Good morning, it's Paul here!

I'm making a guest re-appearance, as Graham's busy today (Monday).

Graham's doing the main SCVR writing this summer, as I'm taking a sabbatical. However, I'll still pop up here every now & then, whenever Graham needs some cover, and to comment on stocks mentioned in Graham's articles.

Premier Technical Services (LON:PTSG)

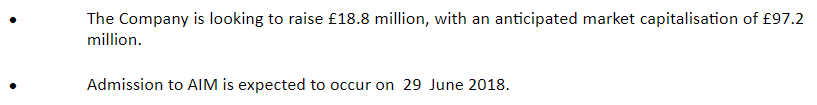

Share price: 172.5p (unchanged today, at 08:33)

No. shares: 104.5m

Market cap: £180.3m

AGM statement (trading update)

This is what the group activities are;

Premier Technical Services Group PLC is the UK's leading provider of façade access and fall arrest equipment services, lightning protection and electrical testing, steeplejack and rope access services and fire solutions.

Operating through four divisions, Access & Safety, Electrical Services, Building Access Specialists and Fire Solutions, the Group provides highly-engineered industrial products and quality services and has a substantial presence in a number of niche markets.

This seems a reassuring update. The company's next year end is 31 Dec 2018;

"I am pleased to report that the Group has seen continued sales growth and strong levels of orders in the year to date.

In addition, working capital utilisation, margin and profit levels are in line with the Board's expectations.

Outlook comments also reassure;

"Contract renewal rates remain high and a number of significant three to five year contracts and framework agreements have been signed across all disciplines with new and existing customers since the beginning of the financial year, underpinning our organic growth strategy.

Acquisitions - going well also;

"The acquisitions completed last year are contributing significantly to the growth of the Group. We have been particularly pleased with the improvement in the contract renewal rates for BEST since its acquisition last year. In addition, we are seeing unprecedented demand for Fire Solutions with UK Sprinklers trading 50% ahead of the acquired business."

The group seems to have a canny eye for acquisitions. When I met the Yorkshireman CEO a couple of years ago, he didn't strike me as the sort of chap who would overpay for anything!

Balance sheet - a reader dismissed my focus on balance sheets last week, quoting Mark Minervini's comments on this matter. Of course I'm not suggesting that the balance sheet is the sole driver of success in investing. It's more something that should be on our checklists, to ensure that (however exciting the story sounds), companies should be soundly financed before I'm prepared to invest in them. This helps avoid dilution from fundraisings, and massive losses when unexpected bad news strikes.

In my experience, holding back from investing in companies with weak balance sheets has helped me avoid an awful lot of bad, or 100% loss investments. When I recently broke my own rules on balance sheet strength, I experienced a 100% loss (Conviviality). We can all get complacent, and I see my £30k loss on Conviviality as a charge levied by the stock market, to remind me to be more disciplined in my investing process. Sound balance sheet strength is therefore an essential attribute in avoiding the most serious investment losses, and eliminating altogether such 100% loss situations.

If people want to punt on companies with weak balance sheets, that's up to them. However, it only takes a few 100% losses to seriously damage one's wealth. We should also remember that this is very much a punter's market at the moment - I'm seeing all sorts of absolute rubbish soaring in price, on speculative frenzies. When the market goes into that mood from time to time, it emboldens the reckless - who for a short period of time look clever - until the market takes back what it gave. Very few punters manage to hang on to exceptional gains made in a speculative market.

Anyway, back to PTSG. I've had a look at its last full year accounts, and the balance sheet stacks up like this;

NAV: £32.4m, less intangibles of £26.2m

NTAV: £6.2m - as this is positive, it passes one of my key balance sheet tests.

My main issue (as mentioned before) with PTSG's balance sheet is that debtors look excessive. The recent acquisitions will have contributed towards this. The acquired companies' balance sheets are consolidated in full into the year end group figures. However, the P&L is only consolidated into the group figures for the part-year from the date of acquisition. Hence this causes a mismatch in the year of acquisition.

The problem with PTSG is that debtors were already too high, even before the acquisitions. So I remain uneasy about this aspect of the balance sheet. High debtors quite often results, sooner or later, in bad debt write-offs. Not always, but that does quite often happen. So it's an increased risk factor here, that I'm not happy with.

Operating cashflow was negative in both 2017 and 2016, which ties in with high & increasing debtors. So again, this is a point which makes me reluctant to invest here.

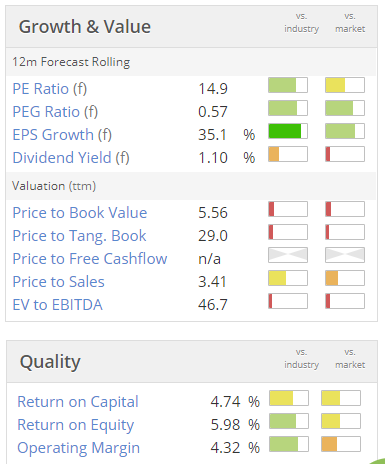

Valuation - the PER looks about right to me. Note that dividends are only modest, as the company is focused on acquisitions at this stage;

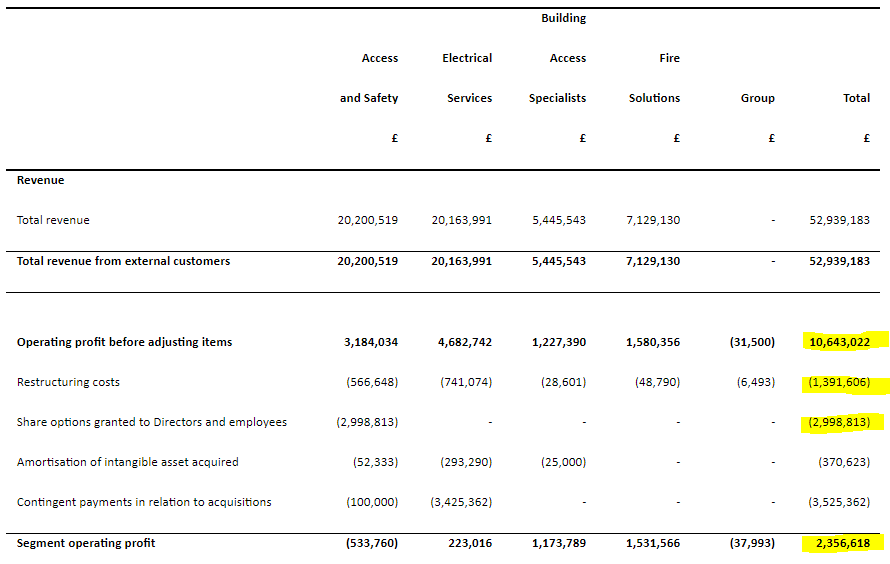

The operating margin above looks low. I think this might be because Stockopedia might ignore adjustments, and reports the overall result. This has just reminded me that the 2017 accounts had very considerable adjustments on the P&L;

The way I look at adjusted profits, is that there is a good amount of sense in trying to strip out non-trading figures, to arrive at a profit number which reflects the underlying performance of the business. However, this opens up scope for abuse, to inflate the profit number that investors use to value the business.

In the figures above, I would put a question mark next to restructuring costs. Also, the share options charge looks excessive, and is remuneration by another name, so should not be ignored, in my view. It looks as if the Directors here are firmly in the camp of ensuring they get paid very handsomely indeed for their work.

I don't suppose outside shareholders mind particularly, when the share price performance has been very good in recent years. However, looking at the 3-year chart, it seems to be struggling to make any further gains for now, perhaps?

My opinion - overall, I can't get over my balance sheet worries. So despite today's reassuring update, this one's not for me. There's not necessarily a problem, but there just seems increased risk here that there might be a problem re debtors & cashflow.

If however you're more relaxed about the balance sheet & cashflow, then the bull case is pretty good - high margin niche businesses, together with canny management making decent acquisitions.

As an aside, the CEO has plenty of skin in the game, holding 18.7% of the company. I see that Bob Morton's company, Hawk Investment Holdings, reduced from 13.0% to 11.57% in Jan 2018.

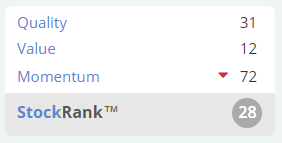

Note also that the Stockopedia computers are surprisingly negative on this share, not seeing quality or value here;

Angling Direct (LON:ANG)

Share price: 105p (unchanged today at 09:45)

No. shares: 43.0m

Market cap: £45.2m

(at the time of writing, I hold a long position in this share)

ANG describes itself as;

... the largest specialist fishing tackle and equipment retailer in the UK

Today's acquisition announcement is so tiny that I wouldn't normally mention it. However, it jogged my memory about some research I did on this company a while ago. Looking through the RNSs, it struck me how cheaply ANG is buying in growth. Fishing tackle is a very fragmented market, with lots of mom & pop operators. ANG's strategy seems to be consolidating the market by rolling up these small competitors, and it's doing so at excellent prices. Buying economies can then be applied to the acquired businesses, so the strategy makes a lot of sense to me.

Plus ANG seems to be emerging as the leader online in the UK. Competitor Fishing Republic (LON:FISH) (in which I also have a long position) put out a profit warning last year, citing tough online competition. FISH is very much cheaper than ANG. I couldn't make up my mind whether I wanted the one that's performing best (ANG), or the one that's dirt cheap & a potential turnaround under new management. So I bought both! Over time I'll monitor both, and at some point probably ditch one or the other, depending on what progress they make.

As an example, the detail of today's acquisition looks remarkably cheap;

... acquired the stock, fixtures and fittings, and goodwill of Ted Carter Fishing Tackle for a total consideration of £125,000 payable in cash, plus stock at valuation.

The Directors believe the total consideration values the business at approximately two times annual profits / EBITDA, taking into account the economies of scale and best practises the company will implement upon acquisition. In the year to 31st March 2018 Ted Carter Fishing Tackle generated revenues of c.£1.2 million.

The stock market is currently valuing ANG on a forward PER of about 45 times. So if it can acquire businesses on low single digit multiples, then that makes for a smashing business model. It reminds me a bit of how Judges Scientific (LON:JDG) expanded, through buying up dirt-cheap businesses, and funding it with highly rated paper, and bank debt. Then the cashflows of the acquired businesses quickly repaid the debt. Something similar (or even better maybe?) seems to be happening at ANG, hence why I like the shares.

My opinion - is this the next Gear4Music (in which I hold a long position)? That was a question posed by a fund manager in an article recently. Overall, I think there's a possibility it might be. The moderating factor is that ANG is not eCommerce only, which G4M is (apart from modest sales from its York showroom). So ANG might not be able to command such a high PER as G4M.

However, I do like niche businesses which are successfully growing online, which are not under too much threat from Amazon, because they're specialists in markets that are too small to interest Amazon.

Looking at the last set of figures, ANG shares do look rather aggressively valued at the moment. However, that's the norm for companies which are generating strong growth. However, for readers who like growth companies, and don't baulk at paying up for them, then this one is worth a closer look, in my view.

FISH is much higher risk, but with a market cap of only £5.4m, it could have more percentage upside, if management is successful in turning it around. The risk with FISH is that it could wither away, if ANG becomes totally dominant with online sales.

OptiBiotix Health (LON:OPTI)

Share price: 65.7p (down 0.8% today, at 10:08)

No. shares: 82.9m

Market cap: £54.5m

Manufacturing agreement with Morley Foods

Optibiotix describes itself as;

... a life sciences business developing compounds to tackle obesity, high cholesterol, diabetes, and skin care...

I wouldn't normally cover this type of announcement in these reports. However, this stock is one which intrigues me. There has been a strong flow of apparently positive contracts & agreements, which is steering me towards thinking that there might be something of substance here. I generally try to avoid jam tomorrow shares like this - which generate negligible revenues, trade at a loss, but have a high market cap due to bullish talk of future opportunities. The actual success rate for this type of share is dismally low. Occasionally though there are exceptions, which do succeed. Maybe this might be one such exception? Who knows - only time will tell.

I thought it might be useful to check out Morley Foods (a private company), so I've had a dig around on the Companies House website. The group holding company seems to be J M holdings Ltd. Its last reported accounts are for 2016, and show £31.2m turnover, £729k profit before tax, and it has a very strong balance sheet.

This suggests that Morley Foods is a small, but solvent company.

Today's agreement says that Morley has developed ingredients for muesli, containing OPTI's "Slimbiome", which is;

SlimBiome®, a patented combination of natural ingredients developed by experts to provide hunger free weight loss, recently won the award for Weight Management of the Year at Vitafoods European trade show.

Under this agreement, OPTI says it will receive "50% of the profit".

My opinion - no figures are given about today's deal. Judging by the relatively small size of Morley, then I'm guessing that this deal is unlikely to be a game-changer for OPTI.

Overall, this share is impossible to value at the moment, as revenues have not started flowing yet, from its various announced deals. In bull markets, investors tend to over-estimate both the speed, and quantity of revenues & profits from jam tomorrow companies like this. They nearly all take much longer, and incur larger losses, than originally planned. Hence why I rarely invest in jam tomorrow companies.

The odd one will deliver great returns, but it's like searching for a needle in a haystack. So unless you have sector expertise, I fail to understand how the average punter thinks they can reliably sort the wheat from the chaff - when the vast majority of this type of share is overpriced junk.

That said, the newsflow from OPTI does look interesting, and suggests it could have something interesting, potentially. So I'm keeping an eye on it.

Whenever I see a share being constantly promoted, I remind myself why the promoters are so enthusiastically pumping the share price. It's because they want the share price to be as high as possible, so they can do repeat fundraisings at lofty valuations. So a small army of excitable, but usually naive private investors, is very helpful in achieving this aim.

The Stockopedia algorithms are designed to steer us away from this type of speculative share. So as you would expect, it has a lowly StockRank (see below). We all like a punt from time to time, so personally I allow myself 1 or 2 jam tomorrow share punts.

The StockRank system can be useful as a risk management tool - e.g. in a portfolio of say 20 shares, we might allow ourselves 1, 2, or 3 low StockRank shares (depending on how much of a punter you want to be). Alternatively, we could put a % maximum limit on how much of our portfolio can be invested in shares with a StockRank of, say, below 30 - maybe something like 10%? That's enough to allow us to indulge our inner gambler, but without the mistakes that inevitably are likely from this tranche of our portfolio, doing too much damage.

In a roaring bull market such as we have at the moment, it should be noted that there can be spectacular profits from low StockRank stocks, if you happen to pick the right one at the right time, when a stampeding herd of punters all decide to buy it at the same time! Cashing out at the right time is the tricky bit though.

Overall, for me, this type of punter's share would only ever be a sideline in my overall portfolio. There are less exciting, but more reliable ways to make money from shares with proper profits & dividends, instead of gambling on what might happen in the future on stuff like OPTI.

Volex (LON:VLX)

Share price: 80.5p (down 0.6% today, at 11:39)

No. shares: 143.5m

Market cap: £115.5m

Preliminary results - for the year ended 1 Apr 2018.

This is a maker of power & data cords for electronic equipment.

The highlights seem to suggest that the company is settling down into modest, but improved profitability, after years of restructuring;

I cannot understand why anyone would want to invest in an electrical cords business. This is high volume, low margin work, with any number of competitors in low cost economies vying for business.

Post year-end - this is very material, so is important to consider the changes in the balance sheet, and number of shares in issue, before analysing the historic numbers published today;

Post year-end, the Group has completed an equity raise of £36 million and the acquisition of two smaller competitors in the Cable Assemblies sector. Residual cash will be used to deleverage the balance sheet, for future investment into automation and to fund future targeted M&A activity.

Cost pressures - it seems impressive that profit has risen, despite increased costs;

We continue to see significant cost inflation in both raw materials and labour rates as well as adverse movements in foreign exchange. However, the underlying gross margin has been maintained year on year through improvements in productivity and operational efficiency as well as stringent cost control. As a result, I am pleased to see the Group return to full profitability.

This suggests to me that the business is now being well-managed, unlike at some points in the past.

My opinion - this share looks priced about right - a forward PER of 10.3 .

It's difficult to see why anyone would want to buy this share. It's cheap because it's a boring company, with little pricing power, in a very competitive market.

There's been a reasonably good turnaround in recent years, but it's difficult to imagine that profit margins could go much higher. There's little organic revenue growth. So what happens next? More cost-cutting perhaps, but then what?

I see this share as neither value, nor growth. It's not cheap enough to tempt me in with a big dividend yield and ultra-low PER. But it doesn't qualify as a growth company either. So it's not for me.

Investors have had a good run in the last 2 years. How much more is there left in the tank, I wonder?

Koovs (LON:KOOV)

Share price: 13.5p (up 18.9% today)

No. shares: 175.4m

Market cap: £23.7m

Fundraising & strategic agreement

This hopelessly under-performing Indian eCommerce venture has been struggling to raise fresh funding for a long time. An ingenious (partial) solution has been announced today, whereby increased marketing spend will be paid for 70% through issuing new shares to its media partner.

This means that £16.8m of new shares could be issued at 10p, which would be 168m new shares, which is almost doubling the share count. The precise price (and hence dilution) will be determined by the price of subsequent tranches of shares issued;

The conversion price for the first £4.2m tranche of new shares to be issued to HT Media is to be 10 pence per Koovs share. Thereafter each tranche will be priced at the lower of Koovs' then 3-month average closing share price or the price of the most recent round of equity fundraising by the Company.

Presumably Koovs is hoping that it can ramp up its share price, thus meaning lower dilution in future.

My opinion - based on financial performance to date, Koovs remains an absolute basket case. The increased marketing firepower could help stimulate the sales growth that the company so desperately needs, to get anywhere near being a viable business.

We're in a bull market, where crazy things happen, so I wouldn't write off Koovs just yet. If they can find deep-pocketed investors prepared to throw large amounts of money at it, then who knows, it might eventually gain some commercial traction?

However, it's difficult to think of a company with a worse financial track record than Koovs, so it will require nothing short of a miracle to turnaround Koovs into something viable. So at this stage, this share is for mad punters only.

A brief mention of 3 new companies coming to the market, which have all put out "intention to float" RNSs today, which I have put links to below;

ASA International Group - describes itself as;

ASA International, one of the world's largest and most profitable international microfinance institutions, which aims to enhance financial inclusion among low-income populations throughout Asia and Africa in a socially responsible manner...

I fail to see what is socially responsible about charging high interest loans to some of the world's poorest people? The argument seems to be that the micro loans enable women especially to expand their small businesses.

It made $29m profit on a $299m loan book.

The float seems to be as an exit route for the selling shareholder.

It's an Institution-only float, which is ridiculous, as that means there won't be any aftermarket liquidity. So why bother with a listing at all?

On an initial quick review, I don't like the look of this one bit - it just isn't the type of thing I would be comfortable investing in -sucking money out of the poorest countries, to pay dividends to the rich in the West.

RA International Group - seems a similar type of concept (I wonder if they are related?)

... a leading provider of services to remote locations in Africa and the Middle East

A few key points;

In the year to 31 December 2017, RA International generated revenue of US$53.3 million and profit of US$13.7 million. As at 30 April 2018, the Group had a contracted backlog of US$120 million.

It doesn't interest me, as I won't usually touch anything overseas on AIM.

Anexo Group - this looks to be a credit hire business (a bit like Redde (LON:REDD) ?)

The market cap will be £110m on listing.

This is enough to put me off;

Differentiated direct capture of credit hire customers sourcing customers directly from garages rather than from insurers / brokers and integrated claims management within a wholly owned legal services firm.

My opinion - I won't touch anything in the ambulance-chasing, or legal services area, having been badly burned several times with these type of companies. Why get involved when you don't have to? There are regulatory risks that can overturn business models in an instant.

Also, I think this sector can attract management of whom a higher than average proportion turn out to be opportunistic spivs. Management at this company may be an exception to that sweeping generalisation, I don't know.

Outside investors don't usually come out of things well, in this sector, in my experience. Redde (LON:REDD) is the only one I can think of where outside shareholders have done well, over a long period of time (since 2012 anyway, not prior to that).

Jolly good, that's me done for today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.