Morning folks,

Before getting into some updates, I thought I'd point out there was a really high-quality discussion in the thread for Friday's report, with a lot of comments on Game Digital (LON:GMD).

I'd particularly point out comments by Paul (who has a long position) and bestace.

I'm planning to update c. four stories by lunchtime.

Cheers

Graham

Plastics Capital (LON:PLA)

- Share price: 115.5p (-3.3%)

- No of shares: 38.9 million

- Market Cap: £45 million

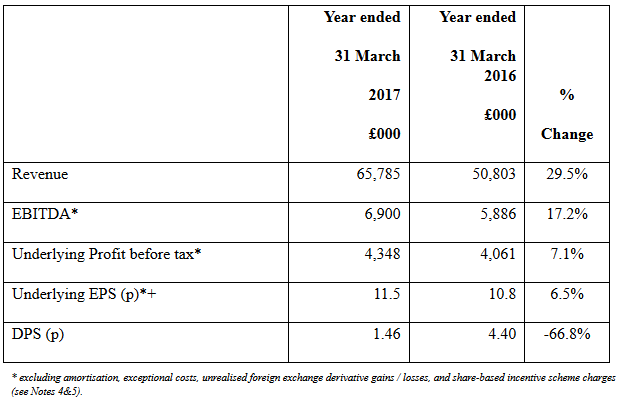

Results for the year ended in March from this niche plastics manufacturer.

Plastics raised net £3.5 million at 117p recently, and suspended its dividends.

Paul and I have mostly been sceptical about this share, so perhaps I shouldn't dwell on it. Briefly:

As you can see, underlying EPS is growing at a much slower rate than EBITDA and revenue, and that underlying measure involves quite a few adjustments.

The "like-for-like organic growth" reported by the company is 6.7%, about the same as underlying EPS growth.

It's a big exporter (45% of sales) and is set to benefit from the expiry of currency hedges.

Subsidiaries are classified by two divisions: Industrial and Films (plastic films!).

Of these, Industrial has produced the far more interesting growth rates this year: 27% organic revenue growth across the entire division, or 16.5% at constant currencies. Meanwhile, Films was up less than 2%.

Capital allocation for the year is summarised as follows:

In total, therefore we have spent approximately £6.7 million in these investment areas [GN note: capex, acquisitions and integration] compared to the £4 million estimated 12 months ago. We also spent £0.4 million to restructure and relocate of Chinese operations. Finally we paid £1.1 million out in dividends. All of this amounts to a total of £8.2 million and was funded by free cash flow of £3.7 million and an increase in net debt of £4.5 million.

I don't like being a perma-bear but I just can't get interested in a company which has the specific goal of doubling EBITDA (this goal being linked to management share options).

Targeting EBITDA usually means balance sheet expansion, rather than high-quality organic growth. Plastics has both raised new equity and increased its borrowings, which is perfectly consistent with this thesis.

Debt is now £16 million, while statutory profit for the year was £2.7 million if you add back the FX impact on derivatives and loans (otherwise just £0.5 million).

Outlook

"Trading for FY2018 started marginally below expectations but it is too early in the financial year to read much into this. We remain focussed on implementing the key initiatives outlined above as this will drive the long term growth of the Group and on improving day-to-day operational performance. The momentum of the Group as we finished FY2017 was strong and, if sustained, will deliver a strong performance in FY2018."

My opinion

I think it deserves a really cheap rating, probably cheaper than the current level.

Quartix Holdings (LON:QTX)

- Share price: 385p (unch.)

- No. of shares: 47.6 million

- Market cap: £183 million

A friend has flagged this to me, so it's my first time looking at this telematics business.

It has a business vehicle tracking system which helps management keep track of vehicle locations, mileage, driving times, driving styles, etc, along with a general fleet management service.

It has clients across the building & construction sectors, support services, transportation, security, distribution, etc. Pretty much what you'd expect.

2016 results, covered by Paul here in February, showed revenue up 19%.

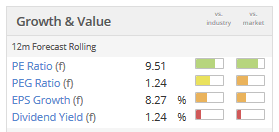

It's distinguished by very high operating margins and returns on capital, and the PE ratio is about 30x:

Today's statement sounds good to me, with some terrific growth rates:

"We have made good progress in all fleet markets. New installations of tracking systems grew by 44% to 14,300 vehicles and we ended the period with more than 10,000 fleet customers and over 97,000 active vehicle subscriptions. New UK installations grew by 44% to 10,450, increasing the subscription base to 78,000 vehicles; in France they rose by 30% to 1760 vehicles, reaching a closing base of over 11,400; and in the USA they increased by 60% to 2,090, lifting the base to 7,700 vehicles."

There is also an insurance side to the business providing data for car insurers, but management have apparently been scaling it back so as only to maintain that business when it offers attractive margins and returns - that's what I like to hear!

Most management teams prefer growth for the sake of growth, even if it's a poor use of capital.

What you really want is management with the discipline to shrink when something isn't working out properly. It sounds like Quartix has that.

This seems worth a closer look.

Fairpoint (LON:FRP)

- Share price: 10p (unch.)

- No. of shares: 48.3 million

- Market Cap: £5 million

Bank Debt and Funding Facility Update

This is below our £10 million market cap limit and the shares have been suspended but I thought I would mention it as a footnote to previous coverage.

The Company has today been notified by AIB Group (UK) plc ("AIB") that AIB has assigned its debt due from Fairpoint to Doorway Capital Limited ("Doorway").

Doorway is also going to lend money to Simpson Millar, the legal services division of Fairpoint.

It's hard to imagine that the existing equity is worth anything at all in these circumstances. I suppose you don't know for sure until the fat lady has sung. There's not a lot of public information at the moment.

But we do know that the annual report for 2016 couldn't be signed off due to the lack of support from AIB, and that bank debt was in the ballpark £20 million. So it looks like a 100% loss to me.

Trakm8 Holdings (LON:TRAK)

- Share price: 98p (-8%)

- No. of shares: 35.7 million

- Market cap: £35 million

This is another telematics business, often covered by Paul.

It has been a roller-coaster for investors over the past few years, and not a terribly happy one as the share price peaked over 400p in December 2015 before sliding back toward current levels.

In March of this year, it raised £2 million to reduce debt levels, with a placing at 65p. So participants in that placing have been doing ok so far.

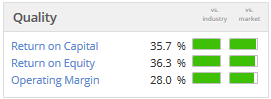

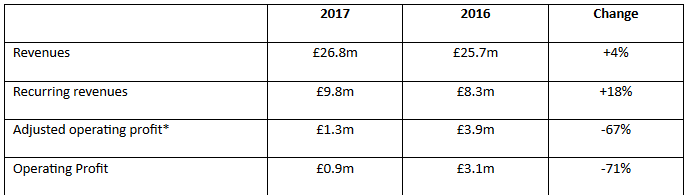

Today's results are obviously quite mixed:

The adjustments to operating profit are "exceptional costs and share based payments", so to be prudent I would ignore these adjustments and use the £0.9 million operating profit figure.

Dividend: Suspended, which makes sense given that it recently raised money from investors. No point in raising money and then immediately giving it back.

New orders booked up 37%, with like-for-like growth of 33%. I'm not sure what to make of this, but with "renewed contract momentum", it sounds like it's picking up steam again?

The outlook statements are certainly promising a big improvement. Revenues for the first two months of this year are 10% higher than last year, and the Executive Chairman comments as follows:

We have recently announced new contracts with a roadside assistance technology company, and Mecalac, and renewed and extended contracts with Marmalade, Iceland Foods, Shell and Direct Line Group. These important contracts together with our strong pipeline of further opportunities provide additional visibility in our outlook for this year.

"Overall, we anticipate reaping the rewards of our investments as evidenced by our renewed contract momentum. As a result we are confident of achieving a much improved performance in the new financial year consistent with market expectations."

Operating costs have been reduced by £1.5 million.

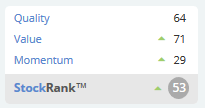

My opinion: The StockRanks are giving this a middling rating, and that's the best I can do, too.

Long-term, how will telematics companies maintain their competitive advantage?

Quartix and Trakm8 appear to offer similar fleet management and business vehicle tracking services. While I'm impressed by the financial returns achieved by Quartix, which reflect well on management, I think I need a bit more info on the specific product offerings and insight on how this industry might evolve over the next few years.

It's the classic problem with tech: what seems like an impressive piece of technology today might not seem very impressive in a few years. So which telematics products are still going to have pricing power in 3-5 years? Any informed predictions would be highly appreciated!

I'm not seeing a lot of other news today but I might add more later in case I've missed something worth commenting on - suggestions are very welcome!

Best regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.