Good morning! Assuming that Paul's airline didn't go bust, he should be back tomorrow.

On The Beach (LON:OTB)

- Share price: 395p (pre-open)

- No. of shares: 130.4 million

- Market cap: £515 million

Mentioning this story first of all because it's time-sensitive and relatively straightforward.

The Civil Aviation Authority has announced to the stock exchange that Monarch Airlines has ceased trading, and that 110,000 passengers are stranded overseas. 300,000 future bookings are cancelled. Those abroad "will be brought back to the UK at no cost to them". 30 aircraft are being chartered by the CAA and government.

This is the equivalent of operating, at very short notice, one of the UK's largest airlines.

So how does this affect the online travel retailer, On The Beach?

The Group has Scheduled Airline Failure Insurance in place which covers the failure of Monarch Airlines Ltd including monies paid to Monarch Airlines Ltd and also the costs to repatriate customers currently in resort. The Board anticipates that there will be a one-off exceptional cash cost associated with helping customers to organise alternative travel arrangements or providing refunds and will update shareholders in due course. The Group has no exposure to Monarch Holidays Ltd bookings as it only offered Monarch Airlines Ltd seat-only flight options on its website.

In short, I don't think this is a big deal for On The Beach.

The CAA website appears to have crashed under the pressure of everyone trying to work out what ATOL protection means, but the costs in my opinion will almost entirely be falling on the government, CAA, various insurance companies and then the passengers themselves. On The Beach is just a middleman, which sounds like it has protected itself from airline failure, and while this will be a messy episode, I suspect that it will have been forgotten about a year or two from now.

For someone who was already thinking about buying shares in On The Beach (LON:OTB), maybe today would be the day to do that?

Stanley Gibbons (LON:SGI)

- Share price: 8.125p (-13%)

- No. of shares: 179 million

- Market cap: £14.5 million

This collectibles company is drifting toward the £10 million level where we tend to abandon coverage.

It's a prime example of a company which tried to grow by acquisition, and then lost control of its financial structure when trading deteriorated.

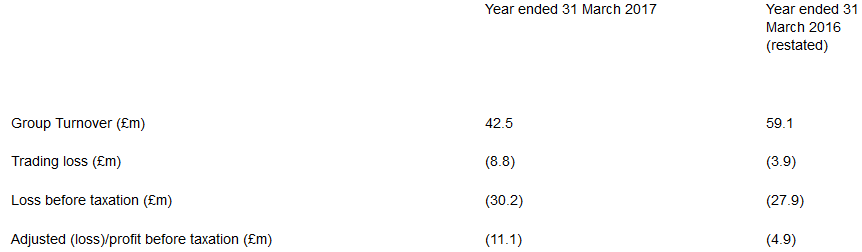

While many other companies have reported their interims for the period ended June, Stanley Gibbons today gives us its final results for the period ended March.

Half of the 28% reduction in turnover is due to a disposal, so like-for-like sales are 14% lower.

Trading conditions have "remained difficult" and "trading continues to be subdued", so I can only presume it is still loss-making at the moment, perhaps heavily so.

The red ink means that even with a variety of business disposals (reversing the acquisition spree), which raised £5.2 million, borrowings have remained elevated. At March 2017, total borrowings are reported at £16.5 million. They are now £17 million.

And the company remains in technical default:

Due to the qualified audit report in these financial statements and the Group's net assets being below £20m, the Group is currently in default on its bank facilities and the Company remains dependent upon the bank's ongoing support. There can be no guarantee that the bank will provide facilities beyond 31 May 2018 and the Company is likely to require access to further liquidity in the intervening period.

The Full Strategic Review is nearing completion; the Board is in negotiation with "several parties". So a big deal might be announced soon.

My opinion

I give management a lot of credit for keeping the business alive to this point, I think it could easily have folded already.

Total borrowing capacity is £17.6 million. As of last week, the headroom was just £0.6 million. £1.25 million is due from a disposal, but we can still assume that more funding is needed.

I still think that this market cap is much too generous, as I did when I covered it in December. Net asset value is reduced to £18 million and this includes a £5 million hit associated with admitting that revenue recognition had been too aggressive in relation to its investment plans (recognising revenue at the start of the contracts rather than waiting to see how these plans evolved).

I don't see why any institutional investor would refinance this company at anything close to the March 2017 NAV, given the risks involved and the continued losses. So the market cap should be much lower than £18 million, in my view. Maybe a 50% discount would be fair.

Blancco Technology (LON:BLTG)

- Share price: 51.5p (-9%)

- No. of shares: 64 million

- Market cap: £33 million

Preparation of Preliminary Results

This is another stock I've been negative towards, but I suppose we can't have good news stories every day!

This data erasure specialist admitted last month that it's another example of a company recognising revenues too aggressively.

Today it tells us:

Blancco Technology Group plc announces that, because of the ongoing review of matters notified to the market on 6 July and 4 September 2017, it has become necessary to delay the release of its preliminary results for the year ended 30 June 2017, which were due to be announced on 3 October 2017.

My opinion: I thought it was uninvestable before, so clearly it is still uninvestable now. Public companies with large shareholders bases should be able to get their accounts published when they say they will. Another red flag to go with the sea of red flags at Blancco.

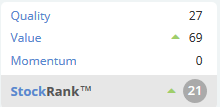

There is wisdom in the algorithms. Even though Stockopedia computers think there is some Value here, the poor Quality and the overwhelmingly negative Momentum do a good job of warning investors that something is rotten:

Hiscox (LON:HSX)

- Share price: 1297.5p (+1%)

- No. of shares: 286.5 million

- Market cap: £3,717 million

Updates on Hurricanes Harvey and Irma

This is not a small-cap but I want to talk about a good company and the big-ticket insurer Hiscox is undoubtedly one of those.

The recent hurricanes killed over 100 people between them and caused massive devastation and disruption for millions.

The cost to Hiscox is estimated at US$225 million:

Although there is still a degree of uncertainty around these hurricanes, this is within the Group's modelled range of claims for events of this nature, and we still have depth of cover in our reinsurance programme.

I personally want to buy shares in Hiscox again, but I've been put off by the market cap over the past while, at 2x book value, which is quite a lot to pay for any insurer. The insurance industry overall has seen huge inflows of capital in recent years, driven by low interest rates, increased risk tolerance and benign claims experiences.

From an investment point of view, it's tempting to wait until costly claims experiences increase pricing in the industry and perhaps drive out some of the excess capital.

The Hiscox CEO sees pricing going back up as a consequence of recent events:

"These events are already having an impact on rates in the global insurance market, particularly in affected areas and specific sectors. After a number of years of rate reductions, we are starting to see price corrections, most acutely in affected lines such as large property insurance and catastrophe reinsurance, which we expect to spread to non-affected lines. Although these are huge insured events, sadly, they also highlight the lack of cover in places."

I'll hold off on buying Hiscox just yet, but it's on my watchlist.

Treatt (LON:TET)

- Share price: 464.4p (+1%)

- No. of shares: 52.1 million

- Market cap: £242 million

This ingredients company is another decent stock to counter-balance some of the bad ones mentioned earlier in this report.

According to this update, trading remains strong and profit before tax and exceptionals will be comfortably in line with the upwardly-revised expectations.

At the half-year report, operating profit jumped almost 60% to £5.9 million.

Scrolling through the updates from throughout this year, I see a multitude of references to prior expectations and revised expectations. It's not Treatt's fault in particular but, as usual, there is a game involved in finding out what the expectations actually are!

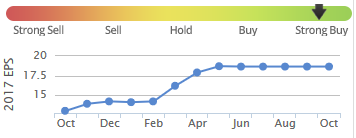

Stockopedia provides the broker consensus EPS as follows:

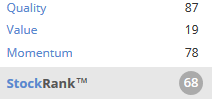

That makes for an 18.65p EPS forecast, putting this firmly in High Quality/Low Value territory:

Reading through today's update, we see that revenues are up 19% at constant currency, with an additional 5% FX tailwind.

Net debt at year-end (end-September) is £11 - £13 million, and if we delve back into the half-year report we find that's an increase of up to £5 million. A new UK site and expansion of the US site will increase this while enhancing capacity and capabilities.

Overall, it sounds like management have performed extremely well:

As previously stated the Group will therefore have met its 2020 strategic objectives three years early. Looking ahead, the Board has approved a strategic plan to drive the business through to 2022 which seeks to build on the success of the last five years.

This isn't a stock I've ever held. It's probably one that I need to analyse further, because it might prove to be worth buying and holding for the long-term.

There's nothing else that has caught my eye this morning, so I'll leave it there for now.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.