Good morning, it's Paul here!

No more Italy comments, I promise! 2 days is enough. I've been stopped out of some of my hedge, at breakeven. As a reader correctly pointed out, it's very difficult to decide how much, and what stop losses (if any) to use on hedges. The ideal hedge is a Put Option, but they're far too expensive, in my experience. Still, I might wait for volatility to reduce, and then buy an index put option, just to protect the downside from a disaster-type scenario.

Having discussed Italy with a very savvy bond investor (who made a killing on the last Euro crisis), he reckons Italy will play out just like last time in 2011 - i.e. posturing by Italian politicians, who are then likely to be battered into submission by the ECB and Euro Group. Voting for populist politicians is a cry for help by the electorate - just as it was with Greece some time ago - but ultimately those politicians are making promises they can't deliver.

Euro-membership is a straight-jacket that countries can't get out of. It will ultimately collapse of course, because it's unworkable, but who knows when? In the meantime, the Southern European countries just have to accept that, if they want sound money, they probably won't get any economic growth. Meanwhile Germany prospers, because they're so good at making stuff that people want, assisted by a highly advantageous exchange rate.

As Varoufakis made clear in his book, you only have leverage with the EU if you're genuinely prepared to exit the Euro - which would be a catastrophic process in all likelihood. To date, countries have toyed with that idea, but always pulled back from the brink.

Mello - Kent - 14 June

I've just been chatting to my long-standing shares friend, David Stredder. David and I met at the AGM of retractable syringes semi-fraud, Medisys. I say semi-fraud, because the company did have a product. They just omitted to tell us that it didn't work! So the £200m market cap in the tech boom subsequently melted away to virtually nothing. I have my Medisys shares certificate (remember them?!) on the loo wall, for 8 shares, to remind me not to be a muppet and buy blue sky, massively over-priced junk shares! Still, one good thing came out of it, in that I met David.

David and I have co-invested in loads of companies. We got so close at one point that, if either of us found a great share, we would actually put in a buy order for each other without having spoken about it. So occasionally I would find some share that I'd never heard of appear in my portfolio. Assuming it was a booking error, I would contact our broker ("Trigger") to query it, and he'd nonchalantly reply, "Oh, David ordered those for you!".

Our success rate was amazingly high, when we both liked a share - I would say over 9 out of 10 were winners. So it really does pay to find the shrewdest investors, and co-operate with them on research. I would do the numbers, and David would dig into all the other stuff - management, products, competitors, customers, etc.

Unfortunately, the one share that David raved about repeatedly, I declined to invest in - a tiny thing called Lo-Q. It has since roughly 1000-bagged and is now called accesso Technology (LON:ACSO) , and David still holds it. He's made squillions on it, but I thought I knew better, and didn't buy any. Ho hum.

Anyway, many of you will also know & have a similarly positive view of David. His Mello events are outstanding - because he restricts them to a manageable size, and only allows in decent quality companies which are worth meeting.

Anyway, the next investor show is coming up on 14 June, and tickets are selling fast - people tend to book mostly in the 2 weeks beforehand, and more than half have already gone. This will be quite an intimate event, it's all about quality, not quantity.

The companies presenting, and top notch fund managers, are outstandingly good. You'll be able to speak personally with them, as attendee numbers are limited. Stand out ones for me are Warpaint(W7L) and Bioventix (LON:BVXP) . Also, Empresaria (LON:EMR) , Pennant International (LON:PEN) , Eservglobal (LON:ESG) and Avation (LON:AVAP) are also interesting attendees - where you can meet and chat to management in an unhurried & relaxed atmosphere.

Top fund managers will also be there, including Mark Slater and Andy Brough.

More details can be found here. I only recommend things that are genuinely good, and am not on commission, I promise! I've asked David for a discount code for SCVR readers, and here is a link which gives 33% off.

On to today's small cap news. I'm running a little late today, as I popped into a number of student music bars last night, and got a bit carried away reliving my youth!

Card Factory (LON:CARD)

Share price: 210.8p (down 3.5% today, at 11:20)

No. shares: 341.5m

Market cap: £719.9m

Card Factory, the UK's leading specialist retailer of greeting cards, dressings and gifts, announces a trading update for the quarter ended 30 April 2018 to coincide with its Annual General Meeting to be held later today.

This company is larger than the usual stuff I report on here, but it's an interesting company where I'm considering a purchase, so will check it out.

The company is staggeringly profitable - I suppose because the profit margin on greetings cards is so high. Although there are question marks over whether people will continue giving each other greetings cards long term? Personally I think they probably will. Younger people may not give cards to each other as much as older people, but that's probably because many of us tend to be pretty thoughtless & self-centred when we're young! As you reach middle age & above, then maybe people grow into sending cards, as we become more conscious of our own mortality, and the importance of family & friends? That my half-baked theory anyway!

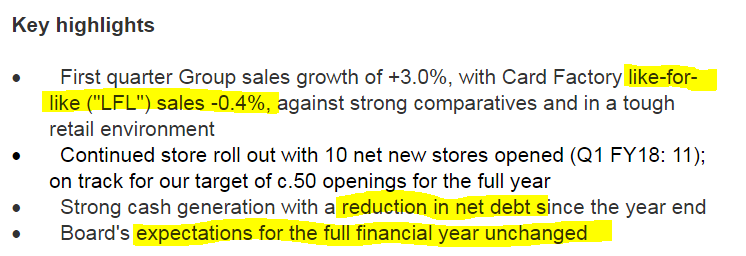

This sounds pretty good to me, so I wonder why the share price has dipped today?;

Retailers generally have had poor to dire results in Q1 of this year - a lot of which I think was weather related. So LFL sales being flat is good going, in my view.

Internet - GettingPersonal is not performing well.

CardFactory is doing better - revenues "grow strongly"

Net debt - this looks OK to me, given how cash generative the group is;

As at 30 April 2018, before the forthcoming payment of the proposed final dividend for FY18 of £21.9m (FY17: £21.5m), net debt was £147.7m (30 April 2017: £125.4m), before deduction of capitalised debt costs. This is £13.6m lower than the level reported at 31 January 2018 of £161.3m, compared with a reduction in net debt of £10.4m over the same period last year.

Dividends - sounds like another special divi is on the cards (geddit?!!)

The Board currently anticipates, subject to trading performance, making a further return of surplus cash to shareholders, in line with our stated policy, towards the end of the current financial year. A further update will be given with our interim results for the 6 months ending 31 July 2018, due for release in late September.

Outlook - sounds solid;

"Overall, Card Factory remains in a strong position as we look forward to the lessening impact of cost headwinds and the benefits of a significant number of business efficiencies being implemented during the year. This will put in place a platform for further growth in the medium term. The Board's expectations for the full financial year remain unchanged and I look forward to providing further updates as the year progresses."

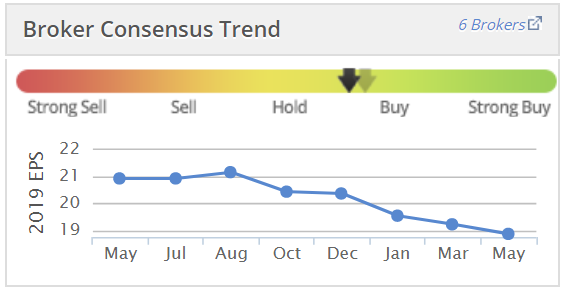

My opinion - it's always worth checking the Stockopedia graph showing the change in broker consensus earnings forecast in the last 12 months. As you can see below, forecasts have been trimmed several times;

The market reaction to reduced forecasts has been fairly brutal since Sept 2017;

I'm very tempted to buy some of these, mainly for the divis.

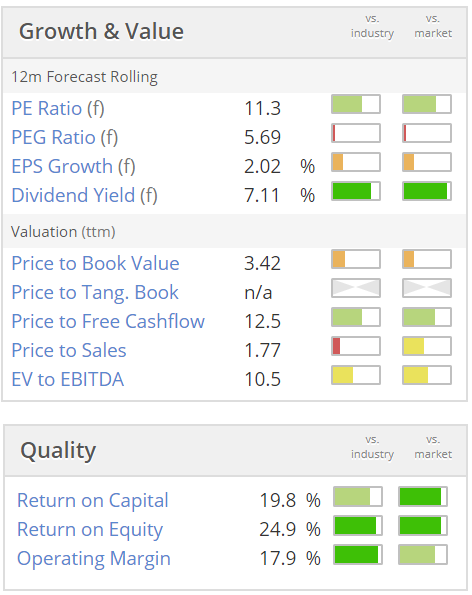

Stockopedia sees it as a business with high quality metrics, but at a value price;

I'm not keen on its balance sheet though. That has held me back from investing in the past. Although with a reassuring update in the bag today, at a time of low footfall due to bad weather, then my finger is hovering over the buy button.

There's nothing much else of interest today.

Brady (LON:BRY) has put out an in line trading update, but that company doesn't interest me, given its lacklustre performance historically. The valuation looks far too high to interest me.

Caffyns (LON:CFYN) is a car dealership, which has put out its results for y/e 31 Mar 2018 today. The figures look poor - with underlying profit down from £2,051k in the previous year, to £1,390k this year. I've held this share before, but never again, as it's too illiquid.

Porta Communications (LON:PTCM) has put out a trading update. I've had a quick look at its most recent results, and the balance sheet is still a mess. Its reliant on loans from Bob Morton, so outside shareholders won't get anything. The equity is clearly worth nothing in my view.

I shall leave it there for today, and hand over to Graham to look after you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.