is now by far the market leader in online or hybrid agents in the UK, and is in a virtuous circle of success giving it more marketing firepower, driving further growth. Consider this;

UK marketing spend in the first half of this financial year is now anticipated to increase by some £3.5m year-on-year, with spend in the second half also likely to rise, should the expected returns come through. As a result UK revenue expectations for the current year are raised to some £80m; a near doubling from the £43m reported for FY17

Bear in mind that this is high margin business, where customers pay up-front, and this is developing into a very good business, just in the UK. The company looks on track to become the UK's largest estate agency, of any type. That alone could be worth the £1.1bn market cap.

Australian expansion is at an early stage, but seems to be going alright. Plus the big wild card is the imminent launch, on a small scale, in the US. If that works out well, in future years, the market cap now could look cheap. It may not work though - overseas markets can be very different.

I don't think there needs to be any network effect from overseas expansion. The point for me, is that PURP has cracked the UK market. So, whilst there will be differences in overseas markets, they should have a pretty good idea how to crack other markets too. So arguably it's a land-grab to become the dominant internet/hybrid estate agent in many countries. Then, once established, the cashflows should finance a marketing budget which can out-spend the competition.

So as a genuine internet disrupter, I think PURP looks potentially very exciting - despite appearing to be very expensive on conventional metrics at the moment. Yes, I know it's not small, nor value, so why am I writing about it here? Because it's interesting, and could be a good investment. This was a smashing trade for BMUS previously - in at 125p in Dec 16, and out at 407p in Jun 2017, once the valuation had become apparently too stretched. The newsflow today is sufficiently strong to make re-entry at 405p a good idea, in my view. We don't have to hold shares continuously. Personally I quite like to sometimes sit on the sidelines for a period, until the newsflow is strong enough to tempt me back in. Mind you, that was a disaster at BOO, when I missed another huge leg up. So whatever we do, sometimes it will be right, and sometimes wrong. There's no single rule that always works, whatever the people who like to throw wise quotes around after the event say!

The problem is that, due to internet disruption, value investing may not work as well in future. Low PER stocks in particular, could be value traps, suffering from internet disruption which may be killing off their business models. Not many traditional companies adapt well to radically different circumstances. Usually the high flyers in a new sector were start-ups a few years earlier - e.g. most of the dominant US tech giants now, are quite young companies. So I think great care is needed when looking at low PER stocks, and imagining that they might recover from earnings falls. Are those falling earnings cyclical, or structural? Many might actually be the latter.

We also saw yesterday how high dividends can also be value traps. With Fairpoint (LON:FRP) being the latest stock which attracted value investors (I fell for it, for a while) from a juicy dividend yield. Only for the company to basically go belly up, or be on the brink of it anyway. I think a generous dividend at companies which are dependent on bank facilities, should be disregarded - as chances are, it could well end up being cut at some point. I prefer divis from companies with net cash - as they have the capacity to continue paying divis, often even through periods of soft trading.

EDIT: Also see the section below on Utilitywise (LON:UTW) - which has also turned out to be a high yield value trap.

Harvey Nash (LON:HVN)

Share price: 81.5p (up 1.2% today)

No. shares: 73.5m

Market cap: £59.9m

(at the time of writing, I hold a long position in this share)

AGM Statement - this is a recruitment company, with a focus on "technology & digital talent".

The company has a 31 Jan 2018 year end.

Things seem to be going alright;

"The Group is performing in line with management expectations for the financial year so far, and ahead of the prior year, despite geo-political headwinds including the UK General Election.

"The immediate outlook is positive, with the key measure of contractor work in progress being comfortably ahead of last year.

Acquisitions - the company is also planning acquisition(s), and it sounds like they're being disciplined about the criteria & purchase price;

A number of acquisitions are being actively considered, each of which would be subject to stringent financial hurdles, and the Board is optimistic of being in a position to announce one or more transactions in the current financial year.

Cost-cutting - the new FD has come up with £1m in cost savings, which will incur £1.25m in exceptional costs. This should be beneficial for profitability.

Move to AIM - had previously been announced. This will be effective from 28 Jul 2017.

My opinion - I quite like companies moving to AIM, if they have honest management. Although regulation is lighter, it attracts investment from growing IHT portfolios. Although there can be a period of indigestion, where funds that are not mandated to hold AIM shares become forced sellers.

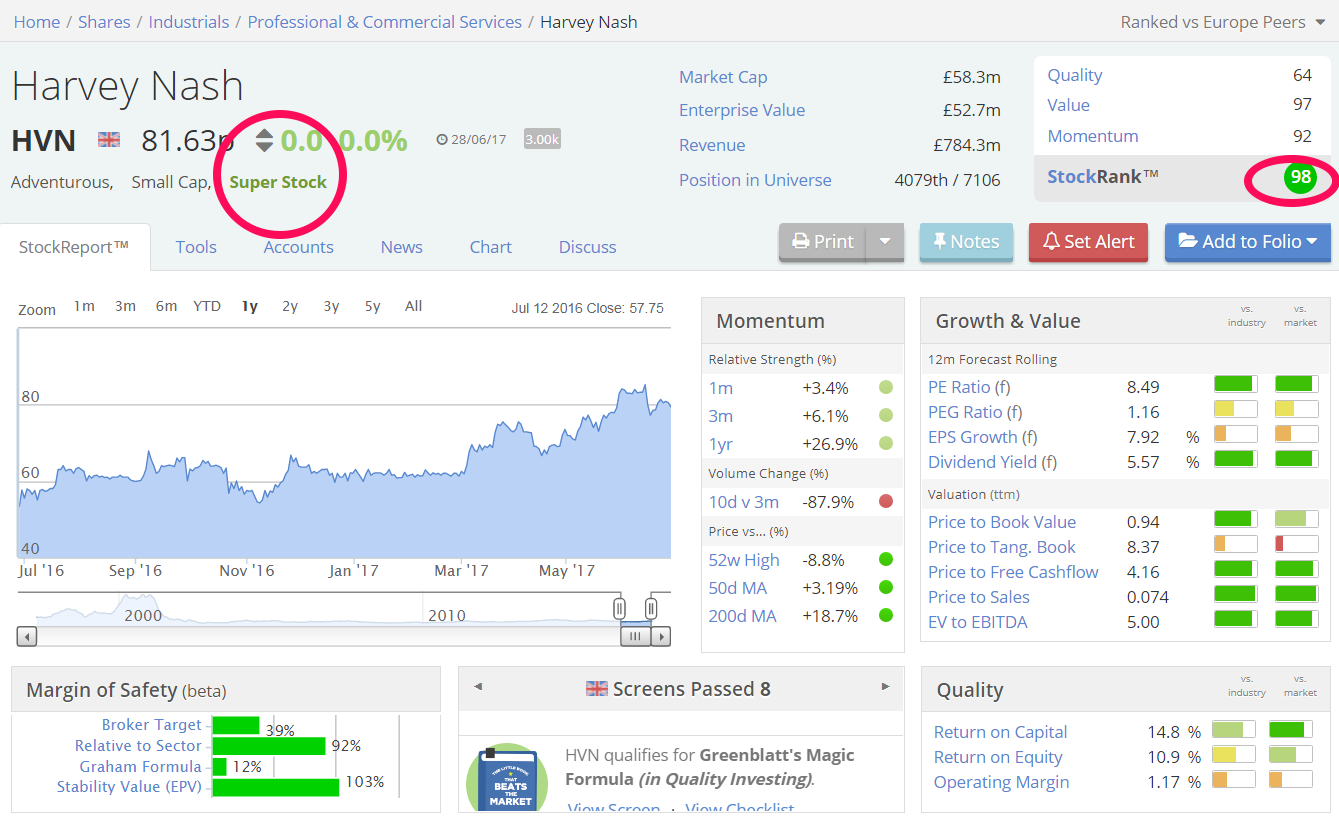

Valuation - this whole sector is cheap (the small caps are anyway). Although even allowing for that, the numbers look attractive for HVN (a sea of green below).

Note also the stand-out StockRank of 98 too, and is rated as a Super Stock, from this excerpt of the Stockopedia StockReport;

Just to reiterate, positive Stockopedia ranks don't guarantee success for individual shares, but are statistically proven to work, for a portfolio of stocks.

My opinion - I like it - HVN seems a decent company, and with bang up-to-date positive trading news today reducing risk, the valuation seems good value. It's a pity the bid:offer spread is so wide.

I might add to my existing long position on a down day.

Utilitywise (LON:UTW)

Share price: 73.5p (down 32.6% today)

No. shares: 78.5m

Market cap: £57.7m

Projected Under Consumption of Energy Contracts (profit warning) - well the accounting wheels have finally come off! I've been warning readers about this company's dodgy accounting for literally years, in these reports.

Utilitywise is a cost consultant for utilities - so it (supposedly) finds the best deals for businesses for their electricity, gas, etc supplies.

The main problem has always been that the company booked revenue & hence profit, a long way in advance of actually being paid their commissions by the energy companies - clearly an imprudent accounting treatment. This gave rise to huge debtors on the balance sheet. The debtors figure on the balance sheet is the total money which has not yet been paid by customers.

Excessive debtors is the single biggest red flag on any balance sheet, in my view. It very often hides all sorts of problems. Excessive debtors often means that the company has been too aggressive in revenue & profit recognition. That has turned out to be the case with Utilitywise. I think all investors should have a point on their checklist, to ensure that debtors are not more than c.60 days sales (inc. VAT). Also look for other, stray debtors, not just trade debtors. Both Globo & Quindell were obviously bad, because they had gigantic & unreasonable debtor balances on their balance sheet.

Today's announcement says that the company over-estimated consumption by some of its customers, and will now have to repay commissions of £7.6m to energy companies. Various excuses are made, and an additional £3.5m charge is also required. So a total hit of £11.2m to the next set of accounts, of which £7.7m is expected to be treated as exceptional.

The company says it can work around this, in terms of cashflow.

It also says this seems to be a one-off relating to one contract.

My opinion - there's a load more detail given in the RNS today, but I wouldn't bother reading it. The company now has zero credibility.

Myself and a few other commentators believed that the accounts were dodgy, and that has now been proven correct. Therefore I would treat this share as a bargepole job. If you can't rely on the accounts, then it's uninvestable.

Does it actually make any real profit at all? Given that so much profit booked in the past has now turned out to be bogus (i.e. based on incorrect assumptions), then I think this share is now impossible to value.

I wouldn't count on the high divis being maintained either - because the company has significant net debt. If you write off intangibles, and a chunk of the debtors, then the balance sheet doesn't look great.

Note also the sheer scale of massive Director sells in this stock in the past.

Anpario (LON:ANP)

Share price: 339.7p (up 3.7% today)

No. shares: 22.9m

Market cap: £77.8m

AGM Statement - this company sells natural animal feed additives. It's a stock that Lord Lee was very keen on, and I assume still is.

Today's update is short & sweet;

"The Company has achieved strong sales growth in the year to date directly attributable to strategic initiatives implemented in 2016 and providing confidence to accelerate the investment in recruitment of sales and technical personnel.

It then goes on to mention that Non-Exec Chairman, Richard Rose, is stepping down after 11 years in the role.

This update is not really satisfactory, as it fails to tell investors how the company is trading against market expectations - which should be mandatory for all updates, in my view.

Broker consensus seems to be for just under 10% sales growth this year. So the paragraph above sounds consistent with (or maybe even better than) that. Therefore, I think we can safely assume that the company is probably trading in line, or a bit above maybe?

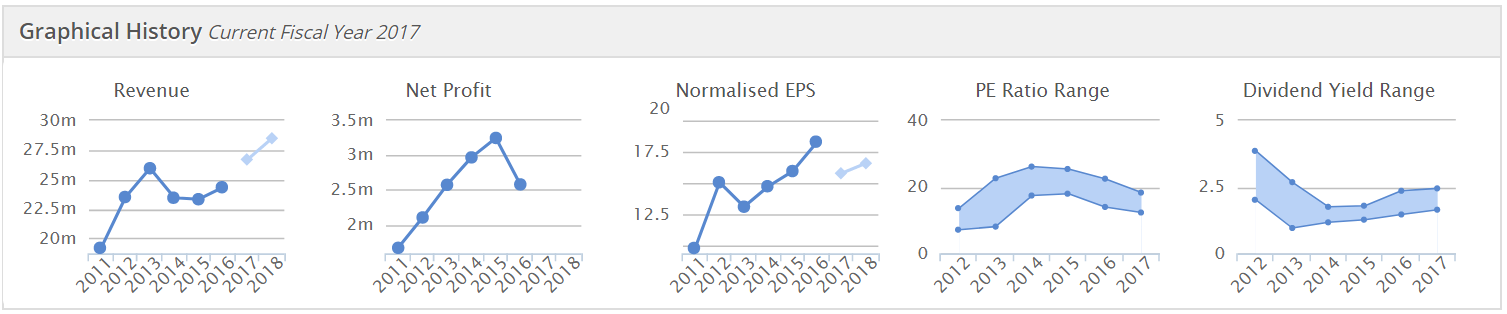

Valuation - as you can see from the Stockopedia graphs below, Anpario has been awarded quite a high PER by the market. However, I question whether its growth in revenues and earnings has been sufficient to justify such a high PER?

Normalised EPS hasn't really gone anywhere much in the last 6 years.

The forward PER of just over 20 seems high, for negligible earnings growth since 2012. Perhaps there are better things to come? There will need to be, to retain this level of valuation.

Dividends are nothing to write home about, with a yield of just under 2%.

Balance sheet - very strong, with plenty of cash.

My opinion - I don't know anything about its markets or products, so perhaps the share is more exciting than the figures to date suggest? It sounds as if some of the upside from increased sales is likely to be ploughed back into increasing overheads, in order to drive further sales.

I think for a PER of 20 or more, I'd want to home in on companies which are demonstrating more explosive growth potential.

A few quickies to finish off with.

Wincanton (LON:WIN)

A very mild profit warning today, which has knocked the share price by 7.7% to 270p, at the time of writing;

In the period since the year end, we have seen year over year growth in revenue primarily driven by organic growth in the Retail & Consumer sector.

The Group has experienced weaker than expected performance in some of its transport-related contracts and activities and these have created some trading profit headwinds in the first quarter. These are expected to be largely mitigated by continued operational efficiencies across the business during the remainder of the year.

Taking into account further reductions in the Group's net finance charges, the Board anticipates that profit before tax for the full year will be broadly in line with expectations.

Not a disaster by any means.

My opinion - this seems a good business, but not one I would buy, because the balance sheet fails my testing. Although the share price has shown that, when a business is performing well, then balance sheet concerns don't seem to bother the market.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.