Good morning, it's Paul here.

Apologies, I forgot to put the placeholder article last night.

It looks quiet for news today.

Vertu Motors (LON:VTU)

Share price: 49.9p (unchanged today, at 10:26)

No. shares: 379.3m

Market cap: £189.3m

(I do not currently hold any position in this share)

Vertu Motors plc, the UK automotive retailer with a network of 120 sales and aftersales outlets across the UK, announces its audited results for the year ended 28 February 2018 ("the Period").

This is a share that I've previously held, but ditched them in the market wobbles earlier this year. No particular reason, other than that something had to go, in order to de-gear. That's looking like a mistake now, as the share price has bounced back decently in the last month.

It's interesting to note how this share has traded in quite a tight range for most of the last 2 years.

It has been paying reasonable divis along the way though. The yield is 3% at the moment.

I wonder if the boffins at Stockopedia HQ could work out a way to show share price charts with dividends included? That would give a better indication of the total shareholder returns - capital gains and income. Share buybacks might complicate things though.

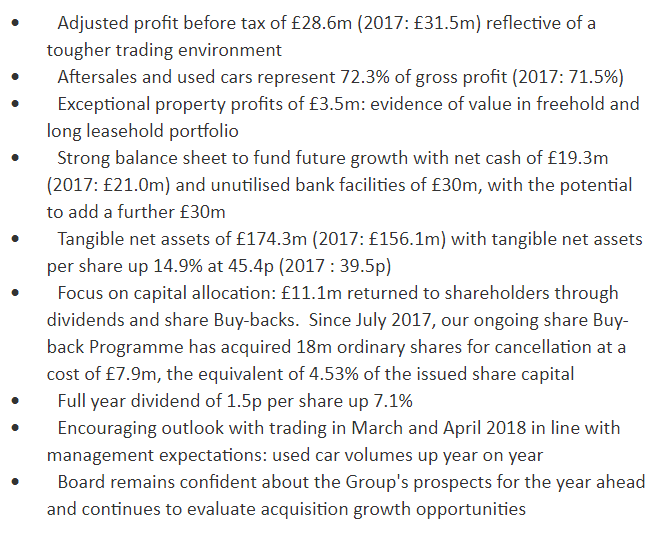

Today's results highlights section neatly encapsulates the main points, so here it is copied, to save me some typing;

Balance sheet -

NAV: £264.4m, which includes £95.7m intangible assets, deducting those gives;

NTAV: £168.7m. The company's highlights section above says that NTAV is £174.3m, which is £5.6m higher than my calculation. I can't see any item of that amount which would reconcile the two, so it's an unknown difference.

Current ratio: car dealers are unusual in that they have massive working capital, which usually nets off to about zero. The businesses are essentially funded by the vehicle manufacturers, and other trade creditors.

In this case, current assets are a huge £666.4m (mostly inventories - i.e. cars in stock), and current liabilities are also huge, at £679.5m. These are such large numbers, that the net cash balance of £19.3m is fairly trivial. Providing car manufacturers continue offering credit, then this situation looks fine.

Freehold property - this is a key positive of Vertu shares. It owns lots of freehold property. So this share is really a hybrid of a car dealer, and a property company.

The commentary today says that total freehold & long leasehold property is in the books at £183.8m - that's only a whisker short of the entire market cap.

As mentioned in the commentary today, having lots of freeholder (52% of all sites are freehold) gives flexibility to raise cash when required - e.g. doing sale & leasebacks.

Pension scheme - this is showing an accounting surplus. The commentary says that company contributions will fall to only £30k p.a..

The next triennial valuation of the scheme is due on 5 April 2018 and this is expected to show the scheme remains well funded on an actuarial basis.

Outlook - this is too long a section to repeat here. However, the overall impression sounds positive to me. It concludes;

Cost increases continue to impact the Group as previously reported and these are likely to absorb some of the expected increases in revenues and gross profit.

Given the encouraging trading performance of the Group and the Group's strong balance sheet, the Board remains confident about the Group's prospects for the current year and its ability to undertake further growth through acquisitions.

My opinion - this strikes me as a good time to revisit car dealer shares. This is the second such company which has recently reported improving conditions.

Valuations are still low, and in the case of Vertu, investors can buy a share that is not only good value on a low PER, with a reasonable yield, but which also has a copper-bottomed balance sheet full of freehold property.

I could see sentiment towards this sector improving, and maybe even some takeover activity?

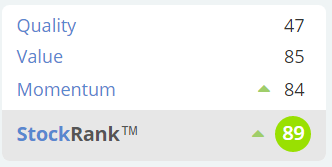

So not a bad area to go rummaging around for bargains, in my opinion. Stockopedia's computers agree, with a high StockRank;

The low-ish quality score is probably caused by the low operating margin. However, I tend to view the high revenues of car dealers as really just pass-through revenues. They're selling new cars for maybe £500-1000 gross profit, but that then generates a future income stream of after-sales revenues (servicing, parts & recalls). When you look at things that way, the margins are a lot better than at first sight. Not everyone will agree with my interpretation though.

Greggs (LON:GRG)

Share price: 1077p (down 15% today, at 11:37)

No. shares: 101.16m

Market cap: £1,089.5m

A quick note that shares in this High Street baker/fast food chain, are down 15% today to 1077p, on a cautious trading update. I like to glance at mid to larger cap retailers' outlook comments, as often there is read-across to smaller companies, and the economy generally.

Footfall in Feb & Mar 2018 was low - why would this surprise anyone, given that the weather was so dire during that time?

Interesting points;

- Cost price inflation easing - Next said something similar recently (Next are reporting again tomorrow, so I'll report back to you on what they say). This confirms that forex-induced inflation is now easing, and might even reverse later in 2018, early 2019 (according to Next).

- Sales in May 2018 have improved somewhat.

- Uncertainty over footfall - makes Greggs cautious for remainder of the year.

- Profit this year likely to be similar to last year.

This does rather raise the question as to why Greggs was rated on a forward PER of 18 as of yesterday? That seems much too high to me, for a business which is mature, and is facing uncertain footfall in its High Street locations.

I don't think I'd be tempted to buy Greggs shares, unless/until the PER fell to something more appropriate for a mature High Street business, which is about 10. So it looks significantly over-priced to me, even after today's fall.

This is the trouble when the market suddenly realises that a sexy growth stock has gone largely ex-growth. For that reason, I could foresee further falls here, and am steering clear.

To my mind, the only retailing shares worth considering, are ones where two key things are happening;

1) Successfully transitioning to online sales (e.g. Next (LON:NXT) - which is currently my largest long position), and

2) Lease flexibility - i.e. short leases, which can be handed back to the landlord, or renegotiated on a lower rent, on expiry, or break clauses.

A possible third item for that list might be the potential to automate processes in-store, thus enabling staffing costs to be reduced - the obvious example of this being the free-standing large touch screens that are rolling out across McDonalds outlets - meaning that no staff are needed to work on tills, and that throughput is increased.

It's difficult to see what Greggs could do, in order to modernise.

I have to leave it there for this afternoon, due to having to travel across London, and then home to the south coast. If the chance arises, I might have some time to look at something else tonight.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.