Happy New Year!

It's a quiet start to 2018, news-wise. Everyone is either still on holiday, or only today back in the office after their break, so there aren't too many updates for us to digest.

I'm going to take a look at Inland Homes (LON:INL).

(Please note that I own shares in Inland Homes)

Inland Homes (LON:INL)

- Share price: 62p (+3%)

- No. of shares: 201 million

- Market cap: £125 million

Strong end of year momentum and positive outlook

This is a decent little house-builder with a good track record of paying dividends since 2012, though it has been listed since 2007. I covered it once last year, and Paul has also written about it several times over the past few years.

It operates in the South and South-East of England regions, owning land from Poole/Bournemouth through Greater London and up to Colchester and Ipswich.

This is a nice little update:

"As we head into the New Year, Inland Homes is well placed to achieve further significant growth in 2018, with the in house construction team now well established and beginning to bear fruit. We have had an extremely productive period, culminating in a number of profitable land sales and a growing order book for Inland Partnerships, our new business principally dedicated to delivering residential units for housing associations and other residential landlords such as PRS funds or Local Authorities. Our housebuilding programme is at a record level, with over 500 homes currently under construction and a healthy pipeline of new development projects in place for the coming months, supporting our positive outlook."

Recent activity growth has indeed been superb at Inland. It is forecast to produce c. £133 million in revenues in 2018 (prior to today's update), versus £91 million in 2017.

Today's update also spells out £13 million in land sales and describes a new purchase for a 40-home site in Berkshire, near the forthcoming Crossrail network. We additionally learn about a £29.5 million building contract secured by its subsidiary, Inland Partnerships.

As you've probably guessed from the disclaimer at the top of this section, I've decided to get my feet wet and purchase a few shares in this company. The size is less than 2% of my portfolio.

I don't expect huge returns but the level of risk should be limited by the fact that Inland had NAV of 61.75p per share as at June 2017 (using cost value of properties), or 86.45p if you include the unrealised value within projects (the so-called "EPRA NAV").

So the share price now doesn't give any premium for the unrealised value which had already been created up to last June - never mind the additional value which may have been created by Inland's activities since then.

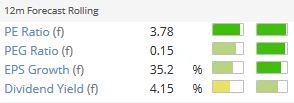

The yield has improved, thanks to dividend increases, which was one of the criteria for buying it which I suggested when I covered this here last year.

Risk factors

At the end of the day, this is still a relatively small house-builder with exposure to success or failure on specific projects. Though scale is improving, with 500 homes under construction, so hopefully this risk will lessen over time.

There is also the great imponderable of house prices. According to a recent RICS survey (external link), house prices in London and the South-East will fall in 2018. In Q3 2017, South-East house prices lagged the rest of the UK for the first time in three-and-a-half years. The negativity surrounding London pricing is said to be rippling out to neighbouring regions.

In terms of financial structure, the company is just over 50% financed by liabilities rather than equity. The balance sheet includes c. £76 million in loans. This looks manageable to me.

Conclusion

The house price bears will eventually prove right. But I'm willing to risk a small portion of my portfolio on this stock given the discount to EPRA NAV, the company's good execution so far, and its reportedly strongly-rising activity levels.

The nice thing about opening small positions like this is that it can be the prelude to deeper research and buying more, if my conviction grows.

Caledonia Mining (LON:CMCL)

- Share price: 535p (+5%)

- No. of shares: 10.6 million

- Market cap: £57 million

Caledonia declares quarterly dividend

As regular readers will be aware, I very rarely cover the mining sector.

But I want to mention this as it is one of the very few small mining companies which has proved it cares about investors by paying a consistent, regular dividend for several years in a row.

Perhaps even more remarkably, it has barely diluted shareholders at all over the past 10 years. This is a rare achievement in the sector.

The company owns 49% of a gold mine in Zimbabwe, whose Mugabe presidency has just ended and where the potential for economic growth could be enormous under new pro-business leadership. Recent political events in Zimbabwe coincided with a huge increase in the Caledonia share price.

The reason for Caledonia's 49% stake in the mine is due to policies restricting majority-foreign ownership of Zimbabwean assets. I wonder if the company might be able to make bigger investments under the new policy regime?

Anyway, today's update confirms that the company will pay another quarterly dividend worth c. 5p at latest GBPUSD exchange rates.

It's a nice update which says that the plans are still on track to reach production of 80,000 ounces per year by 2021.

So I thought I should flag it in case there are readers who would have an interest in the mining space. The Value Rank and Quality Rank are both very good. Clearly, the risk level is extreme when you are buying a minority stake in the natural resource of a developing country. But based on this company's track record, I would at least have a very high level of belief that the management here are trustworthy.

Sec SpA (LON:SECG)

- Share price: 121p (unch.)

- No. of shares: 12 million

- Market cap: £15 million

Acquisition of Newlink Comunicationes Estratégicas

This is an Italian (Milan-based) PR firm.

It listed in July 2016 at 151p, and the first 18 months on AIM have seen its share price drifting lower on almost zero volume. Indeed, the volumes are so low and trades so infrequent, the stock market listing does not yet appear to be justified.

Today, it announces that it is paying up to €2.25 million for 51% of a Colombian agency ("Newlink") which made an after-tax profit of €225k in 2016. Numbers for 2017 aren't given. It will be a base from which SEC will attempt to expand through Latin America.

I've just had a quick look at SEC's interim report for the six months ended June 2017. The results were pretty decent, including net profit of €431k.

2016 results had been disappointing, as the company acknowledged that it had failed to replace some extraordinary revenue sources from 2015. 2016 revenue turned out to be 25% lower than the prior year. And 2016 profits, even on an adjusted basis of €1 million, ended up being much lower than both 2015 and 2014.

So this is another instance of when IPO timing turned out to be a bit unfortunate for investors. Also, it didn't report the 2016 numbers until June 2017. There was a short trading update in May.

The CEO continues to own 69% of the shares, and with further stakes held by other Italian individuals, there are very few shares available in free float for British investors. I couldn't invest in something as illiquid as this.

Also, the usual disclaimers with respect to investing in foreign companies apply. As an Italian business, it should hopefully have a bit more integrity than the typical foreign entity we find on AIM.

The major risk I perceive is that liquidity never takes off, the company doesn't grow fast enough, and it ends up de-listing in a couple of years when it decides that the listing is simply not worth it.

There isn't anything else worth mentioning today, so I'll leave it there for now. I hope your 2018 has got off to a good start!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.