Good morning and Happy Friday!

Thanks for the suggestions, I won't be able to cover all of them but will see how far I get. It's a surprisingly busy end to the week.

Best,

Graham

Indigovision (LON:IND)

- Share price: 116p (-29%)

- No. of shares: 7.6 million

- Market cap: £9 million

Trading Update and Board Changes

This falls below our cut-off minimum market cap as sadly it is another profit warning for this Scottish manufacturer of security systems (CCTV).

The stock has seen many false dawns over the years and confirms today that it will make an operating loss for 2017 with the following expectations:

- Revenues in the region of $41-$43 million (GN note: this compares to $46 million in 2016, $47 million in 2015). The Middle East "has experienced more difficult trading conditions, with unforeseen delays in securing a number of large contracts".

- Gross margins "likely to be a little ahead of those achieved last year", but total overheads "around 5% higher, due principally to the investment in the US".

- Current cash balances of $2.5 million and undrawn bank facilities of $4 million.

The CEO leaves after 14 years with the company, six of them as CEO.

My opinion - I haven't got much to say about this, that hasn't been said before. It's operating in a difficult B2B, contract-driven industry, the type that habitually runs into difficulty getting important customers and prospects to sign in a timely fashion.

Checking the archives, I see that only in May, the company announced a share buyback. Granted that it wasn't very large (5% of shares), and wasn't fully executed, but the announcement declared that the company saw a "persistent gap between the market valuation of the company and the Board's assessment of intrinsic value". The share price was more than double its current level, at the time.

The discount to intrinsic value must be even greater now, yet with declining USD-denominated sales (measured in GBP it's not so bad), and an operating loss, and a very patchy track record over a considerable period of time, the only hope is that the new CEO can breathe new life into it.

Unless you're very close to the company, I don't see how future contract wins can be predicted. Perhaps it would be better off fixing itself away from the glare of the public markets?

At least the balance sheet gives it some time to turn things around.

Caffyns (LON:CFYN)

- Share price: 425p (-4.5%)

- No. of shares: 2.7 million

- Market cap: £11 million

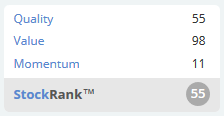

The car dealerships are all very cheap these days, and Caffyns is no exception. See the Value Rank which Stockopedia gives it:

The problem with this one is mostly I think just how small it is. The official bid-ask spread is 400p-450p, which is just too big. Of course depending on how many shares you want, you may find trades either inside or outside that spread.

But car retailers generally are cheap as the fallout from GBP devaluation continues and concerns mount over the UK consumer.

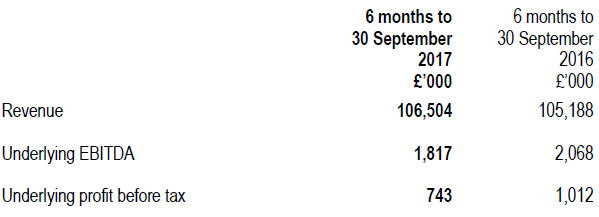

These results do indeed show continuing operations becoming less profitable. And note the very low margins which are typical for the sector, implying there isn't much spare room if the currency situation gets any worse. I'm guessing that volumes would need to shrink considerably in that case:

Like-for-like new car unit sales are down 7.4%, while like-for-like used car unit sales are up 4.6%. Sounds like consumer retrenchment to me.

Interestingly, the revenues moved a bit differently compared to unit sales across the different categories. Revenue per new car was higher, while revenue per used car was lower. So there's a bit more inequality in the system. From the stats given, Caffyns outperformed the car market as a whole.

Dividend is unchanged, while net debt nearly doubled to £10.3 million versus a year ago.

Pension deficit narrowed to £5m million thanks to a higher discount rate and investment returns.

Outlook is cautious. Caffyns has a heavy Volkswagen exposure: VW sales are recovering well, but with new car sales falling and general macro concerns, the company guides for caution for H2.

My opinion. Overall, it seems to be a tidy operation which is dealing with the challenges of the present economic conditions. Car dealerships face plenty of headwinds beyond their control, so they are as much a bet on the economy as they are on management.

In this case, management is family-oriented, usually a positive sign. Though the shareholder structure is unfortunately complicated by three types of preference share outstanding. There are 2,000,000 preference shares which have full voting rights, ensuring that the family retains control.

That's not necessarily a problem, but anybody who wanted to take over the company would find that buying ordinary shares on the stock exchange would not help them make very much progress at all - even if the shares weren't so illiquid. The ordinary shares don't give you the influence that they normally would.

That's a bit of a drawback for me. Still, it's good to have another point of comparison with other players in the sector like Vertu Motors (LON:VTU), Cambria Automobiles (LON:CAMB) and Pendragon (LON:PDG).

Miton (LON:MGR)

- Share price: 38.5p (+10%)

- No. of shares: 181 million

- Market cap: £70 million

This is a high-performing small-cap fund manager, going from strength to strength at the moment. Positive net inflows have been seen in H2:

The unaudited Assets under Management ("AuM") as at 31 October 2017 were £3,635 million and average AuM for the first 10 months of the calendar year were £3,287 million.

The Board remains optimistic about the prospects for the Group and profits for the full year are expected to exceed current market expectations.

Pre-tax profit (on an adjusted basis, I suspect) had been guided for £5.6 million. Another 10% on top then, perhaps?

Taking a quick look at the half-year report, closing AuM at June 2017 was £3,354 million. AuM is up another 8% in four months - that's excellent.

To me, this helps to prove that there is still room for specialist and high-quality active fund managers. Passive funds will continue to see strong inflows, but so will the active managers with a strong franchise. Miton is one of those.

This stock would be a potential buy-and-hold for me. I suppose the biggest risk is probably the key man risk associated with Gervais Williams. Although the fund manager team is quite large, so hopefully that risk is being managed well.

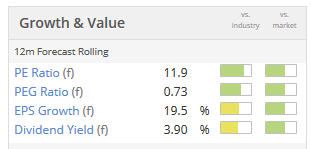

The valuation looks quite reasonable to me:

Sanderson (LON:SND)

- Share price: 71p (+12%)

- No. of shares: 55 million

- Market cap: £39 million

Acquisition of Anisa Holdings Valued at £12 million

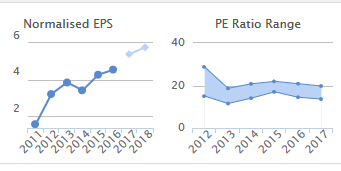

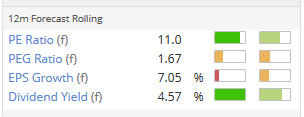

This is a provider of software to businesses in the logistic and manufacturing industries. Shares have been trading within a 60p-90p range for the last few years. Valuation has been getting cheaper as results have improved:

Indeed, the current forward (next 12 months) PE ratio is just 11x. Quite cheap by today's standards.

This is a large deal compared to the size of Sanderson, about a third of the market cap before the announcement. Anisa sounds like a similar outfit to Sanderson, also providing ERP (enterprise resource planning) to business customers.

Anisa complements the Enterprise division of Sanderson and the enlarged, merged business is expected to provide and develop incremental and synergistic market opportunities.

Operating profit at Anisa last year was £380k, on £10 million of revenues, of which over half was recurring.

Against that operating profit number, £12 million sounds like a lot to pay. But then, perhaps 2017 has been stronger? Also, £1.6 million is deferred and the £12 million figure includes the amounts necessary to pay off Anisa's debts.

Still, it's hard to come up with a scenario in which this is a "value" acquisition, based on the numbers.

It sounds like it was a very friendly deal, according to the blurb given, which is a good omen:

"Anisa and Sanderson have known each other for many years and though this transaction is a Sanderson acquisition, it feels more like a merger. Whilst Anisa and Sanderson have rarely competed in their respective target markets, they are very complementary in terms of their ethos and business model - providing cost-effective solutions, supported by providing quality service to customers thereby building and developing long-term relationships. The strategy of the combined business is to continue to develop the existing range of products and services delivered to existing customers; to further invest and develop the Anisa relationships with strategic partners and to provide additional investment in order to accelerate growth opportunities by attracting even more new customers.

My opinion

It sounds promising to me.

Although this is another small B2B group, customer concentration doesn't seem too overwhelming. I've just checked the 2016 annual report, and there was one customer who accounted for 12% of revenue. I suppose that's to be expected.

Now it will be all about execution of the "merger". On balance, you'd expect them to pull it off, based on their track record. So the shares could be a reasonable buy, in my opinion!

Future (LON:FUTR)

- Share price: 382p (-0.5%)

- No. of shares: 45.4 million

- Market cap: £173 million

This is a publisher of special interest magazines, which now describes itself as a "global platform for specialist media". Magazine revenues are now c. 60% of revnues with the rest coming from "digital display", eCommerce and events.

There have been some acquisitions over the past year, so I'm particularly interested in the organic growth numbers. Overall group organic revenue growth was 8%.

Breaking it down by divisions:

- Media division revenue up 43% to £34.1m (2016: £23.9m) of which 34% is organic growth

- Magazine division revenue up 43% to £50.3m (2016: £35.1m), driven by the acquisitions of Imagine Publishing, Team Rock and Home Interest

So the media division is where the organic growth is coming from.

The company gives us a strong adjusted EBITDA figure. However, the statutory numbers are much lower:

· Adjusted EBITDA** increased by 112% to £11.0m (2016: £5.2m), reflecting margin expansion through change in revenue mix and revenue growth across both Media and Magazine divisions

· Continued growth of adjusted operating profit up 218% to £8.9m (2016: £2.8m) before share based payments, amortisation of acquired intangibles and exceptional items of £8.1m (2016: £17.0m) and reported operating profit up to £0.8m (2016: loss of £14.2m)

I recognise some of Future's brands, and have a positive impression of them (TechRadar, PC Gamer, etc.), so it will be interesting to seeif it can return to its formerly strong financial performance. It has a track record going back at least to 1998, and seems to run into a bad patch periodically.

It's now thinking about paying a dividend again, although it took on £10 million of debt over the past year which it's also quite keen to reduce:

In light of the continued focus on debt reduction, confidence in the Group's growth strategy and the continued development of the business leading to more consistent cash flows and diversified revenue streams, the Board is now in a position to consider returning to paying a dividend to shareholders, whilst maintaining sufficient resources to continue investing in the business.I would not expect any dividend to be particularly large.

My opinion

Overall, I consider this share to be "up with events" (to borrow a phrase from Paul. When I covered it in May, at a £75 million market cap, I was leaning toward the view that it was undervalued.

While it's true that a £22 million placing has taken place since then, the market is up in total by £100 million since then. That seems plenty for now!

That's all for today, thank you for dropping by.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.