Good afternoon.

Yet again, I'm running late, but have the rest of the day free now, to catch up with what's going on in the small caps space. So please update this article later for more sections.

Revolution Bars (LON:RBG)

(at the time of writing, I hold a long position in this share)

Have you sold your shares in the market (after the recent big rise), or are you holding out for the mooted 200p cash bid? Or possibly even a higher competing offer? I'm interested to hear what readers have done. I was tempted to bank some profit, but the share price settling around 175p was leaving far too much on the table for someone else. So I've not sold any to date. I think 190p+ might tempt me into banking some profit though.

The nice thing about RBG is that I think it's still good value at 200p. So it's an easy hold for me. If the bid does fall through (unlikely, in my view), then I reckon the share price would probably fall back to say 150p. The potential bid from Stonegate has flagged up that this share is undervalued. So even if the bid falls through, there's likely to be more stock market interest in the company, I reckon. Anyway, we'll see.

Note that the latest LFL sales (up 2.7% in the last 6 weeks) were improved. Plus the company recently confirmed results would be in line with market expectations. New sites are performing well. Also I recently saw a broker note which upped its forecasts. So it seems that the severe reaction to the profit warning in May 2017 was very much overdone. That created a fairly obvious buying opportunity.

Although I can also understand why many people feared that another profit warning might come. Bid interest on top of a recent positive trading update, makes me much more comfortable to hold this share. As with lots of undervalued stocks, it was a difficult hold at the time when the value was greatest, paradoxically.

Johnston Press (LON:JPR)

Share price: 10.9p (unchanged)

No. shares: 105.9m

Market cap: £11.5m

Interim results - for the 26 weeks to 1 Jul 2017.

This is such a fascinating special situation. It's still a substantial business - operating many local newspapers, plus the "i" national newspaper. It's still remarkably profitable - revenues of £102.9m in H1 generated £16.2m in adjusted operating profit (down from £19.4m in H1 last year).

Yet the market cap is peanuts. The reason being, that equity ranks behind debt, and in this case the company is drowning in debt. The main problem is the £220m of outstanding senior secured notes, which carry a high rate of interest, at 8.625%. They are repayable on 1 Jun 2019, so the clock is ticking.

Net debt is £191.2m. However, this reduces substantially to £118.6m if the bonds are marked to market - ie. re-priced at the current market price, since the bonds are tradeable. So clearly there is an opportunity for the company to refinance, and buy back the bonds at a big discount to market value. How likely that is to happen, who knows?

The temptation for bondholders must surely be to tough it out, continue collecting in the bumper interest payments, then end up owning the company once it defaults on the repayment date. I can't really see why the bondholders would want to compromise, since they'll end up probably owning 100% of the company, once they've killed off equity holders in 2019. That's the worst case scenario for shareholders - that the shares end up going to zero.

Restructuring specialist, Crystal Amber Fund, owns 21.36% of the equity. I hoped that they might engineer a restructuring, with bondholders possibly taking a big haircut (which is what would be needed to make the equity worth anything). However, nothing seemed to be happening, so personally I ditched my speculative, smallish position in the equity some time ago. I'm not tempted to buy back in. An article in the Telegraph scared me off, saying that aggressive US hedge funds were buying up the bonds. So the likelihood seems to be that they would crush equity holders, rather than take a haircut. It's usually the debt holders that win, in financially distressed situations like this.

Crystal Amber publicly commented that it seems strange than JPR is still using the same advisers now, that created the terrible existing capital structure in the first place. A fair point, I agree.

The company today repeats its "Viability Statement" that was included in the Annual Report, dated 29 Mar 2017. It highlights the biggest issue facing this company;

The repayment of the £220 million of high yield Bonds on 1 June 2019 falls within the three year period of this viability review. The Directors anticipate that the Group will remain in a position to meet its obligations in respect of the Bonds, including with regard to the payment of interest, in the period to their maturity.

However, in light of the challenges faced by the industry as a whole, the current trading experience of the Group, and the likely financial position of the Group at the time the Bonds are due for repayment in June 2019 there is uncertainty surrounding the Group's ability to refinance the Bonds at par in the debt markets on commercially acceptable terms.

Failure to repay, refinance, satisfy or otherwise retire the bonds at their maturity would give rise to a default under the indenture governing the Bonds dated 16 May 2014 and could have a material impact on the Group's operations and its ability to continue as a going concern.

As a result, the Directors, along with the Group's advisors, are currently exploring the strategic options available to the Group in the event that a refinancing of the Bonds in the debt markets prior to June 2019 is not possible.

Glimmers of hope are that the i paper is doing surprisingly well. Its 12 week comparable revenues are up 28.6% year-on-year. Also, digital advertising is showing decent growth (up 14.8% to £10.0m in H1), and faster growth at +25% y-on-y in Jun & Jul 2017. Could the company morph into a successful digital advertising company eventually? It's possible, who knows?

Pension deficit - this has fallen £14.6m in the last 6 months, to £53.1m. Cash contributions are high, at £5.1m in H1. So this is a continued drain on cash. Together with the heavy interest cost of the bonds, this means that the strong cashflow generated by the group is not available to reduce net debt. That was only achieved through disposals of 13 titles in the Midlands, for £17m.

Maybe the pension deficit could reduce further, or disappear altogether, if interest rates do eventually rise?

My opinion - this share is binary, in my view. There's a good chance that the equity will be worth nothing by Jun 2019, if the company fails to refinance. However, if a good restructuring is done before then, there's a chance that the equity could multibag. It did spike up to about 30p a few months ago, when Crystal Amber got involved, but that burst of enthusiasm has since dissipated.

Overall, I think it's way too risky for me to consider going back in. The clock is ticking, and I don't see that the bondholders have anything to worry about - they're still getting paid huge interest payments, and if/when the company defaults, they end up owning the company. So equity holders seem very much on the back foot, and could easily end up being wiped out altogether. Therefore, it's not of any interest to me, unless some sort of game-changing restructuring news comes out. So I'll keep it on my watch list, just in case.

Be Heard (LON:BHRD)

Share price: 3p (up 1.7% today)

No. shares: 813.0m

Market cap: £24.4m

Strong revenue growth in first half - quite a clever move from this digital marketing group, to actually put their good news in the title of the RNS. It caught my eye, and made me read the RNS. Whereas a more traditional "Trading update" entitled RNS probably would had flown under my radar.

Revenues are up strongly;

Net revenue growth of over 155 per cent to £8.4million (2016: £3.3 million)

The trouble is, that growth is driven by acquisitions.

Positive organic growth is mentioned at two group companies;

Very strong organic growth at agenda21 and MMT Digital ('MMT'), including a high volume of new business wins

Another group company, Kameleon, has suffered from a slowdown in Government work.

The RNS also mentions costs increasing, to cope with the greater volume of work.

All in all, I find this statement very unsatisfactory, as there is not enough clear information in it. Just lots of waffling text, trying to paint a positive picture, which is often what you get from PR/marketing companies reporting their own (and others!) results.

The only indication of where profitability is going (which is the only thing that matters) is this bit;

The Board remains confident in the Group's outlook for the full year.

That sounds like an in line with expectations comment.

There's a broker note today from N+1 Singer, which is available on Research Tree. Their analyst sounds pretty enthusiastic about the company, pointing out cross-selling between its constituent agencies is going well.

Consensus is for adj. profit of £2.3m this year. Looking back at last year's accounts, there were lots of unusual costs (e.g. relating to acquisitions, share based payments, etc). However, before all those costs, it made an adjusted profit of £810k. So it's a real business, and profitable. I'm starting to get interested.

Balance sheet - this is where my interest comes to a shuddering halt. My strict balance sheet testing is the biggest single factor which helps me avoid major losses, most of the time anyway. It amazes me how many investors ignore the balance sheet altogether. That seems crazy, since it's the statement which tells you about a company's financial health.

In this case, the balance sheet looks grim to me. I'm working on the last reported balance sheet, as at 31 Dec 2016. The only subsequent events seem to have been a £3m bank facility added, and a small placing for an acquisition. So the main numbers on the Dec 2016 balance sheet should still be valid.

Net assets are £18.2m. However, that includes £40.3m in intangibles. So NTAV is horribly negative, at £-22.1m. For a small group, that's a big hole in the balance sheet.

The main offending item is £20.2m "provision for liabilities" shown within creditors over 1 year. I'm not sure what that figure relates to (possibly deferred consideration on acquisitions?), but I don't really care. The company hasn't got £20.2m in cash, so how is it going to settle those liabiilties? Will it have to do dilutive equity fundraisings to get the cash together? Or possibly these liabilities can be settled with shares - which would also be dilutive.

My opinion - a promising-looking company, but the awful balance sheet is a deal-breaker for me.

Breaking news:

Entu (UK) (LON:ENTU)

It's almost game over - this share now looks effectively worthless;

Following receipt of several approaches, the Group is proceeding, with the support of its existing lenders, with a small number of interested parties in relation to a potential refinancing of the Group. If one of the currently preferred proposals is successful, the Board expects the Group to see a further increase in its level of indebtedness as creditors are brought back into line with normal payment terms. The Board notes that all of the proposals received attribute little value to the equity in the Company. There is no certainty that any of these proposals, or any alternatives, will be ultimately successful.

Checking back through the archive, I turned negative on this stock about a year ago, when it was 39.5p per share. Since then, I've written 4 more articles about it, all extremely negative. Indeed I described it as a "dead duck" in Feb 2017. So I very much hope readers took on board those warnings, and didn't get caught out on this one.

This post from 6 Jul 2017 contained some useful lessons to be learned from the fiasco that Entu has been. So that's worth revisiting.

Walker Greenbank (LON:WGB)

Share price: 236.5p (down 0.6% today)

No. shares: 72.0m

Market cap: £170.3m

Half year trading update - this is a luxury wallpaper & interior furnishings group. I flagged up that the share looked quite good value here in Jun 2017, and it's risen about 20% since then. Unfortunately, despite my finger hovering over the buy button, I didn't push it, so missed out on a nice profit there.

Today's update is OK, the key part saying;

The Board continues to expect to meet its full year expectations.

Licensing revenues are doing well.

Brand sales (the bulk of revenues) are only up 0.5% in constant currency on a LFL basis, but benefit from currency gains, so +3.6% in sterling.

Overall brand sales are up 35.6%, due to a major acquisition, of Clarke & Clarke.

My opinion - this is a good company in my opinion. The 20% rise in share price in the last couple of months looks fully justified. Today's update is OK, but not madly inspiring. Accordingly, the share looks to be priced about right now, in my opinion.

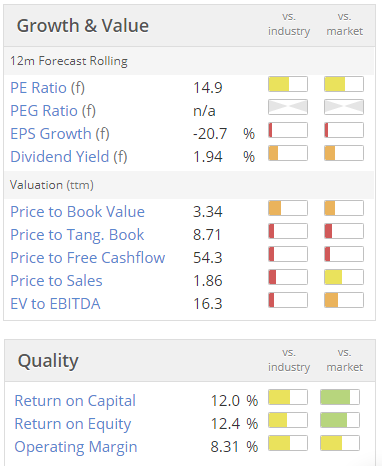

Here are the latest Stockopedia valuation & growth graphics. As you can see, the colour-coding is indicating that the shares are not especially good value now;

Right, that's me done for today. As usual, apologies for the erratic timing. I usually get there in the end!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.