Happy Friday!

I thought I'd get going with another pre-open publication here.

Cheers

Graham

Safestyle UK (LON:SFE)

- Share price: 162.25p (-31%)

- No. of shares: 83 million

- Market cap: £135 million

Bad news for shareholders, I'm afraid. The announcement has the makings of a nasty profit warning for this double-glazing business which describes itself as "the largest company in the UK homeowner window and door replacement market".

There will be a material impact on profits for 2017, due to higher costs and yet revenues only expected flat against last year.

Since [July 2017], the Group's order intake has declined beyond the Board's expectations. The Board believes this is due to an accelerating weakness in the market resulting from increasing consumer caution, as evidenced by the latest FENSA statistics, which show that the overall market has deteriorated further, with installations down by 18% in June and July compared to 2016.

So Safestyle reckons that it has grown market share by maintaining its revenues around the same level as last year, but the expenses around driving those orders will result in a hit to profitability.

The profit warning back in July hit the share price by about 16%, so I wonder what's in store for it today. Edit: Down 31%!

It does at least have the benefit of not being leveraged, with a healthy cash position on the balance sheet. It had almost £18 million net cash at end-June.

Stockopedia metrics like it, with a Quality Rank of 98 indicating to me that it probably has a differentiated business model. Indeed, its market share has been growing, and it has been profitable, for over a decade.

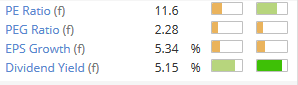

But as Paul has astutely noted in recent times, the PE ratio for a stock like this needs to compensate for the cyclicality of the sector. These stocks can look the cheapest right when they are most overpriced, and can look the most expensive when they are the best value, because of this factor.

I also think the dividend might be at risk, since at 11.25p for 2016 it was already covered less than twice by EPS. With earnings about to take a hit, I wonder if the company might choose to conserve more cash for a potential recession rather than pay out a >5% yield to investors.

My opinion: It could be good value already but I'd personally be on the more bearish side of things economically speaking, so I'd wait for the share price to reflect more gloom!

Greene King (LON:GNK)

- Share price: 659p (pre-open)

- No. of shares: 310 million

- Market price: £2,040 million

AGM Trading Statement for the 18 weeks to 3 September 2017

The SCVR is not supposed to be the doom and gloom report (especially not with stock markets near all-time highs), and the pub operator Greene King is outside our remit anyway, in terms of its market cap. Since we've been discussing restaurants here at some length recently, and it's relevant to economic questions, I thought I'd quickly cover it.

This is another warning about deteriorating trading conditions:

In the first 18 weeks of the year, Pub Company like-for-like (LFL) sales were -1.2%, against a market which declined -0.7%*. Excluding Fayre & Square, which is being rebranded during this financial year, LFL sales were -0.9%.

In the first ten weeks, LFL sales were in line with our expectations and broadly in line with last year, despite the tough comparisons from Euro 2016. However, since the second half of July, when the weather worsened, trading weakened.

It's still bullish in the long-term, but not the short-term, citing weaker consumer confidence, increased costs and increasing competition.

Checking the full-year results, I see that net debt crept up to £2,075 million, or 4x EBITDA, or 5x adjusted operating profit, or 6x operating profit.

Those multiples would be considered reasonable for a pub chain, and I suspect that Greene King is more likely than not to avoid financial distress. However, I do think there are great chances of being able to buy into Greene King at much cheaper share prices over the course of the next cycle. Net income fell by 70% in 2009 on a modest decline in total revenues.

Redstoneconnect (LON:REDS)

- Share price: 125p (+1%)

- No. of shares: 20.8 million

- Market cap: £26 million

Trading update and notice of results

This high-tech building management company issues an update ahead of its H1 results to end-July. Trading is in line with expectations.

There's not much more to say about this actually. Contract wins have been achieved and the company as a whole sounds busy. Though it also has the dreaded second-half weighting prediction for its project-oriented Systems Integration division ("Redstone").

The CEO confirms the H2 effect:

Whilst we anticipate our performance to be largely second half weighted this year, given our pipeline of work, new business momentum and strong order book, coupled with the additional services that we have added to our offering through the acquisition of A+K, we remain confident for the full year."

My opinion: One of the more attractive elements for me about this story is the very strong support which Redstoneconnect (LON:REDS) has enjoyed from its shareholders over the last couple of years. Most recently, £6.5 million was raised in May, for internal/working capital purposes as well as to help fund an acquisition.

These shareholders seem unlikely to let it go bust if it doesn't perform well, and it has already turned the corner into profitability anyway. The products sound nice and the clients are quality, too. I'd say this is one of the small, innovative AIM stocks which has a better-than-average chance of justifying its market cap.

Filta Group (LON:FLTA)

- Share price: 156p (up 8% yesterday)

- No. of shares: 27 million

- Market cap: £42 million

Circling back to cover this oil filtration (and related services) business, operating primarily out of the USA (plus UK).

It was already profitable when it entered AIM last November, if you adjusted out finance costs and AIM admission costs (the company also added back some bonuses to get the "underlying" operating profit, but that's a lot more questionable).

These H1 results (for the period ending June 2017) are the first complete set of numbers for it on the market.

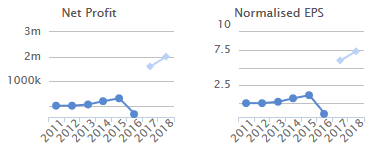

You don't need me to tell you this is promising:

- Revenues increased 39% to £6.6 million (H1 2016: £4.7 million)

- Gross profit margins improved to 46% (H1 2016: £43%)

- Underlying Operating Profit up 62% to £1.0 million (H1 2016: £0.6 million)

Note that post-period end, in August, Filta made a £1 million acquisition of a drain management business in the UK.

As I've said before, Filta is a prime example of something boring and even distasteful, operating in a completely unglamorous sector. These can be some of the most solid areas to invest!

The balance sheet here is steady with £3 million in net cash.

Fryer management services are responsible for the bulk of revenues and drove the growth in this period, up 42% to £4 million.

I don't know if that growth is repeatable, however, as the increase in mobile filtration units (MFUs) (the equipment being driven around in vans) was 9%, a little faster than the total number of franchises.

H2 has started "on plan" across all business sector, and the outlook sounds fine:

With the additional royalties that will be generated from the already enlarged franchisee base, the growing revenues being delivered by the non-fryer activities and the investment in infrastructure that has been made during the year, your Board believes that the Group is well placed for further progress in the second half of this year and, more particularly, in future years as our recurring revenues continue to grow.

My opinion: I still like this business. I like its economic characteristics (high returns on capital via the franchise model) and I like the sector (boring but also one where a niche can potentially be carved out).

The corporate governance seems fine so far, as well. Dividends are being paid and it's worth noting that there was no difference in these results between the "underlying" operating profit and the statutory profit from operations. That lends credibility to management and to their reporting style, in my view.

Stockopedia doesn't like it much yet - StockRank just 44. I think it might warm up to it as the unprofitable prior period fades into the distance.

I think it has the potential to grow into its valuation, and am tempted to open a position.

Frontier Developments (LON:FDEV)

- Share price: 1315p (+6%)

- No. of shares: 37.6 million

- Market cap: £494 million

This is a Cambridge-based video developer whose share price has been storming higher since last last year, recently turning parabolic.

News flow has been spectacular, from an £18 million "strategic investment" by Chinese company Tencent in late July, through to the announcement in August of its latest game, Jurassic World Evolution. JWE will be released next summer, around the same time as the release of the next film in the franchise.

Yesterday's results were thus only the product of the two existing games franchises.

Paul has already remarked that the capitalised development costs were rather large: almost £10 million, versus combined depreciation and amortisation of £4.9 million.

This means that the company used up about twice as much cash on the creation of intangible assets, compared to the loss of value in pre-existing intangible assets during the period.

This can be a red flag, since the disparity can be used to make the income statement look much more impressive than it really is.

I don't see this as a huge red flag, in this case, if it's the case that valuable intangible assets are indeed being created. Based on the revenue growth trend (+75%), and the successful launch of a new franchise during the period, I can see this arguably being the case.

The next step change in growth is two years away with JWE, so investors will need to show just a little bit of patience:

We anticipate that the next step-up in our financial performance will be delivered by the launch of Jurassic World Evolution in summer 2018. The Board currently expect that the majority of initial revenues from this new franchise will fall into the financial year ending 31 May 2019, as the Jurassic World: Fallen Kingdom movie is released in June 2018. The Board therefore anticipates that trading in the current financial year, the twelve months ending 31 May 2018, will principally be based on sales from the Elite Dangerous and Planet Coaster franchises.

My opinion: I'm impressed by the news flow on Frontier, although it's clear that the growth assumptions are on the aggressive side now.

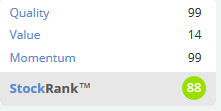

For comparison, the most important gaming stock is the US-listed giant Activision Blizzard. It has the following StockRank:

Now check that versus the Frontier Developments (LON:FDEV) StockRank:

Bit of a pattern, isn't there?

Video gaming is a booming industry, and successful developers exhibit highly attractive features which make investors willing to pay up for them.

But Activision has over 1,000 titles in its armoury, whereas Frontier has just 3. So it's safe to say that Activision is a lot less risky. And Activision is also much better value, although Frontier has great potential.

It's pretty clear what I'd do if I wanted to have exposure to video games, isn't it? I'd pick up some Activision first of all, and perhaps after that, I'd consider owning a few shares in Frontier!

I'm out of time now, have a great weekend everyone and I'll see you next week.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.