Good morning!

Thank you for suggestions, which I will prioritise for coverage.

There are a lot of updates today, so I may need to be selective.

Regards,

Graham

SThree (LON:STHR)

- Share price: 368p (-1%)

- No. of shares: 132 million

- Market cap: £485 million

Final Results for the Year ended 30 November 2018

Mentioning this international STEM recruiter only briefly, for two reasons.

1) It doesn't get requested very much, and 2) its market cap is now pushing the limits of what we tend to cover here, after a strong share price performance over the past year.

I covered SThree a few times last year, and my overall stance on it hasn't changed. I think it's a very well-run international business with attractive geographical diversification and an excellent track record of profitable performance.

Today's results show further progress in the strategy to limit Permanent hiring activities, while expanding the more reliable Contract-based activities.

It's more and more international, as 81% of gross profits are now derived from outside the UK.

Some people might be reluctant to invest in this sector due to low margins and its hyper-competitive nature, and I can understand that position. But for an investor who does want to get involved in recruitment, I think this should be one of the first stocks they look at.

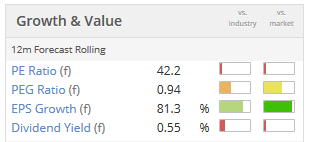

The algorithms are impressed too, giving it a StockRank of 97.

Utilitywise (LON:UTW)

- Share price: 41p (suspended)

- No. of shares: 78.5 million

- Market cap: £32 million

Temporary suspension of share trading

I haven't studied this utilities consultant in any detail before, as my modus operandi is to find things that I might like to buy shares in, and there were more than enough red flags to keep me away from this.

On Jan 17th, Paul highlighted (actually he put it in bold) the risk of the company failing to get its July 2017 accounts published in time to avoid suspension. It was an important warning for anyone holding these shares, as that is indeed what has happened.

Prior to suspension, Utilitywise was trading on an official PE ratio of 5x, but it was no bargain. The algorithms on this website had correctly, I think, identified it as a Value Trap.

The big accounting problem at Utilitywise is one of revenue recognition.

Something which I always reinforce is that revenue should be recognised in accordance with how much work has been done - not how much cash has been paid or will be paid.

At Utilitywise, revenue is recognised on long-term contracts on the basis of an estimate of how much value will be created over the life of the contract. Prior to August 2017, 85% of the total expected value of a contract was recognised on day one.

As admitted by Utilitywise, bigger contracts have under-performed, and the average under-performance (called "under-consumption") for all contracts over FY 2016 and FY 2017 was 18%, i.e. worse than the 15% under-performance which the company priced in.

From August 2017, the company has been using the new IFRS accounting standard for revenue recognition, IFRS 15 (external link), and assuming 20% under-performance.

But an independent accounting firm has reviewed the Utilitywise accounting policies and determined that they were inappropriate both for the old and new accounting standards.

Small contracts need to be treated more conservatively, and big contracts can no longer be treated using a simple percentage estimate of under-performance.

The accounts need to completely redrawn, in other words.

Without good accounting data, it's virtually impossible to understand the value of a potential investment, at least not in any quantitative way.

Maybe when the accounts are cleaned up and the financial situation has been clarified, I will look at this again.

Conviviality (LON:CVR)

- Share price: 316p (-12%)

- No. of shares: 183 million

- Market cap: £579 million

I am a long-time bear of this alcohol wholesaler and retailer, and have generally been on the wrong side of the share price.

Having said that, the last time I covered it, the share price was 386p. Perhaps the tide is turning

Trading is said to be in line with expectations for the full year. But although it isn't explicitly said, there is an implication that H1 did not quite go according to plan, and the shortfall will be made up in H2.

H1 was the period to October 2017:

- Revenue up 9% to £840 million

- Gross margin down to 12.5% from 12.8%

- Adjusted EBITDA up marginally to £23 million

- Adjusted net income down marginally to £12.3 million

- Statutory net income down 10% to £5.2 million

- Net debt of £133 million (had been at £96 million in April).

At lease one broker had been forecasting c. 4% growth in adjusted PBT for H1.

As an aside, for those of you interested in Revolution Bars (LON:RBG), it might be worth noting that Stonegate Pub Company (a previous bidder for Revolution) is one of Conviviality Direct's top customers.

In Conviviality Retail, like-for-like sales growth comes in at just 0.4%, or 2.3% excluding tobacco. For the last six weeks of the year, LFL growth was 0.6%.

As I covered recently, 127 new retail stores were added to its estate from a Palmer & Harvey subsidiary (P&H went into administration).

My opinion - I'll stick to my guns and continue to suggest caution, even though I have usually been wrong by doing this in the past.

The profit figures are said to reflect "the phasing of cost synergies into the second half of the year".

I think today's share price move reflects simple disappointment in the profit miss, and also maybe some fear that the cost over-runs and reduced margins won't be entirely offset by the cost synergies anticipated in H2 and beyond.

My major concerns are the low-margin nature of the work it does and its partially debt-fuelled expansion.

The constant use of "exceptional items" and the focus on adjusted numbers also leave me cold.

Additionally, I have a concern about its possibly excessive use of share-based payments. In the twelve months to October 2017, it generated nearly £18 million in profits, and spent £3 million of this on share-based bonus payments to its managers.

Finally, I think that today's H1 results were a profit miss, which is confirmed by the share price decline.

But with respect to results versus expectations, today's statement has merely expressed confidence that results for the full year will be in line. It doesn't actually say whether or not the H1 results were in line with the company's prior expectations. Would it be much trouble for this to be included?

Brokers are now forecasting that net debt will reach almost £150 million by the end of the current financial year.

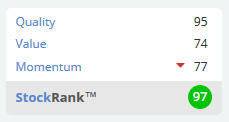

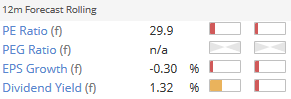

The algorithms give it a high Quality Rank. I'm not sure I agree:

Fishing Republic (LON:FISH)

- Share price: 10.25p (-2%)

- No. of shares: 38 million (before placing)

- Market cap: £4 million

This fishing equipment retailer is now too small for coverage in this report, but I just want to point out that it has raised new money, as was predicted. 13 million new shares raised at 10p.

It has also issued 1,000,000 shares to pay for consultancy services.

It made a loss in 2017 (accounts yet to be published) but has now refreshed its management team and hopefully doesn't need any more cash in the short-term.

Being firmly in the nano-cap space, it's too small for most of us to even consider investing in. All I want to point out is that the smart thing to do, if you were going to invest, was to not hold any shares until the Placing took place.

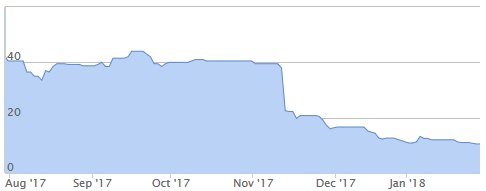

It had become increasingly obvious that more funds were needed (£700k left after a £1.4 million outflow in H1 last year). If you simply held off on buying shares until the Placing occurred, it would have made the world of difference to your entry price:

Coincidentally, Angling Direct (LON:ANG) also put out a little bit of news today.

Sopheon (LON:SPE)

- Share price: 575p (+17%)

- No. of shares: 10 million

- Market cap: £58 million

Yet another positive surprise from this software company, which has been on a roll for the past two years. Investors have been handsomely rewarded as the shares have multi-bagged:

We already knew that 2017 performance had been upgraded, but it is further upgraded today. Note the reporting in USD:

The Board expects that reported revenues for the year ended 31 December 2017 will be over $28m, up from $23m in 2016, and comfortably ahead of current market expectations. The Board expects that both EBITDA and pre-tax profits will be significantly ahead of current market expectations. The year-end net cash position is expected to be $9.5m (2016: $4.2m).

The business success in 2017 has a knock-on effect in 2018 due among other things to the recurring revenue it creates.

The company says that its "Accolade" software platform is being used in applications beyond the core "innovation management" it has been traditionally associated with. You can read about this software at Sopheon's website here (external link).

It's still undeniably a medium-sized business, having signed 59 deals with customers in 2017. $18 million of 2018 revenue is now visible as recurring revenue, up from $13 million a year ago.

My opinion - Research paid for by the company suggests that adjusted EBITDA will fall in 2018, due to spending to improve the software platform, but will then recover back to $7.3 million in 2019.

That might disappoint some investors if there is a pause in profit growth, but there are still some very attractive features to this stock.

Firstly, you have the strong cash position as noted above ($9.5 million).

Secondly, you have the company's recent track record of beating expectations. Perhaps its forecasts tend to be on the conservative end of the scale? No bad thing.

Finally, there is the intriguing potential of its software have much wider uses than previously conceived.

Overall, therefore, I retain my positive impression of Sopheon.

Carillion (LON:CLLN) (suspended) - Investigation into the audit of the financial statements of Carillion plc.

A post script on this story, with news that the Financial Reporting Council (the accounting watchdog) will be investigating KPMG's work on Carillion from 2014-2017. I've added the emphasis below:

The investigation will be conducted by the FRC's Enforcement Division, and will consider whether the auditor has breached any relevant requirements, in particular the ethical and technical standards for auditors. Several areas of KPMG's work will be examined including the audit of the company's use and disclosure of the going concern basis of accounting, estimates and recognition of revenue on significant contracts, and accounting for pensions.

It's the old chestnut of revenue recognition on long-term contracts, plus a few other very important questions.

There's a lot to be said for investing in businesses which don't have to worry about estimating the outcome of extremely complicated contracts!

Anpario (LON:ANP)

- Share price: 488p (-1%)

- No. of shares: 23 million

- Market cap: £113 million

This company makes animal feed additives, produced in the UK and exported around the world.

Today's update is in line with expectations. New senior managers have been recruited and the cash balance has grown to £13.6 million.

We haven't covered it very frequently in these reports, but maybe I'll put it on watchlist from now on? I don't know if he is still holding it, but it was previously held by Lord Lee.

The rating is rather high, reflecting the company's international growth prospects, with international sales said to be taking off very strongly (albeit from a low base). I need to investigate this company in greater depth, so will end my note here for now.

Yu (LON:YU.)

- Share price: 1115p (+9%)

- No. of shares: 14 million

- Market cap: £157 million

Trading Update and Notice of Results

This company provides gas and electricity to SME customers around the UK, with headquarters in Nottingham. It listed about two years ago.

According to its website, it wants to "unseat the big six".

This is an update for the full-year 2017. Revenues will be significantly ahead of market expectations. Overheads (including staff headcount) have been increased too, but operating profits should also be ahead of market expectations.

Based on its success catering for the medium sized corporate sector, Yu reckons that 2018 and 2019 revenues will be "substantially ahead of our previous expectations".

Broker research reckons there is a good chance of more positive surprises over the next few years, on the basis that there are still two million customers who haven't switched from the Big Six.

Trustpilot reviews, which according to the website's best knowledge are not being actively collected from customers, give it a 4-star rating - see here (external link).

My opinion - the high customer service levels promised by Yu are likely to require a substantial and ongoing investment in headcount as the company grows

This is borne out in the forecast operating leverage: according to forecasts, adjusted pre-tax profit margin is set to grow from 6.5% in 2017, to 8.3% in 2018, to 8.6% in 2019, during which period revenue is set to double. While there is some operating leverage to be enjoyed, the margins here are unlikely to explode higher.

It does appear to have a substantial growth runway, it pays a small dividend, and it's hard to fault its performance so far. All of these facts are perhaps already priced in now?

ITM Power (LON:ITM)

- Share price: 35.7p (+2%)

- No. of shares: 324 million

- Market cap: £116 million

This hydrogen energy company raised almost £30 million (gross) last year, to shore up its balance sheet.

That fundraising is included in the cash flow statement, published today, for the six months ended October 2017.

The company actively measures its cash burn, using this as a KPI. Cash burn for the six-month period was £5.1 million, significantly worse than the prior period, mostly due to heavy investment in PPE.

The order backlog has thankfully increased by £10 million to £27 million, versus 12 months ago. The "total backlog" (perhaps aggressively including "contracts in the final stages of negotiation"), has more than doubled. There have been some promising deals with Royal Dutch Shell (LON:RDSB).

Actual revenue remains very small for now, at just £1.4 million in these accounts.

The outlook for the second half is "exciting":

The second half of the financial year to end April 2018 looks set to be busier than ever when we will be beginning the process relocating to new manufacturing premises in the South Yorkshire region which will give us the additional capacity necessary to manufacture large scale electrolysers of 10MW and beyond. In addition the ability to operate under one roof is expected to provide important operational and cost synergies.My opinion - I'll reserve judgement on this, as it's too early-stage for me.

Revenues are still so small, they are no basis on which to make an investment.

In terms of the risk factors at play, at least the company should have enough cash to last it for a few years. But I do expect that investment will remain very significant: the CEO commented today that "scale is key", and moving into larger factory premises will doubtless be expensive.

Unsurprisingly, given the very low revenues recorded to date, there are only a few decent-sized paying customers so far. Four customers accounted for >80% of the revenues in this period.

On the positive side of things, there is the growing order backlog.

Hopefully, margins can improve: the gross margin was 9% in these results. Nearly all of the revenue came from construction contracts. Perhaps maintenance and fuel services, when they are material in size, will be higher-margin?

I don't think this is anything resembling a "value investment" but maybe someone with expertise in hydrogen as a source of power would think it was attractive?

Since we had quite a few trading updates and requests today, here's a reminder of the not-very-scientific criteria I use to decide which stocks to write about each day. Failing one or several of these criteria doesn't mean I won't cover it, but it reduces the likelihood. Paul and I may differ, this is just what I do:

- Market cap: £10 - £400 million market caps are the most preferred.

- Industry/Sector: I generally don't cover resources, pharma, investment funds and blue-sky stocks. I like consumer stocks, financials, software, property and industrials.

- Requests: This article is ultimately for the benefit of readers, so the more requests something has, the more likely it is I will cover it. Thumbs up on requests are also taken into account!

- Timeliness: Companies which have issued annual/interim results have priority. After that, companies which have issued interesting updates (results above or below expectations, for example). After that, companies which have issued updates in line with expectations. If there is no news, I am unlikely to write anything about it.

- Familiarity: Stocks which I have previously analysed require less work to analyse their news and write up a reasoned opinion on them. So if I've covered it before, it's more likely I will cover it in the future.

- Is it a good company? If it's not something I would ever invest in, because it's just a "bad" company, then I am less likely to write about it, except as an example of what to avoid.

This is the most scientifically I can describe my selection criteria for now!

A busy day in the market, thanks for dropping by.

Cheers

Graham.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.