Happy Friday!

Today I'm thinking of writing about the final results from ITM Power (LON:ITM), the management update at Provident Financial (LON:PFG), and the half-year report at Camellia (LON:CAM). Let me know if you'd like me to write about something else, too!

Cheers,

Graham

Provident Financial (LON:PFG)

- Share price: 908.75p (+21%)

- No. of shares: 148.2 million

- Market cap: £1,346 million

Consumer Credit Division Management Update

A huge boost in the market cap today for this troubled lender, though of course the share price remains significantly below its pre-profit warning levels.

The CEO had already walked the plank, and now the MD of the home credit division leaves too, being replaced by a returning former MD of the entire consumer credit division (CCD).

Perhaps this will herald a switch back to the former model of self-employed agents? No matter what course of action is taken, the disruption to collection agents is likely to continue in the short-term. But returning to a manager from the good times suggests to me that Provident might go back to the business model that was working rather well up until recently.

It's an interesting special situation, since the non-home credit division parts look rather valuable and difficult to replicate (I'm thinking particularly of the bank when I say that). So even if the home credit division is worthless now, as estimated by JP Morgan, the shares are still potentially interesting.

Computacenter (LON:CCC)

- Share price: 999.25p (+13%)

- No. of shares: 122.7 million

- Market cap: £1,226 million

This is (strictly speaking) outside our remit here at SCVR, but in response to requests I will say a few words on it!

Also, it's a nice change to talk about shares going up from time to time.

Computacenter provides a fairly wide range of IT/computer services for businesses: security, data storage, networks, etc.

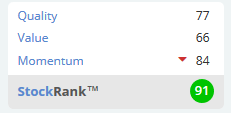

We haven't covered it in the Small Cap Value Report before (for obvious reasons) but Ed included it in his Top Stocks for 2017 (see here) thanks to a StockRank at the time of 96, and indeed it's been in his list of top stocks since mid-2015.

With the share price having improved considerably so far this year, the Value Rank is not particularly special at the moment.

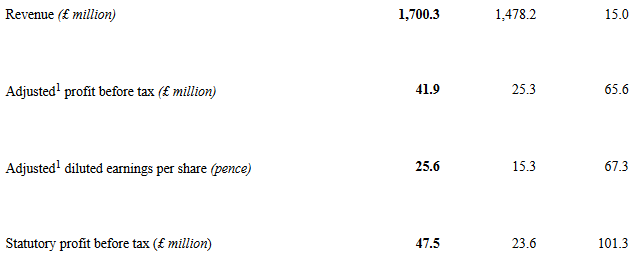

But trading is going well and momentum has built up, just look at these numbers:

(left-hand column = H1 2017, middle = H1 2016, right-hand = % change)

The statutory profits are higher than adjusted profits - there were some exceptional property gains plus a couple of other small items.

Dealing in small companies trying to make their results look as flattering as possible gets a bit tiring after a while. One of the benefits I find of dealing in larger companies like this is they tend to be a bit more straightforward in the presentation! The adjustments tend to make sense, rather than being there purely to make the numbers look better than they really are.

The extraordinary growth in profitability during this period is attributed to a wide range of causes: operational improvements, currency tailwinds and weak comparatives from last year.

Like-for-like (i.e. constant currency) revenue growth of 8.7% is not bad at all, but it was 15% at actual currency levels and that's a strong boost for these results (much of Computacenter's income is Euro-denominated).

The track record of rising dividends is excellent, and there is a very strong net funds position of £137 million, so there is scope for the forward yield of 2.7% to improve. The Chairman remains as optimistic as ever.

CCC is not as trendy as the typical tech stock today but I'd much prefer it to your average NASDAQ listing on a stratospheric rating. The PE ratio here is a very manageable 15x.

Henry Boot (LON:BOOT)

- Share price: 303.75p (-0.3%)

- No. of shares: 132.1 million

- Market cap: £401 million

Also covering this one in response to a request (from matylda).

Henry Boot is multi-pronged property company which covers land trading, commercial development and construction.

Revenues rose 82% to £195 million, though this was not matched by an increase in profitability:

Operating profits increased 8.1% to £22.8m (2016: £21.1m) with the contribution from property development now arising from larger, pre-funded and pre-let schemes where we take lower risk and commensurately lower margins.

In addition to this, last year's result benefited from one particularly profitable transaction.

Property development companies tend to have their results decided by the success of failure of a relatively small number of deals, and that's why they should never receive a very high valuation rating: there's just too much uncertainty.

As they noted in May's trading update which Paul included in his report:

Henry Boot is, fundamentally, a transactions driven business and there is always a degree of uncertainty with regard to the timing of these deals within a particular financial period.

Generating an acceptable return on equity often involves taking on significant liabilities, and indeed Henry Boot has £438 million in total assets backed up by £243 million of equity.

The most prudent way to invest in property companies is to use the NAV as an anchor, but the NAV of Henry Boot is currently just 184p per share.

So there's a fairly generous premium for management expertise and for the value of the projects currently underway. Perhaps these shares are fully up with events, then.

ITM Power (LON:ITM)

- Share price: 32.25p (-7%)

- No. of shares: 250.6 million

- Market cap: £81 million

This is a hydrogen energy company with capabilities in energy storage and in refueling technologies for hydrogen vehicles.

It sadly hasn't turned a profit yet, and the share count has grown rapidly in recent years as presumably additional funds have been needed.

With a market cap of £80 million+, investors are evidently pricing in an attractive refinancing and/or the possibility that further financing will not be needed. Consider the following extract from today's statement:

ITM Power had cash held on guarantee that totalled £1.5m (2016: £2.2m). Presently, the Group is required to place amounts on guarantee as cash cover, which limits working capital available to the Group mid-contract. This limited the Group to £1.6m of available cash at year end. As such, there is a material uncertainty over the going concern assumption due to the risk around the timing of cashflows.

In the company's favour, the scale of losses reduced somewhat this year, and the total work pipeline is £35.5 million (of which half is under negotiation).

Recorded revenues this year were just £2.4 million, versus R&D spend of £2 million and prototype production costs of £2.6 million, so it's no surprise that it produced another loss.

So now the question is whether it can get enough work done, and get paid for it, quickly enough to cover the cash burn.

A small placing would be no harm. The risk is that shareholders end up nursing a heavy dilution at an unfavourable level (for existing shareholders).

The company is dependent on the timing of receipts which is beyond its control - not something I'd choose to get involved with, therefore.

Once its finances are sorted out, it could be very exciting. The hydrogen vehicle refueling market has enormous potential, perhaps even more than electric, and ITM has a lot of credibility in this industry. So let's keep an eye on it.

WYG (LON:WYG)

- Share price: 54.5p (-41%)

- No. of shares: 69.9 million

- Market cap: £38 million

Trading update and notice of results

It's funny how myself and Paul's views appear to have merged on a couple of topics.

In my own case, having been stung badly or otherwise disappointed after investing in consulting businesses, I've now given up on them. No more professional services companies for my portfolio, as far as possible. They are better suited to the traditional partnership model, in my view.

WYG offers management consulting along with technical and commercial expertise in asset/project management, infrastructure and planning.

Final results in May saw profits reduced to £1.6 million from £2.2 million, on revenues of £152 million. Low net margins - a big warning sign there already.

Operating profitability is set to deteriorate further:

The Board continues to expect revenue for the current year to exceed £160m representing continuing year-on-year growth in line with market expectations. However, for the reasons explained below, the Board has revised its expectation of near term operating performance and now anticipates that operating profit (before separately disclosed items and share based payments) for the half year will be significantly lower than in the prior year.

The reasons are as you'd expect: project delays and lower than anticipated volumes from some customers. Certain practices are performing below expectations, including an acquired real estate business. Problems which are fairly difficult to predict, unless you're inside the company.

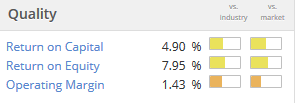

Aside from the lack of visibility, it seems to me that very few consulting businesses are capable of achieving long-term compound returns for external investors. The quality metrics from Stockopedia tell the story:

The one positive here is that net debt is low, at £2.5 million, so it shouldn't face any immediate financial stress.

I wouldn't blame someone for trying to make a bit of money on this while sentiment has been crushed. But there's no way I'd consider holding it for the long-term.

That's all I've got time for today, thanks for checking in!

All the best

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.