Good morning, it's Paul here!

I'm staying overnight at the Royal Oxford Hotel, after a busy & enjoyable day at Stockopedia HQ yesterday. My head's pounding, as Graham dragged me to "ATIK" for some boogying after we had waved off the rest of the team at the Red Lion, plus a few stragglers that we picked up along the way. I felt like a ball inside a pinball machine, as drunken youth constantly & unapologetically lurched into me. People now really don't have any manners at all, do they?

I can't even make myself a cup of tea, after reading a horrific article in the Guardian recently, which revealed the unspeakable things that people do with communal kettles in hotel rooms - weeing in them, or boil-washing their underwear apparently. No wonder the Guardian has such a tiny readership, and ironically only still exists due to the financial support of an offshore trust - it really is the most gloomy, negative publication imaginable. I'm so glad I'm not left-wing - life must be hell if you only see the negatives around you.

Anyway, whilst I conduct emergency rehydration, I shall attempt to review the trading updates today from: MCB, CPR, BMY, SHOE. The hotel are intending to throw me out of my room at noon, so that might cause some temporary disruption to this article.

EDIT: Thanks to Trident, for reminding me about Gear4Music results, which came out at an unusual time yesterday. I haven't actually read them yet, but my broker read out the key points to me over the phone yesterday, and there don't seem to be any surprises. European growth is the excitement there, and UK still growing strongly too. I'll cover that later, once I've found a decent eatery with WiFi in Oxford. The nice thing about having a clapped out old laptop is that nobody wants to steal it. That's why I also use a cheap phone from Argos, instead of all that fancy Apple business.

McBride (LON:MCB)

Share price: 215p (down 6.6% today)

No. shares: 182.1m

Market cap: £391.5m

Trading update - McBride describes itself as;

...the leading European manufacturer and supplier of Co-manufactured and Private Label products for the Household and Personal Care market

Today it is holding its AGM, and updates us on trading in the early stages of year ending 30 Jun 2018.

Trading is in line;

At this early stage of the year the Board is comfortable that the business remains on track to deliver its full year expectations.

However, there is an H2-weighting comment, which unfortunately does tend to frighten the horses. Although as it's apparently been mentioned before, the impact on share price today is quite limited;

As we indicated at the time of our recent full year results announcement, we expect our current year financial performance to be weighted towards the second half of the year as increases in revenues from our "Grow" strategy begin to benefit the business.

Q1 (Jul-Sep 2017) revenues are down 6.7% in constant currency, and a "key contract" loss seems to have been mitigated with new business wins, and cost reduction.

The CEO sounds happy;

"The Group is making good progress on its growth initiatives, including the completion of the Danlind acquisition, while ongoing activity to deliver on our targeted opportunities mean we remain on track to see growth in our Household business as expected this financial year."

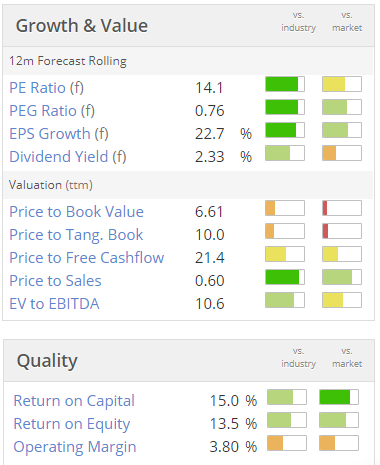

Valuation - are the shares good value? Everything seems to be expensive at the moment, so a PER of 14 seems a relative bargain. Although considering that the company has quite a lot of debt, it's probably not a bargain. The divi yield doesn't excite me either;

My opinion - there's been an excellent turnaround at this company. Personally I don't usually buy shares in any companies which supply supermarkets - because they're under constant margin pressure from customers with wafer thin margins themselves.

Carpetright (LON:CPR)

Share price: 175p (down 2.8% today)

No. shares: 67.9m

Market cap: £118.8m

Trading update - this will save me some typing;

Carpetright plc, Europe's leading specialist carpet and floor coverings retailer, today announces an update on trading for the 25 weeks ended 21 October 2017.

The paragraph below is the most important bit in today's update. I admire the clever wording of this, which seems to be couched in terms which soften the blow of a mild H1 profit warning;

"Whilst we expect the Group first half profit to be below that of the prior year, we are pleased with the improvement in sales in the Rest of Europe and beds in the UK over the past few weeks.

When these are combined with continued progress in our core flooring category we expect a significantly stronger second half with full year profit within the current range of market expectations.

That doesn't sound too bad. Although here at SCVR we generally don't like H2-weighting comments from companies. The reason being that it increases the risk of a full year profit warning, if H2 doesn't perform as well as management hope. Management everywhere tend to be optimists.

Performance in Europe is strikingly good - LFL sales up 6.3% in H1.

UK LFL sales aren't bad, up 0.8% - although disruption to the company's bed ranges masks a 2.1% LFL sales growth in the core flooring business - pretty good going, in a touch consumer environment.

Valuation - one broker note has entered my inbox today. It reduces PBT forecast for this year by 8%. This drops out at EPS of 16.9p - giving a current year PER of 10.4 - which looks about right to me.

Another number that jumps out at me, is the EV/EBITDA of only 3.8. That really does look good value. For retailers, EBITDA is actually a very useful number, as it approximates to cashflow, pre-capex. So it's misguided to simply dismiss EBITDA as "b***shit earnings". That description should be reserved for companies which are capitalising a load of internal costs - particularly software companies. But for retailers, deals are done on an EBITDA multiple - for a very good reason, as it gives a very good idea of how much cash might be available to repay debt in leveraged buyouts for example (once tax & maintenance capex are taken into account, of course).

Note that company hasn't paid dividends for several years, although a modest divi reintroduction is forecast for this year.

Balance sheet - looks a bit odd to me. There are lots of creditors over 12 months, which would need more investigation before I would consider a purchase.

My opinion - sentiment is very negative for many retailers at the moment - which makes sense, due to softening consumer sentiment, inflation, etc.

However, companies like CPR remain highly cash generative, so I'm starting to sniff around this sector for potential value. This is a very negative-looking chart though - so if anything, investor sentiment looks likely to get worse before recovering.

At some point though, this share could get interesting. I'd struggle to choose between this and Topps Tiles (LON:TPT) though - probably TPT has more appeal, due to its 5% dividend yield.

Bloomsbury Publishing (LON:BMY)

Share price: 163p (up 0.9% today)

No. shares: 75.3m

Market cap: £122.7m

Interim results - for the 6 months to 31 Aug 2917, are out today from this book publisher.

The results statement opens with this nice summary;

The Group saw strong growth in the first half and is trading in line with the Board's expectations for the full year.

Traditionally, sales of trade titles peak for Christmas and sales of academic titles at the beginning of the academic year in the autumn. We therefore expect our sales to be second-half weighted, as in past years.

An H2-weighting isn't a problem, if that's just the natural seasonality of the business. Checking back to last year's results, H1 reported £1.4m adjused operating profit, and H2 was £10.6m. So it's actually a hugely H2 weighted business. For that reason, there's little point in reporting extensively on these interim figures. So here are just a few numbers;

Revenues up 15.1% to £72.1m in H1

Adjusted profit before tax up 74% to £2.5m - whilst this looks a terrific percentage rise, it's obviously won't be anything like that high for the full year, due to the H2 weighting to profits.

Dividends - interim divi of 1.15p isn't much, but the total divis for the year are forecast to be 7.0p. That gives a good dividend yield of 4.3%.

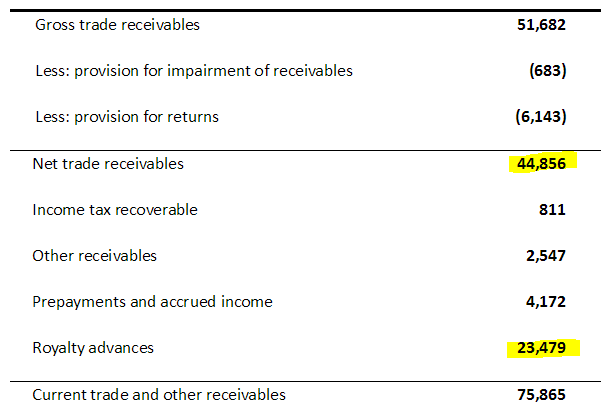

Balance sheet - this looks very strong. Here are the usual key numbers that I tend to look at;

NAV: £139.3m

NTAV: £76.5m (once goodwill & other intangibles are written off)

Current ratio: very strong, at 2.43 (includes £16.9m net cash (85% in 12 months)

Receivables strikes me as very high, at £75.9m. That's more than H1 entire revenues. Note 7 provides more detail, and sure enough, there are some additional items within receivables, especially royalty advances to authors;

Clearly then, receivables is tying up a lot of capital, but I suppose that's the nature of the sector in which BMY operates.

Anyway, my conclusion is that this is a very sound balance sheet, with this business being financially strong. So there are no concerns at all over solvency.

Outlook - there's plenty of detail given about forthcoming book releases, including Harry Potter, cookery, and others. The upshot is that everything seems to be on track;

As in previous years, the Group is targeting a number of new contracts from which we expect to deliver rights and services income in the second half of our financial year.

October is the peak period for academic book sales and Christmas for sales of consumer books. We therefore expect our results to continue to be second-half weighted, as in previous years.

Since the period end the Group continues to trade in line with the Board's expectations for the full year.

That sounds fine.

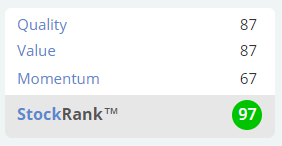

Valuation - current year (ending 02/2018) is for adjusted EPS of 12.3p. That gives a PER of 13.3. That feels about right to me, for a mature business which is not really generating any earnings growth. Bear in mind though, that you do get a decent dividend yield, and a strong balance sheet thrown in for that price. So it's not unattractive.

My opinion - it looks OK, but I just don't want to own a book publisher. To tempt me in, it would have to be on a sub-10 PER, and paying a 6%+ dividend yield.

As you can see from the chart, it's really just traded sideways for the last 2 years. So whilst investors would have received a nice stream of divis during that time, holding a static share has an opportunity cost. The money could have been better invested elsewhere, in something that has multi-bagged in the last 2 years. That's the big problem with this type of thing.

The Stockopedia computers are altogether much more excited by this company than I am. The Stock Rank is high (see below), and it's rated as a "Superstock"

Shoe Zone (LON:SHOE)

Share price: 161.5p (up 4.2% today)

No. shares: 50.0m

Market cap: £80.8m

Trading update- from this shoe retailer, covering the 52 weeks to 30 Sep 2017.

I'm quite surprised the share price rose today, as results are slightly below expectations;

The Group has traded well in the second half of the year and expects to report revenues for the 52 week period of approximately 158 million (2016: 159.8 million), reflecting the continued planned closure of loss making stores.

The business continued to develop during the year at pace with continued roll out of the new Big Box stores and expansion into new online channels. Despite the impact of the foreign exchange headwinds that continued through the second half, the Board expects to deliver full year Profit before Tax broadly in line with expectations.

Coincidentally, ShoeZone is another very heavily H2-weighted business, similar to Bloomsbury Publishing above. So the full year results are far more important than the interim results.

Another similarity is that SHOE has a good balance sheet. Net cash is reported as being £11.8m on 30 Sep 2017.

Its "big box" stores are performing well, with more planned.

My opinion - I like the business model of this show retailer. In particular, it usually only rents shops on short leases. With low fit-out costs, this gives it great flexibility - shops which don't trade profitably can be jettisoned quickly & easily. Whereas onerous lease liabilities are usually what kills many retailers. That isn't a risk here.

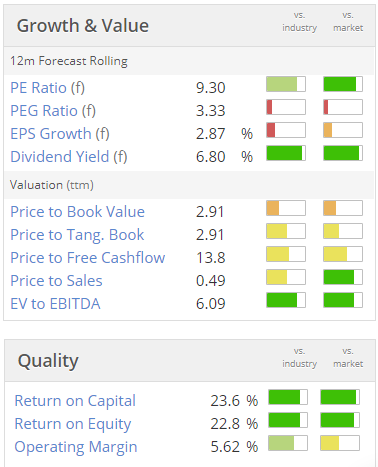

The valuation metrics, in particular PER and dividend yield, look very good. Also, the quality scores are surprisingly high;

I suppose the question is, how will consumer demand for cheap shoes hold up?

As a boring, high yielding share, I'd say this one looks worthy of consideration, for an income portfolio. It looks good value to me, but I'm not sure that there's much upside potential on the share price.

Gear4Music (LON:G4M)

Share price: 799p

No. shares: 20.2m

Market cap: £161.4m

(at the time of writing, I hold a long position in this share)

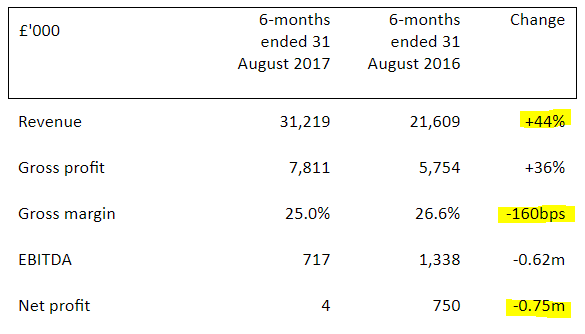

Interim results - covering the 6 months to 31 Aug 2017. Rather unusual circumstances - someone has made a cock-up here;

Gear4music (Holdings) plc, ("Gear4music" or "the Group") (LSE: G4M), the largest UK based online retailer of musical instruments and music equipment, has become aware that external parties have had sight of certain information from its unaudited financial results for the six months ended 31 August 2017, following a distribution error by a third-party research provider.

As a result, the Group is announcing the results for the six months ended 31 August 2017 below, ahead of the scheduled date of 24 October 2017.

The highlights table shows continued very strong revenue growth (all organic too), but margins under pressure (due to import cost pressure), and an overall breakeven level of profitability.

You might think that breakeven isn't a very good result for a company valued at £161m, but the market isn't really interested in profitability for this type of company. Valuations are currently more based on top line growth, rather than PERs, for eCommerce companies. I'm not necessarily saying that's correct, but that's what I observe happening.

Also, the company planned to increase costs in H1, to drive future growth;

As highlighted in previous announcements, we expected increased operational costs and investment in our customer proposition to restrict profitability during H1, but we are well prepared for a busy seasonal period and the Group continues to trade in line with the Board's expectations for the full year."

Growth in the UK is still impressive, but the overseas sales growth is looking much more exciting;

UK revenue of £17.9m (+30%) and International revenue of £13.3m (+70%)

Outlook - looks fine;

Trading in line to meet full year expectations

Remember that H2 is busier, as it includes crucial Xmas sales.

Average order value - is much higher than most eCommerce companies (e.g. fashion companies). It's £131.66 for G4M. So even though the gross margin is only 25.0%, that still equates to £32.92 gross margin per order (that could be including VAT, I'm not sure), which is good business.

US website launched. G4M has done very well in the UK, is growing strongly in Europe, so if they can crack the USA too, then we could see continued strong growth for years to come, hopefully.

Valuation - now the tricky bit! On conventional metrics, there's no disputing that G4M shares look very expensive. Panmures are forecasting EPS of 10.5p this year, 13.6p in 02/2019, and 17.9p in 02/2020.

So the forecast PER is 76.1 this year, 58.8 next year, and 44.6 the following year. Clearly a rich rating. Edison has slightly lower forecasts.

Research notes from Panmure and Edison were published yesterday on Research Tree.

My opinion - I remain very positive about this company, taking a long-term view. It's executing well, and management has navigated a lot of big issues well (e.g. forex movements, relocating its head office, international expansion including opening distribution centres in Germany and Scandinavia).

The opportunity is longer term, when profit margins should increase considerably. The point is that, once decent scale has been achieved, then the marketing spend (a major cost) reduces considerably. Also obviously as purchasing gets cheaper as volumes rise.

I've no idea what the share price will do in the short term, but I'm pretty confident that this will be a much bigger & more profitable company in future. As we've seen with Asos (where I have a short position) on a forward PER of 55.6, and BooHoo on a forward PER of 59.3, the market is prepared to pay up for successful eCommerce companies. The forward PER of G4M is shown on Stockopedia as 63.6, so it's on a slightly higher rating than Asos or BOO - reflecting that it's smaller, and likely to be faster growing in percentage terms.

It's up to each investor whether you think the price is reasonable or not. I think the price is full, but for good reasons. Investors are backing the longer term potential which is exciting, as G4M grows into a global eCommerce company.

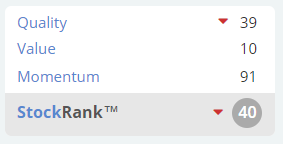

Stockopedia is not keen - a Stock Rank of only 40, and classified as a "Momentum Trap".

Right, all done, belatedly! See you in the morning.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.