Hi, it's Paul here.

Please note that I added more company sections to Tuesday's report last night. So to recap on yesterday's report, here is the link. It covers the following companies:

Elecosoft (LON:ELCO), LPA (LON:LPA), Boku Inc (LON:BOKU), Eagle Eye Solutions (LON:EYE), Flowtech Fluidpower (LON:FLO), SCISYS (LON:SSY), Velocity Composites (LON:VEL), LoopUp (LON:LOOP), Lakehouse (LON:LAKE), dotDigital (LON:DOTD)

Please feel free to add your comments, and small caps requests below from 7am! I like it when readers give your own view, rather than just asking for mine! This is a team sport, so your views & ideas are welcomed.

I will start off by tackling 7 companies today - Fevertree Drinks (LON:FEVR) , Ubisense (LON:UBI) , Hostelworld (LON:HSW) , Empresaria (LON:EMR) , Hotel Chocolat (LON:HOTC) , James Cropper (LON:CRPR) , and Staffline (LON:STAF) - so since those are already on my list, there's no need to request them in the comments below.

Fevertree Drinks (LON:FEVR)

Just a brief mention of this premium mixer drinks company, as it's now way above our usual market cap range here. It announces today 2017 revenue of £169m, up 66% on 2016. This is also above the broker forecast of £159.3m shown on its StockReport.

Profits? "Comfortably ahead of market expectations". Talks about the global opportunity. There have been recent takeover bid rumours/speculation in the press. It's on a very high (c.60) forward PER, but when a company keeps beating expectations, as this one does, then the actual PER is lower than it appears. Well done to investors who spotted the opportunity here. A learning curve for those of us who held back from buying because it appeared to be too expensive - it's worth paying up for the occasional exceptionally strong growth company, because this type of company thrashes forecasts, repeatedly. They're few & far between though.

Ubisense (LON:UBI)

Share price: 44.5p (unchanged today, at 08:35)

No. shares: 73.1m

Market cap: £32.5m

Ubisense Group Plc (AIM: UBI), a leader in high performance Enterprise Location Intelligence systems through its RTLS SmartSpace and geospatial myWorld offerings, is pleased to provide the following trading update for the year ending 31 December 2017.

Growth of 25% in own product revenues has been partially offset by a reduction in "legacy third party services projects".

Outlook comments sound positive, although it uses the phrase "invest in" to talk about increased overheads, a phrase popularised by Gordon Brown. "Invest in" has even been extended now to cover discount pricing by retailers, to shift things that can't be sold at full price. So basically anything that reduces profits is now an investment, apparently;

The Company is continuing to invest in both sales capacity and further development of its software and hardware solutions. Ubisense enters 2018 with a strong order book for its own products, a growing sales pipeline and momentum with key customers.

Profitability - comments on this are conspicuous by their absence. Really, what is the point of a trading update which doesn't actually tell us anything about profitability? It should be a requirement that trading updates have to comment on profitability versus market expectations. That's really all that matters. So not saying anything about this, makes the statement pretty useless. It also doesn't fool anyone, because it means that things are, at best, lacklustre.

Cash - this is the latest position, so I'm wondering if it's possible to work out cash burn (and hence trading losses) from these figures?

The Company expects to report a cash balance of £9.1 million and a net cash positive position of £6.6 million as at 31 December 2017.

The last interims show net funds of £3.2m at 30 June 2017. Plus it raised £5.5m in a placing in Oct 2017. So at nil cash burn, it would have had £8.7m by 31 Dec 2017. The actual figure of £6.6m suggests that the company burned £2.1m in H2, less maybe £0.2m for costs of the placing, so just under £2m cash burn in 6 months - hmmmm, not very good, is it? Mind you, that's just continuing the ongoing theme of losses & cash burn, which this company has produced for the last 5 years. Its track record is very poor, which makes me surprised that investors are prepared to continue pouring in more money to fund its losses.

My opinion - this looks a very stale story to me. This company has been promising jam tomorrow for years, but seems to have made no commercial progress, still operating at a loss.

I wish them well for the future, hopefully it might one day succeed commercially. The technology does look interesting, and useful - but where are the profits, and dividends? There's not enough evidence of sales taking off to interest me. That might change in future though, maybe? Or it might not. I'm not prepared to gamble on what might happen. So this stock is really just for punters at the moment.

Hostelworld (LON:HSW)

Share price: 379p (up 5.1% today, at 09:06)

No. shares: 95.6m

Market cap: £362.3m

Hostelworld, the world's leading hostel-focused online booking platform, today issues a pre-close trading update ahead of its preliminary results for the year ended 31 December 2017 which will be announced on 10 April 2018.

This is how a trading update should be done! The first line tells me everything I need to know;

Results for the full year to 31 December 2017 are in line with the Board's expectations.

Although I wonder why they say "the Board's expectations"? That phrase is usually used when talking about part-years, where there are no specific market expectations. For the full year however, the update should tell us about performance versus market expectations, with a footnote to state clearly what figure (or range) the company believes market expectations actually is. The reason I'm writing this, is because I know from the email list that a lot of brokers & PR people read my reports here. So I'm trying to suggest ways that communications with investors can be improved.

I suppose we have to just assume that the Board's expectations, and market expectations, are roughly the same.

Revenues - more detail is given on 2017 revenues. I am surprised that the share price is up today, as this reads as rather lacklustre to me - there's not much growth being generated, for an online business. Indeed H2 only scraped into the positive, with 1% Y-on-Y growth. Unimpressive;

The Group has delivered 6% overall bookings growth for the year. Bookings growth in the second half was, as anticipated more modest, up 1% on H2 2016.

Bookings on its flagship Hostelworld brand increased by 13%, with growth in H2 2017 of 6%. Gross average booking value for 2017 was 11.5, flat on the prior year and up 2% on a constant currency basis.

The problem is that growth in the flagship brand seems to be cannibalising sales at the other brand.

The update today also mentions strong cashflow.

My opinion - I'm rather underwhelmed by today's update. It sounds like a mature business, rather than a growth company. My worry is that anything which is failing to grow fast in the online space is probably going to go backwards, in the face of stronger competition. There are so many booking websites for booking accommodation.

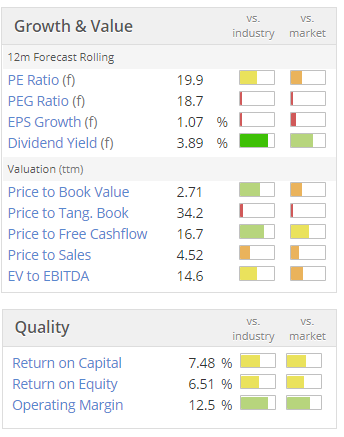

The stand out number below, in the usual Stockopedia graphics, is the dividend yield. So, unusually for an online business, it's the divis that are the main attraction. It's difficult to see much scope for share price appreciation, unless growth accelerates from the current, pedestrian level. I'd be more worried about somebody else (e.g. booking.com ) eating their lunch, and putting this business into decline.

I think OnTheBeach (LON:OTB) looks a much better bet, if you want to own an online travel business. It is priced at a similar PER to Hostelworld, but is demonstrating much better organic growth. Therefore I'd say OTB looks a better investment proposition. For the avoidance of doubt, I don't have a position in either company.

Empresaria (LON:EMR)

Share price: 105.5p (up 5.4% today, at 09:42)

No. shares: 49.0m

Market cap: £51.7m

Empresaria (AIM: EMR), the international specialist staffing group, today announces a trading update for the financial year ended 31 December 2017, ahead of announcing its final results on Wednesday 14 March 2018.

This company also follows best practice, with a simple first line (see below) telling us the key information. Well done! This approach is so useful for people who are under time pressure, and want to read as many updates as possible between 7-8 am.

Record profit, in line with market expectations

More detail is then supplied, including these commendably specific figures - which are much better than the general waffle that so many companies give us;

The Board is pleased to advise that full year profitability will be in line with current market expectations.

The Group is expected to deliver a record adjusted profit before tax, up approximately 20% year on year.

We expect net fee income to be approximately 17% ahead of the prior year and diluted adjusted earnings per share up approximately 9% on the prior year.

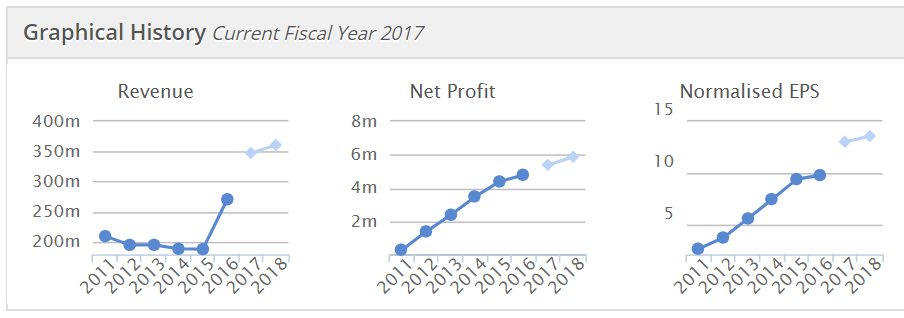

As you can see from the Stockopedia graphs below, there has been a smooth progression in profits. This has been helped by acquisitions, and a good geographic spread. Overseas earnings have benefited from conversion into weaker sterling in the last year.

Based on those graphs, this looks like a well-managed business. I've met the CEO & FD, and they both seem like safe pairs of hands.

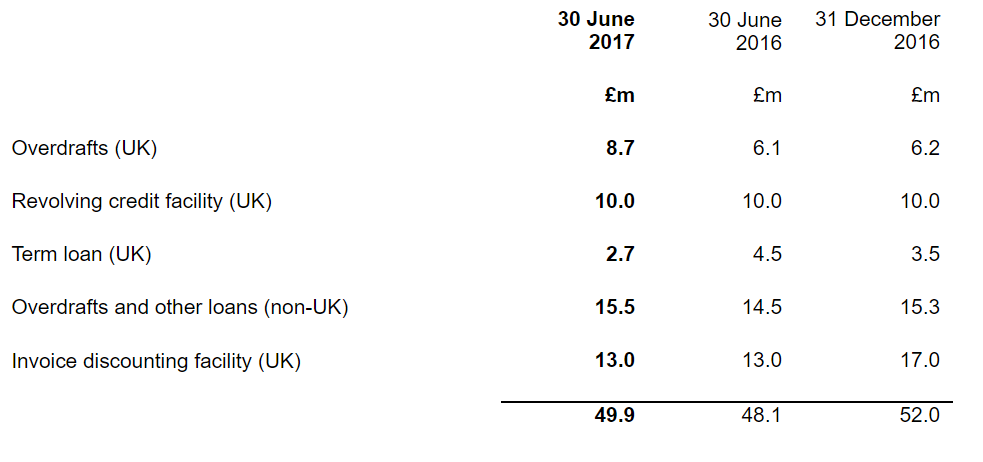

Valuation - it looks cheap on a PER basis. We have 2017 forecast EPS of 13.1p, rising to 13.6p for 2018. I make that a PERs of 8.1 (2017) and 7.8 (2018). That might look cheap, but bear in mind that Empresaria has quite a lot of debt, and a quite weak balance sheet by my criteria (I always write off intangibles - which are high here, due to multiple acquisitions). This balance sheet weakness is also reflected in a poor dividend yield.

My opinion - I'm surprised the share price has gone up 5% today, on an update that was in line with expectations. That should be share price neutral.

My hunch is that investors might be focusing on the lowish PER (although all small cap staffing companies are cheap), whilst ignoring the weak balance sheet & considerable debt. I'm not saying the debt is necessarily a problem, as the company looks well within its banking covenants (as disclosed at the interim results, which is an excellent disclosure, very helpful to investors). However, the valuation should be low, to reflect that a lot of debt is being used to finance the business.

Overall, I think this share is probably priced about right. Any further uplift in valuation would need to come from more acquisitions. Although that in turn would further weaken the balance sheet, unless more equity is raised. Overall then, I don't see much potential upside here for now, unless it starts beating forecast earnings (which it might do, as European economies seem to be recovering now). It looks a sound, well-managed business, probably priced about right.

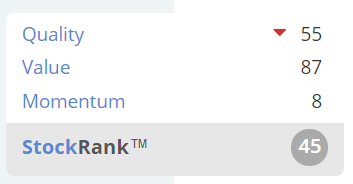

Note that the StockRank is a little low. This seems to be mainly due to a low momentum score - note that earnings forecasts were revised down a few months ago.

Hotel Chocolat (LON:HOTC)

Share price: 333p (down 2.1% today, at 10:49)

No. shares: 112.8m

Market cap: £375.6m

Hotel Chocolat Group plc, a premium British chocolatier and omni-channel retailer, today announces the following trading update for the 13 weeks ended 31 December 2017.

Revenue up 15% on prior year. Of that growth, 6% came from 10 new stores, bringing the total to 100. That's adequate, but not sparkling growth. Remember that with 10 new stores, costs will have risen considerably too.

Recent trading continues to be in line with management expectations.

No Christmas stock overhang.

Valuation - in a word, too high, for what seems to me a not particularly convincing roll-out, and fairly modest growth;

(insert picture here)

My opinion - this share looks far too expensive to me.

My biggest problem is that, having tried the product, it's just not very good. At best average tasting chocolate, at greatly inflated prices. That might fool people once, but I bet repeat visits are low. There's only so long people can be lured into buying things with fancy packaging & a posh-looking shop. That's just my personal opinion though, so other people may think the product is good.

Although judging from Trust Pilot reviews which can only be described as dire, the company seems to be alienating some customers with its poor online service too. I know that online reviews can be manipulated, but these speak for themselves - some very unhappy customers.

For me then, this gets a firm thumbs down. A trendy new brand that fails to deliver on product or service, won't remain trendy for long. Give me a Cadbury's Dairy Milk (whole nut, preferably) for £1.50 any day, over HOTC's overpriced, and fairly tasteless offering. So I would be more inclined to short this share, than to buy any.

James Cropper (LON:CRPR)

Share price: 1571p (down 12.1% today, at 11:15)

No. shares: 9.47m

Market cap: £148.8m

Trading update (profit warning)

James Cropper, the advanced materials and paper products group, provides the following trading update.

The current financial year will end on 31 Mar 2018.

As explained below, the company has been hurt more than expected by higher pulp prices (an issue that pole-axed Accrol Group (LON:ACRL) incidentally);

At the half year results, announced on 14 November 2017, it was stated that the full year's results for the Group were expected to be in line with the Board's expectations, notwithstanding a 2 million adverse headwind due to a significant increase in pulp price impacting the Paper division. The initial impact of this headwind was offset by interim cost savings and the trading strength of the Technical Fibre Products Division ("TFP").

Since the half year results announcement, however, the price of pulp has continued to rise beyond levels forecast by the Group's external specialists. The full year impact of the higher pulp price on the Group's pre-tax profits is now expected to be approximately 3.5 million, with a net impact, allowing for the strength of TFP's trading and the interim cost savings, of 1.5 million.

The Board, accordingly, expects pre-tax profits for the year to 31 March 2018 will be in the region of 5.7 million.

It's never easy to deliver bad news. However, in this case the company has explained it very well. Also I think that giving specific profit guidance in the last sentence above, has probably helped limit the share price fall today to only 12%. Specific guidance is always better than vague wording which we then have to try and interpret, and hence introduces uncertainty.

Valuation - Stockopedia shows forecast net (i.e. after tax) profit of £5.18m for 03/2018. That would probably gross up to about £6.2m. Therefore the £5.7m revised guidance looks like a fairly modest profit miss. I've not seen any revised broker forecasts as yet.

My opinion - with both Cropper and Accrol, the question is why they didn't have better hedging in place, to protect against increases in pulp prices? If their selling prices are on fixed price contracts, but a key raw material is at variable, and unpredictable prices, then that sounds a flawed business model. Either they need to better control the input price of pulp, or they need to build in automatic cost increases into selling price contracts, triggered by big rises in raw materials prices. Or a bit of both.

It sounds as if management is on the case on these issues;

James Cropper Paper's ("Paper") underlying performance year-on-year, excluding the effect of rising pulp prices, remains healthy with operating margins increasing in line with Board expectations.

Positive media reports on Cupcycling have generated additional interest in the Company's capability and brand.

Moving forward, the Company expects the pulp price to reduce to more normal levels over the next 12 months. Notwithstanding this, Paper is accelerating investigations into alternative strategies that should minimise the effects of such commodity price increases in future years.

I don't agree that the company can strip out pulp price, to arrive at underlying profits. Surely it's too fundamental a cost to ignore in this way?

The coffee cup side of things could be interesting - I haven't looked into that in any detail, but there might upside there? All those billions of disposable coffee cups going into landfill (as they can't be recycled presently) is certainly a topical issue. So if Cropper has a solution, and can patent it, then that might be exciting for the future, perhaps?

There was a 5-fold increase in EPS at Cropper between 2012 and 2017, which is highly impressive. So it might be worth taking a closer look at this company.

Staffline (LON:STAF)

Share price: 975p (down 3.1% today, at 11:38)

No. shares: 27.8m

Market cap: £271.1m

Yes, audited results, for the year ended 31 Dec 2017, published on 24 Jan 2018. That's an astonishingly rapid reporting timetable. How on earth is that achieved?! Can anyone else find another company that manages this feat? The finance department at Staffline must be absolutely tip-top to achieve such fantastically quick reporting. Why can't other companies also report this promptly?

Underlying profit fell by 1.1% to £36.3m. This was due to a tailing off (already known about) of the Work Programme scheme, which offset higher profits in the main business.

Further winding down of the Work Programme means that 2018 profits are expected to only be "slightly higher" than 2017.

Net debt has fallen sharply, from £36.7m to £16.5m at 31 Dec 2017, and is expected to be eliminated altogether from cashflows in 2018 (providing no more acquisitions are made).

Balance sheet - isn't that great actually. Net tangible assets is negative, at -£19.2m. However, the reason that net debt is low, seems to be that Staffline has good control over debtors - which seem to be collected in quite quickly, thus reducing the need to rely on bank funding.

Outlook - the thorn in this company's side, is the winding-down of the lucrative Work Programme scheme. On the upside, the company says that the new Apprenticeship Levy has "created a huge new market". Note that Staffline has proven to be adept at expanding into new markets in the past.

My opinion - given that 2018 profits are expected to be only slightly higher than 2017, I've decided to take a break from this share for the time being, as the short term upside seems rather limited.

Longer term, I'll want to revisit it, depending on how much upside flows through from new lines of business. It's an ambitious company that hasn't put a foot wrong, generating years of profitable growth. So a nice company, that I like a lot, but maybe not much immediate upside?

That's everything for today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.