Good morning!

This is the placeholder article, published the night before, to enable early comments and suggestions from readers.

Best,

Graham

Fishing Republic (LON:FISH)

- Share price: 22.75p (-40%)

- No. of shares: 37.9 million

- Market cap: £9 million

Trading Update and Board Changes

This retailer today falls below our £10 million limit but I certainly need to cover this trading update given it's one that Paul and I have been commenting on.

Paul has been a long-term bear on it (kudos to him!), whereas I previously thought it had some potential to be a winner for shareholders. Though I did have some big concerns about the recent interim results on 25 Sep, when gross margin collapsed from 50% to 36% and own-brand sales declined. At the time, I said it looked like the company might need another placing, given that cash had fallen to less than £700k.

The collapse in gross margin was a huge red flag, but the company justified it at the time by saying:

To support the new openings, we utilised discount offers to promote high value capital items. This led to a negative mix effect in the period as the balance between higher margin consumables and lower margin capital items changed.

Furthermore, the company anticipated moving back into profitability for the full year, so shareholders were still being guided that things were more or less on track.That was on 25 Sep.

The last seven weeks have apparently been terrible:

Since the Company last updated the market in September, the Group has seen a significant deterioration in trading. This reflects a substantial increase in price competition as major competitors and independent stores have aggressively sought to maintain their market share, particularly at the end of the main fishing season. As a consequence of this change in market conditions, for the first time this year, monthly like-for-like store sales reduced, with a decline of 13% in October. This is in contrast to like-for-like sales growth of 16% experienced in the nine months up to the end of September.

If you can excuse me for using the phrase, I think the 16% LfL sales growth in the first nine months of the year might be a bit of a red herring! Since I think at least a quarter of the stores being measured in that calculation were still very immature in 2016.

Management Changes - the company has appointed a new acting CEO with good experience driving online sales at SuperGroup (LON:SGP). The comments also make the right noises today about improving returns on invested capital, and "reducing and making better use of inventory".

My opinion - with hindsight, the loss in gross margin was the big red flag here. Commiserations to anyone who has held this through today's 40% decline.

Taking market share in this sector is going to be harder than originally thought.

The other big red flag during the interim results was the decline in the company's own-brand sales, which aren't mentioned in today's update.

If customers don't see value in the Fishing Republic brand, it makes it that much harder for the company to build any pricing power. In that case, the competitive advantage will have to come mostly from the company's scale and logistics capabilities.

But with cash running low, I don't see how it's realistic for the company to build and advertise a big e-commerce platform, particularly since it's now confirmed to be loss-making for the full-year. The only hope in that regard is that the the acting CEO is able to liquidate inventory and carry much lower inventory going forward, something that previous management failed to do.

The operations and IT directors have also left the company with immediate effect.

Since I now think that a Placing is necessary for the company to have any hope of achieving its ambitions, I'm going to have to sadly put these shares in my "uninvestable" pile. After it raises more money and steadies the ship, I will look at it again.

The StockRank offered a sensible summary of the investment merits here:

Beeks Financial Cloud Group

Continuing our IPO theme, today brings another "intention to float" announcement for AIM.

This is a small Glasgow-headquartered financial group which helps clients to trade forex and futures with low latency, i.e. very short delays in execution. It seems to cater to mid-tier clients who don't want to build this sort of trading infrastructure themselves. It has datacentres in nine global locations but less than 40 staff (including contractors).

A £7 million placing is on the cards, and an estimated market cap of £24.5 million. I can't find the mix of new and existing shares to be sold, so it's unclear how much money will be raised for the business versus how much will be raised to enable existing shareholders to exit.

There is some debt to be paid off, in the form of asset finance, so some of the new money will be earmarked for that.

Other uses for the new money might be to build new data centres or to make complementary acquisitions.

Revenue spiked in the latest financial year from £2.7 million to £4 million, and the company reports that it could sustain up to an additional £3 million in revenues from its existing operational asses.

These numbers are all rather small against the proposed market cap, so I can only presume that this is a high-margin business. It does report that it has been profitable every trading year.

The other thing is that everything cloud-related has a hot valuation these days, so investors need to be a little bit wary of IPOs which heavily promote their association with "the cloud".

Personally, I would have thought that any company using data centres for low-latency trading would by default be an online, "cloud" type of business, so I'm not totally sure about what differentiates this as such. The company says it's the following:

The Directors believe that organic growth can be achieved through enhancing and upgrading Beeks' self-service web portal, which sets the Group apart from other so-called cloud providers of Trading Software

Anyway, I'm sure we'll learn more in the weeks ahead.

Zoo Digital (LON:ZOO)

- Share price: 59.25p (-3%)

- No. of shares: 73.5 million

- Market cap: £44 million

It's my first time covering this software/media production business. It localises entertainment content for particular audiences - subtitling, captioning, dubbing - and writes software which can be used to deliver the content better. It has access to a network of over 3,000 freelance translators.

Its shares have multi-bagged over the past few months. Checking the archives, I see Paul wrote in June and remarked that it had tackled its balance sheet woes. In May, it issued 41 million new shares at 9p per share, partly in a placing/subscription, and partly in a deal with lenders. The CEO participated heavily in the fundraising.

It's open and honest about its customer concentration issue, and seems to be making great progress on that front. Its big customer is now 28% of sales, down from 47% a year ago and an incredible 64% two years ago.

With the shares down 3% today, the market is a little cool on this guidance:

"Trading in the second half of the year has begun well, with revenue expectations ahead of market guidance, balanced against our increasing investment to satisfy increasing demand and support future growth. The Board remains confident of meeting its full year management expectations for adjusted EBITDA and is excited for the Group's future.

It's an in line with expectations update for adjusted EBITDA, but the "increasing investment" forecast suggests that the bottom line and/or the cash flow won't be overly impressive.

This is another business which heavily emphasises its positioning in the troposphere:

ZOO's point of difference in the marketplace is its development and use of innovative cloud technology. This ensures that content is subtitled in any language and delivered to all the major online platforms such as Amazon, iTunes, Google and Hulu with reduced time to market, higher quality and lower costs. ZOO's agile, cloud-based business model...

At this point, I will now simply assume that any software/online business is in the cloud! After all, doesn't it just mean using a server hosted by the supplier to centrally store data, instead of storing data on the customer's computers? It's hardly such a mysterious or unusual thing these days.

Anyway, these are promising results from Zoo Digital (LON:ZOO). Revenues are up by 63% to $12.7 million, driven by subtitling and dubbing.

Despite that, it all adds up to a pre-tax loss as $1.3 million in positive adjusted EBITDA succumbs to various expenses including $500k in amortisation/impairment and $550k in total finance costs (of which $300k I might classify as unusual).

It's only a small loss of and I can see the case for adding back in some of the unusual finance costs so that the underlying result was indeed a small profit. And the company is guiding that operational leverage and net margins will yield better results in future as a consequence of all the investment taking place. But I can't help thinking that a pre-tax loss looks a bit disappointing against the large increase in revenues.

Balance sheet - while much improved (net debt has been reduced to $3.9 million), I think it's worth noting that the balance sheet is still very low in terms of tangible asset value. It has net assets of $7.4 million, but this includes $6.7 million of intangible assets, so the net tangible asset value is less than $1 million.

Also, growing receivables have been a drag on cash flow, and they increase again to $7.1 million, or nearly 100% of the company's equity value.

It's not distressed but it could use some positive cash flow to provide more of a buffer against its debt and to eventually allow for some dividend payments!

My opinion

Has made good progress, but still has a lot to prove in terms of profitability and cash generation. Throughout the past several years, it has usually been unprofitable. Of course, this could be the inflection point! I haven't seen enough evidence of that yet, but I should probably keep researching it.

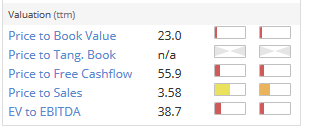

The valuation ratios below, which may need to be updated, highlight some of the things I've been talking about. Not much book value or tangible book value, and not much cash flow or EBITDA compared to the market cap or enterprise value (EV). The guys over at the Small Cap Growth Report might love it, but it's a different story at the SCVR.

That's all I've got for today! Paul is back tomorrow.

Cheers,

Graham

PS: I've been kindly informed by Andy at Equity Development that there are webinars tomorrow (Tuesday) for two companies which we have covered here recently.

To register for the Gattaca (LON:GATC) results webinar at 13:45, click here.

To register for the Blancco Technology (LON:BLTG) results webinar at 16:30, click here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.