Good morning folks!

Accrol Group (LON:ACRL)

- Share price: 132p (pre-suspension)

- No. of shares: 93 million

- Market cap: £123 million (pre-suspension)

Paul speculated last week that this tissue supplier would not be put into administration over its net debt, which was last reported at £19 million.

Today we have confirmation that directors think a solution will be found:

The Directors believe that the current challenges facing the Company relate largely to FY18 and are likely to have less of an impact on the Company's trading performance in FY19. The Board are therefore confident that, whilst there can be no guarantee, a solution will be found to the Company's short term funding requirements.

Certainly, this is comforting. What is the probability of a solution being found, then? 60-70%. perhaps?

If a solution can be found, it then becomes a question of how much dilution is needed to steady the ship.

The PE outfit which floated Accrol is still on the register. I'd strongly suspect they are more interested in continuing to divest rather than increasing their stake. So it will be up to the nearly half a dozen other institutions involved, in cooperation with the bank, to figure it out.

If we assume that earnings will return to an approximately "normal" level next year (PBT c. £8 million), but then apply a discount for loss of trust over this incident, and for the debt level, and for the potential HSE fine, then existing equity looks worth maybe 40% of the level it was at pre-suspension?

YouGov (LON:YOU)

- Share price: 300p (+2.6%)

- No. of shares: 105.1 million

- Market cap: £315 million

Some nice results from this market research firm, suggesting that I've been too harsh on it in the past. Although valuation remains a concern.

Current trading is in line with expectations.

For the year ending July:

- Group revenue increased by 21% (9% on a constant currency basis)

- Data Products and Services revenue up by 37% to £47m (24% on a constant currency basis); now represents 44% of Group total (2016: 38%)

- Cash generated from operations (before paying interest and tax) increased by 37% to £19m (2016: £14m)

Excluding the currency tailwind arising from US/international sales, the constant FX growth is stronger than the market as a whole and it has been for 3 three years now. Bear in mind that the growth is being achieved organically, which is always encouraging and actually not very common!

Organic growth has had the side-effect of leaving the company's cash balance to grow, another bonus for shareholders.

Staff numbers are up by 87 to 779 - very important to keep track of this. Staff costs are 50% of revenue.

My opinion: I'm increasingly impressed by YouGov as a business. From what I can gather, it is a true market leader, with excellent international growth opportunities.

My main gripe is with the accounts. I think the accounting rules are there for good reasons, and the amortisation of intangibles (which YouGov ignores for its adjusted profit measurements) are an important part of the accounts. YouGov spent £7 million on intangibles according to these figures, including £3.5 million spent on recruiting people for its international panel.

These costs need to be accounted for, not ignored, so I would trust the £4.6 million net income figure before I trusted the adjusted numbers. On that basis, I still can't justify the market cap here!

XP Power (LON:XPP)

- Share price: £30.825p (+7.4%)

- No. of shares: 19.2 million

- Market cap: £591 million

Thank you to readers for the requests for coverage of this stock.

I last covered this supplier of power components at the half-year report in July.

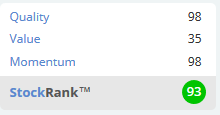

It was a Greenblatt "Magic Formula" stock at the time, although the Magic Formula Ranking has deteriorated a little since then due to a declining earnings yield (i.e. the valuation has increased). Return on capital is still excellent.

These attributes are encapsulated very well in the breakdown of its high StockRank:

So let's take a look at today's Q3 trading update:

Trading in the third quarter has been robust. Revenues for the nine months ended 30 September 2017 increased by 34% over the prior year to £123.9 million (2016: £92.6 million). In constant currency the increase in revenues was 21%.

Regular readers will know that I always focus on constant currency changes whenever possible. In this case, 21% is a fine result.

That's organic growth but the company is also looking to make acquisitions and indeed has already made a £17 million acquisition (announced last week). It used a new debt facility to complete the deal, so net debt is now c. £11 million.

XP pays quarterly dividends and increases the next dividend to 49 pence, up 9%.

Outlook is excellent and the full year looks set to be ahead of expectations:

We are encouraged by another quarter of strong order intake with our end markets remaining buoyant.

The Group believes it is continuing to take market share as its portfolio of industry-leading power technology products is increasingly designed-in to new equipment by our target customers. These design wins will translate in to orders as our customers’ projects move to production phase over the coming years.

My opinion: It's hard to find any faults here. XP is designing most of its own products, so it's got control of the intellectual property which is generating so much of the value here. It's enjoying real underlying business momentum and the acquisition strategy doesn't look too aggressive.

A premium rating is deserved and so in my opinion it's quite possibly still a buy at current levels.

Impax Asset Management (LON:IPX)

- Share price: 150.5p (+7%)

- No. of shares: 127.7 million

- Market cap: £192 million

It's a Q4/full-year update for this environmental asset manager.

AuM increased by another 9% in Q4 to £7.3 billion. That's pre-closure of the recently-announced US acquisition, which is set to take total group assets over £10 billion.

The movement can be broken down as 6% increase from flows and 3% increase from growth in the existing assets.

That's another fine result. The full-year result is 46% increase from flows and 15% increase from growth in existing assets.

I think it's worth adding a bit of caution that a small number of additional mandates can make a huge difference to the flow results. These are large and potentially one-off transactions.

The market cap to (pre-acquisition) AuM ratio is now 2.6% which is fairly average among asset managers as a whole, although arguably still inexpensive against active or specialist asset managers. Schroders (LON:SDR), for example, is trading at 2.3% of AuM. I would argue that Impax is a lot more specialised, although you could also argue that it's a lot riskier compared to its larger rival.

On balance, I'm still positive on Impax. I expect these quality ratios to improve in the years ahead, with increased scale.

CAP XX (LON:CPX)

- Share price: 15.125p (-2.4%)

- No. of shares: 298 million

- Market cap: £45 million

Audited results for the year ended 30 June 2017

Thanks to readers for the suggestion to cover this one, too!

I haven't looked at it before, and note that it is headquartered in Sydney. Accounts are denominated in AUD.

It's still early-stage:

Sales revenue of A$4.1 million (2016: A$5.0 million) and EBITDA loss of A$1.2 million (2016: A$0.7 million) in line with guidance announced on 7 June 2017

Royalty revenue of A$0.7 million (2016: A$0.2 million) up 177%. Q4 Murata royalty up over 50% on prior quarter, following major new product launches during the year. Introduction of additional product ranges by AVX during the year

Despite the worsening overall result (pre-tax loss is A$1.7 million, widening from A$1.3 million), the Board reckons that the IP/patent portfolio is in "strongest position ever".

The results published are for the year ending June. There is a lot happening at the company which might improve future results, e.g.:

- New licensing deals ("at least some of these to successfully close").

- Sales inquiries for prismatic supercapacitors are "at record levels". First large volume design win already announced.

- High-volume orders are expected in current financial year in relation to further IoT design wins.

- Negotiating with manufacturers over automotive opportunities which currently with customers for evaluation.

Cash is A$3.9 plus A1.5 million tax rebate expected.

The tone, as you might have guessed, is very positive. Interest in the small product range is "sharply on the increase" from the IoT (Internet of Things) market.

My opinion

I rarely go for "blue sky" shares although I try to keep an open mind as to whether or not they might eventually succeed.

In the case of Cap-XX, it does have a partial explanation for the fall-off in sales, as its manufacturing plant produced nothing for 7 weeks.

But I think scepticism is the right stance to take. It's not a new listing. Indeed, it listed all the way back in 2006, with the same founder-CEO in charge. At the time, it said:

'Floating on AIM is a real milestone for CAP-XX and is pivotal in our Company's aim to become the number one supplier of supercapacitors into the mobile devices market.'

'We believe that there is a fantastic opportunity in this market, as mobile handset providers seek to provide increasingly power hungry applications, such as quality flash photography. At present there is a widening gap between the power these applications require and the power current battery solutions provide. The attributes of the CAP-XX solution means we are ideally placed to capitalise on this by providing an immediate and easily accommodated solution to the issue of power in mobile devices.'

As you can see, back then it said that its products were going to revolutionise the next generation of mobile phones. Today, it says it is going to revolutionise the Internet of Things.

Anything is possible but scepticism is the correct stance, especially in the absence of confirmed sales.

That's all I've got time for today. Thanks for the requests and I'll see you again later this week!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.