Good morning! Graham here.

Edit 1: Change of plan, as Paul is also writing a Part 2 report at this link!

Edit 2: This is the finalised list of stocks covered here in this report:

- Learning Technologies (LON:LTG)

- Empresaria (LON:EMR)

- Midwich (LON:MIDW)

- Koovs (LON:KOOV)

- Paysafe (LON:PAYS)

Cheers!

Graham

Learning Technologies (LON:LTG)

- Share price: 48.9p (+8%)

- No. of shares: 568.4 million

- Market cap: £278 million

A detailed trading update from this e-learning business, growing via acquisition.

It's an update for the half-year ending June 2017.

The Board is pleased to report that LTG has made excellent progress over the period delivering on its strategic ambition of building an international business with annualised revenues in excess of £50 million and strong operating margins. The Board expects the Group to achieve record revenues of not less than £20.8 million for the first half compared to £12.8 million in the first half of 2016, an increase of 62.5%.

That's interesting - the strategic plan is to shoot for a specific revenue target? I generally prefer to see objectives stated in terms of returns on capital, and I'd wonder about how the £50 million target was specifically chosen. I suppose the combo objective of revenue and strong margins is not a terrible substitute in theory (depends how strong the margins are).

The release includes a long paragraph about progress with the NetDimensions Holdings (LON:NETD) acquisition, which is going according to plan.

We also read there is strong organic growth in the group's other businesses and the period-end order book is at record levels.

Overall, it's a difficult picture to understand as there are a lot of different parts to it, as you'd expect with a company growing by acquisition.

The shares have risen so presumably the numbers are better than expected, but the update didn't actually confirm whether or not overall performance was in line with management or analyst expectations.

My opinion: I'm going to sound like a broken clock, and those of you who are long will not appreciate me saying it, but acquisitive growth strategies turn me off.

I wish LTG every success. It's simply too complicated and difficult for me, without devoting a very considerable amount of time to it.

There is a lot of contract-driven work, and net debt including defcon is now £10 million. The StockRank is also just 14 and it qualifies for James Montier's "Unholy Trinity" short-selling screen. I'm not feeling motivated to look into it any further!

Empresaria (LON:EMR)

- Share price: 154.5p (+5.5%)

- No. of shares: 49 million

- Market cap: £76 million

I've covered this UK & Int'l recruiter twice so far this year, when the share price was at 122p (January) and 148p (March), and written favourably about it both times, so I should have listened to myself and thought about buying a few!

It's a solid mid-size recruiter and tends to be rated (by PER) about half-way between the tiddlers and the giant recruitment companies.

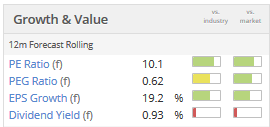

That's still the case today, the PER about 10x:

This trading update reads well but the share price arguably should have stayed where it was (if markets were efficient!), since performance is merely in line with expectations:

Empresaria has delivered a record first half performance, with net fee income up approximately 26% on the comparable H1 2016 period, with the strongest trading in the UK, Continental Europe and Asia Pacific regions. As such, the Board confirms that the Group remains on course to meet market expectations for the full year.

This is another business which is has allowed debt to increase (about £10 million at the annual results) as it has made investments into other, pre-existing recruitment businesses.

Again there is some personal bias at work here, but the recruitment industry in my opinion is somewhat predictable - yes, it rises and falls with the economy, but a well-run recruiter should continue to make money in good times and bad. Under-achieving consultants can be let go, and there is rarely a reliance on a single large customer.

So I'm a lot more comfortable taking risk in this industry, and wouldn't mind owning some Empresaria (LON:EMR), even after the share price rise this year.

Koovs (LON:KOOV)

- Share price: 39.75p (+4.3%)

- No. of shares: 175.4 million

- Market cap: £70 million

This Indian online fashion retailer is raising more funds.

Paul has covered this at some length before, writing about how it's inability to generate self-funding growth led to serious dilution for investors.

The share count was only about 24 million back in 2013.

This update is a significant capital raise. The plan is for £19 million in convertible loan notes, to be "primarily" used for more marketing of the brand.

The loans will fall due in two years and are convertible at a share price of 40p. Interest rate is LIBOR + 6%, which I guess is high yield in current conditions. They can be converted to shares at any time.

For existing shareholders, worst case scenario is that the loans can't be refinanced or repaid in two years. Best case scenario is that the company performs well and the loans are converted to shares at 40p.

By my reckoning, that would be an extra 47 million shares. So the loan note holders could own more than 20% of the company.

Koovs highlights that it is now making positive gross margins but since that is the most basic test of whether a company such as this might have a decent business model, I'm afraid I wouldn't be getting excited yet!

Midwich (LON:MIDW)

- Share price: 388.5p (+19%)

- No. of shares: 79 million

- Market cap: £308 million

This is a distributor in products for the audio-visual and documents markets - TVs, cameras, printers, projectors, etc. The very impressive list of brands it works with can be viewed here (new tab).

Results for the full year are anticipated to be comfortably ahead of prior expectations, thanks a very strong first half to June and continued H2 momentum so far.

The Group has traded well in the first half, seeing good top line growth across all of its geographies on a constant currency basis helped further by the continued weakness of Sterling. This underlying revenue growth has been delivered whilst maintaining overall gross margins in line with those reported for 2016.

So it's not just a fluke based on Sterling weakness, the underlying growth is good too.

And the Sterling weakness is just a bonus (perhaps a temporary one) on top.

I wrote positively about Midwich the one other time I've covered it. It's still fairly new to the market, having listed in May 2016.

But it seems to be worth of increased investor trust as it builds its dividend track record and a history of meeting and exceeding forecasts.

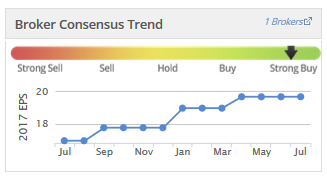

See how the earnings forecasts for 2017 have improved over the past year:

The PE ratio is not too bad, at 16x, for a company that is growing and has successfully executed a £20 million acquisition.

So it's one to watch, I think.

Paysafe (LON:PAYS)

- Share price: 579p (+7%)

- No. of shares: 485 million

- Market cap: 2,800 million

Statement regarding possible offer

Acquisition of Merchants Choice Payment Solutions

By request, I'm covering this big-cap payments processor.

It lived on AIM until moving to the main market in 2015.

Today brings a double barrel of announcements including this possible offer from private equity funds Blackstone and CVC:

Under the terms of the Possible Offer, the ordinary shareholders of Paysafe would receive 590 pence in cash per ordinary share in Paysafe. The terms of the Possible Offer represent a premium of approximately 34% to the volume weighted average price for the six month period ended 30 June 2017, the day prior to broad sector consolidation speculation.

There is no objective answer to what a "fair" premium is. From my point of view, it's ok to use the period before merger speculation begins.

But why not also use the endpoint of that period? On 30 June, the share price looks around 511p to me. The offer is only a 15% premium to that level.

Old Mutual are happy to accept the offer and have 10% of shares.

It must be emphasised that the offer is still not yet firm. According to stock market rules, it must be firmed up by 18 August or else the bidders must pull out.

Separately, Paysafe has announced it is paying $470 million for a Texas-based payments processor. Most of the funding is from its debt facility.

The target is already heavily linked to one of Paysafe's subsidiaries, so there will be a lot of inter-company transactions to be consolidated in the new accounts.

My opinion

On the offer, I would have thought that a 20%+ premium to the end-June SP was more appropriate. With Old Mutual signalling support for it, I don't know if the other investors will have the clout to get it raised.

On the Texas acquisition, I wonder whether it's in line with the strategy which the bidders would favour? I presume it must be, as the Paysafe team seem to be receptive to getting an offer.

The rating on the acquisition is 24x pre-tax income, as you'd expect in current conditions.

I'd be slowly and carefully cashing in my chips if I was involved here.

That's all for today.

Don't forget to read Paul's report too and have a good weekend!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.