Hi, it's Paul here.

Sorry this is rather late again.

Cloudcall (LON:CALL)

Share price: 165p (down 6.5% today)

No. shares: 24.08m

Market cap: £39.7m

(at the time of writing, I hold a long position in this share)

CloudCall (AIM: CALL), a leading cloud-based software business that integrates communications functionality into Customer Relationship Management (CRM) platforms, is pleased to announce its audited full year results for the year ended 31 December 2017.

This company has been a long-standing favourite of mine, and I'm firmly of the view that it is (at long last) gestating into a decent company. The problems before were that it kept running out of cash. As is nearly always the case with blue sky shares, it failed to meet the original targets. Also, it has taken much longer, and burned a lot more cash, than originally planned.

However, to my mind this company is now very clearly on it way to becoming a decent SaaS business - so think in terms of an earlier stage dotDigital (LON:DOTD) , or LoopUp (LON:LOOP) - both of which soared in value when they reached a tipping point where profitability became assured. The key features for a SaaS business to soar in value are;

- Strong organic growth

- High gross margin (hence lots of operational gearing as revenues rise)

- Mainly recurring revenues

- Low customer churn rate

Those elements are clearly in place with CloudCall, hence why I think it's now looking very interesting.

Here are my notes from skimming over the 2017 results;

- Revenues up 42% to £6.9m - organic growth of 40% or more very much interests me.

- Gross margin up 150bps to 80.0% - very impressive.

- Net cash of £4.9m should be fine for now (but how many times have we thought that before, only to find another placing is done?!)

- Bullhorn relationship is key - maybe it might acquire CloudCall in future?

- Overheads increased again, and set to rise further in 2018, due to beefing up of sales & development teams - this pushes breakeven out further, again.

- Strong growth in 2017, despite cash constraints, before the last placing.

- 2018 outlook - fast growth from Q2 suggested, as new sales team exit training & begin selling.

- New product launches imminent, which should drive incremental sales from existing customers.

- Outlook - strong start to 2018, in line with market expectations.

- EBITDA loss of -£1.9m looks an improvement on 2016 of -£3.0m.

- However, capitalised development spend shot up from £0.15m in 2016, to £0.91m in 2017. Add that to EBITDA, and there was little improvement in cash burn.

- R&D tax credit of £0.6m due to be received in the summer. As this is a material sum, we should probably measure performance using PAT, not PBT.

- Balance sheet looks strong, with sufficient cash.

- Cashflow statement - I make the cash burn £2.6m - the same as in 2016.

My opinion - I can see why some will see these results as glass half full. That's how I see it. For me, the company spending money on better products, and faster growth, is money well-spent. However, other investors might be frustrated that breakeven always seems so near, yet so far.

Broker forecasts have been revised down today for 2018, due to the increased spending to drive growth. However, that should pay off in 2019.

I'm in this one for the long haul, and am very confident it's likely to be a considerable success. You only have to roll the growth figures forward manually, to see that in say 2-3 years' time this could easily be a £100-200m market cap company. It's very difficult to find companies generating 40%+ organic revenue growth, on very high gross margins, and those revenues being monthly recurring revenues.

Admittedly I was about 5 years too early, with my bullishness on this share. But it's coming good, so I'm happy to continue holding for another 5 years, so long as the organic growth & high margins continue to hold. With growth companies like this, it's not about short term profitability. There is a big opportunity to build a much larger business, and it's right that short term profitability is subordinated to properly financing the growth. So this share perhaps suits long-term growth investors better, rather than people looking for a fast buck.

In a time when many smaller, more speculative stocks have sold off heavily, this one remains strong;

Pennant International (LON:PEN)

Share price: 94p (up 13.9% today)

No. shares: 35.7m

Market cap: £33.6m

This maker of simulation equipment seems to be on a roll.

An existing major contract has been extended by £3.5m.

Also, a £10m letter of intent has been received from a potential Middle Eastern customer. Although this is not yet a firm contract, it sounds like good news.

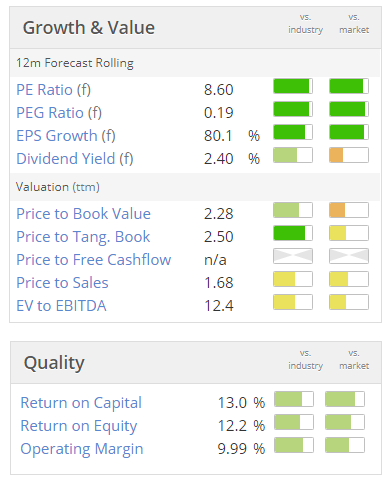

The valuation metrics are already looking attractive, and perhaps today's contract news might lead to further forecast rises?

My opinion - this seems a nice company, although subject to the vagaries of large, lumpy contracts. That's fine when orders are rolling in, but can lead to profit warnings when any gap appears in the order book.

I've struggled to get in or out of this share in the past, hence consider it too illiquid for my portfolio. However, for small portfolios, liquidity doesn't matter, so it might be worth considering if you're in that position. The company seems to be a successful operator, in a niche market.

Blancco Technology (LON:BLTG)

Share price: 62.9p (down 2.5% today)

No. shares: 64.0m

Market cap: £40.3m

Blancco Technology Group plc, the leading global provider of secure data erasure solutions and mobile device diagnostics, is pleased to announce its half yearly results for the six months to 31 December 2017.

Just a few brief comments from me, as I can't see anything of interest here. If you recall, this company was beset with problems & accounting corrections, under incompetent previous management. It's currently looking for a new CEO, said to be at an advanced stage.

- H1 revenue £12.6m (2016 H1: £12.8m)

- Adjusted operating profit £0.8m (2016 H1: £2.5m)

- Weak balance sheet, with negative NTAV

- Net debt £3.4m

- Cashflow was heavily negative, at -£5.1m in H1 2017

- No divi

- Outlook statement - waffle

My opinion - I don't see any attraction to this share. Maybe the new CEO can do something positive with the company?

Maybe GDPR might provide a stimulus to the company, as managing data securely is becoming an increasingly important thing? Personally I wouldn't be willing to pay a £40m market cap, just on hopes that new management can make something viable out of what has previously been a complete mess.

It might be worth looking out for any future substantial Director share purchases here. That can sometimes be a precursor to recovery. As things stand though, buying this share would currently be a total punt. I think it needs to strengthen its balance sheet too, which could be a discounted placing on the cards. It's not for me.

GetBusy (LON:GETB)

Share price: 30p (down 17.8% today)

No. shares: 48.4m

Market cap: £14.5m

2017 full year audited results

GetBusy plc (AIM: GETB), a leading document management software business, is pleased to announce its audited results for the year-ending 31 December 2017.

We don't have anything in our archive yet for this company, which floated on AIM in Aug 2017. Although I recall having a quick read of its admission document when I was bored, one weekend last autumn. So I have a "potentially interesting" mental note of it.

- Revenue growth of 20% in 2017, to £9.3m, most of which is recurring (i.e. good)

- Adjusted EBITDA improved from a -£1.7m loss in 2016 to a -£1.2m loss in 2017.

- Stripping out the IPO costs, it made a loss of about £1m in 2017. This seems to be a long way below the forecast shown on Stockopedia of a net profit of £1.0m.

- There might be some confusion over performance against forecast. I'm reading a broker note out this morning, saying the IFRS 15 has impacted the results negatively. On the old accounting basis, the broker says its forecast was beaten.

It therefore seems that IFRS 15 is a big issue. I should probably do some reading up on it.

My main concern with GetBusy is its weak balance sheet. Whilst there is £2.8m cash, this has more than all come from up-front payments by customers of £3.95m (deferred revenue creditor). The problem with this, is that deferred revenue can move about during the year, which might mean that cash could be tight at another point during the year. This looks to me like a company which needs to do a placing to strengthen its balance sheet.

My opinion - I like the growth, and the high margins, and recurring revenues. So it ticks the boxes which I mentioned above as being things to like at SaaS companies.

At a guess, it looks like another company which might benefit from GDPR.

On the downside, I'm not keen on the weakish balance sheet.

Overall then, it goes on to the watch list, as something which might be worth keeping an eye on, for a possible future purchase. I'd rather wait until its balance sheet is a bit stronger, and it's moved into profit (or closer to it than at present).

That's it for today, see you at some point tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.