Good morning, it's Paul here!

There are loads of results & trading updates today, so I'll wade through as many as I can manage.

End of the momentum trade?

It's intriguing how so many share price charts look remarkably similar at the moment. When we're doing well on the markets, it's tempting to think that this is due to one's own genius! However, then you realise that many similar type of shares are all going up. In the last couple of years, the action has mainly been in growth/momentum shares. So anything that's showing decent growth, has been re-rated upwards. Then other people just started buying those shares because they had gone up a lot, for the momentum trade.

I think the momentum trade has possibly come to an end now. We're seeing lots of momentum shares falling sharply at the moment, as people bank profits. Also I think it's dawning on some people that a lot of shares have risen far too much, and are now over-priced.

Significant price corrections have happened recently on Purplebricks (LON:PURP) (in which I hold a long position), Fevertree Drinks (LON:FEVR), Hotel Chocolat (LON:HOTC) , Porvair (LON:PRV) , Frontier Developments (LON:FDEV) , Tristel (LON:TSTL) , and loads more shares that are popular with private investors. So I've been looking at these recent big fallers, hunting for bargains. However, even after a sharp sell-off, I'm really not finding any value.

Take Hotel Chocolat (LON:HOTC) for example. As you can see from the chart below, it's fallen a lot recently. However, Stockopedia shows the forward PER as being 30.7 - nowhere near value territory. The company is growing, but at a fairly pedestrian rate, so I certainly wouldn't pay anything near a PER of 30 for it. So what on earth were people thinking, when they chased the share up to 400p in May 2017? Maybe they thought that growth would be faster than existing broker forecasts?

My feeling is that, with valuations already stretched, there's no room for any disappointments. Any highly rated company that does disappoint is likely to see 25-50% wiped off its share price, instantly. Quite a lot of risk. The upside is that companies need to out-perform against forecasts, in order to drive the share price even higher.

So that means that overall, risk:reward doesn't look at all good right now, for highly rated companies generally. It's only the truly exceptional growth stocks, which deliver continued strong newsflow, that are likely to continue rising from already elevated levels.

So personally, I'm being a lot more cautious at the moment. Maybe I'm being too cautious? After all, "buy the dip" has been by far the best investing strategy in recent years. Possibly the sell-offs in highly rated stocks are a buying opportunity? Who knows?! My feeling is that it needs strong newsflow to take shares to higher highs. Without strong newsflow, I wouldn't buy, or continue to hold anything highly rated.

Many of us have done extraordinarily well in the last couple of years, so it is tempting to lock in the gains, and not get too greedy. A correction has to happen sooner or later, we just don't know when, or what will trigger it.

Porvair (LON:PRV)

Share price: 480p (up 5.5% today)

No. shares: 45.5m

Market cap: £218.4m

(at the time of writing, I hold a long position in this share)

Trading update - this company makes specialist filters for a variety of industries.

It's another example of a growth company whose shares became over-valued earlier this year, and have since corrected. This share peaked at 605p in Jun 2017, and recently bottomed out at 430p. I managed to pick up a small scrap of stock at 440p, a few days ago, which was lucky timing.

It surprised me how tricky this share is to trade, despite a £218m market cap - it's quite illiquid, and the quoted spread is often wide. Although quoted spreads on small caps are meaningless actually, because they don't show the RSP machine prices, which are inside the quoted spread. To find out the real prices on small caps, you need to either use a telephone broker, who will tell you the real prices, or put a dummy trade into an online dealing account.

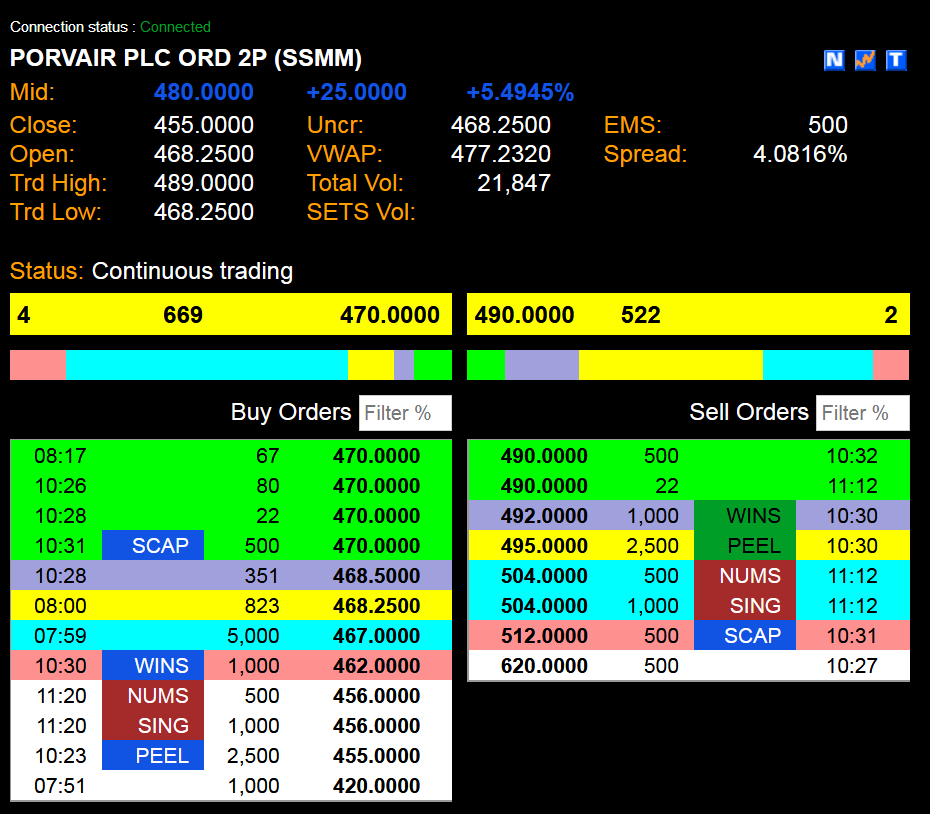

So looking at PRV, the quoted price is currently (at 11:30) Bid 470p, Offer 490p. Here is the Level 2 (courtesy of MoneyAM);

That's a very wide spread, of 4.3% (worked out as a percentage on the mid price of 480p).

To find out the real prices, I've just rung my broker, and he tells me that one market maker is offering stock at 485p (size 2,500 shares), and a different market maker is bidding 475p for 1,000 shares. So the real price is not 470/490p, it's actually 475/485p, which is a more palatable spread of 2.1%

Therefore, as you can see, the above reality means that any analysis based on published prices & spreads for small caps, is actually meaningless. The published prices are not the real prices.

This is particularly relevant for those of us who use spread bets as a tax-free wrapper for small caps trades. In case you haven't seen it, I put your questions to Tom Salmon of Spreadex, in an audio interview late last week. Here is the link to my website, to listen to the audio. It's 37 minutes long, but covered a lot of ground. Of particular relevance for small caps, Tom confirmed that they will happily "work an order" for you, inside the quoted spread, for small caps. They will give you the best prices on the RSP. That's what I do with my small caps trades, most of which I put through Spreadex.

I think the best way of using a spread bet account for small caps, is not to use any gearing at all. i.e. if you want to go long of a share that is 100p, at £100/pt (equivalent to buying 10,000 shares), then I find the best thing is to deposit £10,000 in cash into the account for that trade. That way there is no gearing, and there cannot ever be a margin call. Risk:reward is then identical to actually owning the shares. Although the funding cost of a spread bet is quite pricey, something like 4-5% p.a., plus there's the opportunity cost of getting no interest on the £10k that you deposited with them. Although those costs pale into insignificance when you get a multibagger, with tax-free gains.

Obviously the big danger with spread bets, is that people use far too much gearing, and then end up blowing up in a bear market, or if a particular share collapses in price. That's exactly what happened to me in 2008, so lessons learned the hard way for me, that's for sure.

Sorry, back to Porvair's trading update. Key points;

- Covers 9 months to 31 Aug 2017

- Good progress

- Revenue growth of 8%. Q3 growth is in line with H1 growth (reported on 27 Jun 2017)

- Profit before tax ahead of management expectations

- Underlying revenue up 13% on last year - this adjusts out forex movements, and also (controversially) strips out large projects - not sure I'm happy with that.

- An acquisition contributed 5% of the underlying growth - so that's not really underlying then, is it?!

- Order books healthy

- Net cash nearly £4m

My opinion - a good quality company, but the rating is still expensive, based on existing forecasts. I've not yet seen any revised broker forecasts, but they might possibly be increased, based on today's update.

I'm not inclined to buy any more, but will stick with the little scrap of stock I already hold.

Eagle Eye Solutions (LON:EYE)

Share price: 248p (down 2.4% today)

No. shares: 25.4m

Market cap: £63.0m

Final results - for the year ended 30 Jun 2017.

This is a technology company, which provides electronic discount vouchers for retailers, e.g. supermarkets. This clearly is better than traditional, paper vouchers. So the product reduces administration costs, and tracks individual customers. It has some impressive, big name clients, including Asda and John Lewis Partnership. So this looks an interesting company - albeit still currently loss-making.

Key points;

Impressive revenue growth of 71% to £11.1m

Very high gross margin of 88% - so in future, the operational gearing could kick in nicely

Placing of £5.5m done in June 2017, so these results include the benefit of that cash injection

EBITDA is negative, at -£1.8m (similiar to last year). Take off £1.6m depreciation and amortisation, and £431k in share payment charge, and the operating loss was £3.8m (reduced from £4.1m prior year)

See note 3, which indicates that £3.5m of revenues are "development & set up fees", so non-recurring. The balance of £7.5m are subscription & transaction fees, which are recurring in nature.

Current trading /outlook - sounds good;

Q1 FY18 revenue expected to be at least £3m, 32% growth on prior year, with growth anticipated to accelerate in future periods as our significant clients begin to transact through the platform at scale and from the impact of new strategic partnerships that drive increased transactions

Balance sheet - looks reasonable, following the recent placing.

NAV is £8.9m. Deduct intangibles of £4.8m, gives NTAV of £4.1m - which is probably adequate for the size of business.

Note that net cash is £3.7m, which is only about 1 year's worth of cash burn. So more fundraising(s) are likely, unless cash burn reduces from increased revenues in 2017/18. I don't think this is necessarily a problem though - because the business is demonstrating such strong growth (top line), that investors will probably be eager to fund another placing, if one is required.

The problem would be if growth stalls, and the business then would have to raise more equity from a position of weakness. If that coincided with a bear market, then they could struggle. That's a downside risk to consider, but not something that worries me at the time being.

My opinion - this does look an interesting company. However, I'm baulking at the £63m market cap, which seems very high given that the company is still significantly loss-making, and will probably need (at least) one more fundraising.

When I held the shares and tried to sell them, it was a nightmare. So that's an added risk with something this illiquid - if there is any company-specific bad news, or just a general stock market downturn, you could really struggle to dispose of them.

I'm tempted to buy back in, but not at the current price. So it's going on my watchlist to possibly buy back in at some point in the future.

French Connection (LON:FCCN)

Share price: 44.1p (down 0.8% today)

No. shares: 96.3m

Market cap: £42.5m

(At the time of writing, I hold a long position in this share)

Interim results - for the 6 months to 31 Jul 2017.

This company is a fashion label, which has a successful brand licensing & wholesaling business, attached to a heavily loss-making retail business. Although note that 29.2% of the retail division's revenues are now online.

This business has an H2 trading seasonality, so the interim results usually look awful most years. Historically, I've made good money buying after the interims in some years.

Key points;

H1 operating loss of -£5.7m - clearly bad, but a useful improvement of £2.2m from the prior year H1 loss of -£7.9m. Last year, the company made a £2.6m operating profit in H2. Therefore, with an improved performance in H2 this year, I reckon that we might be looking at a £4-5m profit in H2, which would bring the company close to full year breakeven for FY 01/2018.

Net cash of £6.7m, is only down £1.0m on prior year. Mid-year cash is always low, but should be a good bit by year end of 31 Jan 2018. Note that the commentary says the minimum net cash balance during the year was £4.9m. This is a well-financed business, and I have no worries at all about solvency.

Outlook comments sound the most upbeat I can recall for some time, in particular;

We have definitely seen positive momentum build in the first half of the new financial year with improvements across all the divisions despite difficult trading conditions.

With full price sales in Retail up during the early part of the second half, combined with the strong Winter 17 order books in Wholesale and very strong reaction to the Spring 18 collection, I am confident that we will see a good performance during the rest of the year.

In November we will be opening our first new French Connection store for a number of years, in Manchester, reflecting our strategy to open new stores in appropriate locations where we believe the brand will trade profitably.

We have been working with the goal of returning the Group to profitability as soon as possible and, while there is still much to do, I believe that we have made significant steps to achieve that in the near future.

I'm not at all keen on the company opening any new stores. Surely the lesson from the last few years is that French Connection just doesn't work in standalone stores. It does however trade well on a wholesale basis, online, and in-store concessions (in Dept stores).

My opinion - I'm quite encouraged by these results. The long-term value from the highly profitable wholesale & licensing divisions should be unlocked at some point, once the heavily-loss-making retail leases have expired. I can't find anything in the narrative about lease expiry dates, which would have been useful.

It's probably too long-term an investment proposition for most people, and it doesn't pay divis at the moment either. However, I remain pretty sure that one day I'll be able to say, "You see! I knew there was some value there!" - most likely from a trade sale of the business. Stephen Marks is getting on a bit now, so presumably at some point he'll want to cash out for the maximum possible price. Of course we're all in his hands, given his dominant shareholding, which is rather scary, hence why I'm keeping my position size here fairly low.

Quick comments now, as I've got a headache, and want to go out for a pizza & a pint soon!

Escher Group (LON:ESCH) - poor interim results are published today. It's a software company for postal service companies around the world. H1 2017 was a loss of -£27k, versus a profit of £1.8m in H1 2016. The reason seems to be because one-off licence sales dropped considerably. That exposes the flaw in the business models of many software companies - profits are often totally dependent on winning lumpy licence sales.

Outlook comments indicate a good pipeline, but caution as follows;

While there is an adequate pipeline of opportunities to deliver a material licence sale in H2, the spending patterns of our traditional customer base are such that the timing of these sales remains difficult to predict and can therefore impact the Company's earnings in the short-term.

I really cannot see any appeal to this share at all - other than that a bigger company might want to buy it, for its customer relationships & the cross-selling opportunities maybe?

It's very surprising that it has a high StockRank of 93. Maybe the Stockopedia computers have seen something good that I've missed? I rarely invest in small software companies now - profitability is usually totally unpredictable, as it's dependent on lumpy contract wins.

Character (LON:CCT)

(at the time of writing, I hold a long position in this share)

Trading update - which came out tonight after the market had shut.

Underlying profits for y/e 31 Aug 2017 are;

... expected to meet current market expectations

Conditions "remain challenging at the consumer level".

Notes that Toys R Us has gone into bankruptcy protection in the US & Canada - noting it is a "major customer";

At this early stage, we do not know the extent to which this will impact our trading position with them both in the UK and internationally. Consequently, we do not currently have reliable visibility on the important 2017 Christmas trading period and its effect on the current financial year ending 31 August 2018.

Oh dear, that doesn't sound too good. I read on CNBC today that Toys R Us operations internationally (outside of USA & Canada) have not gone bust.

Unfortunately, I think this announcement is likely to trigger a negative share price reaction tomorrow morning - at a guess I'd say 10-20%. It depends what financial impact this is likely to have. Character might suffer a bad debt from goods already delivered to Toys R Us, but not yet paid. We'll have to wait and see what amount that is likely to be.

From other stuff I've read today, the intention seems to be for Toys R Us to continue trading. It just needs to restructure its debt, hence entering bankruptcy protection. So long term, this shouldn't be a problem for Character. For that reason, if there is an excessive fall in CCT's share price tomorrow, then I might well snaffle up some cheap shares, and then ride out a few months of poor sentiment. Although it would be safer to wait for the company to update us again, on the financial impact.

Speedy Hire (LON:SDY) - this tool hire company has put out a fairly good update today. Various details are given, but the key paragraph says this;

Adjusted profit before tax for the full year is expected to be well ahead of the prior year and slightly ahead of the Board's previous expectations.

Net debt at 30 Sep 2017 is expected to have reduced from £85.4m a year earlier, to £70m. That's very pleasing.

This company seems to be getting back on track. It doesn't particularly interest me though, although it's looking better value now than it has done for a while. You would need to be very confident about the UK economic outlook though - as tool hire companies are not good things to own if a recession is looming.

Action Hotels (LON:AHCG) - this is a hotel operator in the Middle East & Asia, listed on AIM (why?!). I had a quick skim of its interims this morning, and am deeply unimpressed. The company doesn't generate much operating profit, yet has a mountain of debt to service, so overall it's loss-making.

The only appeal is that it trades below book value. However, in my view, if assets are not generating an economic return, then the book value needs to be written down.

Surprisingly, it does seem to pay divis, yielding over 5%. However, as that's not covered by earnings, then it's unlikely to be sustainable.

The only upside here, is if profitability greatly improves. Until then, I see little to no value in the equity, so I wouldn't touch this share.

Augean (LON:AUG) - interim results today aren't too bad - adjusted profit before tax down 7.2% to £2.9m for H1. The share looks amazingly cheap, on a forward PER of 4, and a divi yield of over 5%. So I started to get interested in it this morning.

Then I noticed a plunge in share price in late Aug 2017, so I had a brief look at the RNSs at that time. Sure enough, there's a disastrous announcement on 25 Aug 2017. HMRC reckon the company hasn't paid enough landfill tax, so is going after it for £2.1m. However, here's the real sting in the tail;

Should HMRC make further such assessments, for this and one other subsidiary, the total amount that could potentially be claimed could be very large. Augean intends to work with stakeholders in the sector about the broader adverse implications for the continued and necessary proper treatment of hazardous waste.

That makes it uninvestable, as far as I'm concerned.

Bango (LON:BGO) - I had a chat with the CFO of this company a while ago, who kindly briefed me on what it does. The company processes small payments for phone apps, via the end user's mobile phone bill. It does this in various countries.

The bull case for this share is that it has operational gearing, and the capacity to process much larger volumes of transactions, on a largely fixed cost base. This has seen the market cap shoot up to a remarkable £160m. That seems orders of magnitude too high, for what has been achieved so far.

H1 2017 shows revenues of only £1.7m, and an operating loss of £2.0m. There's an impressive uplift of 102% against revenues for H1 2016. However, there doesn't seem to be any uplift in revenues against H2 2016 - in fact H1 2017 is slightly down on H2 2016.

The operating loss was £2.0m in H1 2017, down from £2.8m in H1 2016. So clearly this company needs to dramatically increase revenues to get anywhere near breakeven, let alone profits.

Cash isn't an immediate concern, with net cash of £5.6m.

My opinion - there's no way I would pay £160m for such a small, loss-making company. Clearly investors believe that this is the next big thing. If anything goes wrong, or the company fails to live up to growth expectations, then this share would drop vertically, like a stone. Much too risky for me.

Swallowfield (LON:SWL) - am wishing I looked at this one earlier, as it rose very nicely throughout the day. Results (for the 52 weeks ended 24 Jun 2017) look excellent, boosted by an acquisition. Note that the narrative says it benefited from some unusually large contracts in the period, which may not repeat.

Full year divis are up 68% to 5.2p.

Outlook comments sound upbeat.

There's a massive share-based payments charge of £1.76m, which strikes me as excessive.

Pension deficit - looks small, and overpayments are only £108k p.a., for 10 years, so not a worry.

Balance sheet is middling - so satisfactory, no worries there for me.

My opinion - I like the look of this, and am going to do some more research on it. What do readers think - does anyone hold this one? If so, would be great to hear your view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.