Good morning! It's Paul here.

The big news today for me is the Q1 trading update from Next (LON:NXT) (in which I have a long position) - yes, we all know it's not a small cap, but I cover it here because the guidance is so detailed, and gives all sorts of clues to the overall state of non-food retail.

This is a fascinating time, on a macro level, where the stock market really can't decide where things are going. There's a lot of gloom towards most consumer-facing stocks. There could be some bargains about, but deciding which ones to pick (if any), is our intriguing challenge right now!

Next (LON:NXT)

Share price: 5,632p (up 7.4% today, at 10:13)

No. shares: 141.46m

Market cap: £7,967.0m

(at the time of writing, I hold a long position in this share)

This retail & online fashion (and homewares) bellwether updates us today on the 14 weeks to 7 May 2018.

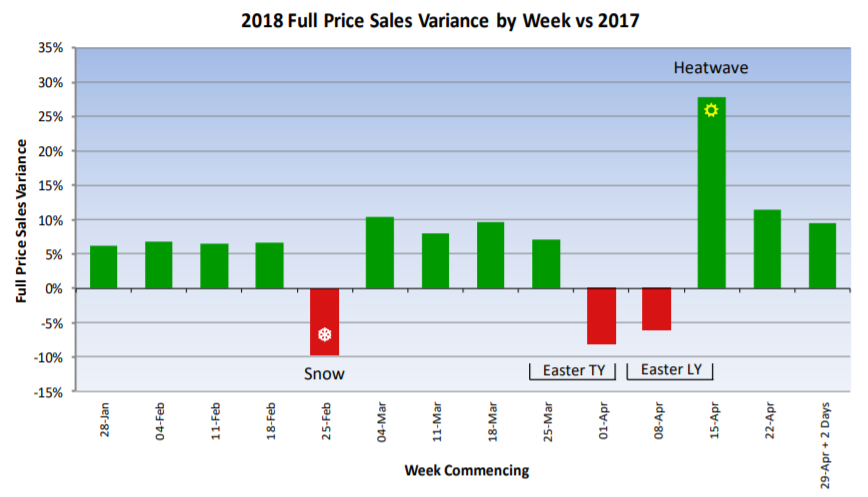

I had braced myself for a disappointing update this morning, given that poor weather in much of Feb & Mar must have hurt retailers. Also, the BRC reported earlier this week that retail sales had fallen off a cliff in April.

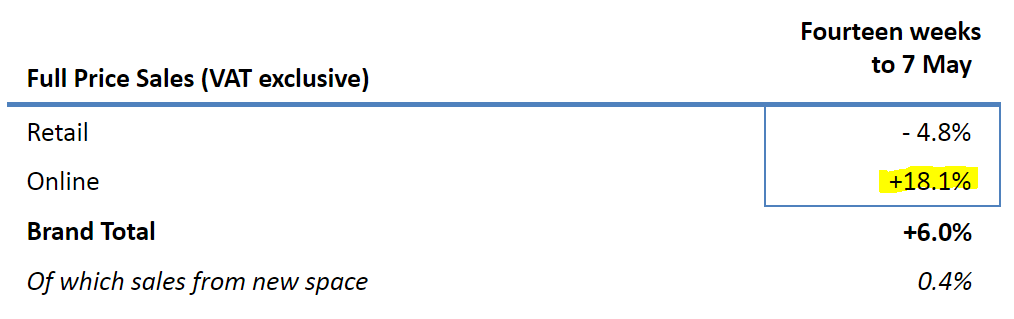

As it turned out, Next somehow managed to trade pretty well overall in Q1, with total sales up 6.0% (against admittedly weak prior year comparatives);

Obviously the stand-out number is the excellent online growth of +18.1%. This supports my view that Next is successfully transitioning to being a predominantly online (in terms of profitability) retailer.

Sales in our Online business were particularly strong and up +18.1%, driven by the growth of NEXT branded stock and third party brands on our UK platform along with continued growth from our overseas business.

What's interesting is that the period of bad weather in the spring doesn't seem to have affected Next much overall. It seems to me that when the weather is bad, Next customers probably switch from visiting the stores, to shopping online.

Note also the spectacular boost from the recent heatwave (see below), which is much greater in magnitude than the impact of the bad weather earlier. NB the figures below combine stores and online sales.

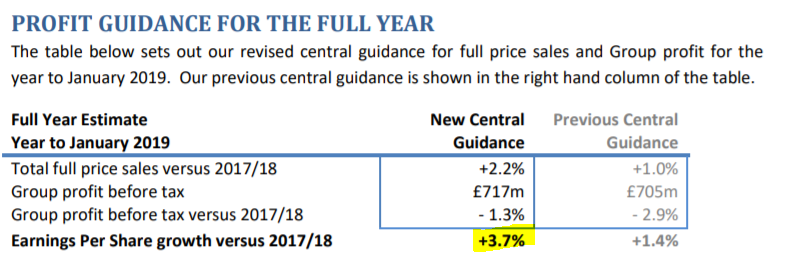

As usual, Next updates us on full year profit guidance. Wouldn't it be a dream if all companies could do this?! Our lives would be so much easier.

Note that share buybacks and a lower tax charge are the reasons why forecast EPS rises 3.7%, despite profit before tax being forecast to fall by 1.3%.

Valuation - by my calculations, Next seems to be guiding to about 432p EPS this year.

That translates to the following PERs at various share prices

5632p (current share price) = PER of 13.0

6000p share price = PER of 13.9

6250p share price = PER of 14.5

6500p share price = PER of 15.0

It's up to individual investors to decide what we think the correct price is. My view is that a business of this quality, which is doing extremely well online, should probably be on a PER between 14-15. That suggests a share price of 6,250 to 6,500p. Hence I see further potential upside on the share price, and am happy to continue holding.

Another factor is that I think the guidance looks too conservative, so I'm expecting further increases in profit guidance later this year.

The company has explained in great detail before how it plans to manage the decline of its physical stores. A friend pointed out this morning that, with so many other retailers now struggling, we could see a situation where much competition in the High Street disappears. There seems to be an avalanche of CVAs (creditors voluntary arrangements) in the pipeline, which will result in many shops closing. So could Next be one of the last men standing? There's more business to be had, for those retailers which survive.

Younger consumers apparently think that Next is fuddy-duddy. Who cares? The youth market is too crowded anyway, and middle-aged people have more money, and arguably are under-served. So I'm perfectly happy with Next's market positioning.

Another idea I had, is whether Next could become a bid target for a big overseas buyer? (Amazon, possibly?). Fashion is very different to other online retailing, because you have to design all your own products, rather than just shifting boxes containing generic products. Therefore, I suspect Amazon won't do well with its own attempts in the fashion space, it just doesn't have the expertise on the product design & sourcing side of things. It's possible that at some point, it might decide to buy in the fashion expertise it needs - Next would be a perfect fit, in my view. But that's just idle speculation on my part.

It's fascinating how almost everyone in the City seemed to be negative on Next, yet the consensus was completely wrong.

Superdry (LON:SDRY)

Share price: 1,278p (down 17.6% today, at 11:06)

No. shares: 81.63m

Market cap: £1,043.2m

(at the time of writing, I hold a long position in this share)

Superdry Plc ('Superdry'), the Global Digital Brand, today announces a trading update covering the 16 week period from 7 January 2018, and the 26 week (the 'half year') and 52 week (the 'full year') periods ended 28 April 2018.

Today's sell-off looks like it might be an over-reaction, possibly. Especially given that this share had already dropped considerably in previous months;

The problem today seems to be that its physical stores really struggled in Q4.

As you can see from the table below, Q4 store sales fell by -6.0%. However, that fall is despite an increase in selling space of 13.5%. If I'm reading that right, it seems to suggest that same-store sales must have fallen almost 20%, which is a dire performance. Some of that would be weather related in the UK, but it's still a worrying trend.

Wholesale and Ecommerce are both showing excellent growth though. So there's a lot of similarity here with Next - strong online, poor in stores.

Profitability - overall this looks in the same ballpark as the forecasts I've got, but am awaiting updated figures.

The Board anticipates that underlying full year profit before taxation, after the distribution centre migration and development market investment, will be in the range of £96.5m to £97.5m representing another year of double-digit profit growth.

That sounds OK, but the worry must now be that a deep down-trend in retail sales may have established, which would lead to a sharp reduction in future profitability, if that trend continues.

Outlook -

During FY19 we expect to generate high single-digit statutory revenue growth, led by double-digit growth in our capital light Wholesale and Ecommerce channels, as per our stated ambition, while managing ongoing challenging conditions in stores.

Our commitment to future operating efficiency and the increased scale of our two key development markets will each contribute to moderate operating margin expansion.

That last sentence sounds rather encouraging. If the operating profit margin is expected to rise (moderately) then that seems to quash my worries of a decline in future profits, driven by sharply falling retail sales, on fixed or rising costs.

My opinion - this is a tricky one. The very positive growth story here seems to have wobbled in Q4. We don't know at this stage whether the retail side of the business will bounce back, or whether a more worrying down-trend has set in?

I like the good profit margins here, and the international expansion. Both wholesale & eCommerce are going well. So for now, the positives seem to outweigh the negatives. Also, the share price has fallen so much now, that it's possibly entering value territory - providing that earnings remain robust.

There have been a couple of times in the past when this share sold off heavily, as the market thought it had gone ex-growth. In both cases, it rebounded strongly, once the market's fears were dispelled by continued strong growth. For that reason, I'm minded to stick with it for now, but I'll keep that under review.

Sprue Aegis (LON:SPRP)

Share price: 125p (up 13.6% today, at 11:35)

No. shares: 45.9m

Market cap: £57.4m

This smoke alarm company has today announced that it has settled a problematic dispute with BRK Brands. Detail is set out in the RNS, but the key points seem to be;

£10.97m will be paid by SPRP to BRK, in monthly instalments by 24 Dec 2018.

£4.2m of extra costs will be charged to the 2017 accounts.

£3m overdraft has been repaid - this is reassuring, as the company's announcement on 19 April 2018 alarmed the market, in that the case pile seemed to have gone. It now turns out the £3m drawn down from HSBC was not needed after all.

My opinion - this company is far too accident-prone to interest me. Maybe I'm missing an opportunity, now that the incestuous relationship with BRK has been dissolved.

It seems to me that there is still a question mark over the balance sheet, and what the cash position is. Overall then, it doesn't interest me at all - too complicated & problematic.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.