Good evening/morning! It's Paul here.

Skip this bit, if you want to just read about shares. The long rambling introduction was written last night, after a particularly good dinner at a local steakhouse.

UK Investor Show - what a lovely, and simultaneously disastrous day it was for me. Various factors ended up with me cutting it fine, as regards timeliness. The situation then went from bad to worse. One of the organisers, Hannah, rang me to ask if I could be wired for sound, as I was about to go on stage for a keynote session with Nigel Wray.

Sadly that wasn't possible, as instead of being in the foyer of the QEII Centre, I was actually being flung around in the back of a cab, as on my command, my driver was beginning to take hare-raising risks in North London traffic, as it dawned on him that I was ranting on my mobile phone at increasingly high pitched and expletive-laden vocabulary.

In the end, I decided that it wasn't worth causing an RTA, to speak at an investor show, and got him to drop me off at Tottenham Court Road tube station, where I ran down the escalators & platforms, diving into a train just as the doors were closing. Eating my pre-presentation banana (the sugar rush helps control nerves), I pondered my fate. Undoubtedly I was about to be the worst villain since my late arrival last year.

What to do? Make lame excuses and hide? Never. Turning up, and facing the music is the only option. We all make mistakes. It's no good being in a state of panic, if something bad happens, even if it's my fault, I just apologise profusely, and the decent people will eventually calm down enough to forgive me. If they don't, then such is life. Ultimately, in 10 years' time, nobody will know, or care. I lost my house & all my money in 2008, so that has made me pretty resilient in dealing with bad situations. Life goes on. It's never as important afterwards as it feels at the time.

Anyway, the domino effect from my lateness, was that Tom Winnifrith got into a lather, and at this point opinions differ. Tom claims that he tried to get Ed Croft (our wonderful boss here at Stockopedia) off the stage early. Ed declined, and said the audience probably wanted to hear the end of his presentation. Now they're having a massive Twitter spat.

My view is, chill out guys! Nobody really cares if a presentation over-ran by 5 minutes, for goodness sake, there are far more important things going wrong in the world. And if I was the catalyst for the whole giddy structure collapsing, then I apologise unreservedly.

In fact, I tracked down Dr Paul Jourdan of Amati (look at his performance stats, they're sensational, and he's also a thoroughly nice guy), and Nigel Wray, on the day, and apologised profusely in person.

I hope that all the fuss dies down soon, and everyone chills out.

I shall be appearing at the next investor show, Mello Derby 2018, from this Weds. David Stredder has very wisely booked me a hotel room at the venue, the night before, to ensure I arrive early, in plenty of time for my presentations.

Look, I'm the UK's most disorganised shares blogger, and am very sorry indeed for inadvertently throwing a spanner into the works at UKIS. It was a smashing day out, and I also really enjoyed my time at the Westminster Arms, catching up with so many friends.

Half, or full marathon?

Regulars here might recall that you raised thousands of pounds for charity, when I dragged my overweight carcass around the Brighton, and London Parks half marathons. Thank you again for that, it was brilliant. For me, that was a big achievement, as I've never been any good at running, and couldn't normally manage more than a few hundred yards, even as a child.

However, I was left feeling distinctly deflated, when at an investor event a few years ago, the FD of a small cap company told me that my achievement was massively inferior to his own achievement, of running a full marathon. "A half marathon is nothing like half a marathon", were his exact words, accompanied with a slowing, and lower inflection of the voice, to emphasise his mean-spirited point.

They always say that, years after the event, you don't remember what people say, you just remember how they made you feel. In this case, I can remember both. This chap couldn't wait to quash my momentarily positive feelings after a charity run, but instead wanted to big himself up, about his superior sporting achievements.

I declined to buy his company's shares, and took a small amount of delight at them subsequently failing to do well. Although I never allowed such emotions to affect "my opinion" sections here, which have to be as objective as I can make them. That said, it was clear to me after meeting him, that he was a very ordinary FD, at a very ordinary company.

I resisted the emotional urges to tell him what a thoughtless pig he was, and tip his dinner into his lap - which is what I did to Simon Barlow at primary school c.1977. Instead, I took a deep breath, composed a from of wording in my head that would strike the right tone, and then explained that he was built like a whippet, whereas I was more like a faithful old golden retriever. Accordingly, I had no particular desire to kill myself through over-exertion, and had more important things to do than spend hundreds of hours doing training runs.

I could tell from the expression on his face (read books on "micro gestures" and body language - they are very revealing!) that he was something of a body fascist, who look down on anyone that doesn't fit his body image.

Anyway, his shares have done badly since, which gives me quiet satisfaction. Maybe he should have spent more time in the office, being a highly competent FD, rather than wasting his time running on pavements?

Brian Basham - London Marathon

Which moves me on to another, slighter older, faithful old golden retriever, my friend Brian Basham. If you google Brian, you'll find many things from his long career, in stockbroking, fund management, and financial PR, where he's locked horns with many people, and made plenty of enemies. He's also made plenty of lifelong friends, myself included.

I judge people by some very simple criteria. Firstly what doesn't matter at all - pigmentation of their skin, background & class, sexuality, gender, religious or political beliefs - all this is background noise.

What matters is (I sound like a politician now!) the decency of someone's personality. Have they got warmth & kindness in their heart? Are they prepared to forgive me if I say something thoughtless or unkind, in the spur of the moment? If the chips are down, is their instinct to try to help people, or to walk away? Also, I don't tolerate any form of physical violence, or abuse. If someone crosses a line for me, there is no way back. Because abusers always abuse again, in my experience.

How does this relate to Brian Basham? Well, he became a friend about 15 years ago, and we had lots of pleasant lunches, where often Brian would go on & on about previous anecdotes, often involving people I'd never heard of. Sometimes I would get exasperated with him, and send emails, ranting about how annoyed I was with something or other. Yet he always forgave me, and we remained firm friends.

In the great financial crisis, as readers will know, as it's not a secret, I lost about £5m, and ended up broke. I had to sell my lovely house, lost all my savings, and ended up £2m in debt. Thanks to the decency of Spreadex's CEO, I was able to work out a payment plan, and it took years to emerge from this terrible situation. Thankfully, that is now all behind me, and life is good again. It took 8 years to resolve things amicably. This was a tough period, as I could have wiped the slate clean in 1 year, by going bankrupt. However, my view was always that, if you get into a mess, you have a duty to find a way out. Insolvency procedures are an easy way out, for people who can't work it out the hard way. I was happy to spend 8 years living very modestly, in order to pay back the payment plans, and as I say, thankfully Spreadex were very decent & kind, and helped me find a way out that was realistic. I paid off the last instalment recently, 5 years early, despite it being interest-free, because that felt the decent thing to do - given how well my investments have gone in the last few years, for the "start again" fund.

So, going back to my friend Brian Basham, how does he fit into this? Well, Brian was one of about 4 people who took the trouble to not only try to boost my spirits, when my life collapsed in 2008, but who also offered practical, financial help.

In 2008 or 2009, Brian invited me over to his modest, but lovely home, with a stunning, sun-drenched terrace, overlooking a valley of beautiful countryside. Then he just asked me, "Scotty, what can I do to help you get back on your feet? You're a talented guy, and someone needs to give you a break".

By the end of our lunch, Brian had offered to pay me £x per month, as a consultancy fee, to be available any time he wanted, to help him on any project or ideas he came up with. Of course, I agreed, and was delighted. The consultancy fee was enough to make a difference between being broke & in a state of panic on the one hand, and having a stable domestic situation, where I could calm down and plan my next move.

It was a vital breathing space, which got me back on my feet. Before long, I'd worked out a new strategy on my personal investing, and had started my blog, which later turned into these reports here on Stockopedia.

At these low points in our lives, we just need someone to make a generous gesture, and help us see the woods for the trees. My brother & sister in law were also wonderful at that time, doing kind things for me, like acting as a guarantor on my rented flat. There is also another great friend, who I won't name, who gave me brilliant advice, and even let me trade in an account in his name, but with agreed rules - so that I couldn't over-gear again. This account generated a remarkable amount of money over several years, just because I needed some rules to operate within.

There are some wonderful people out there in the shares world, who in my case have probably saved my life. Yet they have never advertised what they did to help, as just quietly helping a mate in distress, was reward enough.

A similar situation has recently emerged with a good mate of mine - the person who comforted me, when I was sobbing uncontrollably after my Gran died in 1995, has recently hit hard times, through no fault of her own. So I remembered what Brian Basham did for me back in 2008, and have done the same for her.

Some people say that it changes, or can ruin, your relationship, with people, if you help them financially. In my experience, it doesn't. As long as both sides behave as normal, and don't think it elevates or depreciates your friendship, then everything is fine. Also it's important not to accidentally create financial dependency, which can cause resentment & unintended consequences.

Right, get to the point Scotty! Brian Basham is nearly 75. He had a heart attack quite recently. He ran the London Marathon on Sunday, known as the Gerry Jogger! His charitable cause is prostate cancer, a big killer of men, and which does not get anywhere near enough research funding, compared with other forms of cancer.

Brian's been an amazing friend to me (along with a few others), so I would love it if readers of this blog, who wish to, would support his remarkable achievement of completing the London Marathon, at an advanced age. He took the training very seriously, and I'm so thrilled that he completed the course. How many of us could do that aged 74?

With typical humour this morning, I rang Bash to find out if he was still alive. I explained that I'd donated £250 before the Marathon, but wanted proof that he'd completed it, before donating some more. He retorted, "I think that constitutes a technical short on me dropping dead!", followed by us both collapsing with laughter.

Oh, and before anyone posts articles about Brian's battles with BA and Virgin, let me tell you that Richard Branson is no angel - as you can see from some of the appalling pictures online. So let's not even go there.

Royal Baby

Not strictly to do with shares.

However, I've had a punt on "Philip", on the basis that it's just a guess.

6:1 seem reasonable odds for what might be considered a nice gesture to the Queen's loyal consort. If I win, I'll be donating half the winnings to my own long-suffering consort, and the rest to buying performance-enhancing drinks.

Nobody is making a market in the royal baby being called Paul, sadly. I would have willingly put a tenner on that!

OK, this is where the shares stuff starts, having covered every other topic imaginable above last night!

Proactis Holdings (LON:PHD)

Share price: 111p (down 41% today, at 11:19)

No. shares: 92.9m

Market cap: £103.1m

Interim results - for the 6 months ended 31 Jan 2018.

This group calls itself;

PROACTIS Holdings PLC, a global spend management solution provider...

My commiserations to shareholders here - these interim results seem to have gone down like a lead balloon. It's feeling increasingly like a game of snakes and ladders at the moment, with profit warnings happening almost every day. It's very difficult to avoid them altogether. We're all stung by a profit profit warning from time to time, it's unavoidable in the small caps space - just an occupational hazard. It does make me question the generally rather high valuations though. Is risk:reward really at appropriate levels in UK small caps? Maybe not.

Groups which have done lots of acquisitions tend to be rather difficult to analyse. A few key points;

- Underlying revenue growth of only 3% (H1 LY: 12%). I recall from a company presentation that management saw growth of about 10-12% as being the norm. So H1 this year has fallen well below that rate of growth.

- Total revenues up 124% to £26.4m - which reflects the acquisition spree of recent years, including one very large acquisition relative to the rest of the group.

- "Strong balance sheet", with net debt of £29.8m. This is always a warning sign. Sure enough, the balance sheet is not strong, it is weak! It fails my two key tests, as follows;

1. NTAV is negative, at -£56.7m - I don't usually invest in anything with negative NTAV. This is the simplest way to avoid potential blow-ups, for groups that have expanded too fast, with too much debt (which is how I see this share).

2. The current ratio is weak, at 0.87 . This is calculated very simply, by just dividing total current assets by current liabilities. A level of 1.3 is adequate, and over 1.5 is best. So 0.87 is quite a poor score.

- Whilst net debt is £29.8m, gross debt (i.e. excluding cash) looks to high to me, at £42.5m . Great care is needed with software companies, as EBITDA is an inflated figure (because it ignores current, and previous development spending, which is often substantial). This leads to investors & banks taking on more risk than they realise.

- Cashflow statement - not very good. There doesn't seem to be much cash generation at this group.

- Adjusted EPS is up 20% to 5.4p, although note that this is flattered by a negligible tax charge. I think the group might be utilising tax losses, so in valuing the share on a PER basis, the tax charge should be normalised, in my view.

- Cost savings - annualised £4.2m has been achieved, with a £5.0m target.

- More acquisition activity planned. Really? Is this such a good idea? I'm worried that management might be biting off more than they can chew.

- Recent loss of customers - this sounds concerning, and I imagine is a large factor in having scared some holders into selling today;

... latterly, a loss of a number of customers which the Board does not expect to continue.

Forex - this is a very important point, as it has read-across for many other shares;

However, this performance is not fully reflected by reported revenue which has been slower to build principally due to a strengthening Sterling which is reducing the impact of the Group's performance in the United States and in Europe...

It's been a long time since I can remember companies complaining about the strength of sterling! In recent years it's very much been the opposite - that weak sterling has hurt importers, but boosted exporters and companies with overseas subsidiaries.

So it's very important to realise that this previously positive effect is now turning negative. We need to factor that into valuations, and growth rates may sharply slow at companies which previously gained from weak sterling. So we all need to have a proper think about how this reversal of forex impact could affect companies in our portfolios.

I mentioned this point at the UK Investor Show, pointing out recent commentary from Next, saying that they will soon begin to benefit from more favourable forex. i.e. Next, and other retailers, will soon begin to see favourable year-on-year comparisons of forex, enabling them to reduce prices. Therefore, this should create a very benign effect on inflation. I reckon inflation could be close to zero in a year's time, based on what Next have told us (that they will have scope to reduce prices in the shops later this year & in 2019).

Hence the squeeze on consumers' real incomes is ending, and that gives potential positive upside for well-managed consumer-facing stocks. Although it's also true that there are other headwinds for consumers (e.g. rising pension contributions, rising council tax, higher interest rates in May 2018 forecast, etc).

Broker forecasts - the house broker has put out an update today. It has also reduced profit forecasts quite a lot - e.g. this year down 20%, and next year down 16%.

The reductions in adjusted EPS are smaller however, at -10% and -13% for this year & next year respectively.

I'm a little surprised at the extent of the share price fall today, which seems harsh. However, I think we're in a market where people just hit sell, and ask questions later, which can lead to exaggerated share price falls in the short term.

Although we also have to bear in mind that bad news sometimes comes out piecemeal, over a period of time. So I think the market often over-reacts, in order to build in some slack for a potential future profit warning.

I'm very wary of getting involved in situations where the newsflow has turned negative, whatever the reasons given.

My opinion - it looks a bit messy to me. I'm really not keen on companies which grow rapidly through a series of acquisitions. I sometimes wonder if management can become addicted to the thrill of deal-making?

From an investor's point of view, lots of acquisitions makes analysing performance much harder. It also means the balance sheet gets more & more top-heavy with intangibles, thus leaving little financial strength to absorb any problems which might later emerge.

Overall, I'm very wary of all acquisitive groups, after the Conviviality debacle, so personally I'm giving Proactis a wide berth. I'll be happy to take a fresh look at it, in a year or two's time, once the acquisitions have bedded in properly.

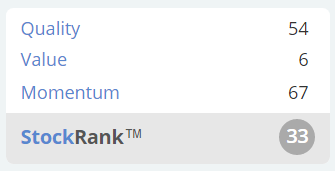

As of last night, the StockRank system here did not like Proactis. Given today's sharp sell-off, then I imagine the StockRank is likely to deteriorate further;

Focusrite (LON:TUNE)

Share price: 442p (up 7.8% today at 12:45)

No. shares: 58.1m

Market cap: £256.8m

Focusrite Plc, the global music and audio products company supplying hardware and software products used by professional and amateur musicians, today announces its Half Year Results for the six months ended 28 February 2018.

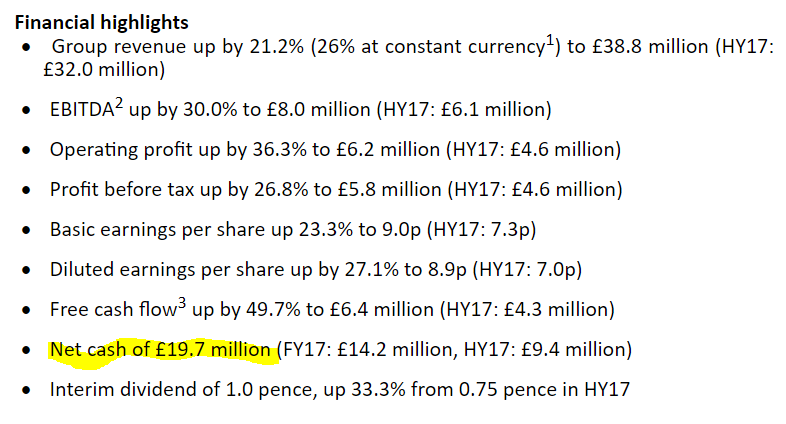

This is a smashing set of figures. See the highlights below, with very good growth, which is all organic I think. Note also the lovely cash pile on the very strong balance sheet;

I've reviewed the P&L, balance sheet, and cashflow statement, and everything looks smashing - no issues at all.

Outlook - a word of caution here that the very strong growth in H1 is likely to slow in H2;

The first half benefited from an especially strong Christmas holiday season. Since the half year end, revenue and cash have continued to grow although, as expected, at a slower rate than in the first half.

We remain confident about the outlook for the rest of the year and beyond: future product plans are taking shape, the geographic expansion continues and the strategy developments are bearing fruit.

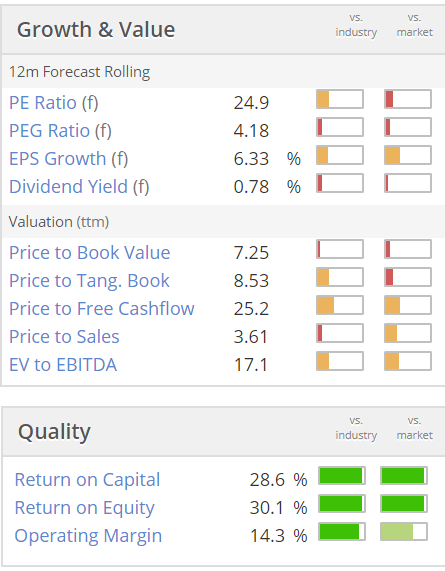

Valuation - it looks expensive, but the PER could be justifiably adjusted down by about 10%, to reflect the outstanding balance sheet strength.

Also bear in mind that the company has established a trend of beating forecasts, so the shares may not be as expensive as they look on current forecasts.

My opinion - this looks a really excellent company.

My only slight reservation is that the products have a limited lifespan. So the company has to keep investing in R&D, and producing attractive new products. So far so good though, it seems to be performing very well, and the Directors sound confident about the future.

A big thumbs up from me about the company. Although I think the price looks up with events.

My apologies, but I've got bogged down in preparing my presentation for Mello Derby, so didn't manage to look at Ab Dynamics (LON:ABDP) in the end.

So that will have to be it for the day.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.