Good morning!

Today we have:

- Fireangel Safety Technology (LON:FA.) - profit warning from this accident-prone company (formerly known as Sprue Aegis).

- Lok'n Store (LON:LOK) - trading update, seems in line with expectations.

- Symphony Environmental Technologies (LON:SYM) - trading & operations update. In line with expectations. Upbeat.

- SDL (LON:SDL) - half-year report. "Good start to the year", full-year outlook in line with expectations.

- Ascent Resources (LON:AST) - CEO moves to part-time basis and other UK staff will move to ad hoc basis. Could run out of money before the end of the year, though a positive outcome from the strategic review is still expected.

- Omega Diagnostics (LON:ODX) - final results. The first time I've seen a "bread tomorrow" statement. "I do believe that after many years of famine shareholders will see some bread in their basket by this time next year."

Shares Awards: If you'd like to help support Stockopedia, you can vote for us in ‘Best Investment Software Programme’ (Category 15) and ‘Best Investor Education’ (Category 17) at the Shares Awards. We'd really appreciate your vote! Here's the link.

Fireangel Safety Technology (LON:FA.)

- Share price: 44p (-29%)

- No. of shares: 46 million

- Market cap: £20 million

It has been a stunning fall from grace by this fire safety company.

It has changed name (from Sprue Aegis) and then produced a profit warning less than six weeks later.

If it was trying to appeal to shareholders, it might have changed its name only after all the bad news and accidents were already priced in.

From a customer/marketing perspective, the name change does make good sense as it unifies the company's products under a single brand.

The H1 operating loss of £1.8 million is in line with expectations, but the full-year loss is now expected to be up to £0.5 million, below expectations.

To spin it positively, I suppose this does at least mean that we are forecast to have an operating profit in H2.

The cause of the profit warning:

...a combination of certain short term transitional issues within the supply chain recently identified, the continued weakness of GBP Sterling against the USD dollar and difficult UK high street trading.

The company has switched to manufacturing its products with a Polish partner, and I think it's excusable that there would be a few issues as production ramps up there.

A bit harder to swallow, however, is the switch from its traditional role as a hardware provider to "a more integrated safety solutions provider", i.e. the "connected homes" or "smart homes" idea.

While the items described as "Connected Products" on its website look interesting, I would be a bit concerned that the company might be hoping to market itself as an "Internet of Things" stock, i.e. to chase the mountain of speculative money that has entered that space.

FireAngel had £3.4 million of cash at the end of June and a £7 million working capital facility, so it should not suffer any financial distress.

Maybe the market cap is sufficiently low now (£20 million) that it makes sense as a contrarian bet. While I haven't got enough conviction/faith in the company's long-term earnings trajectory to make that bet myself at this stage, and I'm not convinced by the underlying quality of the business, I do think it might be worth a little bit more in-depth research at this very depressed share price.

Net tangible asset value was £14 million at December 2017, with £13 million of intangible software and product development costs shown on the balance sheet too. So you can see how it's beginning to approach levels where it would look quantitatively cheap (assuming that losses aren't huge).

Lok'n Store (LON:LOK)

- Share price: 405p (+1%)

- No. of shares: 30 million

- Market cap: £119 million

Regular & long-time readers will know that I'm positive on storage as a concept and on its economics as an investment, i.e. I think it will outperform the overall property market as living conditions become more cramped. This is particularly true in southern England, where Lok'n Store operates.

This is a strong update with revenue, occupancy and price per square foot all moving upwards.

Lok'n Store owns its own stores and also manages stores that are owned by 3rd-party investors, so there's a mix between capital-intensive and capital-light activities.

Total trading space, i.e. including both owned and managed stores, is set to grow by 35% with the current secured pipeline of new sites. Managed space is growing faster than owned space.

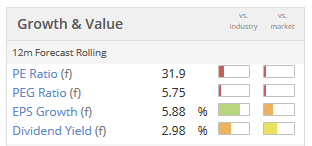

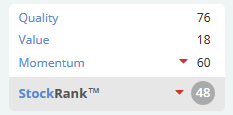

The earnings multiple is unfortunately rather high but I am personally inclined to think that this is justified, given the company's track record and long-term prospects.

If you allow for an uplift on property valuations and other adjustments, the company puts its net asset value at 418p per share, implying a current price to book value of 0.97x.

I would view the true NAV as a little lower than this, as I wouldn't exclude the shares held in the employee benefit trust from the calculation.

Either way, the shares are not particularly expensive when you look at it from that perspective.

But it's unlikely to appear on any Value screens for a while:

Symphony Environmental Technologies (LON:SYM)

- Share price: 14.625p (-1%)

- No. of shares: 154 million

- Market cap: £23 million

Symphony Environmental Technologies Plc (AIM: SYM), a global specialist in products and technologies that "make plastic smarter", is pleased to provide a positive trading and operations update and healthy outlook.

The outlook for the full year is in line with expectations.

Revenues are up 11% in H1 to £4.1 million, despite a currency headwind but also with the help of a new type of product.

The company makes materials for single-use plastic products, e.g. shopping bags and drinking straws.

There is a regulatory tailwind for this type of product, and some businesses are voluntarily making the switch to single-use products. McDonald's, for example, is switching to paper straws in the UK & Ireland.

Symphony is still at an early stage, relative to its ambitions:

"Our strategy to become a multi-product Group continues to progress as more of our projects reach the commercialisation phase."

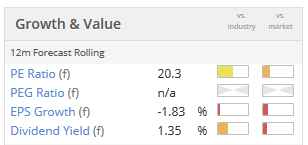

Financially, it hasn't achieved too much yet. Results for 2016 and 2017 each showed a small profit. It is forecast to make about £500k this year.

Given the £23 million market cap, I would be looking for faster top-line growth than c. 10% in order to demonstrate the potential for mass adoption and to help justify this valuation.

Perhaps some other products are going to come on stream and accelerate growth. But based on the numbers as they stand, in this instance I would agree with the StockRank: not enough value on offer.

SDL (LON:SDL)

- Share price: 513p (+1%)

- No. of shares: 91 million

- Market cap: £465 million

This is a share we have rarely covered in this report.

It provides translation software, translation services, and online content management for businesses.

The explanation of their content management service has made my head spin. They say they help companies to manage content and the user experience across multiple content categories, multiple devices and in multiple languages, but I can't figure out any more detail than that.

Clients include "85 of the top 100 global companies" - that's worthy of respect.

Worth noting that a $77.5 million acquisition was made last month and is not reflected in these results.

Some bullet points:

- Constant currency growth of 6% in H1 - not bad.

- H1 PBT increases from £6 million to £7.8 million.

The company has made "steady progress", in the words of the Chairman, and "solid progress" is anticipated in H2.

Considering the revenue growth rate and bearing in mind the adjectives used by the Chairman, I'm not seeing too much to get excited about here.

I would value organic revenue growth much more highly than the cross-selling and up-selling opportunities created by the acquisition.

The shares are already quite highly rated, and its track record for ROCE (return on capital employed) does not stand out.

So while I don't think this is a bad business, I don't see any reason to get interested in the shares and to research it any further.

It's a slow news day, so I'm going to sign off there. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.