Good morning!

Today we have:

- Trakm8 Holdings (LON:TRAK) - contract win

- Stewart & Wight (LON:STE) - final results

- LPA (LON:LPA) - half year report

In big-cap land, Dixons Carphone (LON:DC.) announced annual results too - worth a brief mention.

Trakm8 Holdings (LON:TRAK)

- Share price: 108p (+12%)

- No. of shares: 35.9 million

- Market cap: £39 million

It feels like an important contract for Trakm8, the telematics company.

The contract, initially for three years, provides Intelematics Australia with data, including automotive diagnostics, and a 4G self-fit on-board diagnostic ('OBD') device. It is believed that this is the first 4G OBD device to meet the requirements of the Australian Cat M1 networks. The demand over the three year period is expected to amount to circa 40,000 connections.

According to the full-year trading update (for the financial year ending in March), Trakm8's total connections increased to 251,000 during FY 2018. So this contract represents a 16% increase on that number.

Stockopedia user blondeamon has written an article at this link arguing that the number of connections in fleet management is what matters from a valuation and recurring revenue point of view, and he estimates that this contract represents a 57% increase on Trakm8's existing year-end fleet connections.

It looks to me as if the market is fatigued with this stock.

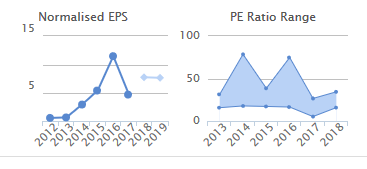

See how EPS rose rapidly before disappointing last year (left-hand-side).

Then see how the P/E multiple has failed to reach its previous heights (right-hand-side).

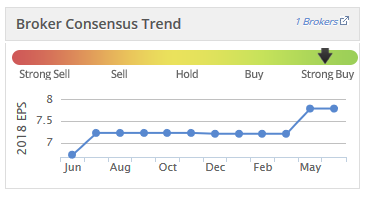

And yet the earnings momentum has looked pretty good. EPS forecasts have been firming:

If I was going to put my sceptical hat on, I would say that the contract announced today is only for three years, and we aren't given any financial numbers to base our investment decision on. Perhaps that would be commercially sensitive?

I think I'll refrain from saying much more until we get the full-year results. These are set to be released on July 2.

One thing I will say is that I've been impressed by the quality of performance at another telematics company, Quartix Holdings (LON:QTX). I don't understand this space well enough, but I'd love to know why does Quartix do so well, and yet the performance at Trakm8 seem so much more complicated, by comparison?

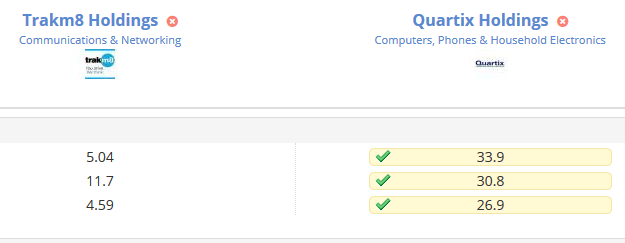

Stockopedia has a useful stock comparison tool. You can plug any two stocks in and compare them side by side. For example, here's what you get when you plug in TRAK and QTX.

Quality metrics (return on capital, return on equity and operating margin):

Operating margins are a key measure of profitability. As you can see, the Quartix operating margin is more than 5x the Trakm8 operating margin.

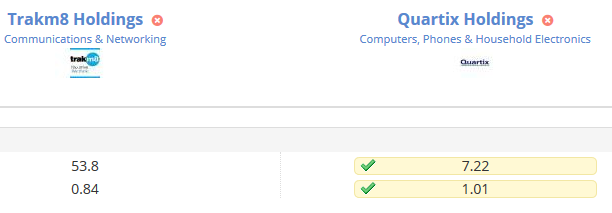

And now some efficiency metrics (cash conversion cycle and asset turnover):

These tend to signal management effectiveness, although they can also be affected by the company's competitive position (e.g. if it is forced to give customers a long time to make payment, to help compensate for having a poorer product offering).

By all of these important metrics, Quartix is significantly better than Trakm8. As I've said, I don't understand the sector well enough yet to know why this happens to be the case. But it makes me biased in favour of Quartix as an investment opportunity.

The market has spotted these differences in quality and awards QTX a trailing P/E multiple of 31x, while TRAK only has a trailing P/E multiple of 14x. So you might argue that the differences are already fully priced in.

Stewart & Wight (LON:STE)

- Share price: 525p (unch.)

- No. of shares: 1.6 million

- Market cap: £8 million

This is a tiny property investment company. It's impossible to trade, and is de-listing at 590p (I checked whether it was possible to buy any for less than 590p, but could not get a quote).

The relevance from the point of view of the SCVR is the macro comment.

S&W's property portfolio has been revalued 12% lower than its former values. This is the explanation:

The reduction in the value of the company's properties was particularly evident in the last six months of the year due mainly to the consequences of the failure of a number of national retailers leaving vacant properties on the high street. This, together with the growth of internet shopping, increased business rates and staff wages have all led to a general fall in rental values. The company's shop property in Falmouth let to New Look is an example of where the rent is currently reduced following that Company's CVA and the property's future is uncertain.

In light of these conditions, the company is "hesitant" about buying any new retail properties. It evidently believes that the market is still quite far from bottoming out.

I wonder how all of this ends? What is going to happen to all of these properties?

Perhaps we will see the proliferation of experience-type businesses such as GYM (LON:GYM), Hollywood Bowl (LON:BOWL), Escape Hunt (LON:ESC) and GAME Digital (LON:GMD) arenas? (I own shares in GMD!)

Perhaps some of them can be converted into residential property?

We don't need a greater supply of restaurants, so that's not really an option.

Whatever happens, it's going to take several more years for this to work itself out.

LPA (LON:LPA)

- Share price: 119p (-26%)

- No. of shares: 12.4 million

- Market cap: £15 million

A nasty share price fall at this one today. LPA manufactures LED lights, circuit breakers, fans, electrical cabinets, etc.

The opening sentence would suggest everything is fine:

LPA Group PLC ("LPA" or the "Group"), the high reliability LED lighting and electro-mechanical system manufacturer and distributor, announces a strong performance for the six months to 31 March 2018, £1.8m of LED Lighting and power socket contracts from a new customer and board reorganisation.

Revenues are up 29% and operating profit before exceptional items up 45% to £1.1 million.

The problem is:

- Order entry decreased 43.4% to £8.40m (2017: £14.85m)

- Order book stands at £16m (2017: £22m)

Order entry must means fresh new additions to the order book. That's a useful number to have - it would be nice to see other companies reporting it as standard, too.

At LPA, sales have outstripped order entry, with the result that the order book is shrinking and the medium-term sales outlook has deterioriated.

The reasons given are familiar to anyone with much experience of public sector-facing stocks: the government's procurement policies have shifted.

Cross Rail and London Overground have changed the way they make their purchasing decisions.

As well as that, existing trains have been sent for early retirement (instead of being refurbished with the help of LPA), and new trains have been imported from foreign suppliers who are not existing LPA clients.

Finally, competition has been heating up in Asia from Chinese and Korean entities.

LPA remains confident in the long-term. It increases its dividend and plans to promote an existing MD to the CEO position.

The company has a consistent long-term track record of profitability and insiders are well-invested, giving me confidence that its probably quite conservatively managed.

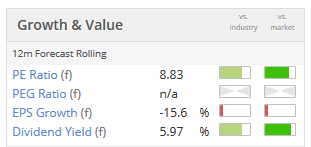

Stocko algorithms like it, too:

Although the StockRank says it is cheap, I'm inclined to believe that this is fairly priced. Small government-facing industrial businesses such as this ought to be on a modest rating.

Dixons Carphone (LON:DC.)

- Share price: 195.9p (+3%)

- No. of shares: 1158 million

- Market cap: £2,269 million

Let's take a quick look at this electrical retailer.

We've been talking a lot about dirt-cheap retailers. This is another one:

The weakness with so many of these companies is that they are middlemen, and anything that can get disintermediated is almost certain to get disintermediated, sooner or later.

Do we all remember Phones 4u? It was one of the biggest mobile phone retailers in the country. But when the phone networks pulled the plug, it was over.

When it collapsed, the phone networks took over many of its retail units, no doubt stealing many of its former customers.

Carphone Warehouse also tried to fill the gap. If you google 'Phones 4u', you are now led to a Carphone Warehouse landing page for orphaned customers who need a new phone.

Part of Phones 4u's problem was that it had been left heavily indebted by its private equity owners, who never properly funded it.

But the vulnerability was caused by its fundamental lack of negotiating power.

Signs aren't great for the negotiating power at Dixons Carphone. Margins are hurting.

In electricals:

The combination of channel and product mix effects led to a greater adverse gross margin year on year due to the costs of providing home delivery and installation services as well as lower levels of service attachment.

In UK mobile:

As seen throughout the year, postpay market conditions and our contractual commitments with the networks have meant that gross margins continued to be challenged,

And the outlook sounds difficult in both sides of the business.

In electricals, the company is again budgeting for a decrease in the market in 2018/2019 and is expecting cost increases from the living wage and IT depreciation.

In mobile, "we are making progress in our contract discussions with the networks with the aim of improving our business model."

But why would the networks be concerned about profitability at DC?

I'm not overly bearish on these shares in the short-term, because they are already priced so cheaply relative to recent earnings, and because the company's outstanding debt load is not yet onerous.

My concern is that the company is going to have to shrink for the foreseeable future, and I can't see any relief in margins. Buying will continue to go online for electricals, and mobile networks will continue to hold all the cards in mobile.

Duke Royalty (LON:DUKE)

- Share price: 44.4p (+0.45%)

- No. of shares: 97 million

- Market cap: £43 million

Although it's hard to get around to reader requests, especially in the busy period, it is something I like to do, when there is time.

We had a couple of requests to cover this stock, and I like the sound of it, so here goes.

Duke Royalty is "the first UK quoted diversified royalty investment company".

It was born from a Canadian approach to royalties, transposed to Britain. Judging by the RNS trail, it took some time for it to raise initial capital. Eventually £35 million was raised in two placings last year.

The idea is that Duke buys the right to a percentage of future revenues from a business, allowing the existing managers (presumably the founders) to retain control. Duke takes a hands-off approach. You can read about the attractions of the model at this link.

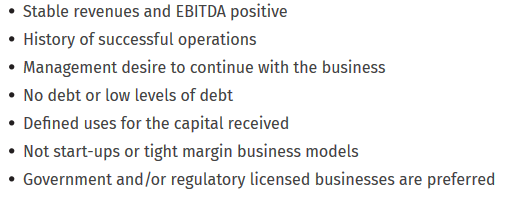

From a shareholder perspective, Duke's investment criteria are reassuring. It's not buying into speculative, "blue-sky" affairs. It's buying businesses with a good chance of succeeding for the long-term:

The case studies on Duke's website are encouraging, too. Paybacks in each case look solid, suggesting that Duke is disciplined not just in its investment selection but also in how much it's willing to pay.

For example, its inaugural royalty agreement was with a river cruise provider. This generated a cash-on-cash yield of 13%.

It is seeking to generate "robust, predictable, long term returns" and has already started paying dividends for shareholders.

Last week, it announced a letter of intent for its fifth investment. This one is "the largest US provider of legal information that is solely focused on serving the law enforcement market". It will invest between $3.5 - $7 million in this opportunity, the initial payment being funded by a loan at 9% (rising to 12% for the last six months of the loan).

The loan expires in June 2019. I guess must Duke plan to use the income from its other investments to repay the principal.

Overall, I'm intrigued by what this company is doing. It sounds like the type of model which could generate sustainable compound returns for shareholders. I'm definitely interested to research it more!

All done for today! Thank you for dropping by.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.