Good morning!

Impax Asset Management (LON:IPX)

- Share price: 107.5p (pre-open)

- No. of shares: 128 million

- Market cap: £137 million

This environmental asset manager announces it's buying a US (New Hampshire)-based asset manager ("Pax World"), operating in the same field of sustainable investing.

The two companies already have a partnership together, running a $511 million environmental fund, so they should know each other well.

Impax's run-rate Revenue and EBITDA are given as £36 million and £11 million, respectively (July 2017) based on managing £7.2 billion of AUM.

This deal will create an entity with combined AuM of over £10 billion, using August figures. It's a >40% increase in AUM in one shot! And it will now be a trans-Atlantic operation with a much wider range of research capabilities, and wider product ranges.

The deal is valued at $52.5 million plus up to $37.5 million in contingent payments out to 2021. It's mostly being paid in cash, with a $26 million bank facility being involved.

My opinion

Looks very exciting! Asset managers thrive on scale: the costs of infrastructure weigh them down initially, but then they are scalable to infinity.

Reaching over £10 billion in AuM puts this in a new size category and gives a fresh reason to invest. The overall risk has certainly increased with the addition of a large debt facility, but successfully integrating this company should set Impax up nicely for many years ahead.

Finsbury Food (LON:FIF)

- Share price: 101.25p (+2%)

- No. of shares: 130.4 million

- Market cap: £132 million

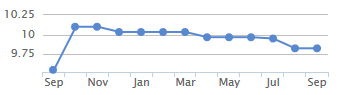

Paul has been rather underwhelmed about this bakery for a while. It's not hard to see why, as like-for-like sales and earnings growth have been underwhelming for a while. Profit forecasts have been gradually sinking too:

Today's final results confirm adjusted EPS of 9.6p, putting this share firmly in "cheap" territory (though not necessarily value!)

Full-year like-for-like sales are flat at £314 million, adjusted operating profit is up 4% to £17 million, and PBT comes in at £13 million, vs £11.8 million last year. The CEO describes it as "solid delivery against expectations".

Given the conditions in the sector, it seems like a reasonable set of results. I don't think that Finsbury should have a huge amount of pricing power vs. its customers, in terms of its business model, but it continues to do ok in a very unforgiving environment which includes Sterling devaluation, rising wage costs and keen competition.

The dividend gets a nice little increase and reaches 3p for the full year. Net debt is c. £17 million and assuming there are no shenanigans, that is no problem (I would still take it into account for valuation purposes of course).

Free cash flow is limited by another £12 million being used up in capex. The investments sound well-justified.

My opinion: I've had a quick look at the Stockopedia graphics, and they reinforce that the quality here is not exactly spectacular.

The mediocre operating margin alone, for a food business, would worry me, and then you have the various headwinds it faces, as mentioned above.

All of this is encapsulated in a PE ratio of 10x. If you're happy with a 3% dividend yield which is well-covered then I suppose that's fair enough and there's nothing wrong with that. And there's always the chance Sterling will recover, so you might form a view that the outlook isn't so bad here.

Sportech (LON:SPO)

- Share price: 98p (+1.7%)

- No. of shares: 185.6 million

- Market cap: £182 million

Board Changes & Strategic Review

Not much share price movement even though this is a crucial development for this betting systems and venues operator.

The CEO and CFO are both resigning, and will assist in an orderly transition.

The statement reflects positively on their tenure, describing their various achievements including £21 million having been returned to shareholders "with an anticipated substantial distribution to follow from the Group's £64m net current assets as at 30 June 2017".

Along with these resignations, the company is also undertaking a comprehensive review of "the business and the capital structure".

Recent interim results showed a modest but improving operating profit result of c. £1 million. The really big news here has been a win against HMRC for c. £97 million in a VAT case last year.

We can assume the Board, representing key shareholders, have decided to explore either splitting up or selling off the company entirely, along with the distribution of the VAT money. Today's announcement perhaps doesn't come as a big surprise. And it would make sense for the CEO/CFO to prepare to leave in these circumstances.

I was going to write that the valuation looked much too high against the profitability of the remaining businesses, but I see there's a chance that the value of the win against HMRC could be more than doubled, i.e. an extra £100 million or so could be on the cards, depending on the outcome of a similar case, if I have understood the implications of this correctly.

That would bring the combined value of the company's existing net current assets plus the extra HMRC claim to >£164 million. The implied earnings multiple on the remaining business units wouldn't be too large, and maybe they will attract a bid premium?

It's not exactly a foolproof investment thesis, but it sounds promising!

Veltyco (LON:VLTY)

Share price: 100.5p (+15%)

No. of shares: 74.2 million

Market cap: £75 million

This is an Isle-of-man based marketing company in the gaming sector. It joined the stock market via a reverse takeover in June 2016.

Today's results are remarkable: revenue has more than doubled, it has swung into profitability, and a dividend might be on the cards next year:

- Revenues increased by 202% to €6,355,573 (H1 2016: €2,102,558) exceeding the full year 2016 revenues of €6,082,468

- EBITDA for the first six months increased 410% to €3,801,354 (H1 2016: €744,129) and an increase of 80% compared to the operating EBITDA for the full year 2016 (€2,107,975)

- Net profit amounted to €3,601,996 (H1 2016: loss of €1,123,289)

A number of acquisitions took place late in the period to June 2017 so I don't think they have had an effect on the numbers given above.

These acquisitions were satisfied by share issuance at 39p - a huge win in the short-term for whoever got their hands on those shares.

Outlook is excellent:

"Trading in the third quarter of 2017 continues to be strong and we now expect the business will exceed current market expectations for the full year."

"The Directors are currently focusing on the roll-out of the new Bet90 operations and continue to review potential acquisition opportunities which fit into the Company's profile."

The acquired websites can be viewed here and here (external links). Both are in German by default although the first one has an English translation available. It's based in Malta.

I've gone back and had a look at the annual results published in May, and the disclosures are disappointingly thin.

Offshore gambling is lucrative but also inherently secretive, and I suppose I shouldn't be surprised by the limited comments made by management at the full-year results.

But if you go further back and look at the admission document, you get some meatier information. The core business is finding marketing leads for three main partners. It's an outsourced lead generation business (probably a lot like £XLM), and Veltyco itself outsources its activities to affiliates (p.24):

Whilst financial risk associated with unsuccessful marketing campaigns is reduced by outsourcing marketing activities since affiliates are only paid if they deliver new players/traders, there is still risk that new players/traders may only deposit small amounts or may not be retained and this might adversely affect the Group’s business, financial condition, results or future operations.

The admission document tells us that Veltyco has promised not to promote any other gaming site in Germany, Austria or Switzerland apart from betsafe.com, from whom Veltyco receives commission based on the net revenue generated by players it directs to that website. The agreement with Betsson, the operator of betsafe.com, lasts until 2020.

Veltyco's reliance on its partnership with Betsson is mentioned as one of the important risks in the admission document. Some of the directors have career links with Betsson.

Another point mentioned in the admission document is as follows:

Approximately 90% of the Group’s revenues from Betsson operations are generated by a small group of high net worth players, described as “VIP Players”. These are loyal players that regularly deposit high amounts on the Betsson websites. Sheltyco knows these players and makes them feel valued through focussed highend client entertaining, such as access to sold-out sporting events, proximity to celebrities at events and expensive branded gifts. The loss of any of the VIP Players could significantly adversely affect the Group’s business, financial condition, results or future operations.

I wonder if this source of risk is also the basis for its recent success, as these VIP players have suddenly increased in number?

I'm struggling to come up with a conclusion right now but on the basis that the numbers are real, it looks potentially very interesting. It could be a high-risk play, though, since it might be the case that results are sensitive to a small number of high-value customers. If the company has a long-term source of competitive advantage, I hope it might tell us what that is!

That's it for today. Paul is back tomorrow!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.