Good morning!

Stocks crossing my radar today are:

- McColl's Retail (LON:MCLS) - final results

- MJ Gleeson (LON:GLE) - half-year report

- City of London Investment (LON:CLIG) - interim results

- Spaceandpeople (LON:SAL) - contract renewal

(Edit: the Photo-Me International (LON:PHTM) announcement wasn't interesting enough, so I've left it out.)

McColl's Retail (LON:MCLS)

- Share price: 237.5p (-5%)

- No. of shares: 115 million

- Market cap: £274 million

I've just been reviewing the arguments for and against this convenience retailer. We last discussed it here in December at the full-year trading update, just after the fall of Palmer & Harvey, one of its major suppliers.

Thanks to the trading update, we already knew that LFL sales were +0.1% for the year ending November 2017 (improved from minus 1.9% the prior year).

Now we get these figures:

Adjusted EBITDA up 20.0% to £44.0m (2016: £36.7m)

Net debt increased to £142.2m (2016: £37.0m), in line with management expectations

Profit before tax increased to £18.4m (2016: £17.7m)

Basic earnings per share slightly reduced to 12.3p (2016: 12.8p)

Sales exceeded £1.1 billion so the pre-tax margin comes in at 1.6%.

Looking back at my previous writings on this stock, my criticisms have been less to do with the specifics of the company and more to do with the sector. I've suggested that it's too competitive to be attractive, while others have suggested that good locations and scale provide some form of a moat against competition.

There is no denying of course that margins are very thin, and that the chosen strategy of debt-fuelled expansion elevates the risk.

P&H: I also warned that the replacement suppliers for P&H (in administration) might be less generous on pricing, which would impact margins at 700 stores.

Today we learn that there have been "some availability issues" and then "further disruption" in the new financial year, following on from this issue.

We have put in place contingency arrangements, entering into a new short-term supply contract with Nisa on 4 December 2017 for the affected stores. We also began our new supply partnership with Morrisons (agreed in August 2017) earlier than previously scheduled to supply these same stores with tobacco.

Whilst these contingency agreements have largely ensured continuity of supply, we continue to closely manage distribution to these stores and the disruption has impacted our sales performance. Total LFL sales for the 11 week period ended 11 February 2018 were down 2.2%, held back by sales in our stores formerly supplied by P&H where LFL sales were down 3.6%.

Those LFLs are a significant deterioration, and I think they imply that the non-P&H stores have not performed well either (since the -2.2% total LFL sales figure should be mostly driven by the c. 900 stores not supplied by P&H).

My opinion

The news isn't all bad. Gross margins improve slightly, as expected, as the company sells more food and fewer newspapers.

If you can look past the frictional costs associated with the Co-Op store acquisition (£5 million) and costs of closing underperforming stores (£3 million), then pre-tax profit was £26.4 million rather than the reported £18.4 million.

I would argue that there might regularly be costs associated with closing underperforming stores, so would not add back that £3 million. There is a stronger argument for adding back at least some of the £5 million acquisition costs, I think.

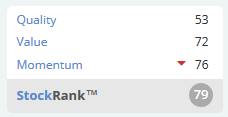

It continues to show an above-average StockRank. The dividend yield is not bad, either.

Ultimately, I can't get away from the company's weak LFLs, low-margins, low returns on capital (the balance sheet has ballooned to nearly half a billion pounds), and its exposure to macro forces (wage costs, inflation) which are beyond the control of any company. I also suspect that we haven't heard the last of the problems associated with its supply chain.

Hopefully I'll be proven wrong and can turn into a bull on this stock in due course!

MJ Gleeson (LON:GLE)

- Share price: 720p (+4%)

- No. of shares: 54.6 million

- Market cap: £393 million

This is a house builder and land trader. I've not studied it before, but I should, since I happen to own a few shares in rival brownfield developer, Inland Homes (LON:INL). (Gleeson builds for low-income families in the North of England, while Inland is based in the South of England).

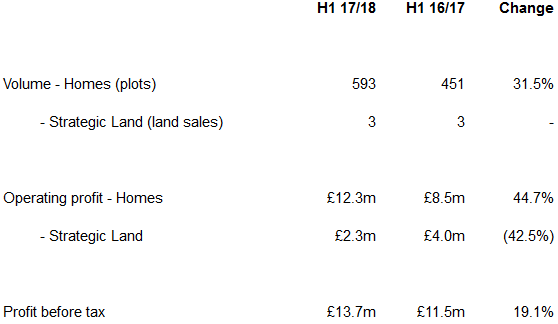

These are nice results:

The company reports ROCE (return on capital employed) at a whopping 26%. More companies should voluntarily highlight this metric!

Checking the operational highlights, the biggest driver has been the sheer number of homes sold, up 31.5% (as shown above). Average selling price also improved a little (2.5%), with a small improvement in gross margin too (i.e. costs rose at a slower pace than the average selling price).

The Strategic Land division did a little worse than last year, due to smaller sites.

The full-year outlook is in line with expectations.

There has also been more progress with the pipeline. Gleeson now has 12,000 plots (as of Dec 2017), versus 11,600 in June 2017 and 10,500 in Dec 2016. The number of sites and outlook for sites is very good too:

At 31 December 2017, we were selling from 59 sites, an increase of seven sites on the corresponding period last year. We expect to open a significant number of sites during the coming months and anticipate the number of active selling sites to be approaching 70 by June 2018.

I think I can see another big reason why the share price might be up today - investors happy with a new, more generous dividend policy. The company only requires dividend cover of 1.75x - 2.75x from now on (versus 2x - 3x before).

My opinion

Really impressive results, and I think this is reflected in the valuation. Net assets are £174 million, with very low leverage (total assets £210 million).

This gives a price to book value of 2.2.5x at the current share price, which doesn't allow for any uplift in property values which might not yet be recorded on the balance sheet.

Nevertheless, it's a much more adventurous valuation than my own holding, Inland Homes (LON:INL), which is only at 1x book value. Personally, I focus on book value first and foremost for this type of company.

On the other hand, if Gleeson continues to perform well for long enough, it will certainly grow into this share price and generate attractive dividends for shareholders while it does so.

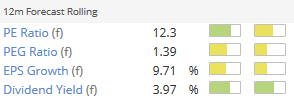

So if you're willing to put the book value to one side, and focus only on earnings and dividends, it does look attractive:

City of London Investment (LON:CLIG)

- Share price: 430.5p (+3%)

- No. of shares: 27 million

- Market cap: £116 million

This is a fund management company, primarily serving US clients.

Its primary strategy is to invest in emerging market closed-end funds (i.e. investment trusts and similar), using quantitative strategies to exploit discounts to NAV and other pricing anomalies in these funds.

According to the Chairman, the size-weighted average discount to NAV for its investments was 15%, before the "hiccup" in markets earlier this month. So there was "compelling value", even before the sell-off.

However, performance over the past year was behind the emerging market sector as a whole. CLIG's strategy earned 6.1%, versus 7.4% - 7.5% for emerging market indexes.

An underweight exposure to technology was partially blamed. Since I'm bearish on the NASDAQ and tech prices in general, I wouldn't have a problem with CLIG underperforming because of an under-exposure to the sector.

Funds under Management (FuM) grew well, total FuM now $5.8 billion as of January 2018. FuM was just $4.1 billion at December 2016. There has been big growth in developed market strategies and other products ("Global Tactical Asset Allocation" and "Frontier"), broadening CLIG away from its emerging market strategy.

The company has a policy of paying dividends with "rolling 5 year cover of 1.2x". That's a clever idea - shareholders get heavy dividends versus earnings, but the company gets to use growing earnings for its own purposes for a couple of years first. The dividend yield is in the region of 6.5%.

CEO succession - an internal candidate has been found to act as Deputy CEO, in advance of succeeding the current founder-CEO in December 2019. It sounds like a very orderly transition has been planned for several years already. No worries on this front.

Outlook from the Chairman sounds good:

Notwithstanding the major gains witnessed in 2017 across global equity markets, the exceptional value we find in emerging market closed-end funds and holding companies gives us confidence that we continue to be well placed to deliver strong relative returns. This, combined with the traction now achieved with our diversification products, justifies my confidence in anticipating a successful outcome for the full year.

(Side note: fund management companies are a great source of commentary on the financial markets in general, even if you don't want to invest in them - they are at the coalface, and have a great view of macro conditions.)

As noted in the discussion thread below in an excellent comment, CLIG benefits from doing its own research, and therefore is not affected by MiFID 2 restrictions on fund managers paying for research through their trading commissions.

My opinion

I'm warm on this share, and will add it to my watchlist as a potential buy.

Brokers warn about the lack of client inflows, and it is true that net flows have been lukewarm.

In the previous financial year, net flows were negative by over $300 million. In the six months to December 2017, they were only marginally positive.

However, the CEO argues that this is due to clients re-balancing after returns were too strong, forcing institutional clients to reduce their exposure to emerging markets back into an acceptable range.

The FTSE Emerging Index is up over 50% in the past two years, so this is quite understandable.

If you are an institution which wanted 15-20% portfolio exposure to EM, you will probably be forced to sell some of your EM holdings if it approaches 30% of your portfolio after strong returns.

In the CEO's words:

Our clients "weight us within their portfolios, and as markets appreciate, and based upon their prearranged asset allocation, if their exposure goes outside of a "range", they will rebalance.

If this helps to describe to shareholders both the cause and effect of client actions during this bull market it should also, as long as we outperform, help them value our shares during the next bear market.

I've warned many times before that fund management companies often benefit from positive investment returns and clients inflows simultaneously, while at other times they suffer from negative returns and client outflows simultaneously. This particularly applies to retail investors and "faddish" investment sectors.

CLIG argues that its client base is a bit more sophisticated than that, and is able to allocate funds in a more disciplined way, based on portfolio weightings. So when there is a bear market in EM, hopefully there will be a return to net inflows.

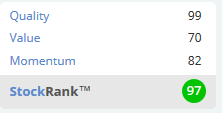

If this is true, it makes the shares look very interesting at a PE ratio of 10x:

Spaceandpeople (LON:SAL)

- Share price: 35p (3%)

- No. of shares: 19.5 million

- Market cap: £7 million

Contract Renewal and Expansion

This one is below our £10 million cut-off, but remains well-followed by readers of this report. It produces "experiential marketing" and promotions in areas of high footfall.

The share price has approximately doubled over the past year, so those who were brave enough to buy in when the market cap was just a few million pounds have been rewarded.

The full-year results are due on 26 March. We can expect a debt-free balance sheet with net cash of £1.9 million (adjusted for an expected working capital outflow) and pre-tax profit of £1.2 million.

As I remarked at the full-year trading update, this is priced as a super-cheap micro-stock. The official bid-ask spread is over 10% of the share price, so you have to be prepared for illiquidity, and the potential for things to go wrong as they have done before.

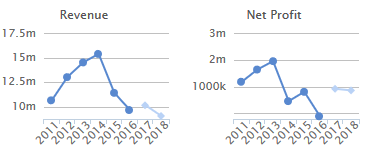

This graphical history tells the story:

Today's announcement sounds promising:

Landsec owns and operates 15 shopping centres and 33 retail and leisure parks in the UK and is one of SpaceandPeople's largest clients. The new agreement is a five-year contract to provide revenues from experiential activity, pop up retail and mobile promotion kiosks ("New Agreement").

The New Agreement extends across their portfolio of shopping centres including, for the first time, Southside Wandsworth and the newly relaunched Westgate Oxford. In addition, the New Agreement includes Landsec's retail and leisure parks, their three recently acquired outlet centres as well as their Central London business estate.

No numbers are given. However, the announcement was classified as "inside information" prior to publication, so the company must have considered it to be material for investors.

So we can afford to have a little bit more optimism.

The spread puts me off investing in this. If my timeframe was long enough, so that I could forget about the liquidity problem, I might consider it.

I'll leave it there for today. Thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.