Good morning, it's Paul here!

Graham is writing today's main report (Part 1).

This report (Part 2) is a bonus report from me, to catch up on some of the company reports which I missed earlier this week, due to generally getting bogged down, not sleeping very well, and feeling permanently tired (which makes writing difficult).

GAME Digital (LON:GMD)

Share price: 39.0p

No. shares: 172.9m

Market cap: 67.4m

(at the time of writing, I hold a long position in this share)

Changes in major shareholdings

All was revealed yesterday afternoon, with a series of "Holding in company" RNSs. I was correct that Elliott Advisors (Duodi) has sold completely, its 36.5% stake in GMD. However, my theory that Sports Direct might have bought the overhang, and launch a bid, was wrong (wishful thinking perhaps!). Our reader "Gromley" was correct - that the overhang has been placed with various institutions.

There are now some excellent new names on the GMD major shareholder list, in particular I very much like that Gervais Williams' outfit, Miton, has taken a hefty 13.1% of the company at 35p. Canaccord has taken 11.8% for discretionary clients (possibly something to do with Hargreave Hale, I wonder?), and J O Hambro has taken 5.1%. The balance I suppose would probably have been distributed to under 3% holders, hence not requiring disclosure.

All in all, whilst falling short of my hopes for a takeover bid, this is a very pleasing outcome. A huge overhang of GMD shares, which was clearly depressing the share price, has been eliminated in one fell swoop. We also have some respected institutions coming on board at 35p.

I reckon this endorses the bull case - the new strategy of developing "BELONG" format stores, both standalone, and within Sports Direct shops. That the deal was done at 35p, with the share price rising as the deal would have been underway, seems encouraging to me, looking at the recent chart (see below).

I imagine there would probably have been presentations to institutions, who clearly like what they heard. It's always good when placings (for new money, or secondary placings of existing holdings) are done into a rising share price, at no discount.

This deal should improve liquidity in GMD shares, and could trigger follow-on buying from institutions perhaps, if they like the company's future progress?

Also, I think it's now a lot harder for anyone (e.g. Sports Direct) to buy the company on the cheap. Previously, a bidder could have just offered to take out Elliott's entire stake (knowing that they were a willing seller). Whereas now that Elliott are gone, any bidder would have to convince the new, keen buyers of GMD shares, that a takeover approach is at an adequate premium.

Overall, this change in ownership structure moves risk:reward in a positive direction, in my view. Sorry if this is overkill reporting on GMD, but it's my 4th largest personal shareholding, so I watch it like a hawk.

What I specifically like about this special situation share is;

- Potential for the company to completely remodel itself, with 80% of existing leases being available for exit in 2018.

- Management at GMD has recognised that its legacy business model is in decline (due to downloads, changing consumer habits, etc), so has created a new format called BELONG, which seems to have good potential.

- Strong balance sheet, with pots of cash - although the balance sheet dates are probably seasonal highs for cash. There's still an excellent overall surplus of working capital.

- New BELONG format works well, and has a payback period of 16 months - so this share should really be seen as a roll-out of a new, successful, experiential leisure format. The stock market hasn't cottoned on to this yet, and is (in my view) mis-pricing GMD as a legacy retailer.

- Deal with Sports Direct should provide 100+ new, larger venues for the BELONG format (stores within a store). GMD is in control. The overheads (rent, rates) should be far lower than standalone sites. So I am hopeful this deal could be transformational.

- On the downside, it's a pity that GMD gave away 50% of the upside on BELONG to Sports Direct for almost nothing. Still, it's better to have 50% of something big, with a motivated JV partner, than 100% of something small.

Overall then, speculative for sure, but with a strong financial base, and a promising new strategy. Let's see how it works out. I appreciate that this share won't suit many investors, hence why it should be seen as a special situation.

I've added some of the holding in company announcements below - it seems to suggest that Elliott selling pushed down the price. Although many small caps had a horrid time in Jan-Mar 2018, and the price possibly got ahead of itself in Dec 2017 maybe?

Trakm8 Holdings (LON:TRAK)

Share price: 93.5p (down 8.8% today, at 11:02)

No. shares: 35.7m

Market cap: £33.4m

(for the avoidance of doubt, I no longer hold a position in this share)

Change of adviser - Arden Partners has been appointed as the new NOMAD & broker. People speculate that this can sometimes be a precursor to a fundraising perhaps?

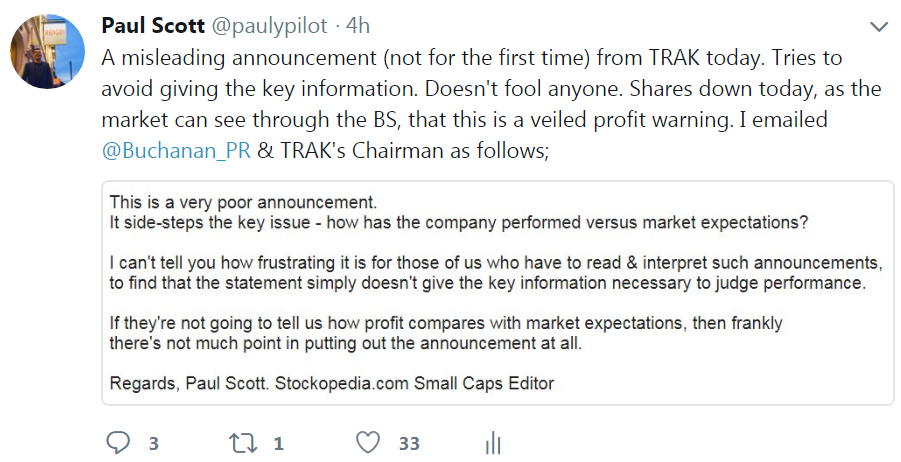

Full year trading update - as anyone who follows me on Twitter will have already seen, I've vented my frustration about this announcement already. I've also emailed Buchanan Comms, and TRAK's Chairman, to protest at what is really a very poorly worded, and disingenuous, update.

I've spent 5 years dissecting & reporting on trading updates from hundreds of companies. My patience is really wearing thin these days, at how some trading updates are simple & clear (which is what investors want), whereas others seem designed to mislead.

Hence I've decided to start complaining to companies and their advisers, when trading updates fail to provide clarity. The only reason not to provide clarity, is because they want to mislead us, or they're incompetent, or both. This was my email to TRAK & Buchanan today, which also went out on Twitter, and currently has many thumbs ups from other investors;

What TRAK's update doesn't say - whether the company is trading (i.e. profitability, not revenues) in line with market expectations, or not. To be fair, TRAK is certainly not the only company which has done this. So my criticism today is intended as general criticism of all companies & broker/PRs, who put out RNSs which dodge the key issue.

In fairness, TRAK's Chairman has replied to my email, but I would always treat a reply as confidential, in this type of situation, so won't reproduce it here. To his credit, he's taken my comments as they're intended - constructive criticism.

What today's statement does say - key points, for y/e 31 Mar 2018;

- Core revenues up 26% to £26.9m. Growth rate is slightly down from +29% reported at the half year stage.

- Net debt of £3.4m, down £0.5m from a year ago, but up nearly £1.1m from 6-months ago (£2.32m reported as at 30 Sep 2017)

- Connections (i.e. customer installations reporting to its servers) of 251k, up from 217k 6 months ago, and 191k 12 months ago.

- Various positive comments re new products, and new strategy of selling online (only recently launched, surprisingly).

- Cost savings have allowed increased spending on sales & marketing.

- AA has begun roll-out of "Car Genie", provided by TRAK, which has "potential to considerably increase the number of connections for Trakm8."

Profit warning? - This bit is rather confusing. I've re-read it several times, and it sounds like there has been some slippage of revenues (and hence presumably profits?) from 03/2018 into 03/2019;

As outlined at the time of the interim results in November 2017, the outcome for the full year was dependent on existing customer contracts where there was a level of uncertainty of end user demand.

Although revenues from existing customer contracts were lower than anticipated, recent order entry has been strong.

In addition to this, several new contract wins have moved into the first quarter of the new financial year.

Did anybody proof-read the above, to confirm that it was readily understandable? It appears not. This sounds like an implied mild profit warning, which is what the share price fall today confirms.

Outlook - nothing specific here;

The Board remains confident in Trakm8's future prospects and an update on trading for the current financial year will be provided in conjunction with the 2017/18 final results.

My opinion - I'm sure you've picked up on my frustration here! What could have been a simple update, has taken me literally hours to unpick.

I remain of the view that there could be something interesting within TRAK. Although a series of disappointments in recent times, means that the 3-year chart tells a story of over-promising, and under-delivery, so far;

Comparing TRAK's profitability (patchy) and cash generation (not very good at all) with that of competitor Quartix Holdings (LON:QTX) they are like chalk & cheese. There again, TRAK is only valued at £33m, whilst Quartix is valued at £174m. So arguably you get what you pay for.

Amazingly Quartix actually has lower revenues than TrakM8, but is highly profitable. Quartix made an operating profit of £6.6m on just £24.5m revenues last year.

Anyway, I shall review the results from TRAK with interest, on the 2 July 2018. It's staying on my watch list. Given the low market cap, there's scope for this share to rise considerably, if the company makes a genuine profits breakthrough. So I shall continue to monitor progress from the sidelines.

There's a third RNS out today;

Publication of circular & related party transaction - this seems to be a technical breach of the Companies Act, in that a dividend paid in 2016 breached the law on distributable reserves.

At first sight, this sounds more embarrassing, and likely to incur some legal costs, but doesn't sound disastrous. Although I'm not a lawyer.

Mothercare (LON:MTC)

Share price:

(work in progress)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.