Hello everyone, it's Paul here.

This is the delayed report from Friday 21 Sept 2018 - apologies for the tardiness.

If you want to read my comments on FCCN results, the only way to do it seems to be to provide a link to comment no.28 in yesterday's report, which is here.

Retailing sector

In this catch-up report, I'll be covering results from 3 retail chains.

Last week, I was asked to give a presentation at a private investment seminar, about the retail sector. A summary of my main points follows below, which may be of interest to the wider audience here;

- Conditions are terrible - with sales leaking away to online competitors, and costs rising (mainly related to weak sterling, and staffing costs)

- Many retailers are likely to go bust - but survivors could prosper (last man standing basis). Current over-capacity likely to take years to unwind

- Consumer confidence is better than people think - Aug 2018 confidence index was negative at -7, but this is due to a -26 score for the perceived general economic picture. Personal financial situation is actually positive, at +8

- Rents will have to come down drastically, so landlords facing a world of pain, and from CVAs/pre-pack administrations

- High Streets need to be rejuvenated with new, independent retailers (e.g. the popular Brighton "Lanes" district) - not the same old chain stores, which make towns indistinguishable from each other

- The best retailers, with the right products, should still do well

- Strong online offering is essential for larger retailers. 10% of sales online is not enough. Needs to be nearer 50% ideally (e.g. Next)

- Supermarket shares have done well in last year, but look fully/over-valued now

- With uncertainty over the UK's Government, and Brexit this might be a good time to avoid retailer shares altogether, instead making a watchlist for things to buy at a discount, on any political shock?

- Selectively there are big, and sustainable dividend yields available (more below)

My comments on individual retailing shares

(my view as at 19 Sept 2018)

£NXT - my top pick - half business already online, very high net profit margin, actively managing down retail stores, rent reductions, highly cash generative & paying big divis (and buybacks). Valuation reasonable on PER of 12.

Marks and Spencer (LON:MKS) - recovery underway. Closing 100+ loss-making stores, should boost profits (and closures are triggering a c.20% increase in sales at nearest remaining stores - double benefit to profit. Cashflow statement is excellent. Secure 6.6% dividend yield. Freehold property. Takeover target? (High Street's best brand). Superlative food offering, but not sold online (opportunity)

Debenhams (LON:DEB) - likely to go bust in current structure, in my view. Long leases make it uncompetitive. Trade insurance could be withdrawn (seems to be heading in that direction)

Card Factory (LON:CARD) (in which I hold a long position) - my top pick of mid-sized retailers. Amazingly high margins. Big dividend yield + specials. Recent results were OK. Opening 50 new stores this year (more on this company below)

Laura Ashley Holdings (LON:ALY) - a possible punt only. Recently sold big freehold, so balance sheet now de-geared. Still profitable. Expanding in Far East (via franchises). Valuable brand.

French Connection (LON:FCCN) (in which I hold a long position) - onerous leases gradually expiring. Valuable licensing revenues & successful wholesale division. Bid discussions last year. Major shareholder/founder likely to retire & sell business. I'm hoping for c.150p+ exit price on a trade sale. Recent interims were a tad disappointing, but confirmed full year outlook for a return to profitability.

Revolution Bars (LON:RBG) (in which I hold a long position) - obviously mis-priced, at 124p, given 203p cash bid last year (rejected by shareholders as too low). Deltic takeover/merger? Could have one more profit warning in it maybe?

Online only retailers

MySale (LON:MYSL) (in which I hold a long position) - strange price collapse, after positive trading update. Balance sheet looks OK to me. Zeus & N+1 say nothing untoward.

ASOS (LON:ASC) - still growing strongly, but operating margin has slipped to only 4%. Fwd PER of 51 doesn't look justified. Never paid divis & not generating free cash.

Boohoo (LON:BOO) - new CEO from Primark. Fwd PER of 40 doesn't look excessive. Higher net profit margin than Asos. Worth revisiting (written when share price was c.183p)

Ocado (LON:OCDO) - joke valuation! Valued as a tech company, not a retailer

Koovs (LON:KOOV) - serial disappointer, bargepole

Sosandar (LON:SOS) (in which I hold a long position) - my top small cap pick. Outstanding management, growing faster than plan, under-served market, celebrity endorsements. Early stage growth looks set to be faster than Asos at same stage

Gear4Music (G4M) (in which I hold a long position) - good, but under competitive margin pressure

Angling Direct (LON:ANG) - hybrid of stores & online. Potentially interesting

High StockRank retailers

SCS (LON:SCS) - SR 99 - doing perhaps surprisingly well

Halfords (LON:HFD) - SR 98 - helped by popularity of cycling & hot summer

United Carpets (LON:UCG) - SR 98 - tiny, but paying good divis & low rating

Shoe Zone (LON:SHOE) - SR 96 - short leases & low capex, so has considerable flexibility. Entrepreneurial management

Next (LON:NXT) - SR 94 - as mentioned above, this is my top sector large cap pick

JD Sports Fashion (LON:JD.) - SR 88 - recent results were fantastic. International growth going well - potential growth in USA is exciting. Just shows, that even in tough markets, the best operator can succeed

Hopefully that might have given you some ideas for things to research, or avoid.

The big question is whether current tough High Street conditions are here to stay, or just a blip. I tend to agree with the consensus view, that it's difficult to see what is going to happen to change things for the better.

Therefore I'm only interested in being highly selective, and only holding special situation retailers. I wouldn't want any general exposure to the sector right now.

Card Factory (LON:CARD)

Share price: 193p (up 8% today)

No. shares: 341.5m

Market cap: £659.0m

(at the time of writing, I hold a long position in this share)

Card Factory, the UK's leading specialist retailer of greeting cards, dressings and gifts, announces its interim results for the six months ended 31 July 2018.

The market cap is a little higher than I would normally go, but it's such an interesting company that I've bent the rules.

As you can see from the 2-year chart below, this share has de-rated sharply in the last year - moving from being considered a growth company, to a value share;

I'm wondering if the de-rating might have been overdone, as there are many attractive features of this company. However, the problem is that profit is now falling, despite opening many new stores - 25 new sites opened in H1, with 50 in total expected for the full year. The estate is currently quite large, at 940 shops - which is getting fairly near to full coverage of the UK.

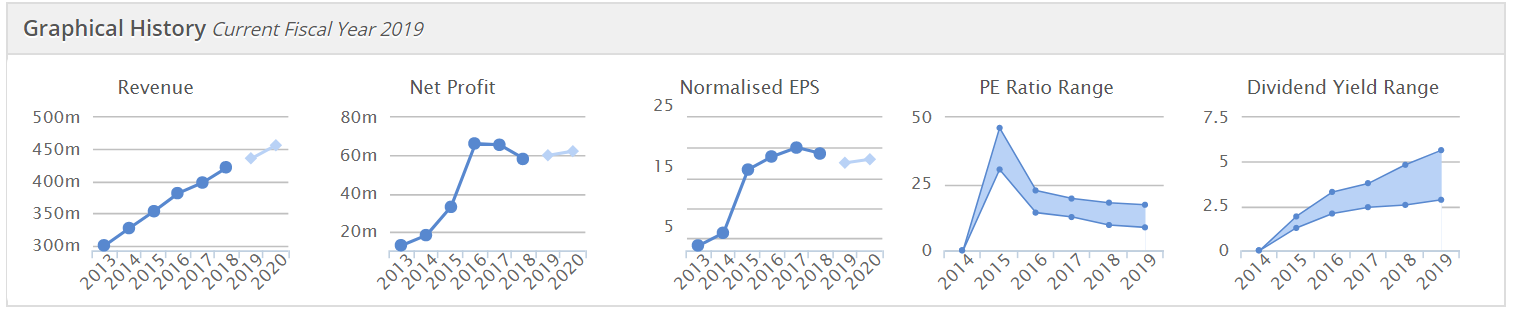

The Stockopedia historical graphs neatly encapsulate the stalling of profit growth, hence the reduction in the previously high PER, to only about 10 now. Note also how the divi yield gets better & better (now forecast at 8.4% by consensus forecasts);

Seasonality - note that there is a strong H2 bias to profitability

Interim results - some key figures;

- Revenues of £185.3m, up 3.2% (due to new openings)

- LFL sales down 0.2%, but this includes online sales growth. Retail stores only saw LFL sales down 0.7% - this is actually a pretty creditable performance, in a half year characterised by extreme weather conditions, and poor footfall. Not many retailers are reporting positive LFLs this year, so being close to positive is a decent result - driven by increased average customer spend, almost making up for reduced footfall & hence sales volumes

- Underlying PBT down 13.9% to £22.7m. I've checked, and am happy with the adjustments to arrive at "underlying" figures

- Interim divi held at 2.9p, plus a 5.0p special dividend announced

- Fantastic gross margin of 67.9% - one of the highest I've seen from a retailer

- Underlying EBITDA margin of 16.5% is still superb, despite being down from 18.5% in H1 last year. The full year figures should be even higher, due to the H2 seasonal weighting

Forex headwinds - are going to ease, because the company has hedged at £1 = $1.35 for the rest of this year & next year.

Outlook - sounds solid. Full year guidance of £89-91m underlying EBITDA is reiterated. This is a good proxy for cashflow at retailers.

Balance sheet - not very good, but in this case, it really doesn't matter, because the business is so incredibly cash generative.

Note that NTAV is negative, at -£106.3m . Normally that would put me off investing, but not in this case. We have to view the financial statements together, in their entirety. The business generates so much cash, that it paid out £82.9m in divis last year. So if the bank gets jittery about anything, then CARD could just stop paying divis for 2 years, and would generate enough cash to repay all the £159.8m net debt from internal cashflows.

Note also that the business requires very little capex. Card shops are not expensive to fit-out. Property, plant & equipment on the balance sheet is only £40m. These fixed assets generate about £90m in EBITDA. That's pretty astonishing! Capex is running at about £10m p.a., which is funding c.50 new shops per year, plus EPoS improvements, and various other stuff (including card central printing operations).

Note 12 shows that there is £12.5m in freehold property, which I imagine is probably head office and/or warehouse(s). Nice to have, although not material.

Bank facilities are £200m RCF with another £100m accordion facility for peak trading presumably. Recently renewed to 2023. It's cheap too, at between 1-2% margin over LIBOR.

Cashflow statement - fantastic, this company is just a cash machine.

My opinion - as you've probably gathered, I really like these numbers. However, enthusiasm needs to be tempered by the reality that profits are now falling, although not badly. Therefore the share price really needs to factor in the likelihood that there's probably not likely to be much upside on profitability in future. It might just grind downwards. Therefore we can't really justify a PER much above say 10-12, especially considering that there is net debt of nearly £160m to take into account.

The main reason to buy & hold this share, is for a sustainable high dividend yield. The total payout will vary each year, as the company adjusts the special divis according to its policy. Look at this for a stand-out comment in today's announcement;

Both the interim ordinary dividend and the special dividend will be paid on 14 December 2018 to shareholders on the register at close of business on 9 November 2018. We will, at that point, have returned a total of 86.6p per share (£295.4m) to shareholders since IPO in May 2014 - equivalent to over 38% of the IPO price.

With the share price currently at 193p, that's 45% of the current share price paid in divis in just over 4 years - hugely impressive.

Performance so far this year looks quite good to me. If weather conditions had been more normal, then I expect the company would have reported slightly positive LFLs.

It's funny how many investors make decisions based on their preconceptions, and not on the facts. Most people just assume that greetings cards are dying out. Yet the figures here show that actually greetings cards are very much one of the most profitable activities out of any High Street retailer.

If you divide last year's P&L by 900 shops, then you get per store revenues of £469k, and profit contribution of £139k per store - that's fantastic, and way above the results that most fashion stores achieve. Bear in mind also that rents are now coming down, on expiry/break. So profits should remain reasonably robust at CARD in future. I particularly like these aspects of its business model;

- Outstandingly high gross, and net profit margins

- Sales are proving resilient, despite poor conditions

- Highly cash generative

- Modest capex & working capital requirements

- Value price points to get customers into the store, then sell impulse by add-ons

- No real threat from the internet - eCards have never really taken off, as they're almost insulting in the eyes of the recipient

I'm not sure how much upside there is on the share price, as it seems unlikely this share would have the capacity to re-rate onto a much higher PER. But it could have maybe 20-30% upside potential? Whilst we wait, it should continue to spew out big divis. So there's a lot to like here, in my view. Worth a closer look, in my view. I may add to my existing (small) long position on any future dips.

Moss Bros (LON:MOSB)

Share price: 37p

No. shares: 100.8m

Market cap: £37.3m

Moss Bros Group PLC ("the Group"), the 'first choice for men's tailoring', today announces its half yearly results, covering the period from 28 January 2018 to 28 July 2018.

These are pretty awful results. I won't spend long on them, as I cannot see any reason whatsoever to invest in this share. We know that the retailing sector is terrible at the moment, and my sector view is worsening by the day.

MOSB now looks a marginal business, and if current negative sales trends continue, then my view is that the business might only have another, say 2-3 years left to exist. What we're seeing at the moment is not a cyclical downturn in retailing, this is major structural change, of sales migrating online, leaving serious over-capacity with physical stores. For a terrific, and detailed explanation of what's going on in the sector, as always, I recommend the latest results release on 25 Sept 2018 from Next, which is full of insights, here.

Some key numbers from MOSB interims;

- LFL retail sales (NB this includes a positive element from online sales growth) were down 6.9% - that's seriously bad, given that retailers have largely fixed costs, which multiplies the impact of sales decreases

- Retail gross margin also fell, by 2.8% to 56.5%, so a double whammy of lower sales & lower margins - bad

- Adjusted profit before tax fell from £3.9m in H1 LY, to just £0.2m in H1 this year. So the business really now has to be seen as probably only operating around breakeven, yet facing in all likelihood continuing sales decreases - so it's probably going to be loss-making from now on - therefore this is not a share I would want to hold, at almost any price

- Interim divi is lower, at 1.5p (H1 LY: 2.03p) - I think the company should be conserving cash now, and not paying any divis at all

Recent trading - showing an improving trend, but still down;

Retail like-for-like* sales, including VAT, in the first seven weeks to 15 September 2018 are down -3.7%, showing an improved trend from the extreme reduction in footfall of the high summer months.

Outlook - a profit warning, as you would expect after the above numbers;

... This decision to continue to invest means that the Group is still on track to deliver an operating profit before adjusting items, but materially lower than current market expectation of £2.3m.

Balance sheet - not bad, I would say there is no immediate threat to the company's solvency. However, as looks likely, the business is probably moving into losses in future, then the balance sheet would inevitably deteriorate.

The big cash balances at interim, and full year end, are probably seasonally favourable points in time.

My opinion - this looks a value trap to me. I've been saying for a long time that the valuation here made no sense, when it was nearer 100p, which was crazy, for what is basically a declining business. Is it cheap now, at a third of that price? Not really, no. Unless you think the business can somehow pull off a remarkable turnaround, and start generating positive sales growth again. I can't see any sign of that being a likely outcome, so it doesn't make any sense to buy the shares.

The one positive thing I can see in these accounts, is that the business is still nicely EBITDA positive. So if it slashes capex, which should be possible given that a lot of stores have already been recently refurbished, then it could continue to generate cash for a while.

The big question, that none of us know the answer to, is how long the existing trends will continue for, and what the end point will be. Will High Streets gradually settle down at a certain point, where no more sales migrate online? Or will High Streets wither and die, with almost everything moving online? Who knows.

I see MOSB as one of many smaller retailers whose outlook is mainly going to be about struggling to survive. That's a terrible investment proposition, in my eyes.

Tasty (LON:TAST)

Share price: 15.5p

Share price: 59.8m

Market cap: £9.3m

This is an operator of 60 restaurants, mainly branded as "Wildwood". Results cover the 26 weeks to 1 July 2018.

This is probably the last time I'll report on this share, as the market cap has now fallen below our usual £10m floor.

The company tipped into losses at the adjusted level, of -£119k operating loss (vs. £544k comparable profit in H1 LY).

There's a gigantic £11.3m "highlighted items" impairment charge. Whilst non-cash for now, this is previously wasted capex which is now being written-off. So it was cash at some point in the past, that is now gone.

Balance sheet has some debt on it, which is not ideal.

My opinion - with massive over-capacity in the casual dining sector, and a me-too product offering, it seems to me that this company is also in the struggling to survive category. That makes it a very unattractive investment proposition, in my view.

Well at long last, this report has been finished. Sorry again for the delay, but I thought it would be useful to get some comments into the archive, for future reference.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.