Good Evening, it's Paul here.

Sorry my report is late today.

Provident Financial (LON:PFG)

Share price: 589.5p (down 66.2% today)

No. shares: 148.2m

Market cap: £873.6m

Trading statement - this is such an interesting announcement that I feel obliged to mention it. This company is a UK sub-prime consumer lender. Its divisions include Vanquis Bank, the Consumer Credit Division (comprising Provident and Satsuma), and Moneybarn.

Looking back to its 2016 results, the group made an adjusted profit of £334.1m, and paid 134.6p in dividends to shareholders. The share price was riding high, at about 3000p in late 2016. Compare that with today, at just 589.5p - that's a share price fall of about 80% this year.

Its interesting how, when a share really collapses, there are often clear warning signs in previous announcements. That seems the case here. The most recent interim results were poor. They also contained worrying comments about several FCA reviews affecting the company. Also, disruption was reported from a change in the business model at the CCD - moving from self-employed, to employed operational staff. This was supposed to be a compelling change in business model.

EDIT - a couple of brokers have flagged up that competitors are saying that large numbers of the best sales agents are jumping ship from PFG, to join competitors such as Morses, and NSF. This sounds ominous to me, and could mean that profits may not necessarily recover at PFG.

Today's announcement has to be one of the worst profit warnings I've seen. The wheels seem to have completely come off at the CCD. This bit from today's announcement sounds awful;

The rate of progress being made is too weak and the business is now falling a long way short of achieving these objectives. Collections performance and sales are both showing substantial underperformance against the comparable period in 2016.

The routing and scheduling software deployed to direct the daily activities of CEMs has presented some early issues, primarily relating to the integrity of data, and the prescriptive nature of the new operating model has not allowed sufficient local autonomy to prioritise resource allocation during this period of recovery.

Things don't get a lot worse than that. It sounds as if the new business model has been an unmitigated disaster. Unsurprisingly, the CEO has now gone.

As a result of these problems, debtor collections have fallen a long way short;

Collections performance is currently running at 57% versus 90% in 2016 and sales at some £9m per week lower than the comparative weeks in 2016.

The extent of this underperformance and the elongated period of time required to return the performance of the business to acceptable levels invalidates previous guidance. The pre-exceptional loss of the business is now likely to be in a range of between £80m and £120m.

It looks as if the customers are possibly taking advantage of the lender being in a shambles, to decline to repay their borrowings? This raises a big question mark over whether bad debt provisions are adequate? That's the inherent weakness with sub-prime lenders. They can report big profits for a while, then often it becomes clear that many debts have gone bad, and won't ever be collected. So a huge write-off then has to be done. That's the main reason why I would never invest in any sub-prime lender.

Divisional profits - to get my head round the numbers, I've looked back at the 2016 results, and this shows the group's profitability as follows;

Vanquis Bank £204.5m

CCD £115.2m

Moneybarn £31.1m

Central costs -£16.7m

As you can see, Vanquis was the biggest profit earner within the group. Interestingly, today's statement says that Vanquis is still trading alright;

The trading performance of Vanquis Bank, Moneybarn and Satsuma remain in line with internal plans.

Therefore I'm wondering if the problems are confined to the CCD part of the business, there could possibly be a value opportunity here?

FCA investigation into ROP - this is the product from Vanquis Bank called Repayment Option Plan. New sales of this were suspended in Apr 2016. However, Vanquis is currently generating £70m in revenues from this product, which seems to have been sold between 1 April 2014 to 19 April 2016.

EDIT - one broker suggests that the ROP product generates 20-25% of Vanquis's profits, this issue is of considerable significance.

It's not clear what the outcome of this investigation will be. However, it sounds like there could be a risk of some kind of customer compensation liabilities, if the FCA decides that the product was flawed.

Dividends - are off the table for the time being;

In view of the substantial deterioration in the trading performance of the home credit business, together with the uncertainty created by the FCA's investigation at Vanquis Bank, the Board has determined that the group must protect its capital base and financial flexibility by withdrawing the interim dividend declared on 25 July 2017 and indicate that a full-year dividend is unlikely.

Sounds sensible, in the circumstances.

Will it go bust? That's the key question. I've looked back to the latest balance sheet, and it's actually not bad. You would expect this type of business to be groaning with bank debt. Its business model is to borrow cheaply, on a large scale, then lend very expensively, on a small scale, to people who are desperate, hence can be ripped off. The high customer default rate should in theory be more than covered by the huge profits made from customers who do repay their borrowings.

In an economic downturn, customers often default en masse, and this type of business therefore often goes bust in a recession. We're not actually in a recession, although there's little doubt that household incomes are feeling the pinch somewhat right now.

Interestingly, PFG had (relative to its receivables book) fairly low bank debt - a £450m syndicated bank facility. It seems to be mainly financed through taking retail deposits into Vanquis Bank - which was a larger figure of £941.2m at end Dec 2016. So Vanquis Bank looks a fairly ordinary savings & loans type of bank.

Therefore, to my mind, the main risk to this group is if depositors are scared off, and withdraw their deposits. As we saw with Northern Rock, once such a bank run starts, it can't usually be stopped without a Government bailout. PFG looks much too small for a bailout (if needed), so who knows?

EDIT - this risk may not be as bad as I feared. Apparently Vanquis takes term deposits (e.g. 1 -5 years). So that should limit the damage from depositors withdrawing funds. I think the key question is whether depositors can withdraw funds before the term has expired. Often that is possible, but carries an interest penalty. Therefore I think the ability of depositors to withdraw funds is an absolutely key question mark here.

My opinion - this is one I'll be watching from now on. What interests me, is that the key value in the share seems to be Vanquis Bank. That doesn't seem to be affected by the problems in the CCD part of the business. Although if the FCA review goes badly, then more, potentially serious bad news could be on the way.

I loathe this type of business. The way I see it, they prey on financially weak people, by offering loans to people who really shouldn't be borrowing at all - because they are poor. I have friends who have (stupidly) borrowed from Vanquis, and I ended up bailing them out, because the high interest charges compounded so rapidly, that my friends soon ended up being overwhelmed by what was initially only a small debt.

So personally I have zero sympathy for shareholders here. As far as I am concerned, the losses that PFG shareholders have suffered here are a well-deserved punishment for trying to enrich themselves at the expense of the poorest people in society. I know some readers disagree with me on this, as we've discussed it here in previous reports.

There are some good lessons from this situation;

1) Selling on the first profit warning is usually the best course of action, when it looks as if something serious, and structural is going wrong. Looking back, there were clear signs in Jun 2017 that something was going badly wrong at PFG, with the reorganisation of the CCD.

2) Management were clearly foolish to tamper with a previously highly profitable business model. So I'll certainly be wary in future, of any company where a big change in business model is being implemented. Do management have the skills to control, and change a business? Clearly in this case, no they didn't.

3) Regulatory risks - the FCA seem to be looking much more closely at businesses like this, which essentially rip-off the poorest consumers. So to my mind, sensible investors really should avoid any business which is over-charging the poorest part of society. The regulatory risks could blow up at any time. Who knows where & when the next mis-selling scandal will blow up?

4) Big dividend yields are often a signal from the market that something is going wrong - and those big divis may not be sustainable. So I would look very carefully indeed at any share where the divi yield is above say 6% - that seems to be roughly the cut-off point where we have to tread much more carefully. Stockopedia is showing an 8.16% forecast dividend yield as of last night, just before the profit warning. Such a figure is well into danger territory.

Overall though, I think this share is probably too risky to have a punt on now, without doing a lot more research. Although I think the value in Vanquis could now be more than the entire group market cap, maybe? That depends on how much profit is derived from the ROP product, which is not disclosed in today's announcement.

Also, would I really want to hold shares in an exploitative business like this? No.

I see that Woodford funds own 19.9% of PFG. Another disaster for them. I do wonder how much real due diligence they're doing? If it's just a scatter-gun approach, with little original research, then investors can do that themselves, without needing a fund manager.

EDIT - my thanks to Clouds, who kindly flagged up Neil Woodford's blog, with his response to the PFG profit warning. He reckons it's ridiculously cheap now, and should recover. Hmmm... we all say that, don't we. Interesting to see that a top fund manager is suffering from the same behavioural biases that novice private investors are often criticised for - averaging down on losing positions.

The trouble is, big funds with big positions, often can't sell, even if they want to. Plus, the moment an RNS comes out, showing a big fund manager selling, then confidence in the share slips further.

It will be interesting to see whether Woodford recoups his client funds on this one, or not. It will also be interesting to see how long his blog will continue to allow comments, given how critical a lot of them are (understandably)!

Sphere Medical Holding (LON:SPHR)

Share price: 1.13p (down 81.3% today)

No. shares: 141.8m

Market cap: £1.6m

Proposed investment & cancellation - a complete disaster for shareholders here today, with the share price down 81.3%. The reason I'm covering this share, is because it's another very interesting situation.

The company is a blue sky, negligible turnover company, which has been listed since Nov 2011. Since then, it's hardly sold anything, and racked up annual losses each year between £5-8m. So clearly it's not the sort of thing I would even look at, unless it had a minimum of say 2 years' cash burn in the bank, and the shares were priced at half net cash. It's only at that sort of valuation that blue sky stocks become interesting to me. The reason being that blue sky shares on AIM nearly all fail, sooner or later, so why take the risk of getting involved with all the hype? Focusing on this type of company is a virtually guaranteed way to pour money down the drain, in my experience.

Blue sky shares which are well-funded are one thing - it can sometimes be worth having a punt. However, blue sky shares which have run out of cash, is where risk:reward is probably the worst imaginable.

Perhaps people took comfort from Woodford owning 29.99% of the shares here. However, that has turned out to be a big problem. Woodford wants to refinance it, but of course he would need a waiver from the Takeover Panel - because normally anyone going over 30% would trigger a requirement for that shareholder to bid for the entire company.

Anyway, today's bombshell announcement says that Woodford is proposing to inject £5m in fresh funds, via a convertible preferred shares. These seem to be convertible at 2.822p into ordinary shares. Other shareholders can also apply for convertible shares, if they want to. So if you really like the company, then buying at 1.13p in the market may not be such a bad idea?

However, the big problem is;

De-listing - the AIM listing is being cancelled, and the company is becoming a private company. Obviously that forces out a lot of existing shareholders, who cannot or don't want to hold shares in a private company. Hence the share price collapse today.

As a private company, cash burn is going to reduce 40%, so the new cash raised looks enough to keep the company going for a couple of years or more.

If shareholders don't vote through these measures, then the company is bust - is a shortened version of the warning in today's RNS.

My opinion - de-listing is the absolute nightmare scenario for small caps investors. Usually it triggers an instant 50% plunge in share price, as a stampede for the exit ensues.

I have heard of instances where people have eventually made good money from companies which de-list, but that's quite rare.

Overall, this looks a fairly sensible plan to rescue a company which has failed to perform in its nearly 6 years as a listed entity. Shareholders cannot really complain, since they held shares in a company which had already told the market that it was about to run out of money. So what do they expect? Existing equity is often worth little to nothing, in this type of situation.

Overall then, it's vital not to get caught up in blue sky stocks which are about to run out of money. They're so high risk, that disaster is often the most likely outcome, in some shape or form. As we see here, even having a (former?!) star fund manager as a major shareholder, is certainly no guarantee of success.

Proactis Holdings (LON:PHD)

Share price: 183.5p (up 0.8% today)

No. shares: 92.7m

Market cap: £170.1m

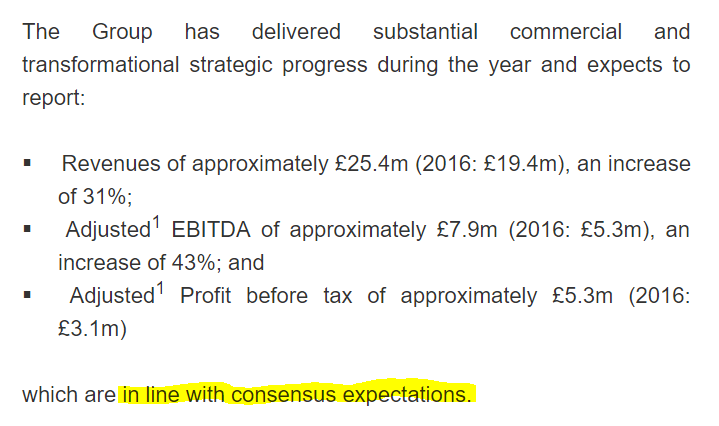

Trading update - this strikes me as a reassuring update today. This relates to the year ended 31 Jul 2017. Proactis is an acquisitive group, providing software & other services to enable purchase ledger cost control for a variety of businesses, including local authorities, and medium to large companies.

How about this for a model of clarity, just 22 days after the year end;

There's an update note today from N+1 Singer, which is available on Research Tree. They sound positive about the company.

My opinion - this is a stock I've previously held, and done well on. For the moment, I'm sitting on the sidelines, as I generally don't like lots of acquisitions, and prefer to wait and see how they pan out.

This is now a much bigger group, as the most recent acquisition was very large. I didn't particularly like the financial details of the company being acquired. Although this share seems to be largely about achieving big cost savings from combining the businesses, and cross-selling to customers.

Everything seems to be going well so far. The shares look good value, if 2018 & 2019 forecasts are achieved. However, for me, I don't see enough upside, nor certainty of upside, to go back in, for the time being. I'll check out the next set of results, when they're published on 11 Oct 2017.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.